Private Company Limited By Shares

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Company Limited By Shares

HMRC, Bank or Creditor Pressure? We Can Help

Free Covid-19 Director Guide - Download Here

100% Confidential - Business Rescue or Closure Options

HMRC, Bank or Creditor Pressure? We Can Help

Home

Articles

Articles about UK Company Law

What is a private company limited by shares?

Further Reading on Articles about UK Company Law

Directors Are More At Risk Under New Small Business, Enterprise and Employment Act Regulations

What is a private company limited by guarantee?

Company Directors Disqualification Act (CDDA) 1986 Definition & Overview

Companies Act 1985 Definition & Overview

Companies Act 1989 Definition & Overview

Financial Services and Markets Act 2000 Definition & Overview

Financial Services Act 1986 Definition & Overview

Companies Act 2006 Definition & Overview

Director Support - Business suffering from Cash-Flow Problems?

If your company is financially distressed, we also offer the below services:

Who we help

Company Directors

Finance Directors

Sole Traders

Accountants

Small Businesses

Large Businesses

Partnerships

Company Owner/ Director

Accountant/Solicitor/Law Firm

Business Adviser

Education Sector

Other

Which best describes you? *

Contact our Team of Experts

or Find your Nearest Office

Almost 100 jobs saved at Midlands bar and restaurant chain Town and Country Inns plc

Estate Agents Sold out of Administration with 32 Jobs Saved

Bradford based Alatas Engineering bought out of administration

Construction Firm Continues Trading following Administration Procedure

Future of Residents and Staff Secured as Care Home is Sold Out of Liquidation

Successful Sale of MSS Clean Technology out of Administration

Women’s footwear specialists Ted & Muffy rescued from administration

Almost 100 jobs saved at Midlands bar and restaurant chain Town and Country Inns plc

Estate Agents Sold out of Administration with 32 Jobs Saved

Bradford based Alatas Engineering bought out of administration

Construction Firm Continues Trading following Administration Procedure

Future of Residents and Staff Secured as Care Home is Sold Out of Liquidation

Successful Sale of MSS Clean Technology out of Administration

Women’s footwear specialists Ted & Muffy rescued from administration

Real Business Rescue, Head Office

340 Deansgate

Manchester

M3 4LY

Tel: 0808 253 3829

Email: advice@realbusinessrescue.co.uk

Real Business Rescue is a trading name of Begbies Traynor (Central) LLP a limited liability partnership registered in England and Wales No. OC306540. The firm is authorised by the FCA to undertake debt counselling and debt adjusting and its reference number is 660455. Copyright 2020 Real Business Rescue, all rights reserved.

Privacy Policy

Site Map

Terms and Conditions

Affected by Covid-19? Immediate Rescue Or Closure Options Available

FAST Free Director Advice & Support, With 83 offices Nationwide our Licensed Insolvency Practitioners can Help Today.

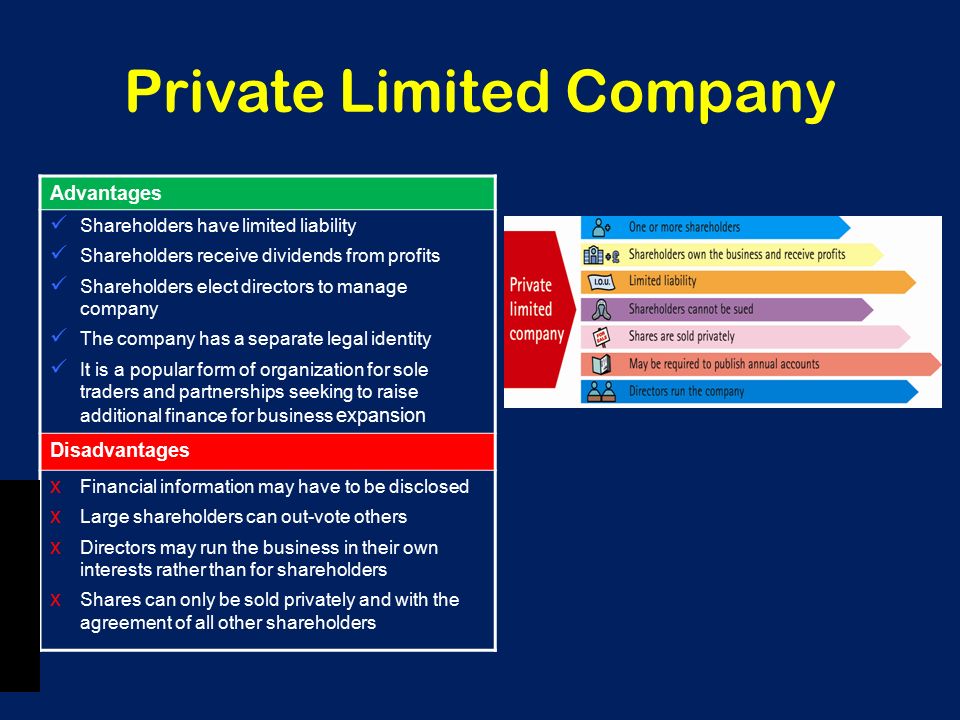

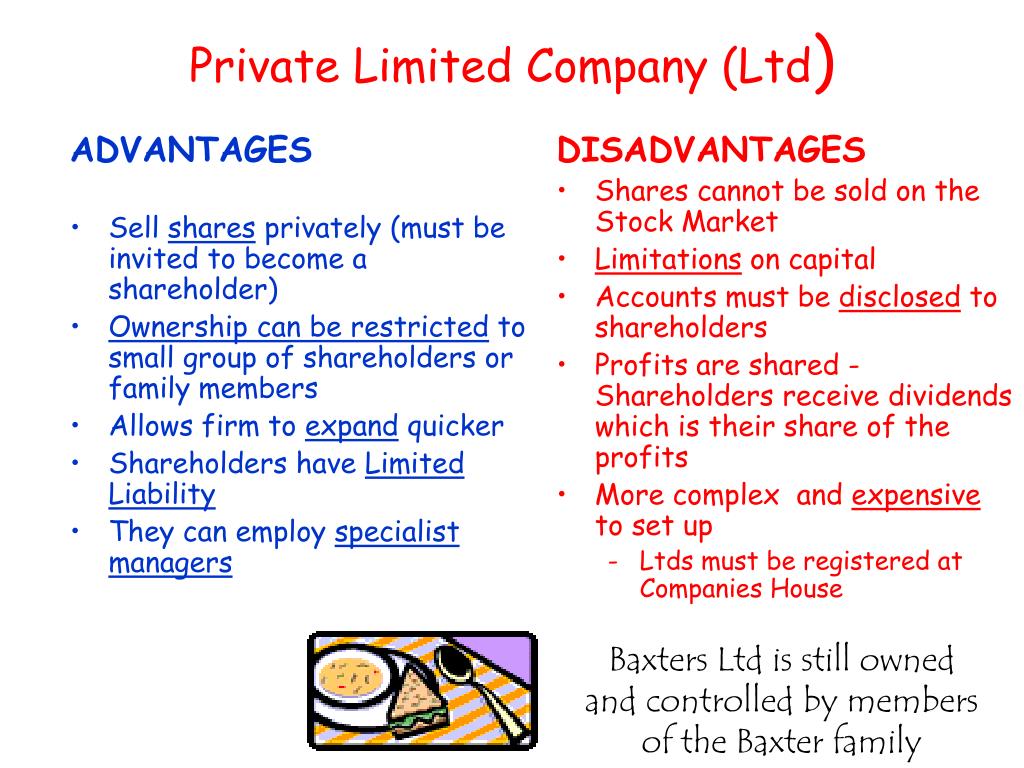

If you are looking to incorporate your company you may be confused about whether it would be more appropriate to adopt the limited by guarantee or limited by shares model. While the two structures have several similarities, there are some crucial differences, particularly when it comes to how profits can be extracted from the company.

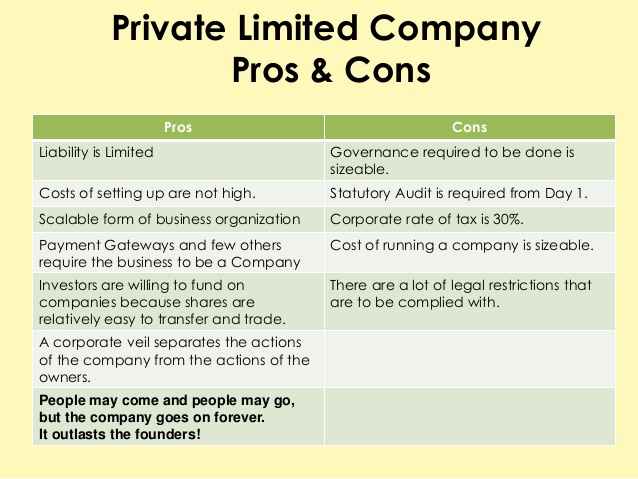

The most common type of company incorporation in the UK is the limited by shares model. This represents the optimal structure for a company which is set up with the purpose of generating profits for its directors and/or shareholders.

The limited by guarantee model , however, is more suited to not-for-profit organisations such as charities and sports clubs, where any profits made are simply reinvested into the core business activities.

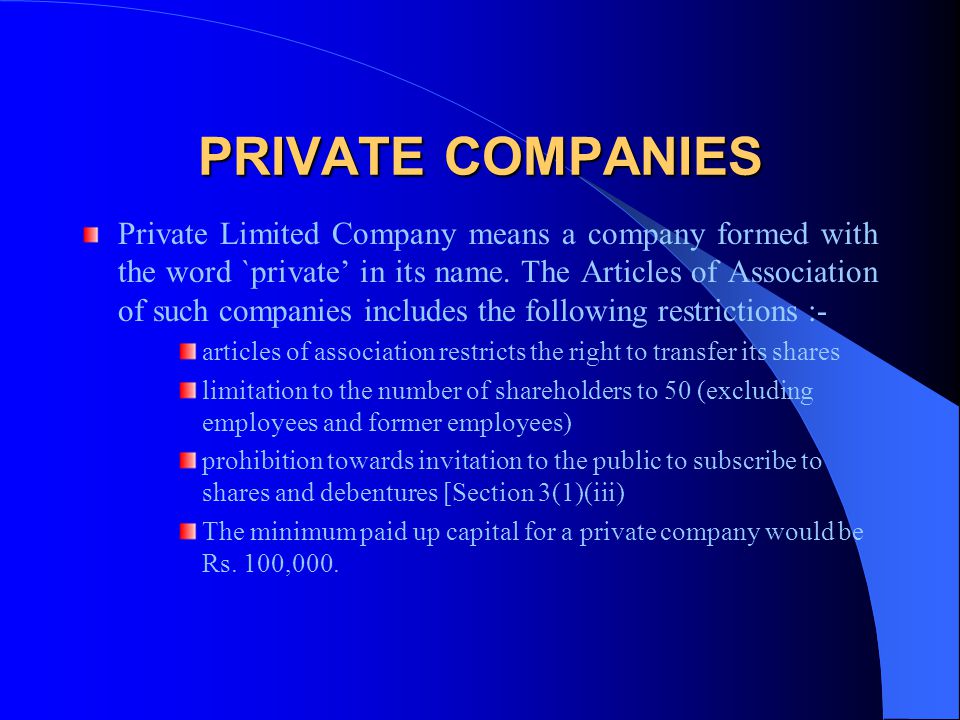

A limited company in the UK must be registered with Companies House. This is done by sending Form IN01, the articles of association, and the memorandum of association, along with a £40 registration fee.

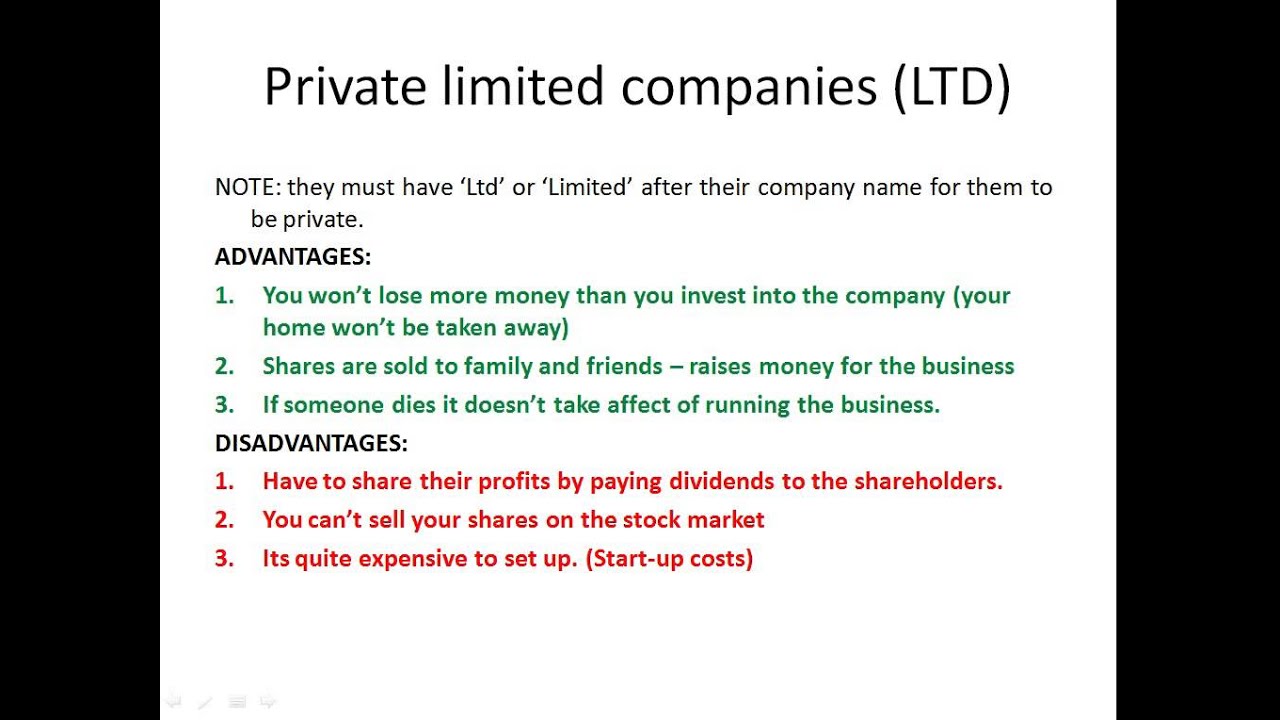

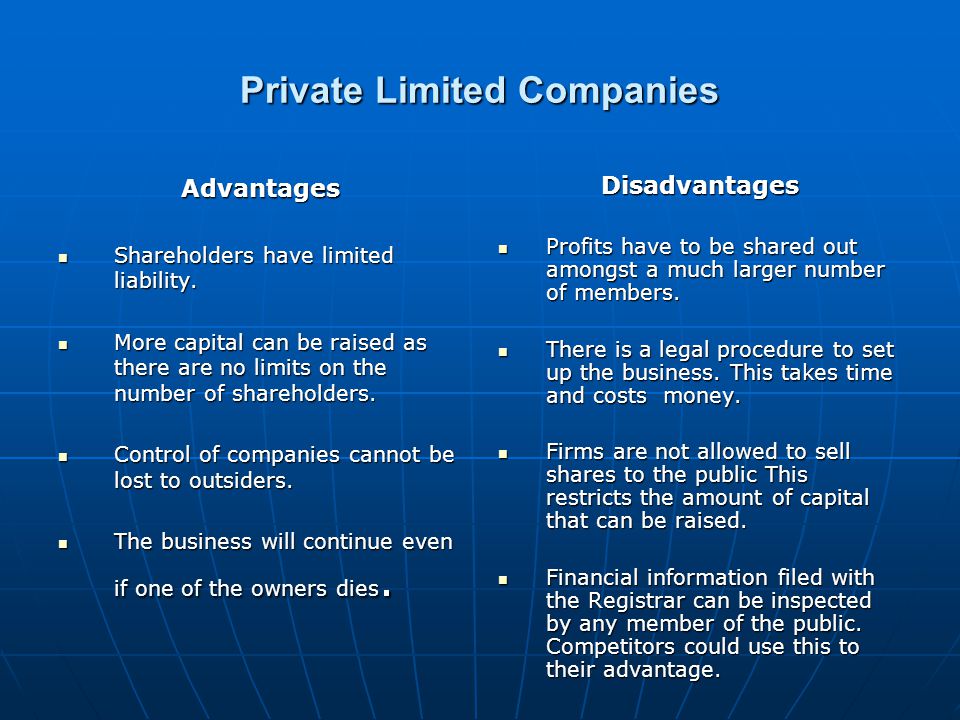

One of the primary advantages of incorporating as a limited company, as opposed to operating as a sole trader, is that as a company director you are able to benefit from limited liability. This provides a valuable level of protection against liability for company debts in the event of the company slipping into insolvency .

So long as no fraudulent trading or any other type of misfeasance has been committed, and excluding any personal guarantees which may have been given, a director’s personal liability for the debts of their company will be limited to the value of his or her shareholding.

This differs from the position an individual operating as a sole trader would be in should the debts of their business become unmanageable . As there is no legal distinction between a sole trader’s business and themselves as an individual, any debts accrued during the course of their business activities are the responsibility of the individual.

When a company limited by shares is incorporated, at least one share must be issued; the number of shares allotted to shareholders affects the distribution of dividends, voting rights in shareholder meetings, as well as the extent of shareholders’ liability should the company enter insolvency proceedings . Additional shares can be issued at a later stage in the event of a new business partner joining the firm, or for the purposes of securing investment. Shareholding percentages can be also be altered to reflect a change in ownership through the transfer and re-allotment of existing shares.

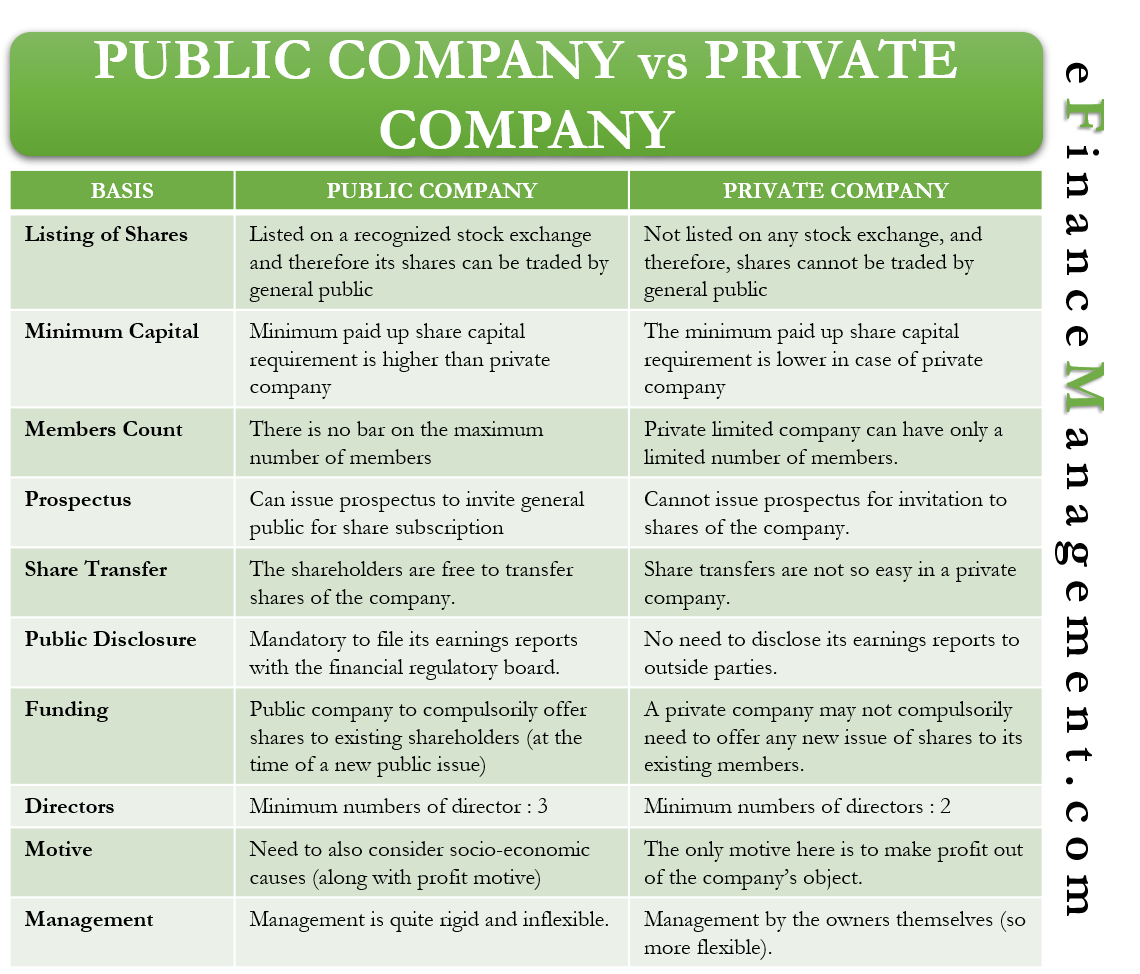

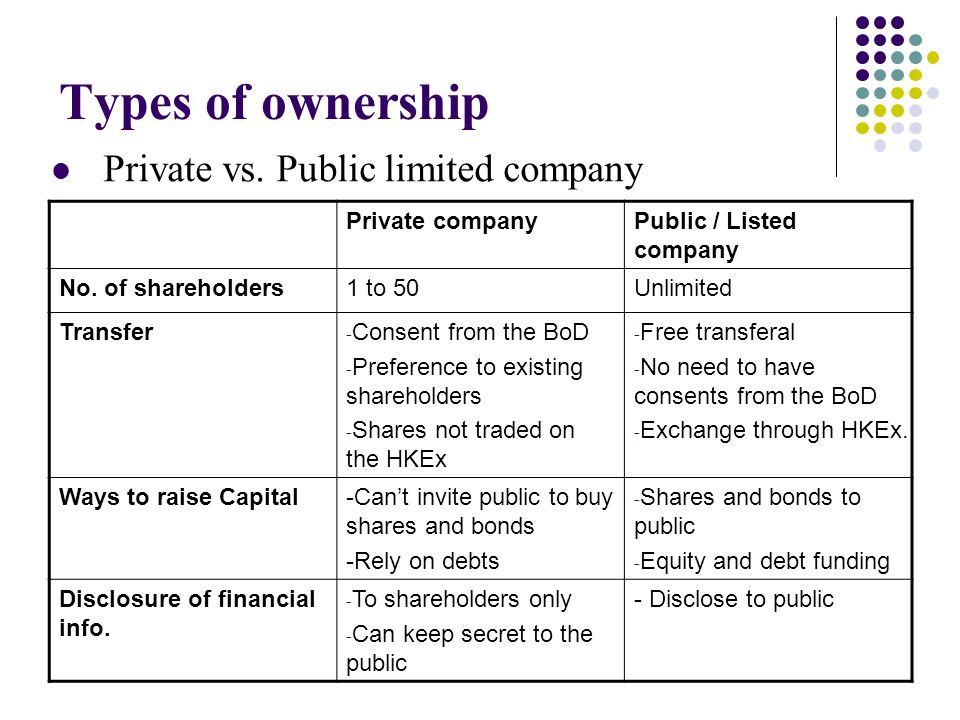

A company limited by shares can take one of two forms: a public limited company, or a private limited company. The main difference between the two structures comes down to how its shares can be sold and traded. As the name suggests, a public company trades publicly and is able to sell its own shares to the general public and trade on the stock exchange. A private company on the other hand is only able to sell its own shares to interested investors. The vast majority of start-ups are incorporated as private limited companies.

Choose any of our 84 UK Offices, your home or business premises.

Here at Real Business Rescue we take your privacy seriously and will only use your personal information to contact you with regards to your enquiry. We will not use your information for marketing purposes. See PRIVACY POLICY

The government is being urged to take proactive steps to support the many thousands of companies across the UK that are facing the prospect of being forced out of business in 2021.

Dozens of Debenhams stores are set to close after the company’s intellectual property assets were sold by its administrators to the fashion retailer Boohoo in a deal worth £55 million plus VAT.

Private Companies Limited by Shares | Advice | Harper James Solicitors

What is a private company limited by shares ?

What is a Private Company Limited by Shares ? (with picture)

private company limited by shares - Английский-Русский Словарь

A complete guide to companies limited by shares

Category:

Law

Business

Finance

Industry

History

Language

Technology

Internet

Education

Food

Beauty

Miscellaneous

Science

Anatomy

Health

Crafts

Cars

Home

Medicine

Fashion

Fitness

Art

United States

Environment

Travel

People

World

Hobbies

What is a Private Company Limited by Shares?

Jessica Ellis

Last Modified Date: January 31, 2021

Login:

Forgot password?

Register:

FAQs

About Us

Contact Us

Testimonials

Privacy Policy

Terms and Conditions

Copyright 2003 - 2021

Conjecture Corporation

A private company limited by shares is a type of business structure that denotes how liability and shareholding is managed. The term is more commonly used in the United Kingdom, Ireland, and Australia, where a private company limited by shares is usually recognizable by the abbreviation "Ltd," as in “Smith Brothers, Ltd.” In the United States, the company may use a similar abbreviation or may be considered a corporation , which has limited liability by virtue of its basic structure.

The term “limited liability” is used to describe the financial responsibility that investors have to the company. In a private company limited by shares, each shareholder is only responsible up to the unpaid amount of any shares he or she owns. This means that, should the company fold with enormous debts, creditors could not come after shareholders for repayments. Limited liability companies, whether public or private, are considered far safer investments than the much rarer unlimited form of company, since the investor can essentially only lose what has already been spent.

A private company limited by shares is distinguished from a similar but separate type of limited company , known as a private company limited by guarantee. This type of structure is usually reserved for non-profit groups and clubs that have guarantors rather than shareholders. Limiting a company by guarantee means that guarantors or members agree to pay a small amount if the company fails, but do not have to invest in shares. Since a non-profit or charitable organization does not generally distribute dividends to investors, acting as a guarantor is generally considered to be in the interest of the organization, rather than for personal financial gain.

The other distinguishing feature of a private company limited by shares is that it is a private, rather than public company. Being a private company entails certain restrictions as to selling or transfer of shares, as well as limiting the total amount of shares and shareholders. Should a shareholder of a private company wish to sell shares, he or she cannot do so on the open market. Unlike a publicly traded company, the shares of a private company cannot be sold on stock exchanges, or to members of the public who are not also shareholders. Many regions also have limitations on the amount of shareholders allowed in a private company; the decision to add more shareholders usually involves reincorporation as a publicly traded company.

With a B.A. in theater from UCLA and a graduate degree in screenwriting from the American Film

Institute, Jessica is passionate about drama and film. She has many other interests, and enjoys learning and writing

about a wide range of topics in her role as a wiseGEEK writer.

Cervix Penetration Manga Hentai

Porn Mature Mom Ass

Lesbian Carry

Private Retro

Blue Ass