Private Equity Capital

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Equity Capital

Learn to trade Glossary Private equity

© 2020 Capital Com SV Investments Ltd Regulations Terms and Policies

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

By using the Capital.com website you agree to the use of cookies .

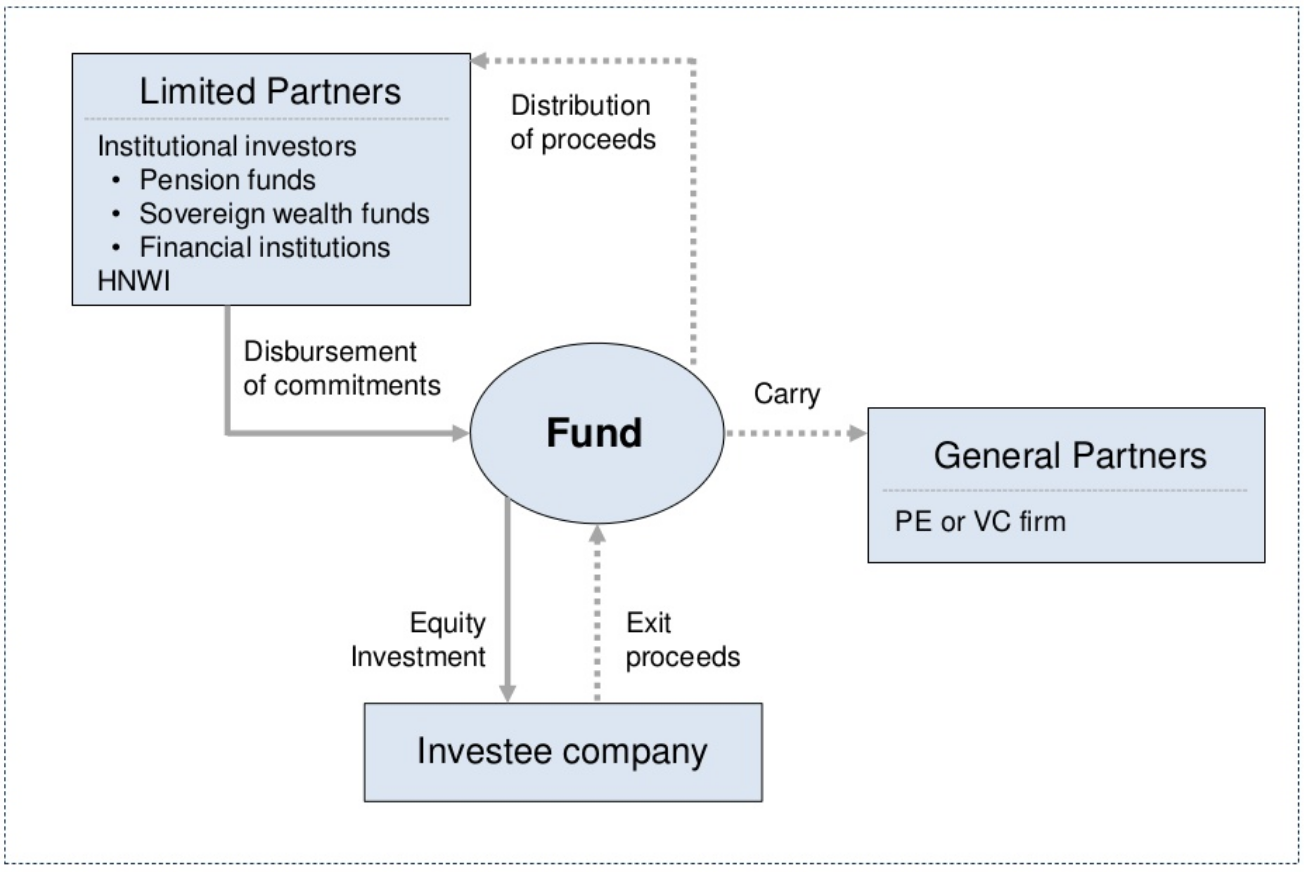

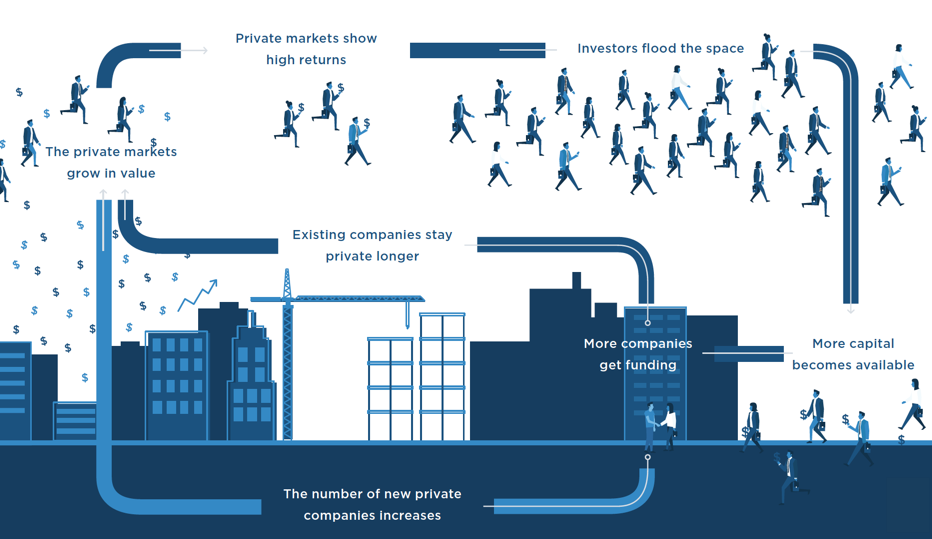

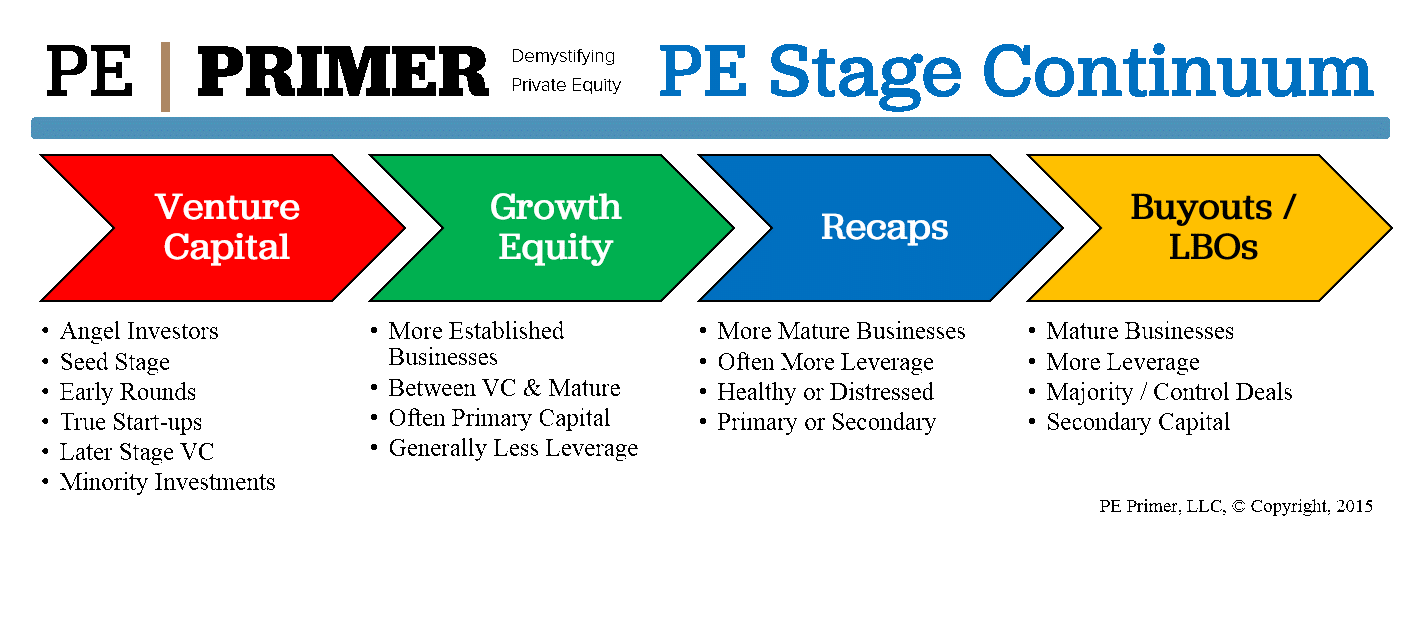

Private equity is a popular alternative type of investment. It involves capital, which is not listed and traded publicly on traditional stock exchanges. Investors and funds directly invest in private companies, contribute venture capital and take part in public companies’ buyouts.

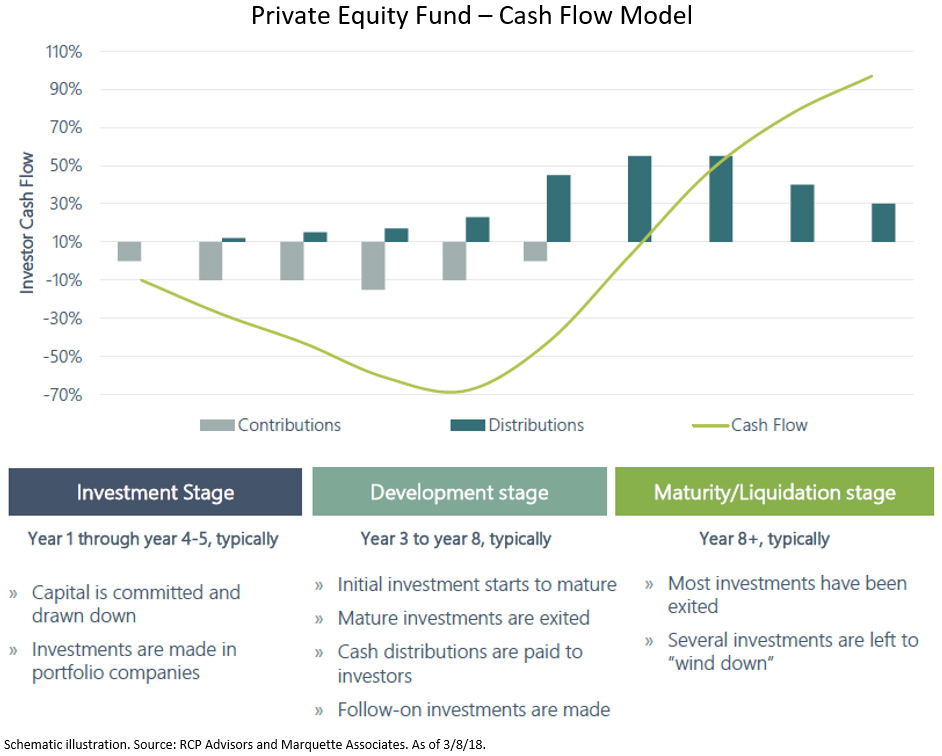

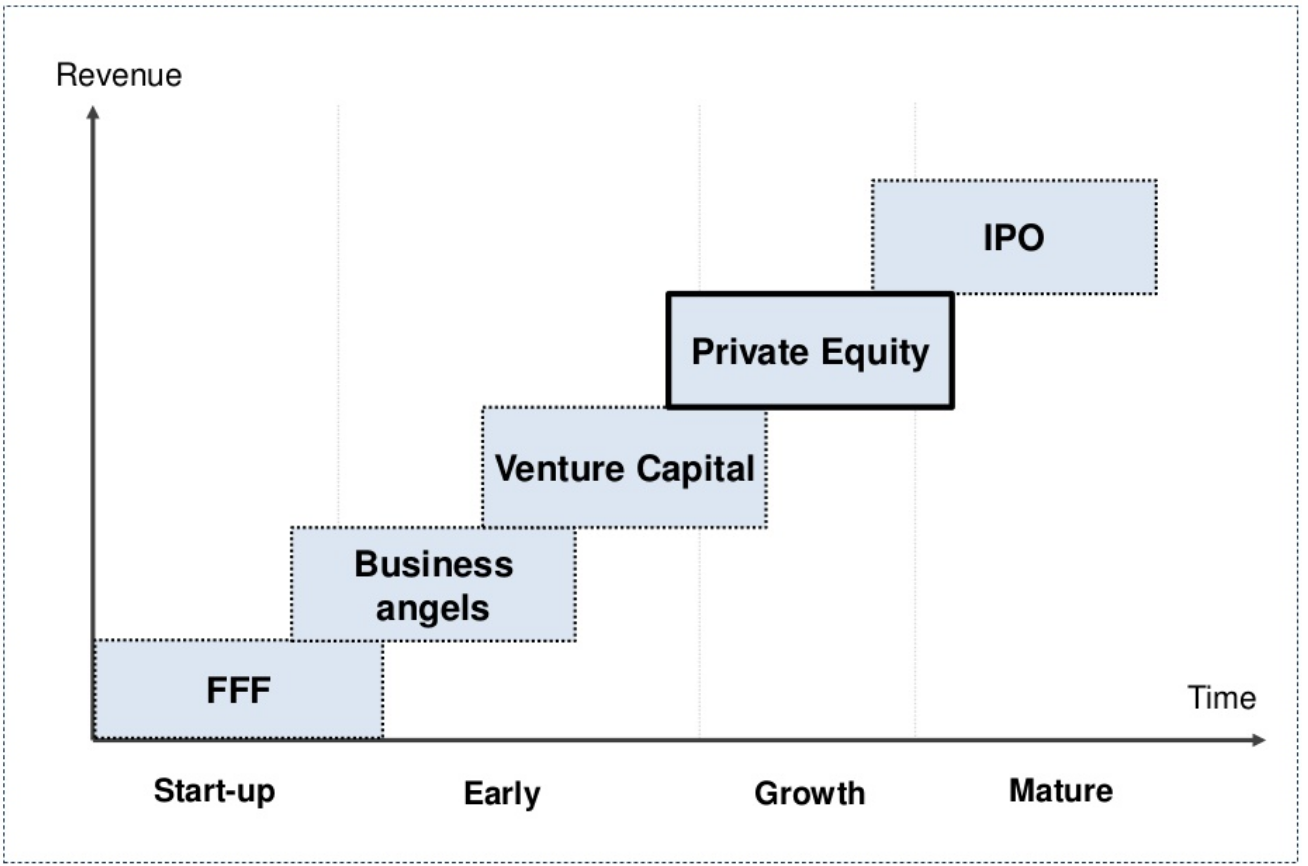

Private companies may attract private equity investments at different stages of their development – progressing from early-stage venture capital to the stage of business growth and beyond – to improve their performance.

Institutional and retail investors may provide funds to restructure business, improve its profitability, develop a new technology, make acquisitions or convert a public company into private.

The history of private equity dates back to the middle of the 20th century. The broader private equity industry embodied two distinct sub-industries, including venture capital and leveraged buyouts. Since its origin in 1946, the private equity industry has experienced 4 major epochs, distinguished by three boom and bust periods.

1946 – 1981 – the early history of private equity with relatively small volumes of investment and rudimentary company organisations.

1982 – 1992 – the first boom and bust cycle with a dramatic surge in leveraged buyout activity

1992 – 2002 – the second boom and bust cycle, emerged after the savings and loan crisis, several insider trading scandals and the real estate market collapse. The period culminated with the Dot-com bubble in 1999-2000.

2003 – 2007 – the third boom and bust cycle when leveraged buyouts reached unparalleled size.

Private equity meaning presupposes a range of advantages for startups and private companies. It serves as an alternative liquidity source instead of traditional financial methods, such as IPOs or bank loans with high interest rates.

A certain form of private equity – venture capital – can invest funds into companies at the very early development stages, or even ideas. Private equity helps delisted companies to implement innovative growth strategies, eliminating the pressure of quarterly earnings results, so important to traditional market scheme.

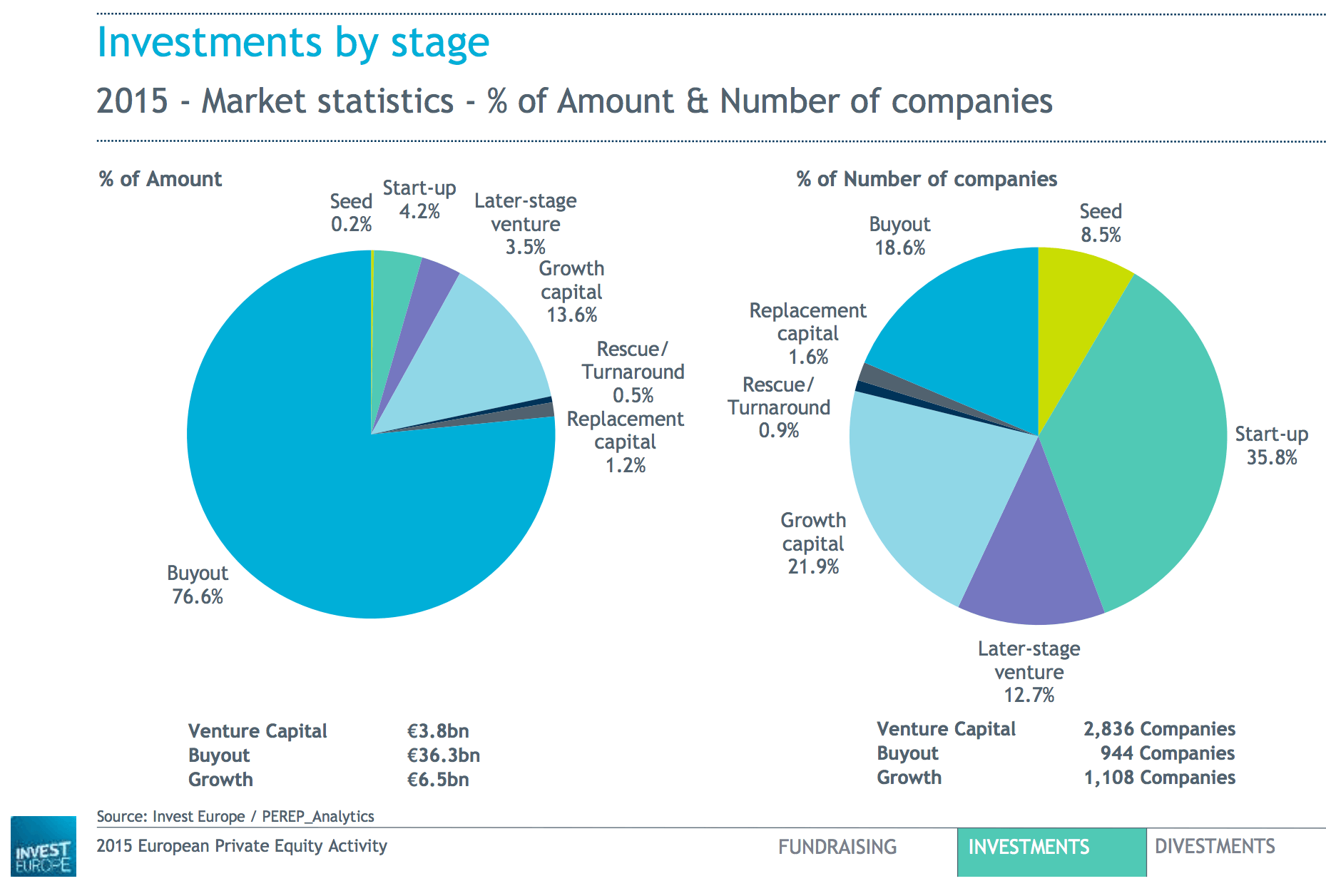

The key types of private equity investments include:

venture capital (investing in startups)

growth capital (investing in a company’s development)

buyout capital (investing used to buy an existing company)

restructuring (investing in distressed companies)

Private equity investments attract many institutional traders and wealthy individuals. However, they are not so easily accessible. The majority of private equity businesses are looking for those who can invest $25 million. Though there are companies which need only $250,000, this number is still out of the reach of ordinary investors.

The most common ways to invest in private equity are:

A fund of funds usually holds shares of various private partnerships which invest in private equities. This method helps to reduce the initial required investment minimum and serves as a good hedging and diversification instrument.

Private equity ETFs typically track and follow an index of publicly traded companies, investing in private equities. Private equity exchange-traded funds are traded on the traditional stock exchanges and presuppose a management and a brokerage fee.

Public shares of private equity managers (companies, managing private equity funds). If you invest in shares of such companies you can still get the benefits of investing in private equity. They invest in a range of funds and help to spread the risk.

Learn more about trading commodities

Start trading global markets by creating an account

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read our Risk Disclosure statement .

Risk warning: transactions with non-deliverable over-the-counter instruments are a risky activity and can bring not only profit but also losses. The size of the potential loss is limited to the size of the deposit. Past profits do not guarantee future profits. Use the training services of our company to understand the risks before you start operations.

Capital Com (UK) Limited is registered in England and Wales with company registration number 10506220. Authorised and regulated by the Financial Conduct Authority (FCA), under register number 793714. Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. Capital Com SV Investments Limited, company Registration Number: 354252, registered address: 28 Octovriou 237, Lophitis Business Center II, 6th floor, 3035, Limassol, Cyprus.

Closed joint-stock company “Capital Com Bel” is regulated by National Bank of the Republic of Belarus, registered by Minsk city executive committee 19.03.2019 with company registration number 193225654. Address: 220030, the Republic of Belarus, Minsk, Internatsionalnaya street 36/1, office 823. Certificate of inclusion in the register of forex companies No. 16 dated 16.04.2019.

Private Equity Definition

Private equity definition | Capital .com

Private Equity vs Venture Capital | 7 Essential Differences You Must know!

Difference Between Private Equity and Venture Capital ... - Key Differences

Bain Capital Private Equity

NOTE - Recommended Courses

Private Equity Course - 35+ hours Videos

Hedge Funds Course - 20+ hours Videos

Investment Banking Course - 500+ hours Videos

Financial Modeling Course - 50+ hours Videos

Private Equity vs. Venture Capital Infographics

Private Equity Training (15+ Courses With Case Studies) 4.5 (234 ratings) 15 Courses | 3+ Projects | 37+ Hours | Full Lifetime Access | Certificate of Completion

Involvement in Target Company’s Operations

Both of the private equity and the venture capital make their investments in the companies where in case of the private equity investment is generally made in the companies which are in their mature stage of working whereas in case of the venture capital, investment is made in the companies which are in their early stage of working.

Technically speaking, venture capital is just a subset of private equity. Both invest in companies, both recruit former Investment Bankers , and they both make money from investments rather than advisory fees. But if you take a closer look at them, you’ll see that they’re significantly different.

The term “private equity” generally refers to money invested in private companies. Such companies become private through investment. Most people in finance, though, use “private equity” to mean firms that buy companies through leveraged buyouts (LBOs) – so that’s how we’ll use it here.

Many of you might be curious as to what exactly they do and what makes them different from one another. So let’s get started and find the answers. In this article, we discuss the following –

The image that you see below will help you understand what Private equity is.

Let’s consider that you are the one who is watering that big tree. Your vision has helped you to choose this one tree from the garden, which you think can bear more fruits once it is nourished with fertilizers and good care.

You have collected the money (for fertilizers) from your friends and family who also intend to eat the sweet fruits of the tree afterward. With the intention that the tree will bear more fruits, you are watering it regularly.

Now connect this example with what happens in Private Equity.

Let’s take the same example to understand what is Venture Capital.

Assume that everything remains the same as the previous analogy that we saw with respect to the above image. The only difference is:

Here the risk can be high, but so are the expected returns.

Private Equity and Venture Capital Statistics (2014):

If you wish to gain Private Equity Skills Professionally, then you may look at this Private Equity Course

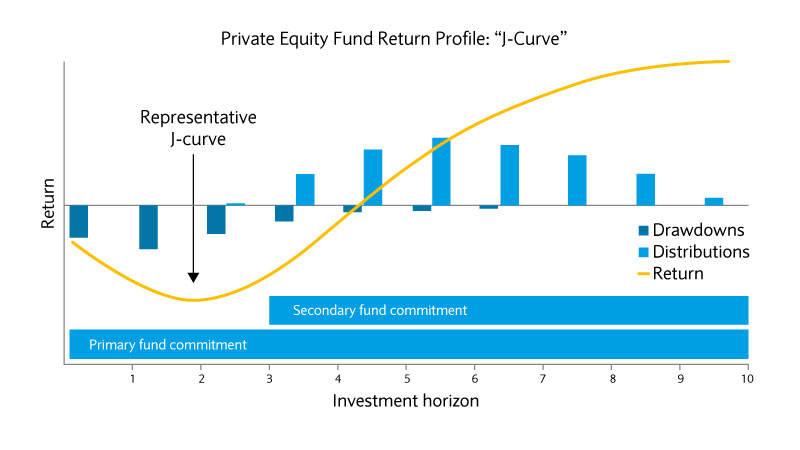

PE firms and VCs invest in companies and make money by exiting, i.e., generally selling their investments. But the way they do it is different.

“So which model actually produces higher returns?” is the basic question that can arise in your mind.

Most of the differences that we have seen are specifically dealing with the theory part of Private Equity and Venture Capital firms.

Now we are going to focus on specific differences between the two, which will help you to determine:

The main point of similarities involved in the interview process is that “Both types of firms focus on your background and deal experience”. But that is it. This is the only similarity.

So, private equity vs. venture capital, what are you up for?

This article has been a guide to Private Equity vs. Venture Capital. Here we discuss the difference between Private Equity and Venture Capital in risk and returns. You may also look at the following articles –

Copyright © 2021. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. CFA® And Chartered Financial Analyst® Are Registered Trademarks Owned By CFA Institute. Return to top

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy

Special Offer - Private Equity Training (15+ Courses & Case Studies, 37+ hrs videos) View More

Target Company (Either Potential Company or Company in need of Restructuring).

Your friends and family who contributed funds for the fertilizers:

Investors contributing Funds to Private Equity Firm;

Sweets Fruit which is intended to be distributed amongst all:

Returns from the Transaction which are distributed to Investors

You charging fee for taking care of the Tree on behalf of everyone:

Private Equity Firm charging Management fe es for the Transaction

PE firms buy mature, public companies.

VCs invest mostly in early-stage companies.

PE firms buy companies across all industries.

Venture Capital are focused on technology, biotech, and clean-tech companies.

It is seen that the PE firms almost always buy 100% of a company in an LBO

Venture Capital only acquires a minority stake which is usually less than 50%.

PE firms make large investments. ($100 Million to $10 billion)

VC generally makes smaller investments which are often below $10 million for early-stage companies.

PE firms use a combination of equity and debt.

Private 2002

Pussy Grannies Hd

Nudist Julia

Japanese Caught Masturbating In The Toilet

Private Block