Private Cost

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Cost

Economics Online Privacy policy Terms of service © 2021 All Rights Reserved - Critic One LLC - EconomicsOnline.co.uk 2008 - 2021

Private cost is the cost borne by an individual or firm directly involved in a transaction.

Explaining The K-Shaped Economic Recovery from Covid-19 A K-shaped recovery exists post-recession where various segments of the economy recover at their own rates or levels, as opposed to a uniform recovery where each industry takes the same ...

Does Public Choice Theory Affect Economic Output? Both on paper and in real life, there is a solid relationship between economics, public choice, and politics. The economy is one of the major political arenas after all. ...

Largest Retail Bankruptcies Caused By 2020 Pandemic As we know at this point, the COVID-19 pandemic has thrown major companies in the US and the world over into complete havoc. Many have filed for bankruptcy, with an ...

Identifying Speculative Bubbles and Its Effect on Markets Speculation plays an interesting role in economics and one that drastically affects markets. If you ever see "speculation" in this context, be sure to pay attention. It is ...

Explaining The Disconnect Between The Economy and The Stock Market Starting with the end of the 2009 recession, the U.S. economy grew 120 straight months, the longest stretch in history. During that time, the S&P ...

Consumer Confidence Compared to Q2 Job Growth Since WWII, nothing has caught global attention and heightened economic fears quite like Covid-19. Many economies are at the brink of collapse, as companies struggle to stay afloat. World governments ...

Alternatives to GDP in Measuring Countries There are currently 195 countries on Earth. Each country is its microcosm—a world inside a world, where people encounter their own problems, just like all of us. It's a ...

The multiplier effect - definition The multiplier effect indicates that an injection of new spending (exports, government spending or investment) can lead to a larger increase in final national income (GDP). This is because a ...

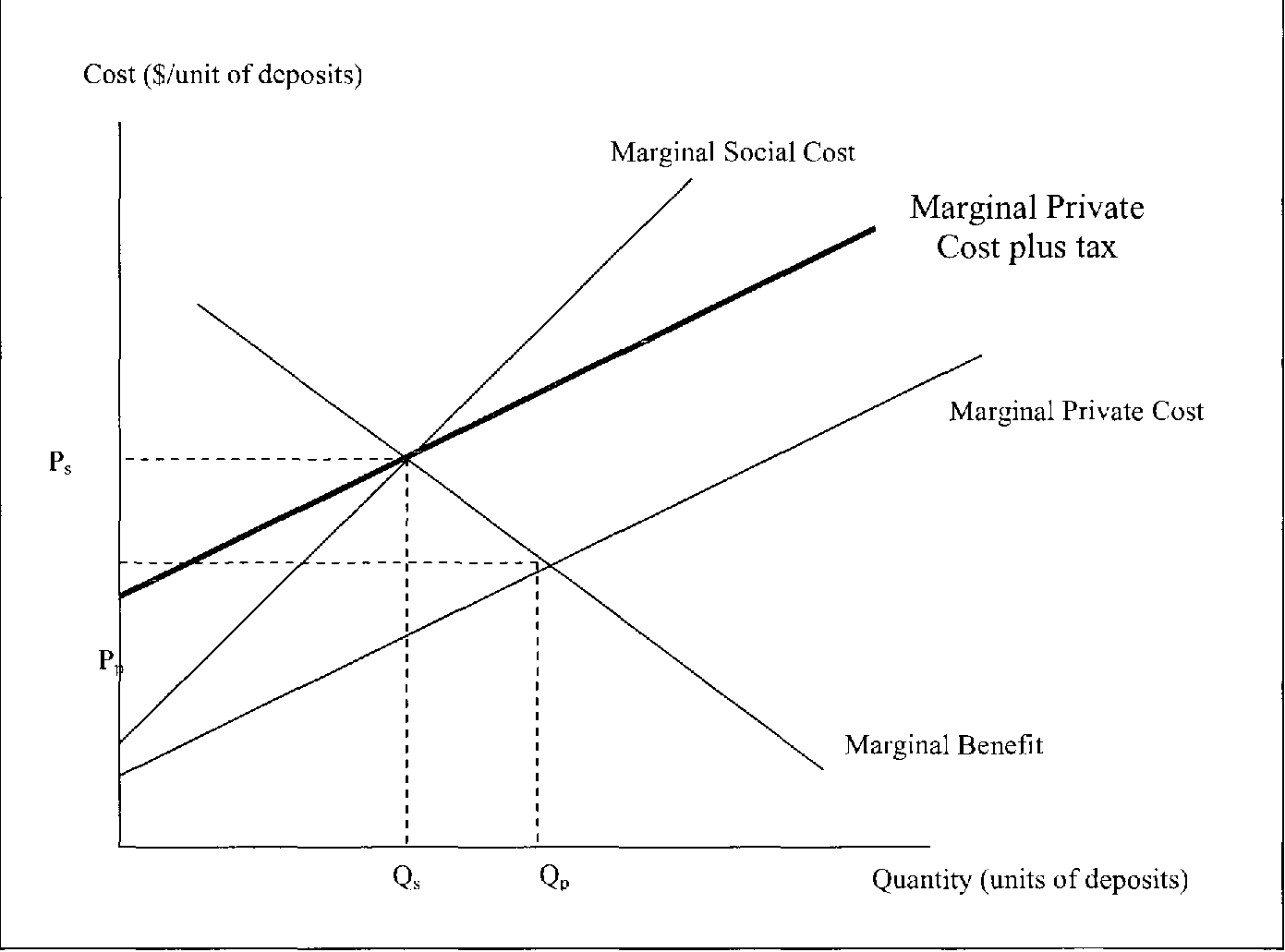

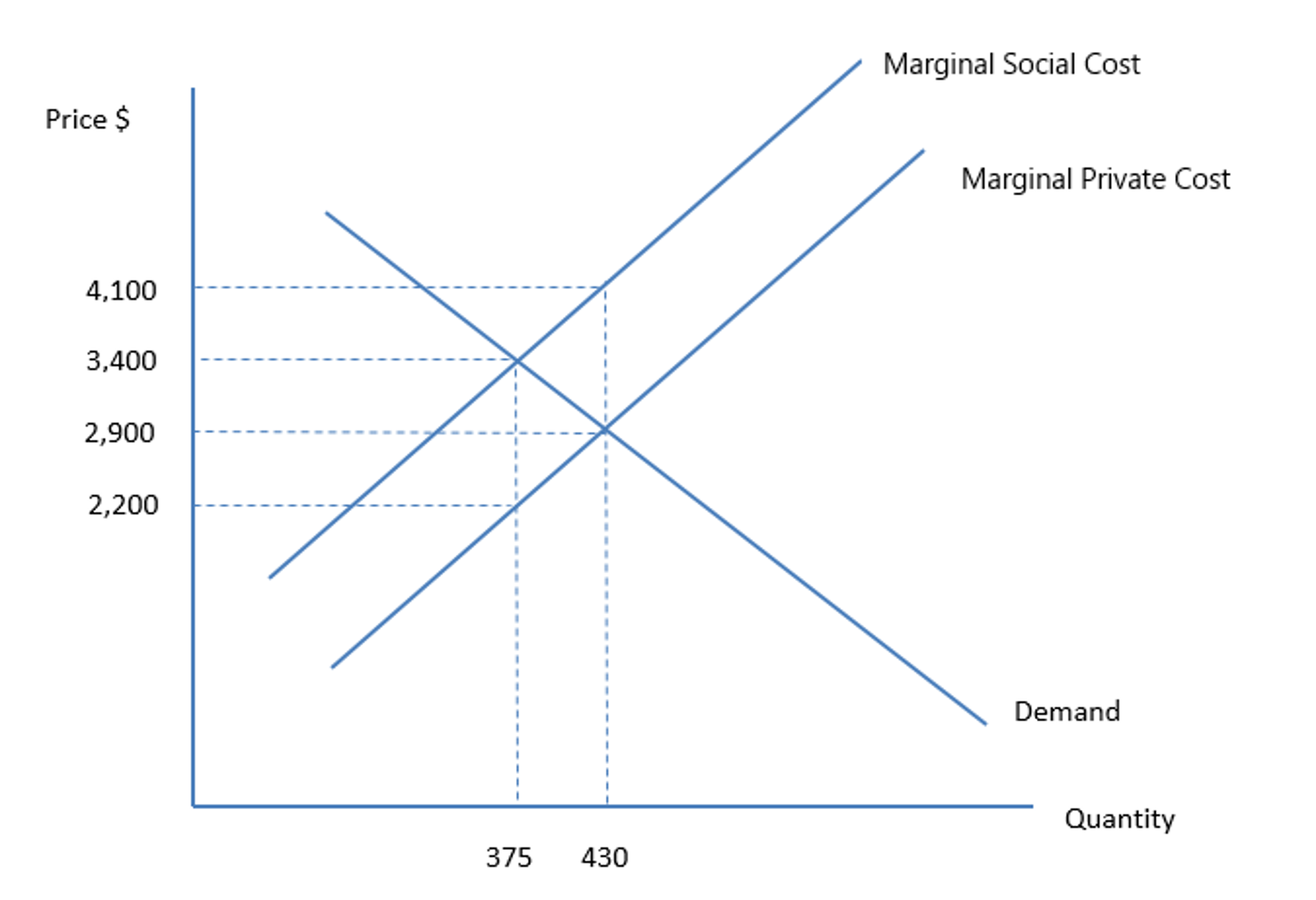

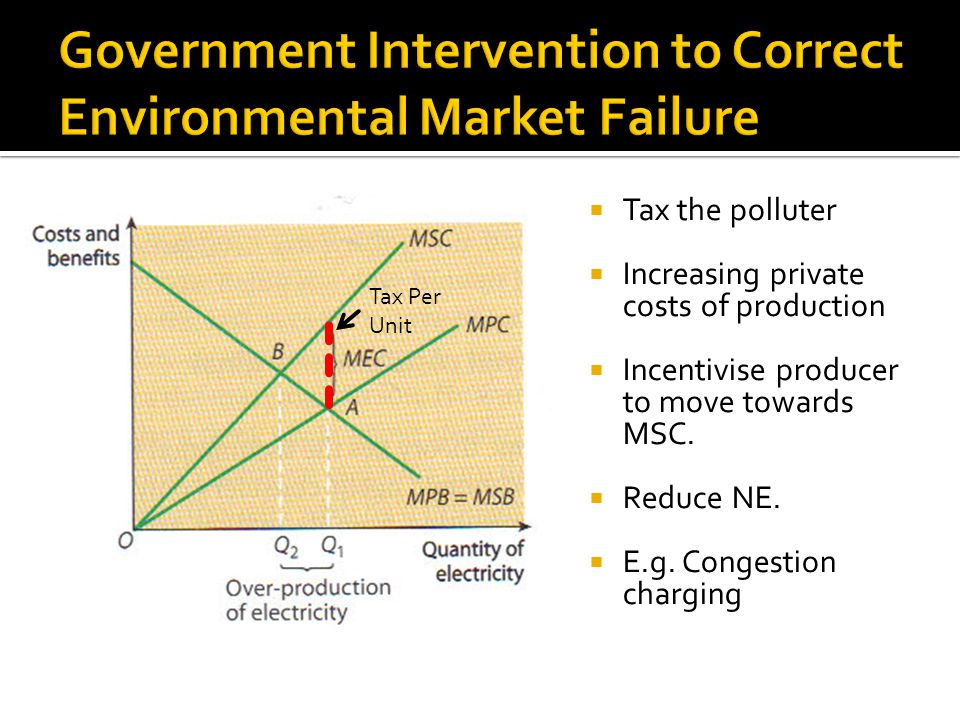

Externalities Question 1 A steel manufacturer is located close to a large town. During production it emits sulphur which creates an external cost to the local community. The private costs of production and the private ...

Education | What is the difference between private and social costs , and...

Private cost - definition | Economics Online | Economics Online

Cost - Wikipedia

private cost — с русского на английский

Social cost - Wikipedia

For other uses, see Cost (disambiguation) .

^ O'Sullivan, Arthur ; Sheffrin, Steven M. (2003). Economics: Principles in Action . Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. p. 16 . ISBN 0-13-063085-3 . CS1 maint: location ( link )

^ "CCP Exam Dumps" . Retrieved 1 March 2018 .

Content is available under CC BY-SA 3.0 unless otherwise noted.

In production , research , retail , and accounting , a cost is the value of money that has been used up to produce something or deliver a service, and hence is not available for use anymore. In business, the cost may be one of acquisition, in which case the amount of money expended to acquire it is counted as cost. In this case, money is the input that is gone in order to acquire the thing. This acquisition cost may be the sum of the cost of production as incurred by the original producer, and further costs of transaction as incurred by the acquirer over and above the price paid to the producer. Usually, the price also includes a mark-up for profit over the cost of production.

More generalized in the field of economics , cost is a metric that is totaling up as a result of a process or as a differential for the result of a decision . [1] Hence cost is the metric used in the standard modeling paradigm applied to economic processes .

Costs (pl.) are often further described based on their timing or their applicability.

In accounting, costs are the monetary value of expenditures for supplies, services, labor, products, equipment and other items purchased for use by a business or other accounting entity. It is the amount denoted on invoices as the price and recorded in book keeping records as an expense or asset cost basis .

Opportunity cost , also referred to as economic cost is the value of the best alternative that was not chosen in order to pursue the current endeavor—i.e., what could have been accomplished with the resources expended in the undertaking. It represents opportunities forgone.

In theoretical economics, cost used without qualification often means opportunity cost. [2]

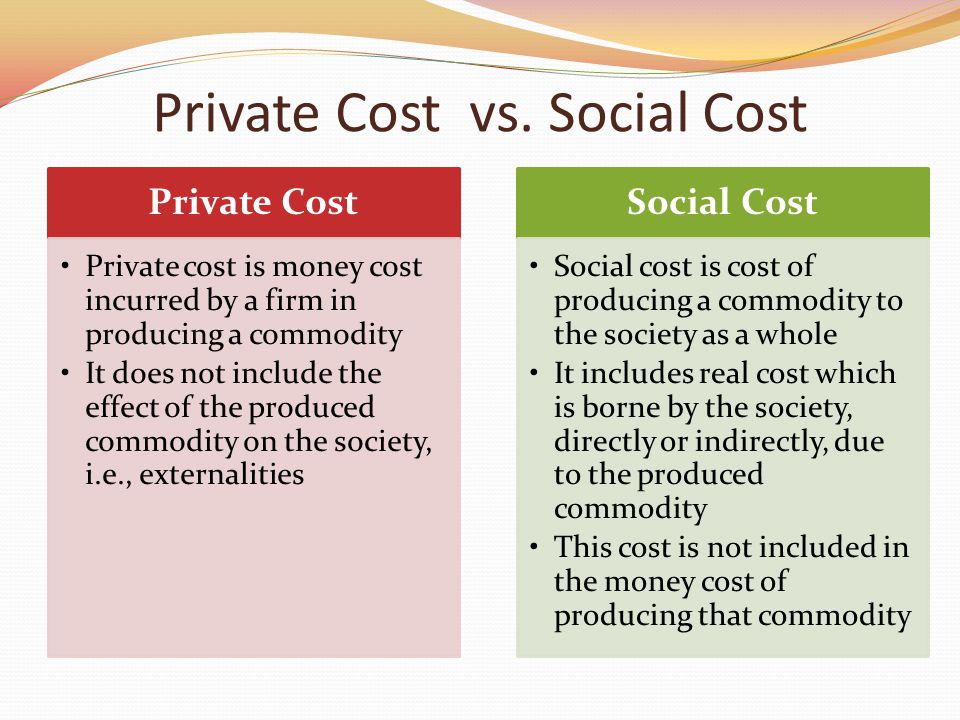

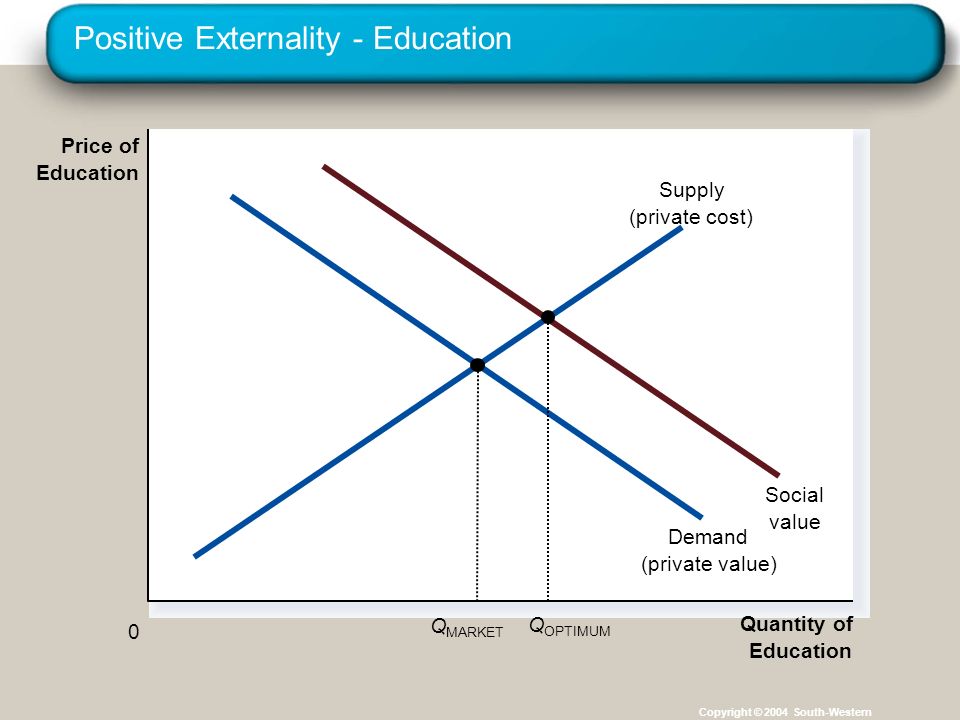

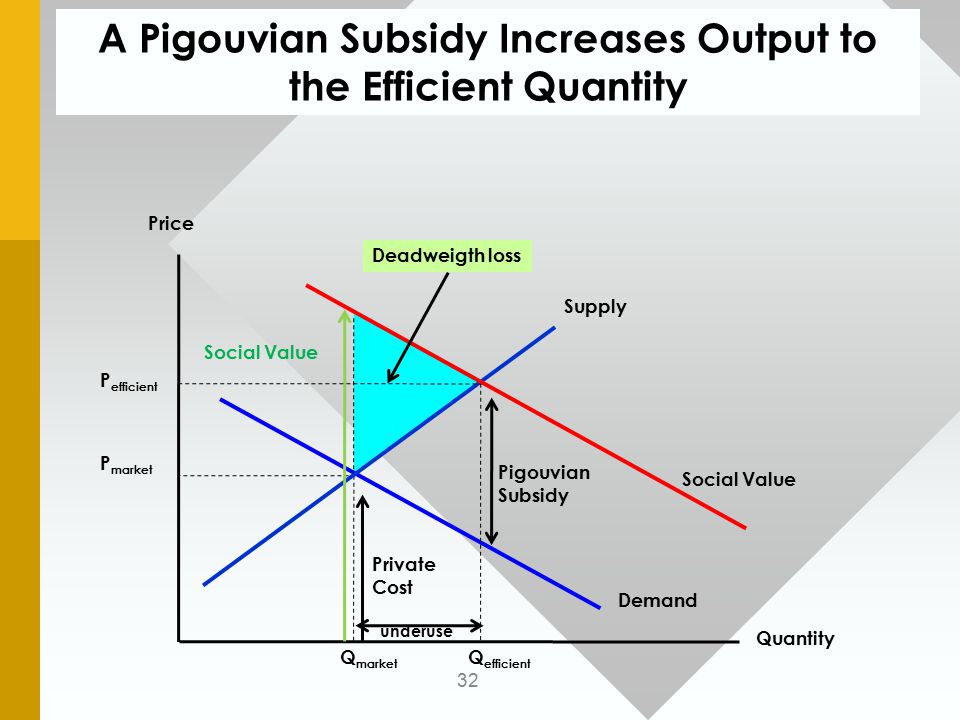

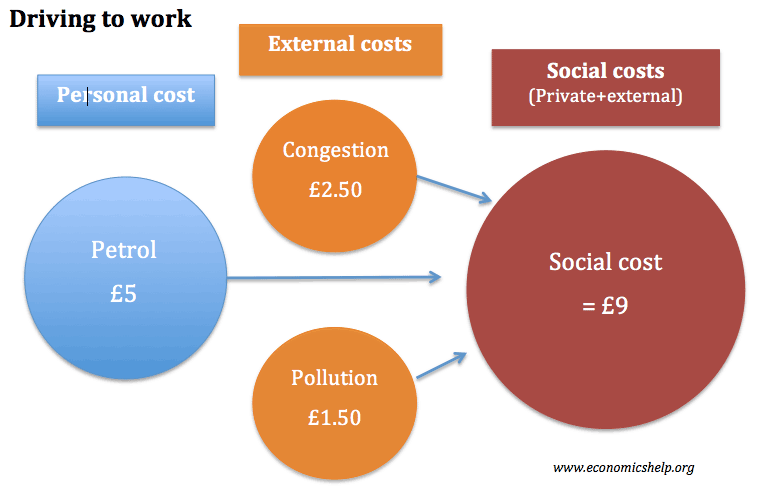

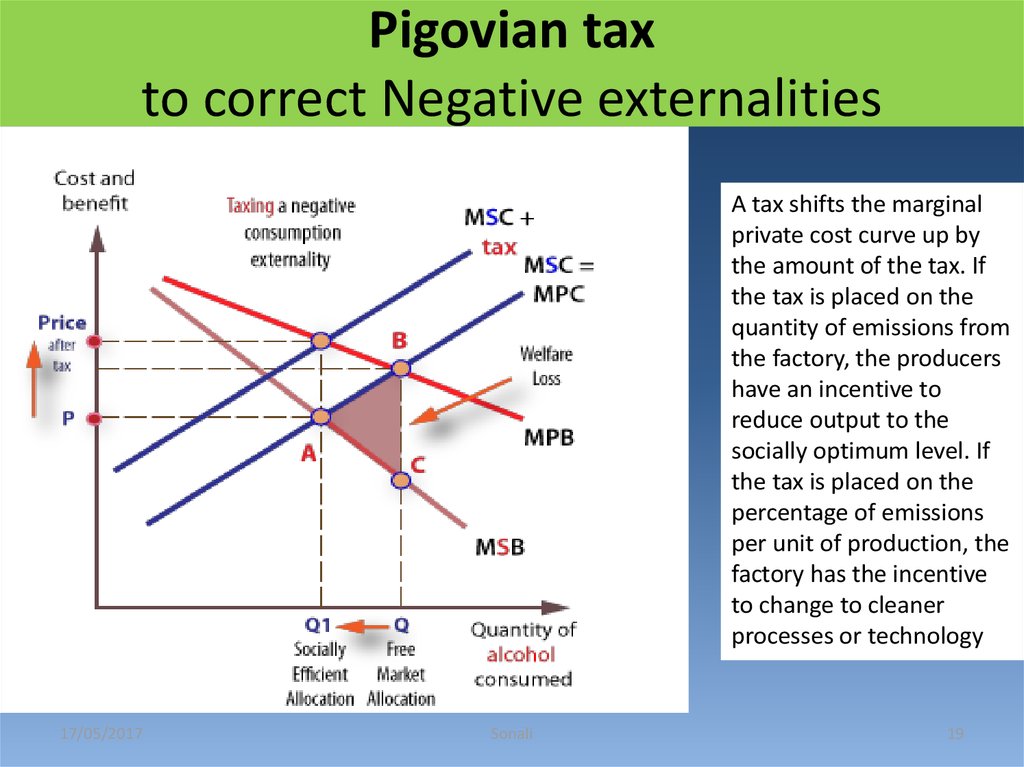

When a transaction takes place, it typically involves both private costs and external costs.

Private costs are the costs that the buyer of a good or service pays the seller. This can also be described as the costs internal to the firm's production function .

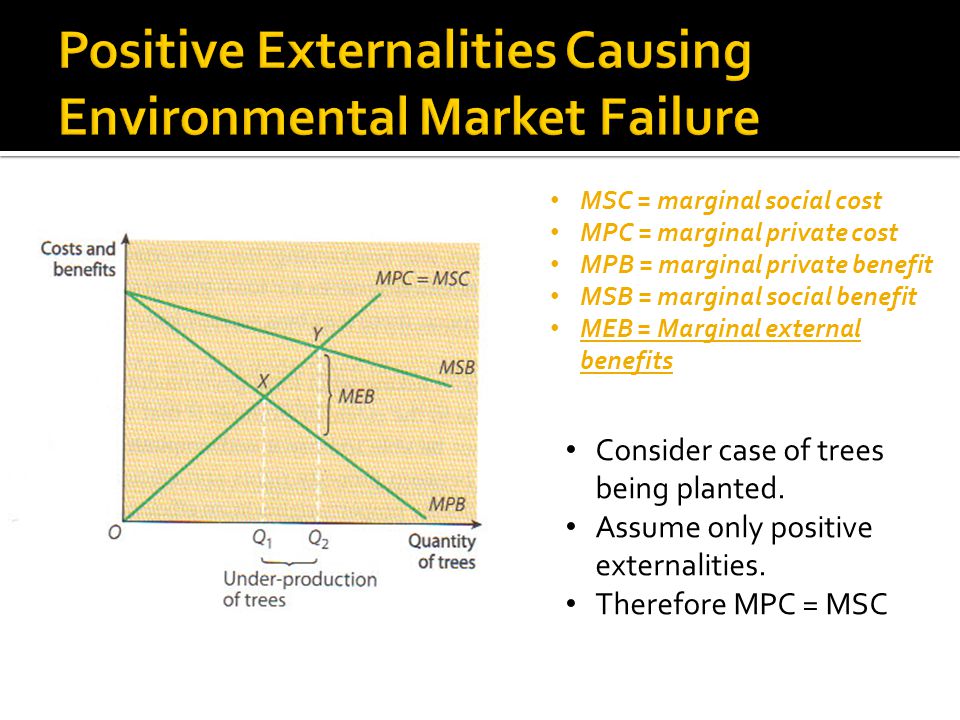

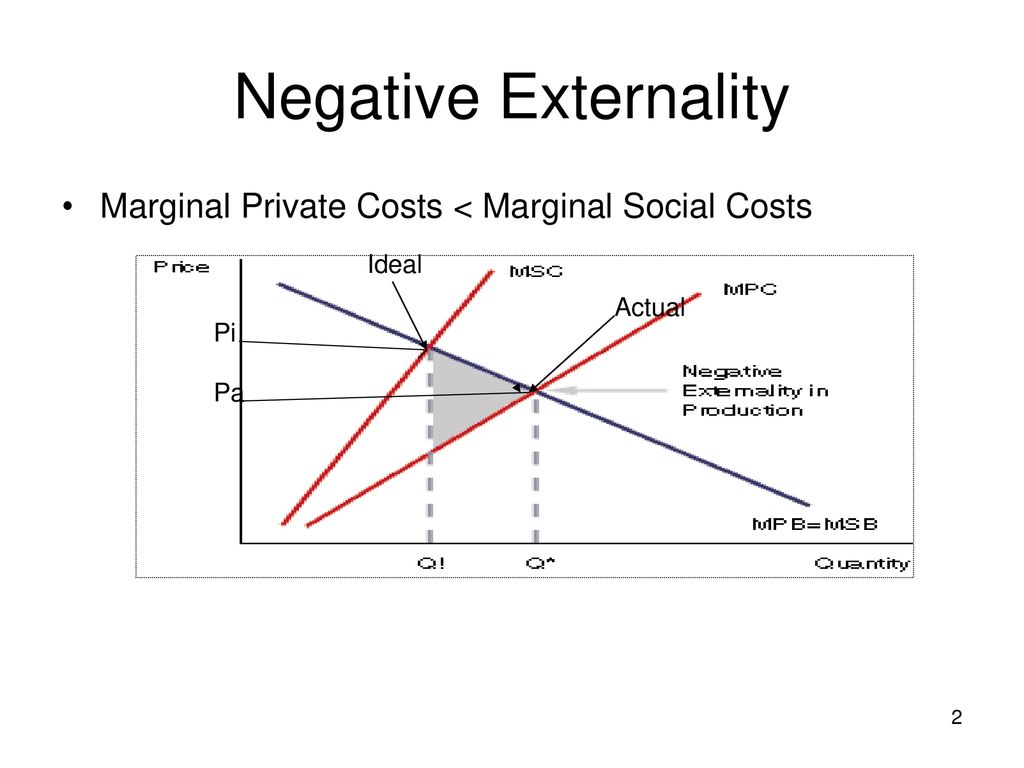

External costs (also called externalities), in contrast, are the costs that people other than the buyer are forced to pay as a result of the transaction. The bearers of such costs can be either particular individuals or society at large. Note that external costs are often both non-monetary and problematic to quantify for comparison with monetary values. They include things like pollution, things that society will likely have to pay for in some way or at some time in the future, but that are not included in transaction prices.

Social costs are the sum of private costs and external costs.

For example, the manufacturing cost of a car (i.e., the costs of buying inputs, land tax rates for the car plant, overhead costs of running the plant and labor costs) reflects the private cost for the manufacturer (in some ways, normal profit can also be seen as a cost of production; see, e.g., Ison and Wall, 2007, p. 181). The polluted waters or polluted air also created as part of the process of producing the car is an external cost borne by those who are affected by the pollution or who value unpolluted air or water. Because the manufacturer does not pay for this external cost (the cost of emitting undesirable waste into the commons), and does not include this cost in the price of the car (a Kaldor-Hicks compensation ), they are said to be external to the market pricing mechanism. The air pollution from driving the car is also an externality produced by the car user in the process of using his good. The driver does not compensate for the environmental damage caused by using the car.

When developing a business plan for a new or existing company, product, or project, planners typically make cost estimates in order to assess whether revenues/benefits will cover costs (see cost-benefit analysis ). This is done in both business and government. Costs are often underestimated, resulting in cost overrun during execution.

Cost-plus pricing , is where the price equals cost plus a percentage of overhead or profit margin.

Manufacturing costs are those costs that are directly involved in manufacturing of products. Examples of manufacturing costs include raw materials costs and charges related to workers. Manufacturing cost is divided into three broad categories:

Non-manufacturing costs are those costs that are not directly incurred in manufacturing a product . Examples of such costs are salary of sales personnel and advertising expenses. Generally, non-manufacturing costs are further classified into two categories:

A defensive cost is an environmental expenditure to eliminate or prevent environmental damage. Defensive costs form part of the genuine progress indicator (GPI) calculations.

Labour costs would include travel time, holiday pay, training costs, working clothes, social insurance, taxes on employment &c.

Path cost is a term in networking to define the worthiness of a path, see Routing .

Wikimedia Commons has media related to Costs .

Look up cost or time-consuming in Wiktionary, the free dictionary.

Casio Smart Outdoor Watch

Ftp Outdoor

Clothed Outdoor

Nudist Teen Photo Gallery

Young Girls Naturists Nudists