Private Company

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Company

A company that does not offer its stocks for sale to the general public

Home › Resources › Knowledge › Finance › Private Company

We and selected partners, use cookies or similar technologies as specified in the cookie policy . With respect to advertising, we and selected third parties , may use precise geolocation data and actively scan device characteristics for identification in order to store and/or access information on a device and process personal data (e.g. browsing data, IP addresses, usage data or unique identifiers) for the following purposes: personalised ads and content, ad and content measurement, and audience insights; develop and improve products . You can freely give, deny, or withdraw your consent at any time by accessing the advertising preferences panel . You can consent to the use of such technologies by closing this notice.

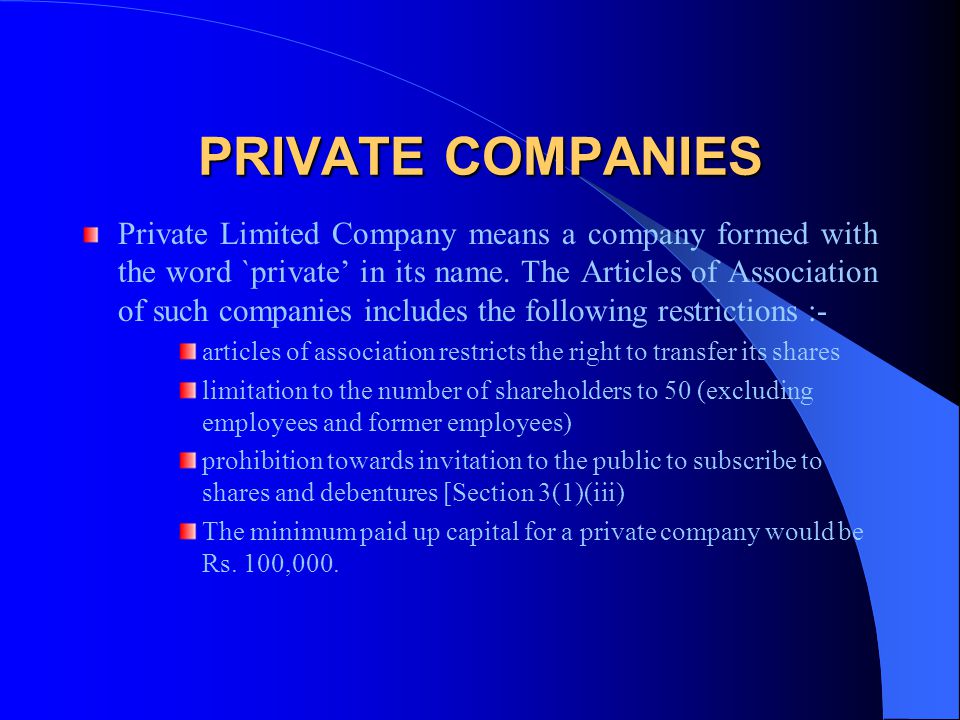

A private company is owned by either a small number of shareholders, company members, or a non-governmental organization, and it does not offer its stocks for sale to the general public. Instead, its stock is offered, owned, or exchanged privately among a small number of shareholders – or even held by a single individual. Private companies are also referred to as privately-held companies, limited companies, limited liability companies Limited Liability Company (LLC) A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and corp , or private corporations, depending on the country where they’re incorporated and how they are structured.

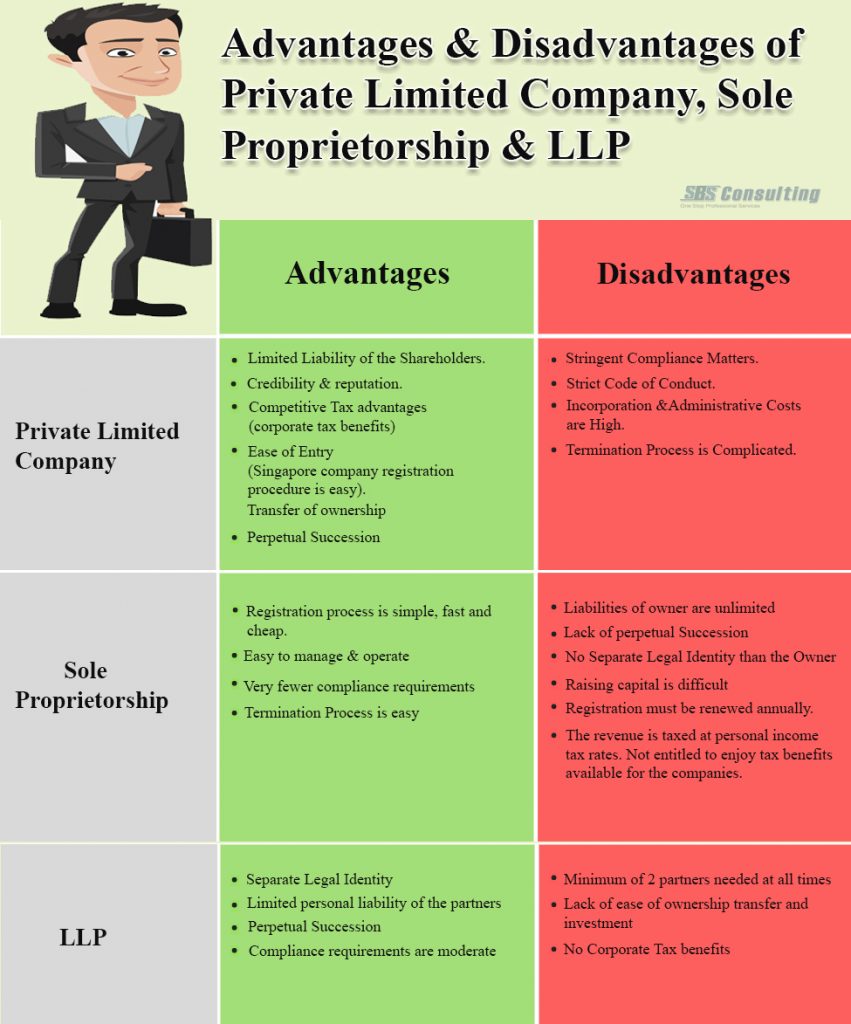

Private companies may include family-owned businesses, sole proprietorships Sole Proprietorship A sole proprietorship (also known as individual entrepreneurship, sole trader, or proprietorship) is a type of an unincorporated entity that is owned only , partnerships, and small to medium-sized enterprises (SME). Since such companies lack access to the public exchange market, they can only raise funds through private investments, company profits, or loans from lenders.

A sole proprietorship is a business owned and managed by one person, and the owner bears unlimited personal liability on the debts incurred by the business. All of its assets, liabilities, and obligations are the responsibility of the business owner.

If the business goes into debt, the owner may be required to sell personal assets to settle the debt. The owner can decide to either run the business on his/her own or employ other people to help run the business.

A partnership has a lot of similarities to a sole proprietorship, except the partnership is owned and managed by two or more people who come together with the goal of making a profit. The partners bear unlimited personal liabilities on any debts incurred by the business. The main types of partnerships include general partnerships, limited partnerships, and limited liability partnerships Limited Liability Partnerships (LLPs) Limited Liability Partnerships (LLPs) are a corporate business structure that enables entrepreneurs, professionals, and enterprises to provide services via .

A corporation is a for-profit or not-for-profit business entity that exists as a separate legal entity from its owners. A corporation possesses the rights and privileges of an individual, as it can enter into contracts, sue or be sued, own assets, and pay taxes. Corporations are owned by shareholders or individual investors who provide capital to the business through the purchase of the corporation’s stock.

The shareholders are required to elect a board of directors, which is required to oversee the overall operation of the business. The board appoints the managerial officers, such as the Chief Executive Officer (CEO), who supervise, direct, and manage the core business activities of the corporation.

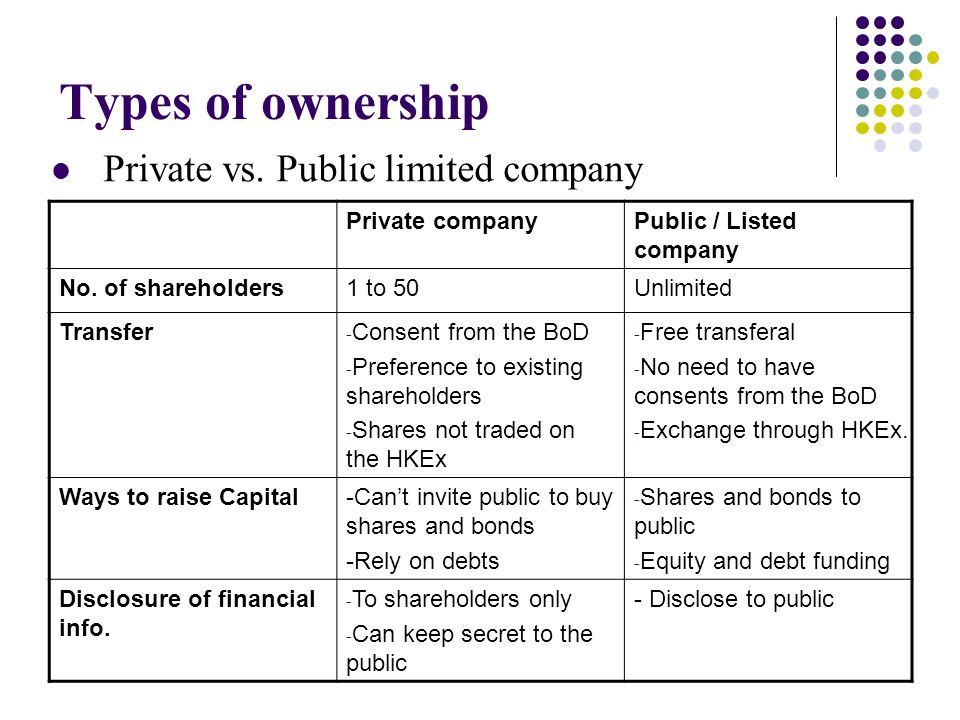

Public companies are under high scrutiny from their shareholders, regulators, and the government, and they are required to publicly release their financial statements by filing the quarterly reports, annual reports, and other major events with the Securities and Exchange Commission in the United States, or with a similar government entity in other countries.

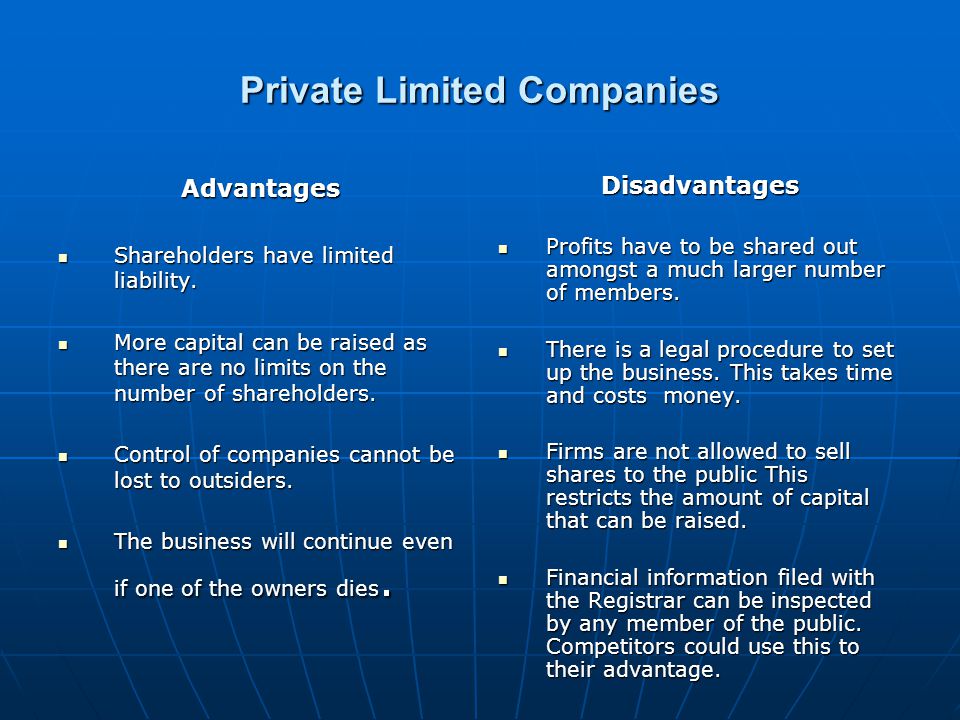

In contrast, private companies can choose to keep their financial status and operations to themselves, avoiding government scrutiny and all the regulations that apply to publicly-traded companies. There are no legal obligations for private companies to make their financial statements public. Privately held companies must, however, keep their accounting records in order and make financial statements available to their shareholders.

Companies sometimes opt to stay private to retain their family ownership. Some of the biggest US companies are family-owned, and they’ve been passed on from one generation to another. Going public would mean that the company would be answerable to a large number of shareholders, and might be required to choose different members for the board of directors other than the members of the founding family.

Remaining private means that the company alone can decide who sits in the board of directors, and it is only answerable to a small number of shareholders or private investors. Private companies self-finance their projects and acquisitions without selling large equity stakes to investors through an Initial Public Offering (IPO) Initial Public Offering (IPO) An Initial Public Offering (IPO) is the first sale of stocks issued by a company to the public. Prior to an IPO, a company is considered a private company, usually with a small number of investors (founders, friends, family, and business investors such as venture capitalists or angel investors). Learn what an IPO is .

A majority of public companies start as private entities, either as a family-owned business, partnership, or limited liability company with a few shareholders and advisors. As the business expands, it typically requires additional funds to finance its operations, expansion, or acquisition of other smaller companies beyond what it can raise from internal revenue sources and a small circle of investors.

Transitioning from a private to a public company gives the company access to a large pool of funds in the public exchange market. The process of becoming a public company involves offering stock to the investing public through an IPO.

The private company planning to go public is required to select an underwriter, usually an investment bank, to provide guidance on the IPO process. The underwriter acts as a broker between the issuing company and the public and is responsible for conducting due diligence and helping the issuer navigate all government regulatory requirements for public companies.

When the company goes public, all the privately-held shares are converted to public ownership, and existing shares are assigned a new value equivalent to the public trading price. The original shareholders can choose to hold on to their shares when the company goes public or sell them to new investors for a profit.

CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)™ FMVA® Certification Join 350,600+ students who work for companies like Amazon, J.P. Morgan, and Ferrari certification program, designed to transform anyone into a world-class financial analyst.

In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional CFI resources will be very helpful:

Get world-class financial training with CFI’s online certified financial analyst training program FMVA® Certification Join 350,600+ students who work for companies like Amazon, J.P. Morgan, and Ferrari !

Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Learn financial modeling and valuation in Excel the easy way , with step-by-step training.

Private Company Definition

Private Company - Overview, Types, Why Stay Privately Held

What is a private company ? Definition and meaning - Market Business News

What Is a Private Company ? How Private Companies Work - 2021 - MasterClass

Private Company | Examples & Definition | InvestingAnswers

© 2020 - Market Business News. All Rights Reserved.

A private company , also known as a privately held company or close corporation , is a business whose shares are not traded in a stock market, as opposed to a public company .

A private company’s shares are offered, owned and traded/exchanged privately. Some people refer to them as unlisted companies or unquoted companies .

A private company may also refer to a corporation that does not belong to the state. In the UK, US and other native-English-speaking nations, this meaning is much less common today.

Just because their shares cannot be bought by members of the general public does not necessarily mean a private company is small.

Many of them are household names, including Mars (food drink & tobacco), PricewaterhouseCoopers (business services & supplies), and Dell (technology hardware & equip) in the US, and the John Lewis Partnership (retail) or Virgin Atlantic (airline) in the UK.

According to Forbes , in 2014 a total of 221 private companies in the US had revenues of at least $2 billion. The same journal also reported that in 2008, the 441 biggest private companies in America employed 6.2 billion workers and accounted for $1.8 trillion in revenues.

In many cases, private companies are owned by their founders and/or their families and heirs. Employees may also own shares in a private company. The majority of small enterprises are private companies.

According to Cambridge Dictionaries Online , a private company is :

“A company that is owned by one person or a small group of people, for example a family, and whose shares are not traded on a stock market,” or “a company that is not owned by the government.”

Many large companies choose to remain private, even though going public would give them access to funds from the general public. Why? Below are some reasons:

You lose your privacy: public companies have to adhere to a raft of regulations, and file financial reports much more often. The salaries, stockholding and option holdings of key officers must be disclosed if you work in a public company.

As a director in a private company, you are not likely to receive letters from shareholders asking you to explain your paycheck – in a public company you will.

Fluctuating stock prices: even if your company is doing well, its share price could plummet if it is listed on a stock exchange when the overall economy takes a downhill turn. If employees own shares, a declining stock price can destroy morale.

You lose control: you could even get kicked out if share prices fall too low, someone buys up lots of them … and does not like you. This happens when you work in a listed company, which uses other people’s money.

Rivals will know more about you: as a listed firm, your competitors will know much more about your company’s margins, pricing, profitability and financial structure. It will be much easier for them to find your Achilles heel, and devise a more effective way to beat you.

If your rivals are private companies, they will know much more about you than you will about them (if yours is not a private company).

Do you want to become a prophet? Your shareholders, and the market in general, will expect you to make forecasts on how you think your company will fare in future quarters. If your predictions are not accurate, you will be criticized and ridiculed.

Say goodbye to long-term plans – in a private company you can sit with the other shareholders and work out long-term plans. In a public company, with possibly thousands of different stockholders, investors are much more interested in what their dividends will be this quarter and perhaps the next.

This hunger for money today and no jam tomorrow means you are much less likely to persuade stockholders to back a 10-year plan. Do you want to end up pleasing analysts by making decisions that yield short-term results at the expense of a better longer-term strategy?

Going public is expensive: – floating a company is neither easy nor cheap. You will be swimming in a pool of bankers, lawyers, accountants and providers of data, who will all be pushing for a slice of the cake.

The cost of floating a company can range from $1 million (no small amount in itself) to several million. Add to this the underwriting fees charged by investment bankers (maybe 7% of the total offering).

Then, when the float is over, there are several ongoing annual costs, for example, compliance costs average about $250,000 annually .

American technology journalist and author Sarah Lacy once said :

“One of the nice things about being a private company is operating without the intensity of public glare. It’s hard to grow a company under a microscope of constant second guessing.”

Prof. Hal Kirkwood, who works at Purdue Libraries, explains the differences between public and private companies, and how that may affect how much information you can find on each.

Fuck My Big Black Ass Hard

Busty Pee

Http Nudism Nudist Com

Tumblr Daughters Nasty Cunt

Oral Cum Inside Porn