Private Equity And Venture Capital Investors

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Инвестирую в ваш IT-стартап до 3 000 000

Венчурный инвестор №1 в России за 2016-2017-2018 г.

В портфеле инвестора более 50 проектов

Заявку на инвестиции отправляйте: 3333626@gmail.com

Стартапы ранних стадий рассматриваются после прохождения онлайн-акселератора.

Первый транш

до 3-х миллионов рублей

за 10% компании

Менторская поддержка,

финансовый и юридический консалтинг

Основатели становятся

участниками закрытого

содружества предпринимателей

Основатели проекта закрывают

большую часть компетенций

своими силами

Минимальная версия продукта,

желательно первые пользователи

и продажи

План развития стартапа,

отраженный в презентации

по типовому шаблону

Стартапы этой стадий рассматриваются после прохождения онлайн-акселератора.

Минимальная версия

продукта и первые продажи

Оборот от 100 000 руб. в месяц в течение полугода, сходится unit-экономика каналов продаж

Электронные письма и заявки на инвестиции

не остаются без ответа -

отвечает лично Александр Румянцев.

Решения об инвестициях принимаются

в течение нескольких дней.

Юридическое оформление занимает около двух недель.

Приобретаемая доля обычно составляет 10%,

чтобы команда не теряла мотивацию развивать стартап.

Возраст основателей не имеет значения.

Документы для совершения сделки

бесплатно готовят юристы инвестора,

гарантируя защиту интересов всех сторон.

Отсутствует необходимость покидать родной город:

возможно полностью удалённое взаимодействие

до и после заключения договора.

Оперативное управление стартапом

не навязывается и жестко не регламентируется -

помощь только по запросу основателей.

Стартапы ранних стадий рассматриваются после прохождения онлайн-акселератора.

Отправьте заявку

на получение инвестиции

на электронный ящик:

3333626@gmail.com

Всё на свете должно с чего-то начинаться, и не надо бояться отсутствия опыта, если хотите заниматься интересным, технологичным и, главное, прибыльным делом.

© «Венчурный Акселератор», 2015–2019

Политика конфиденциальности данных

Private equity and venture capital investors f…

РекламаCarta — платформа для управления реестром акционеров с высоким потенциалом роста

Финансовые услуги оказывает: АО "Инвестиционная компания "ФИНАМ", АО "Банк ФИНАМ"

РекламаСоздай стартап, и получи инвестиции. Онлайн акселератор с личным наставником.

Содействие в подборе финансовых услуг/организаций

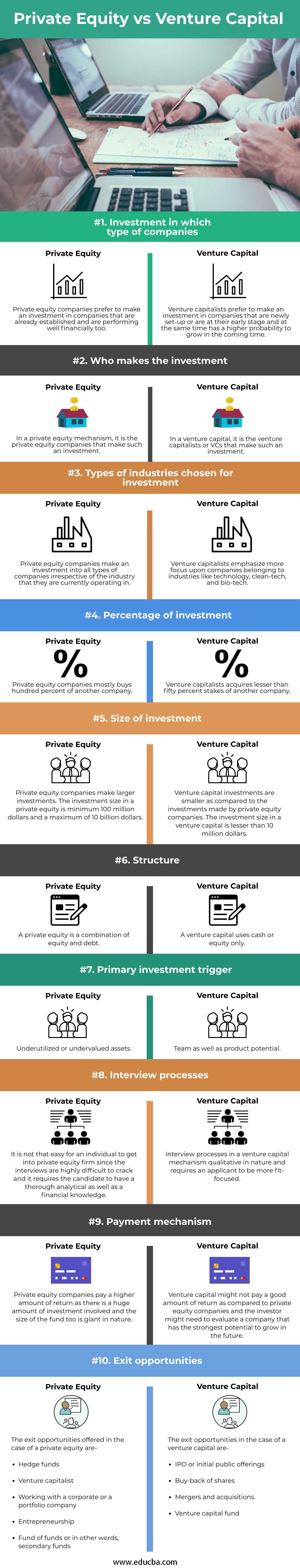

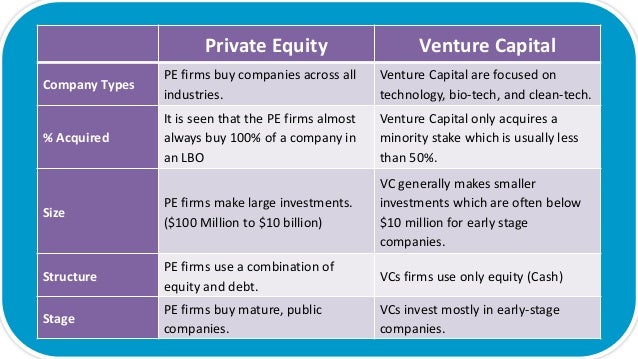

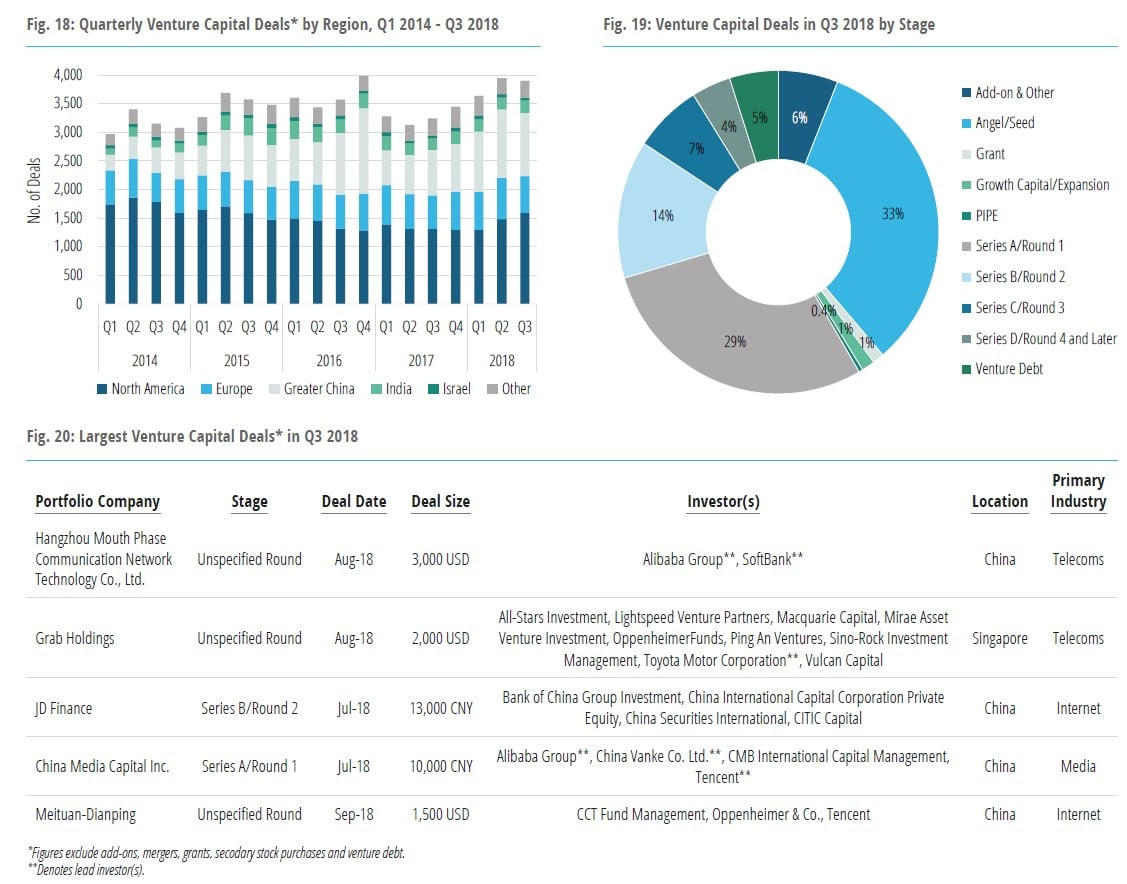

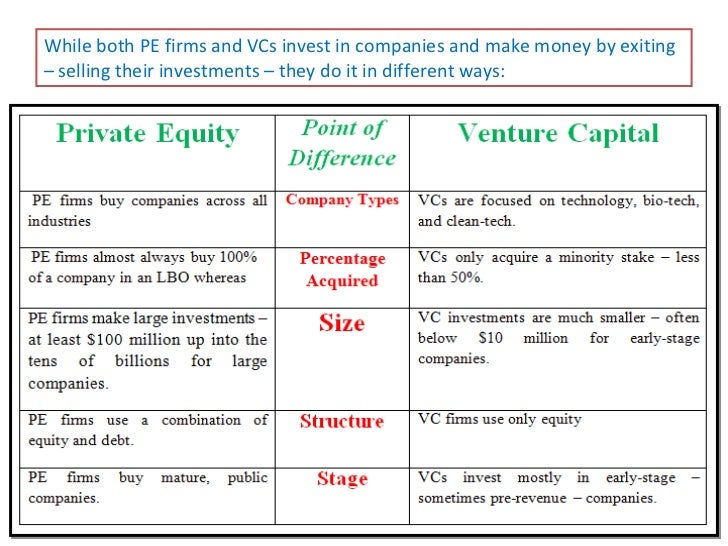

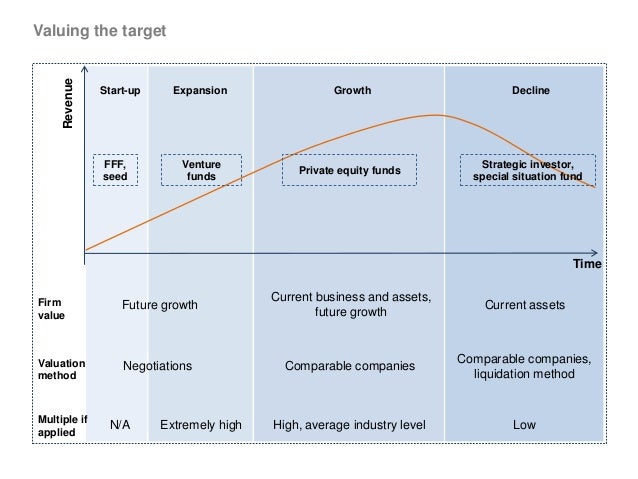

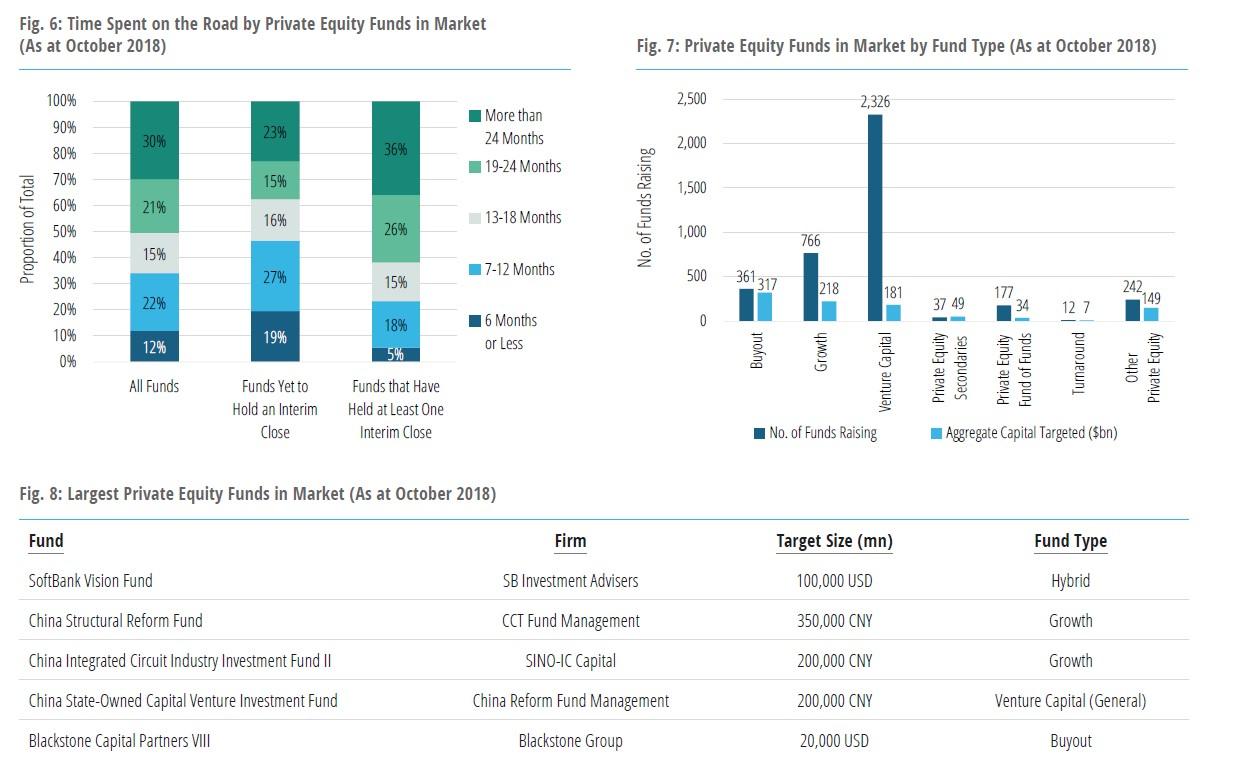

Venture capital and private equity are two types of financial assistance that are used by companies in different stages. Private Equity is a large investment in developed companies and venture capital is a small investment usually made in initial stages of development of a company.

optimizeias.com/venture-capital-and-private-eq…

How does private equity and venture capital work?

How does private equity and venture capital work?

The course deals with the analysis of the private equity and venture capital business. Over the course, students will be provided with a deep understanding of the mechanism underpinning the creation and/or development of a firm and the financial support it can get from the financial system through venture capital investment.

www.coursera.org/learn/private-equity

Who are the institutional investors in private equity?

Who are the institutional investors in private equity?

Large institutional investors dominate the private equity world, including pension funds and large private equity firms funded by a group of accredited investors. Because the goal is direct investment in a company, substantial capital is needed, which is why high net worth individuals and firms with deep pockets are involved.

www.investopedia.com/ask/answers/02041…

Which is an example of a private equity company?

Which is an example of a private equity company?

Uber, Lyft and 23andMe are all examples of private companies that are VC-backed, which means they have raised capital from venture capitalists. Older private companies, like Toms Shoes or Michaels, are backed by private equity firms—and in this case, both are owned by Bain Capital, a Boston-based firm.

pitchbook.com/blog/private-equity-vs-vent…

Who are the largest private equity firms in the world?

Who are the largest private equity firms in the world?

Private equity firms, being later-stage investors, typically do larger deals and the range can be enormous depending on the types of business. There are boutique, mid-market private equity firms that will do $5 million deals, while massive global firms such as Blackstone and KKR do billion dollar deals.

corporatefinanceinstitute.com/resources/ca…

https://www.investopedia.com/ask/answers/020415/what-difference-between-private-equity...

What Are The Differences Between Private Equity and Venture Capital?

Understanding Private Equity and Venture Capital

Special Considerations

Private equity, at its most basic, is equity—shares representing ownership of, or an interest in, an entity—that is not publicly listed or traded. Private equity is a source of investment capital from high-net-worth individuals and firms. These investors buy shares of private companies—or gain control of public companies with the intention of taking them priv…

https://pitchbook.com/blog/private-equity-vs-venture-capital-whats-the-difference

15.07.2021 · Similarly, PE investors also raise pools of capital from limited partners to form a fund—also known as a private equity fund—and invest that capital into promising, privately owned companies. However, the companies PE firms want to invest …

How Private Equity and Venture Capital Investors Accelerate Portfolio Company Success

What is the Difference between Private Equity and Venture Capital Investors

Private equity & venture capital – funding the future

Incubator, Angel Investor, Venture Capital and Private Equity Fund

MasterShare with Alain Fontaine, Angel, Private Equity and Venture Capital Investor

What is ESG? Private Equity, Venture Capital & ESG

YouTube › Nederlandse Vereniging van Participatiemaatschappijen

https://optimizeias.com/venture-capital-and-private-equity

23.08.2021 · Venture capital and private equity are two types of financial assistance that are used by companies in different stages. Private Equity is a large investment in developed companies and …

https://corporatefinanceinstitute.com/.../private-equity-vs-venture-capital-vs-angel-seed

Stage of Business – Private Equity vs. Venture Capital vs. Seed Investors

Size of Investment – Private Equity vs. Venture Capital / Seed Investors

Type of Investment – Private Equity vs. Venture Capital and Seed

Investment Team – Private Equity vs. Venture Capital vs. Angel Investors

Level of Risk

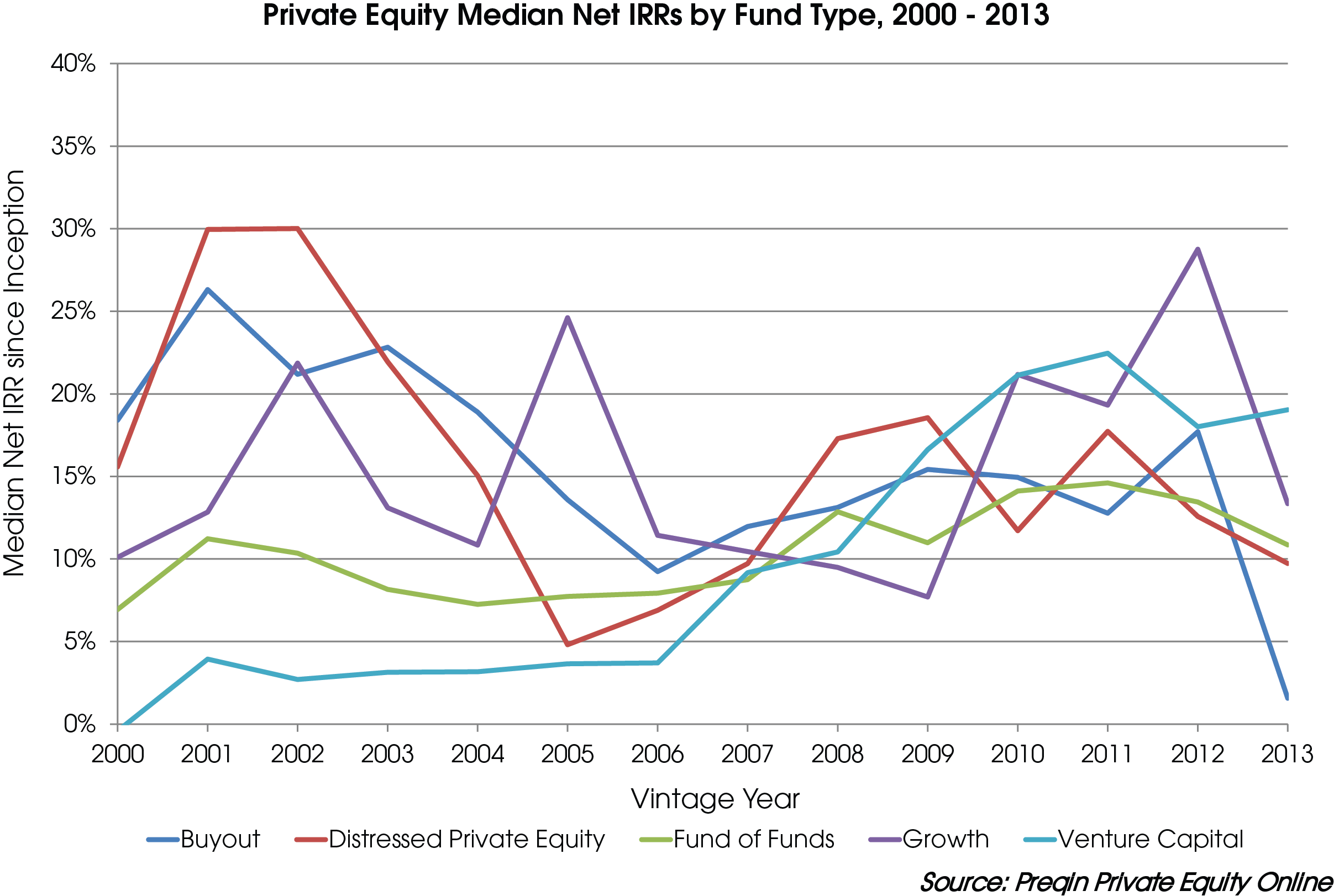

Return Targets

Industry Focus

Investment Screening

Examples of PE, VC, and Angel/Seed Firms

More Resources

As the names imply, “seed” or “angel” investors are usually the first investors in a business, followed by venture capital firms (think “new venture”), and finally, private equity firms. Angel or seed investors participate in businesses that ar…

https://blogs.cfainstitute.org/investor/2020/09/30/private-equity-vs-venture-capital...

30.09.2020 · Managers of private equity (PE) and venture capital (VC) firms have the same goal in mind: maximizing returns. Yet PE buyout and VC early-stage funds go about it in very different ways. Many prospective investors fail to appreciate that the two most popular alternative asset classes adopt often antithetical methods to drive performance.

https://finance-able.com/private-equity-vs-venture-capital

Technically speaking, Venture Capital, Growth Equity, and Private Equity firms are ‘Private Equity’ investors. But, somewhere along the way, the Late-Stage (Leveraged Buyout) investors grabbed the name ‘Private Equity’ …

https://www.coursera.org/learn/private-equity

The course deals with the analysis of the private equity and venture capital business. Over the course, students will be provided with a deep …

https://en.m.wikipedia.org/wiki/Category:Private_equity_and_venture_capital_investors

Pages in category "Private equity and venture capital investors" The following 200 pages are in this category, out of approximately 233 total. This list may not reflect recent changes ().(previous …

РекламаCarta — платформа для управления реестром акционеров с высоким потенциалом роста

Финансовые услуги оказывает: АО "Инвестиционная компания "ФИНАМ", АО "Банк ФИНАМ"

РекламаСоздай стартап, и получи инвестиции. Онлайн акселератор с личным наставником.

Содействие в подборе финансовых услуг/организаций

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Mistress In Latex Gloves

Junior Nudist Pageant Videos

Big Latina Ass Riding

Emel Aydan 18 Erotic Full Izle

Woodman Casting Young Porno

Private Equity vs. Venture Capital: What's the Difference?

Private equity vs. venture capital: What’s the difference ...

Venture capital and Private Equity - Optimize IAS

Private Equity vs Venture Capital, Angel/Seed Investors

Private Equity vs Venture Capital - The Ultimate Guide ...

Private Equity and Venture Capital | Coursera

Category:Private equity and venture capital investors ...

Private Equity / Venture Capital – Assisting financial ...

Private Equity And Venture Capital Investors