Private Debt

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Debt

Все языки Абхазский Адыгейский Африкаанс Айнский язык Акан Алтайский Арагонский Арабский Астурийский Аймара Азербайджанский Башкирский Багобо Белорусский Болгарский Тибетский Бурятский Каталанский Чеченский Шорский Чероки Шайенского Кри Чешский Крымскотатарский Церковнославянский (Старославянский) Чувашский Валлийский Датский Немецкий Долганский Греческий Английский Эсперанто Испанский Эстонский Баскский Эвенкийский Персидский Финский Фарерский Французский Ирландский Гэльский Гуарани Клингонский Эльзасский Иврит Хинди Хорватский Верхнелужицкий Гаитянский Венгерский Армянский Индонезийский Инупиак Ингушский Исландский Итальянский Японский Грузинский Карачаевский Черкесский Казахский Кхмерский Корейский Кумыкский Курдский Коми Киргизский Латинский Люксембургский Сефардский Лингала Литовский Латышский Маньчжурский Микенский Мокшанский Маори Марийский Македонский Коми Монгольский Малайский Майя Эрзянский Нидерландский Норвежский Науатль Орокский Ногайский Осетинский Османский Пенджабский Пали Польский Папьяменто Древнерусский язык Португальский Кечуа Квенья Румынский, Молдавский Арумынский Русский Санскрит Северносаамский Якутский Словацкий Словенский Албанский Сербский Шведский Суахили Шумерский Силезский Тофаларский Таджикский Тайский Туркменский Тагальский Турецкий Татарский Тувинский Тви Удмурдский Уйгурский Украинский Урду Урумский Узбекский Вьетнамский Вепсский Варайский Юпийский Идиш Йоруба Китайский

Все языки Абхазский Адыгейский Африкаанс Айнский язык Алтайский Арабский Аварский Аймара Азербайджанский Башкирский Белорусский Болгарский Каталанский Чеченский Чаморро Шорский Чероки Чешский Крымскотатарский Церковнославянский (Старославянский) Чувашский Датский Немецкий Греческий Английский Эсперанто Испанский Эстонский Баскский Эвенкийский Персидский Финский Фарерский Французский Ирландский Галисийский Клингонский Эльзасский Иврит Хинди Хорватский Гаитянский Венгерский Армянский Индонезийский Ингушский Исландский Итальянский Ижорский Японский Ложбан Грузинский Карачаевский Казахский Кхмерский Корейский Кумыкский Курдский Латинский Лингала Литовский Латышский Мокшанский Маори Марийский Македонский Монгольский Малайский Мальтийский Майя Эрзянский Нидерландский Норвежский Осетинский Пенджабский Пали Польский Папьяменто Древнерусский язык Пушту Португальский Кечуа Квенья Румынский, Молдавский Русский Якутский Словацкий Словенский Албанский Сербский Шведский Суахили Тамильский Таджикский Тайский Туркменский Тагальский Турецкий Татарский Удмурдский Уйгурский Украинский Урду Урумский Узбекский Водский Вьетнамский Вепсский Идиш Йоруба Китайский

фин . частный долг , частная задолженность , долг [ задолженность \] частных лиц ( долг домохозяйств и частных компаний , в отличие от государственного долга )

Книги

Sukuk Securities . New Ways of Debt Contracting , Mohamed Ariff . The essential guide to global sukuk markets worldwide Sukuk Securities provides complete information and guidance on the latest developments in the burgeoning sukuk securities markets .… Подробнее Купить за 5853 . 56 руб электронная книга

Introduction to Private Equity . Venture , Growth , LBO and Turn - Around Capital , Cyril Demaria . This second edition of Introduction to Private Equity is more than an update , it reflects the dramatic changes which have affected an industry which is evolving rapidly , internationalizing … Подробнее Купить за 4617 . 8 руб электронная книга

Private Debt . Opportunities in Corporate Direct Lending , Stephen Nesbitt L .. The essential resource for navigating the growing direct loan market Private Debt: Opportunities in Corporate Direct Lending provides investors with a single , comprehensive resource for … Подробнее Купить за 3898 . 47 руб электронная книга

Другие книги по запросу « private debt » >>

Мы разработали для вас новый сервис!

Пользуясь Скидки.Академик.ру , вы поддерживаете Академик.ру!

Англо - русский экономический словарь .

private debt — total debt of households and private businesses ( Economics ) … English contemporary dictionary

Private Debt — I . e . S . : Fremdmittel , die vorwiegend von institutionellen Investoren i . d . R . außerhalb des Bankensektors zur Verfügung gestellt werden . Dabei handelt es sich um privat platzierte , d . h . im Sekundärmarkt i . d . R . nichtgehandelte ( illiquide ), ( erst und … … Lexikon der Economics

Debt deflation — is a theory of economic cycles , which holds that recessions and depressions are due to the overall level of debt shrinking ( deflating ) : the credit cycle is the cause of the economic cycle . The theory was developed by Irving Fisher following the … … Wikipedia

Debt overhang — is when an organization ( for example , a business , government , or family ) has existing debt so great that it cannot easily borrow more money , even when that new borrowing is actually a good investment that would more than pay for itself . This … … Wikipedia

Debt — For other uses , see Debt ( disambiguation ). Personal finance Credit and debt Pawnbroker Student loan Employment contract … Wikipedia

Debt buyer — A debt buyer is a company , sometimes a collection agency or a private debt collection law firm , that purchases delinquent or charged off debts from a creditor for a fraction of the face value of the debt . The debt buyer can then collect on its … … Wikipedia

Debt levels and flows — Public debt as a percent of GDP ( 2010 ) … Wikipedia

Debt of developing countries — The debt of developing countries is external debt incurred by governments of developing countries , generally in quantities beyond the governments political ability to repay . Unpayable debt is a term used to describe external debt when the … … Wikipedia

debt — n . 1 ) to contract , incur , run up a debt ; to get into , go into debt 2 ) to collect , recover a debt 3 ) to discharge , pay ( off ), settle ; wipe out ; write off a debt 4 ) to cancel ; repudiate a debt 5 ) a bad ; outstanding , unsettled debt 6 ) a business ;… … Combinatory dictionary

Debt Buyer — A company that purchases debt from creditors at a discount . Debt buyers , such as a collection agencies or a private debt collection law firm , buys delinquent or charged off debt at a fraction of the debt ’ s face value . The debt buyer then … … Investment dictionary

Debt - to - GDP ratio — Government debt as percentage of GDP globally . ( 2009 estimates ) … Wikipedia

What is private debt ? | PitchBook

private debt - это... Что такое private debt ?

Public versus private debt – what’s the difference? | ASI

Private debt по Русский - Английский-Русский Словарь - Glosbe

private debt - Translation into Russian - examples... | Reverso Context

Public versus private debt – what’s the difference?

Fixed income

Multi-Asset

Real Estate

Private Markets

High yield

Risk

Commercial

Residential

Interest rates

Labour Market

Debt

Diversification

Thinking Aloud

RISK WARNING

The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested.

Marianne Zangerl, Investment Director, Fixed Income: Credit

With interest rates at historic lows, asset classes such as commercial real estate debt, infrastructure debt and corporate debt are increasingly attractive. But this is not just because of their potentially higher yields. In this article, we compare private debt with public debt (i.e. bond markets). We highlight some of the benefits of private debt investments and the main features distinguishing them from public debt.

One advantage of private debt is that it allows us to invest in markets that are otherwise inaccessible. Private infrastructure debt for example, can provide access to areas such as renewable energy. In the UK and Europe, renewable energy projects are generally backed by government subsidies. These subsidies safeguard a project against fluctuating electricity prices. Importantly, the company can use payments for the energy it provides to create a stable cashflow for investors.

Of course, some publicly traded utility companies also own renewable energy projects. However, their businesses are so broad that investing in these firms also exposes investors to fluctuating energy prices and changes in retail pricing. By including renewable projects in the portfolio, investors can potentially gain exposure to drivers that are more idiosyncratic and less closely linked with the economic cycle. In this way, investors can seek to diversify the sources of return from their portfolios. Investment returns from a renewable project are influenced, not by changes in electricity pricing, but by environmental factors and project-specific technology risks. For example, solar projects are affected by the reliability of sunshine forecasts and the efficiency of technologies still under development.

Commercial real estate debt in the private market tends to comprise one or a few assets in different regions of the UK. Underlying market drivers vary depending on the property sector and location. A prime office in London has very different set of economic drivers to an industrial park in north England. Commercial real estate debt lets us invest in small or rare issuers with unique assets. Typically, these companies don’t seek public bond market funding.

Investors in private debt can have far greater influence over the negotiation and structuring of the debt. Private debt investments are usually tailored to the specific needs of the asset or company being financed. Additionally, they nearly always have some form of financial covenant. This might be a level of debt or profitability that, if breached, would alert the investors and allow them to intervene to avert trouble.

Around 95% of public bond market issuance is unsecured (i.e. not backed by assets that could be sold to repay the investor in the event of default). In the private debt markets, almost all issues are secured, thereby reducing the risk for investors.

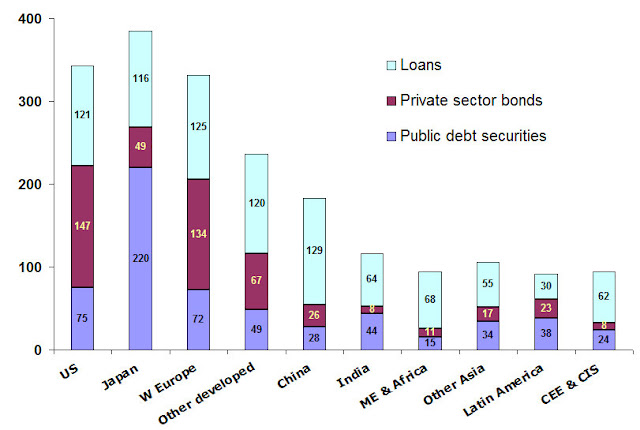

Because private debt is secured, in the event of default, recovery values for private assets are generally much higher than those on the public market. Chart 1 shows that a private corporate debt instrument has a recovery value of around 80% (80 pence recovered for every pound invested). For an unsecured public corporate bond, the recovery value is around 50%.

A bond issue can be sold to numerous market participants. Private deals involve far fewer parties – usually the borrower and one or a small group of investors. This allows considerable scope in negotiation. So, if an investor has a certain requirement – such as cash outflows that need to be met in 20 years’ time – they can work with the borrower to accommodate the needs of both parties.

Most public bonds are rated by one or more of the rating agencies, giving investors an idea of the quality and riskiness of a bond. Most private debt has no such quality-rating. The onus is on the investor or their asset manager to undertake a ratings analysis as part of the credit assessment. However, it also means fewer investors can participate in the debt, so there’s less competition. Moreover, it encourages a more prudent approach to risk management that relies on robust analysis of the debt. This contrasts with public bond markets, which tend to be heavily reliant on agency ratings.

Public bonds are usually traded actively, so market prices are readily available. By contrast, private assets don’t tend to trade regularly and so there are no readily observable market prices for them. Instead, they are valued at ‘amortised cost’ or by calculating their ‘fair value’. Private debt and other illiquid assets tend to pay higher yields to compensate investors for being unable to readily exit a position. This potential extra return over comparable public bonds is called the ‘illiquidity premium’.

It’s important that the extra return being offered is high enough to compensate for the asset’s illiquidity. Asset managers with expertise across both the public and private debt markets are best placed to make this assessment.

Private debt investing offers many potential advantages – higher yields, greater security (and therefore higher recovery values), flexibility and influence over the structuring of the asset, and the right to intervene in the event of problems. Private debt investing can also enhance portfolio diversification by providing exposure to idiosyncratic drivers different from those influencing public bond markets.

These benefits come with a caveat. The lack of a readily tradeable market for private assets limits an investor’s ability to quickly shift position. Therefore, it’s imperative to invest only in well-structured assets that are professionally managed and that have undergone a thorough credit assessment.

Providing expertise across private, unlisted asset classes designed to deliver differentiated sources of investment outcomes

Drawing on a spectrum of global fixed income opportunities to meet a range of client goals

Client focused investments that capture diverse sources of return across global markets

Maximising opportunity from direct and indirect real estate using our scale and presence across local markets

The views and conclusions expressed in this communication are for general interest only and should not be taken as investment advice or as an invitation to purchase or sell any specific security.

Any data contained herein which is attributed to a third party ("Third Party Data") is the property of (a) third party supplier(s) (the "Owner") and is licensed for use by Standard Life Aberdeen**. Third Party Data may not be copied or distributed. Third Party Data is provided "as is" and is not warranted to be accurate, complete or timely.

To the extent permitted by applicable law, none of the Owner, Standard Life Aberdeen** or any other third party (including any third party involved in providing and/or compiling Third Party Data) shall have any liability for Third Party Data or for any use made of Third Party Data. Past performance is no guarantee of future results. Neither the Owner nor any other third party sponsors, endorses or promotes the fund or product to which Third Party Data relates.

**Standard Life Aberdeen means the relevant member of Standard Life Aberdeen group, being Standard Life Aberdeen plc together with its subsidiaries, subsidiary undertakings and associated companies (whether direct or indirect) from time to time.

Investment involves risk. The value of investments, and the income from them, can go down as well as up and an investor may get back less than the amount invested. Past performance is not a guide to future results.

The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested.

Outdoor Chairs

Nasty Trick

Pee Piss Peeing Pissing Lesbian

Private Final Static

Arab Granny