Private Equity

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Equity

Private Equity Training (15+ Courses With Case Studies) 4.5 (234 ratings) 15 Courses | 3+ Projects | 37+ Hours | Full Lifetime Access | Certificate of Completion

Successful Private Equity Firms of World

Performance Measures of Private Equity Firms

Private equity is a type of investment that is provided for a medium to long term period to companies who have high growth potential in exchange for a certain percentage of equity of the investee. These high growth firms are not listed companies on any exchange.

With this article, I aim to provide you with deeper insights on what is a private equity, its structure, fees, how it is like working as a private equity analyst , top private equity firms, and more.

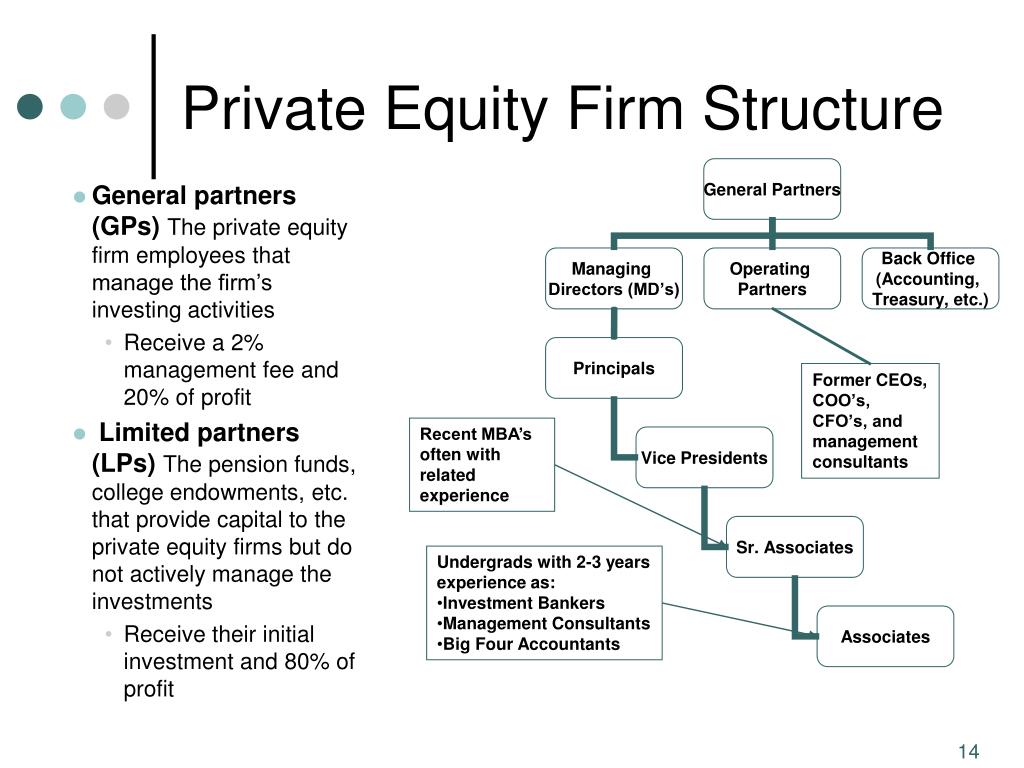

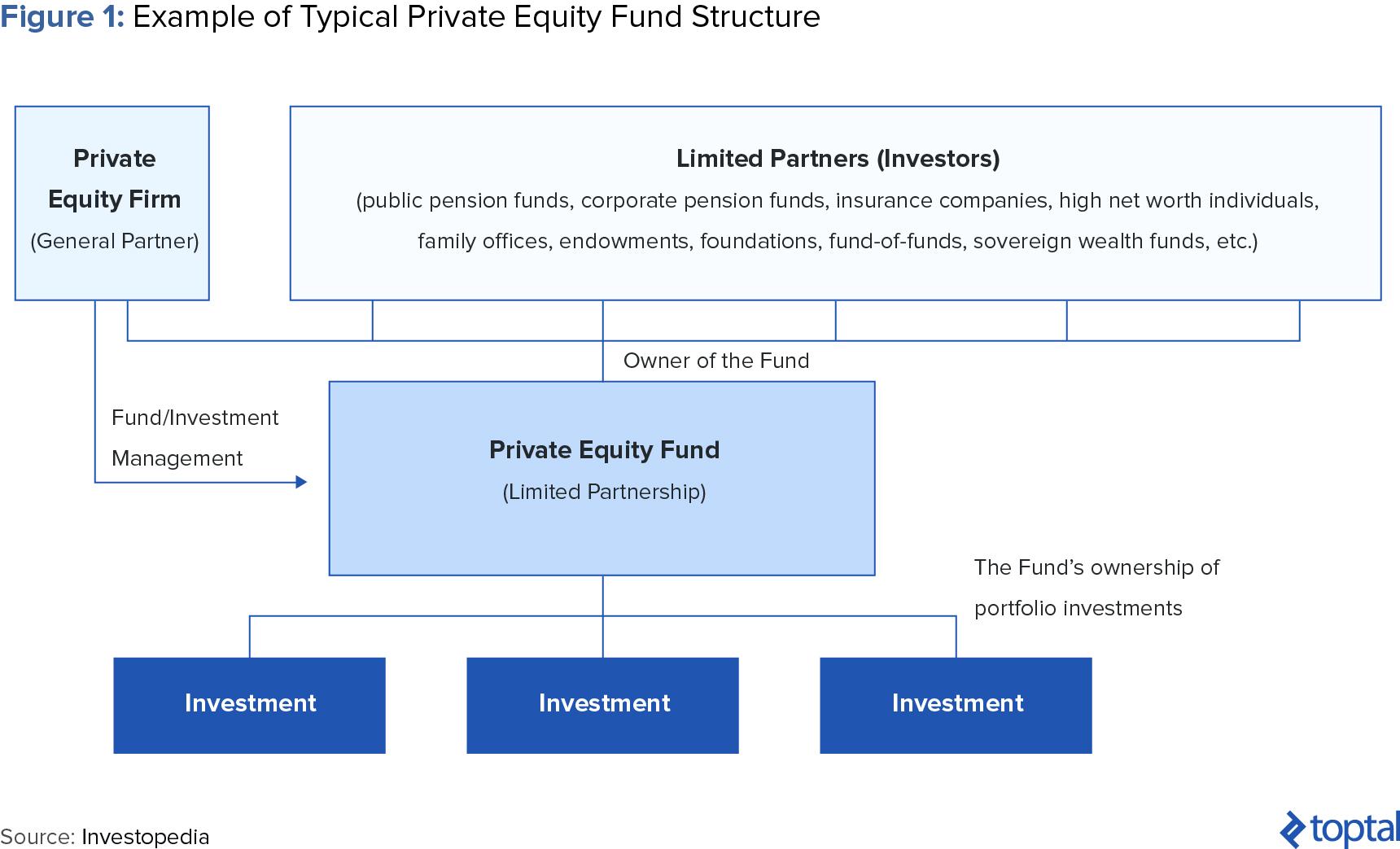

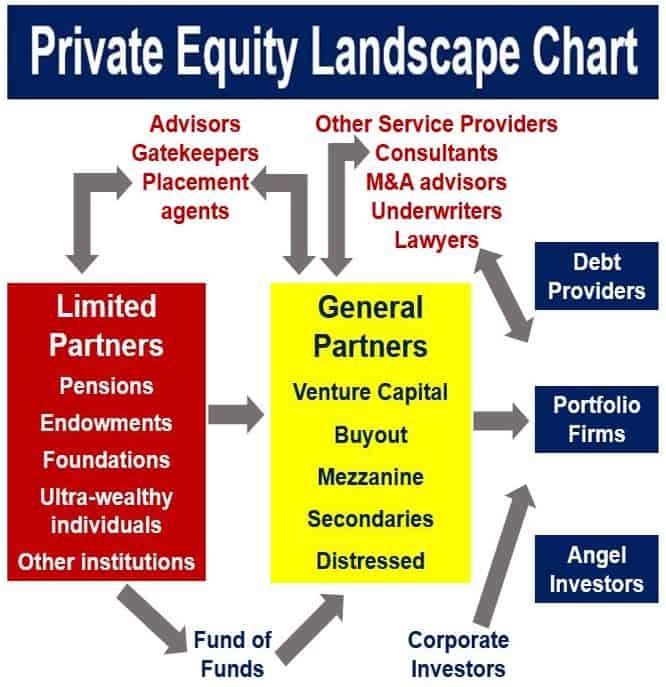

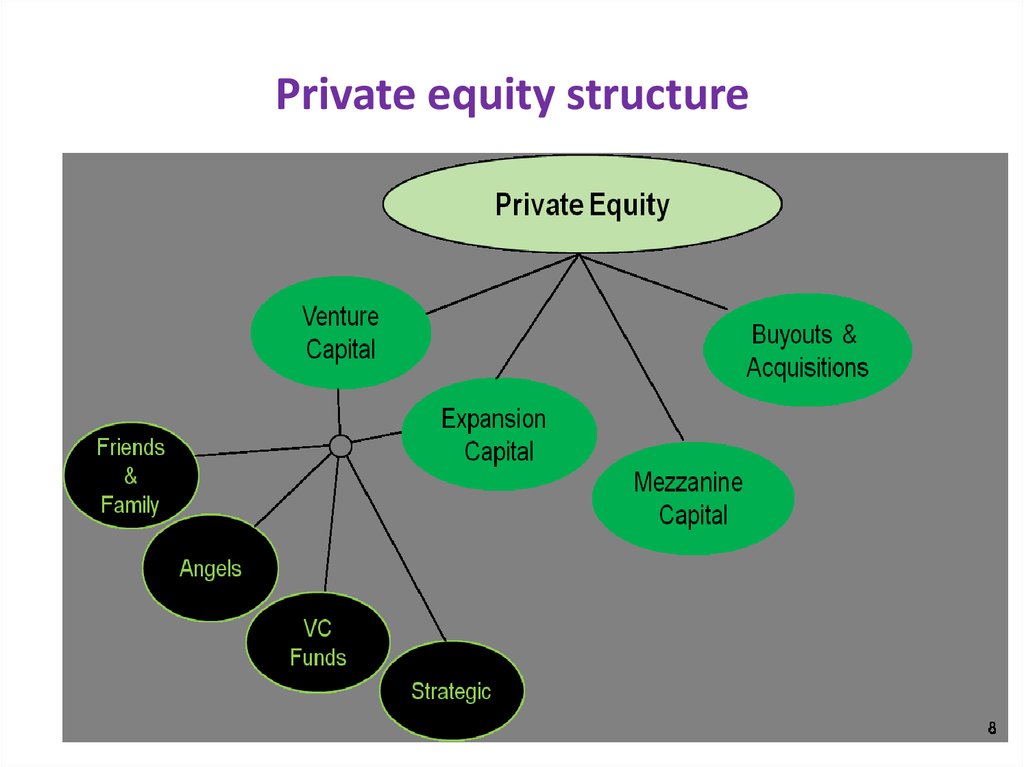

Private equity funds are mostly structured as closed-end investment vehicles. Private is started as a limited partnership by a fund manager or general partner. The fund manager sets forth the rules and regulations governing the fund. General Partner contributes around 1% to 3% of the total fund investment size. The remaining investment is made by Investors such as universities, pension funds, families, and other investors. Each of these investors is a Limited Partner in the fund. So the liability of a limited partner is proportional to its capital contribution . Some private equity firms also have institutional sponsors or are captive units or spin-offs of other companies.

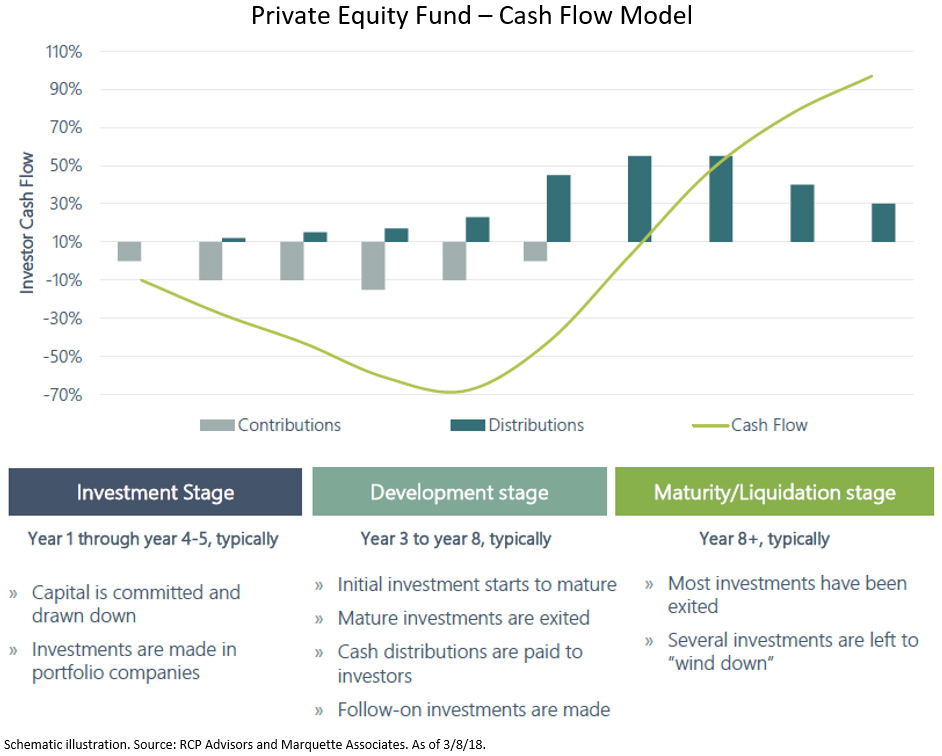

Limited partners make an agreed commitment for a specified time that is an investment period, which can be four to six years. Once a portfolio investment is realized, that is, the underlying company is sold either to a financial buyer or to a strategic investor or it has gone public via an IPO – the fund distributes proceeds back to limited partners.

Just like hedge funds , Private equity fund charges, Management fees & Performance fees.

PE fund uses the money invested by Pension Funds, Labor Unions, Insurance companies, Universities Endowments, large wealthy families or Individuals, Foundations, etc. Public and private pension funds, university endowments, and foundations in the fund.

Private equity would fund a company in different ways. Common stock and convertible preferred stock are two basic ways in which a company is invested. The deal is structured after negotiations with the investee and laid down in a term sheet. Most of the time, the funding will have an anti-dilution provision. It protects an investor from stock dilution resulting from later issues of stock at a lower price than the investor originally paid.

Deal structuring can be done by way of

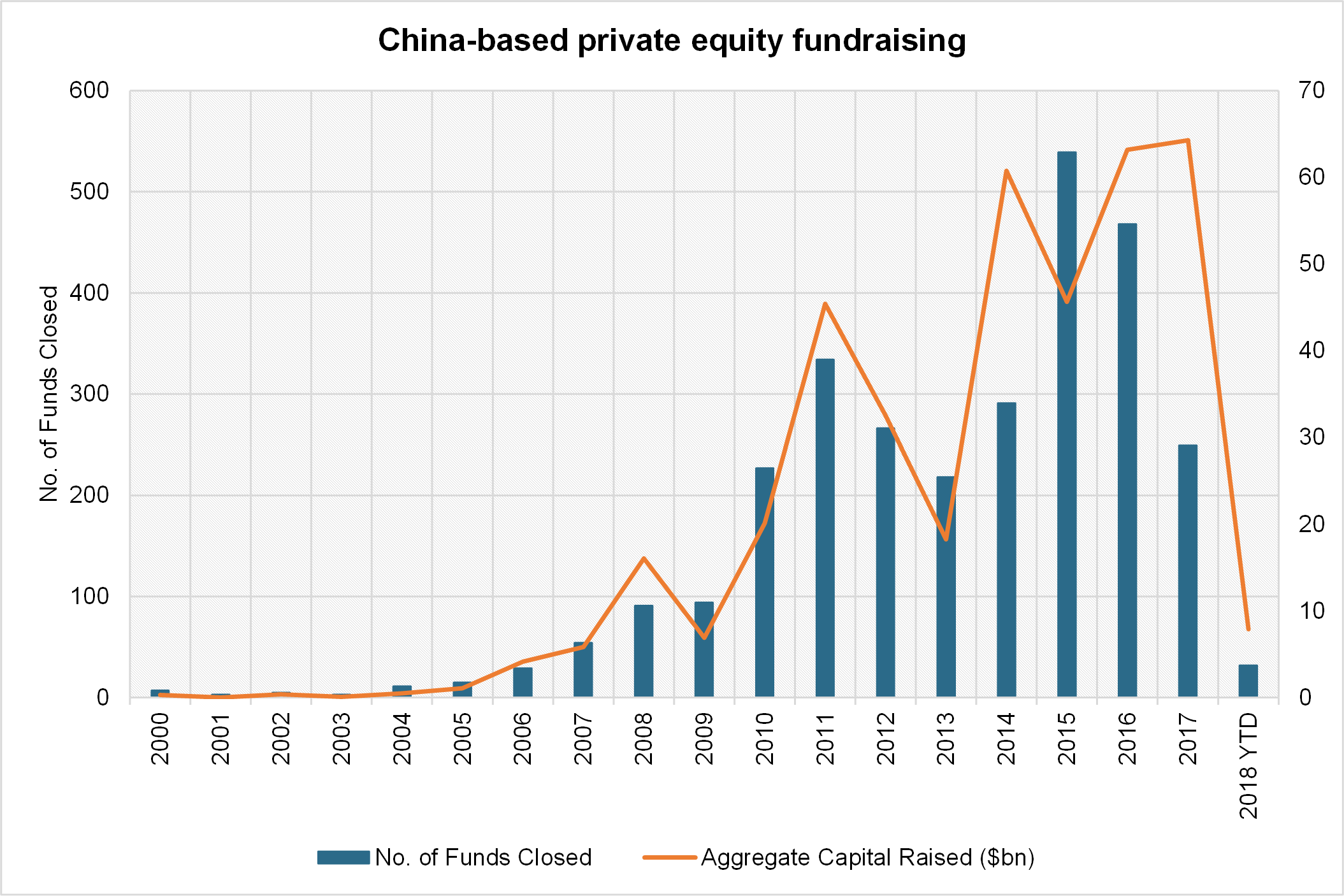

This industry saw tremendous growth post-1970s. As of now, the total asset under management of all PE funds together is USD 2.5 trillion (src: www.preqin.com). This growth has been due to the consistent and strong fundraised over the years by them.

Annual global PE fundraising 1996-2016

PE industry is a cyclical industry , and fundraising trends, as seen above, prove that. Fundraising was also indirectly impacted by credit cycles in debt markets on entry and exit multiples.

Over the years, this industry has undergone consolidation, and hence the number of funds has fallen from 1,666 funds in 2000 to 594 in 2015. Over the years, apart from traditional investors such as family offices and university endowments, PE fund has also been able to attract non-traditional investors such as sovereign wealth funds.

Below is the table of a few successful PE funds which survived the 2008 recession and have performed well since inception.

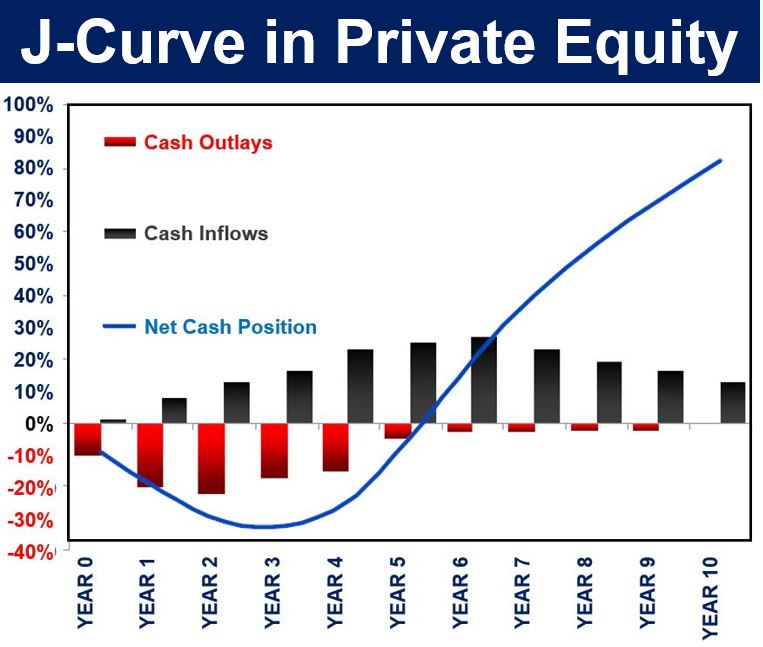

It is not easy to measure illiquid investments like Private Equity Investments as compared to measuring the performance of the traditional asset classes .

As such, the Internal Rate of Return (IRR) and investments multiples are the two measures that are used to assess the performance of private equity investments.

The below table provides us with the types of Private Equity Investments along with its IRR Return Expectations.

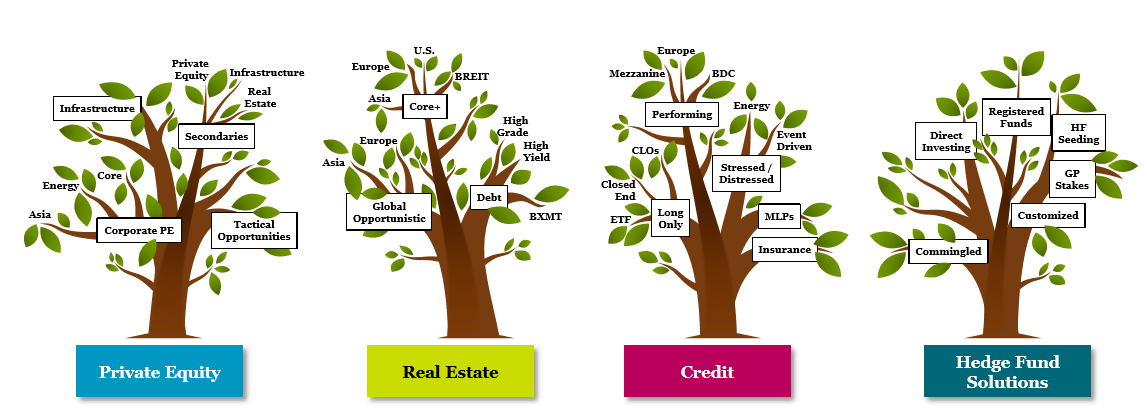

Performance in the past does not guarantee similar success in the future. The PE industry has come a long way since the 1970s. The industry has now spread across the globe to Europe and emerging markets. The globalization of PE firms shall continue in the future. PE faces a threat from direct investing done by Institutional investors than co-investing with PE firms.

As the industry will grow, it will face more regulations from the government & increased scrutiny.

Emerging markets have been the recent attraction of PE funds, but they still need to be careful about immature regulatory and legal systems apart from not so transparent policies. Other attractive investing destinations include Financial institutions, Public equity, etc.

This article has been a guide to What is Private Equity. Here we discuss the structure of Private Equity Firms, Deal structuring in Private Equity, Fees, and Performance Measures. You may have a look at the following articles to learn more about Private Equity –

Copyright © 2021. CFA Institute Does Not Endorse, Promote, Or Warrant The Accuracy Or Quality Of WallStreetMojo. CFA® And Chartered Financial Analyst® Are Registered Trademarks Owned By CFA Institute. Return to top

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy

Special Offer - Private Equity Training (15+ Courses & Case Studies, 37+ hrs videos) View More

Operates from 30 offices across the world

Jerome Kohlberg Jr., Henry R. Kravis, and George R. Roberts

High yield & distressed debt situations

Key investments – RailAmerica, Brookdale Senior Living, Penn National Gaming, and Newcastle Investment Corporation

acquisitions include such well-known companies as Burger King, Hospital Corporation of America, Staples, the Weather Channel, and AMC Theatres

Focused on LBOs, Growth capital & leveraged recapitalization

Raised 15 private equity funds which have invested $58 billion in over 760 companies in 40 countries

Private Equity Definition

What is Private Equity ? | Overview of Structure, Deal Structuring & Fees

What is Private Equity ? - YouTube

Private equity | Словари и энциклопедии на Академике

Investing in private equity : how does it work

Lingerie Tits Pov

Sex Czech Public Pickup

Lingerie Try Thong

Guerlain Lingerie De Peau Natural Perfection Foundation

Peeing Outdoors

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)