Private Club Social Assistance

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Home

Лохотроны

Рекомендую

ВАЖНО

Новичкам

Мошенники!

Интересно

Новости

!!!

Home

Лохотроны

Рекомендую

ВАЖНО

Новичкам

Мошенники!

Интересно

Новости

!!!

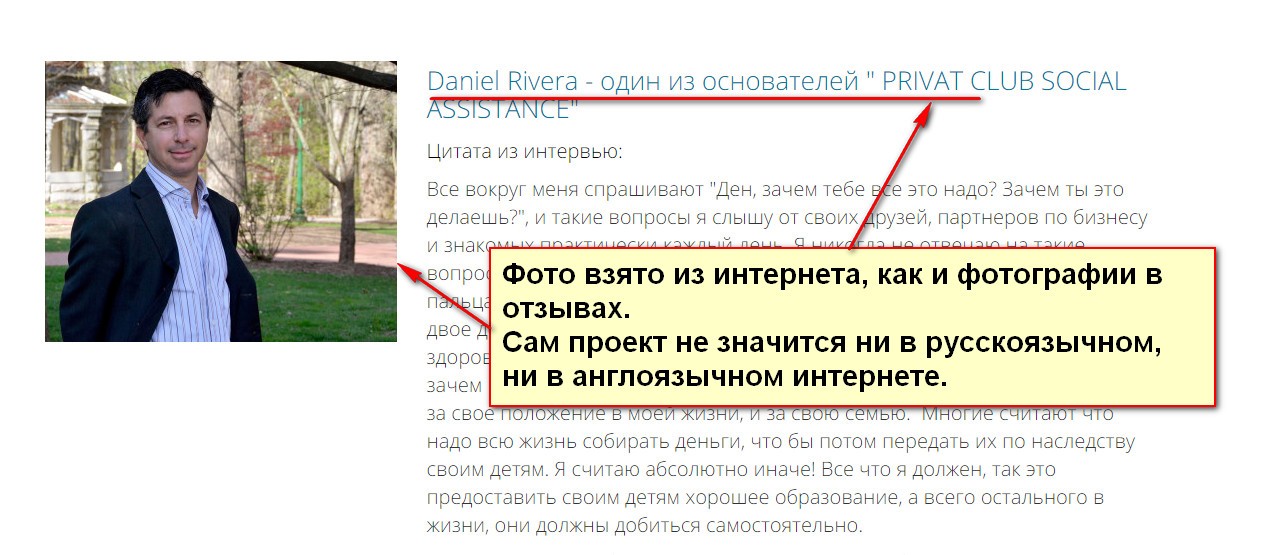

Очередной мошенник, будьте бдительны! Название: PRIVAT CLUB SOCIAL ASSISTANCE и Daniel Rivera. Финансовая помощь простым людям от инвесторов. Отзывы Сайты: http://daniel-rivera.ru http://pc-socialassistance.ru http://pc-social-assistance.ru http://pcsa-officials.ru http://pcsa-approved.ru http://pcsa-official.ru http://pcsa-official.ru/odobreno Внимание!!! Мошенник может поменять ссылку на сайт. Для того чтобы вы могли узнать лохотрон…

🔔 Если хотите найти информацию о каком-то сайте, способе заработка или курсе, пользуйтесь поиском! ⇓ ⇓ ⇓ ⇓ ⇓

НАЧНИ делать необходимое, затем возможное, и внезапно увидишь, что уже делаешь невозможное

Все ссылки в письмах отправляемых вам ведут только на сайт - nifigasebe.net

Если вы получили на почту сообщение от имени моего сайта, а ссылки в нем ведут на другой, вас хочет одурачить мошенник!

Мошенник может подделать полностью внешний вид сайта, но домен подделать у него не получится. Будьте бдительны!

НАПИШИТЕ МНЕ

Если вы купили курс, а он оказался лохотроном, напишите мне об этом. Почта: admin@nifigasebe.net

Мы используем куки для наилучшего представления нашего сайта. Если Вы продолжите использовать сайт, мы будем считать что Вас это устраивает.Ok

By Kerri Rawcliffe, CPA, Senior Manager

Now that the club is closed, and most activities have halted, private clubs are focused on navigating the next few months.

The recently enacted Coronavirus Aid, Relief, and Economic Security (CARES) Act, includes immediate relief and provisions for private clubs. Also listed below are some government-provided relief provisions that all private clubs may benefit from, including:

Both the EIDL and PPP are administered by the Small Business Administration (SBA). Private clubs can qualify to obtain an SBA loan if it has fewer than 500 employees or meets the annual receipts thresholds as set forth in the SBA size standards.

The Paycheck Protection Program (PPP), provides special emergency loans of up to $10 million to eligible nonprofits and small businesses. Applicants can receive loan proceeds to be used for the following:

The SBA began accepting applications on April 3rd.

PKFOD Observation: Currently, the Paycheck Protection Program is only available to non-profit organizations described in 501(c)(3) and 501(c)(19) sections of the Internal Revenue Code. Tax-exempt private clubs are not listed in the CARES Act as being able to take advantage of this; however, it could change in the near future, and we are following this closely. At this moment, we do believe that this does apply to taxable private clubs, and we encourage those to reach out to their SBA lender immediately as the program is rolling out now. Upon receiving further information from the SBA, we will update you accordingly.

The CARES Act expands emergency loans for private nonprofit organizations (of any size) enabling them to receive advances for $10,000 within three days of applying for the loan. EIDLs are loans of up to $2 million that carry interest rates of 2.75% for nonprofits, as well as principal and interest deferment. In essence, this advance is a grant and is not required to be repaid, even if the application is denied; however, the amount of the advance must be deducted from any loan forgiveness amounts under a PPP loan (discussed above).

The loans may be used for broader purposes, including expenses that could have been met had the disaster not occurred, such as for payroll and other costs, as well as to cover increased costs due to supply chain interruption, to pay obligations that cannot be met due to revenue loss, and for other uses.

Eligible grant recipients must have been in operation on January 31, 2020.

A private club that receives an EIDL between January 31, 2020 and June 30, 2020, as a result of a COVID-19 disaster declaration, is eligible to apply for a Paycheck Protection Program loan, or the private club may refinance their EIDL into a Paycheck Protection Program loan. In either case, the emergency EIDL grant award of up to $10,000 would be subtracted from the amount forgiven in the PPP. Note: This provision eliminates creditworthiness requirements for all applicants, including nonprofit organizations.

PKFOD Observation: A tax-exempt private club should consider applying for an EIDL loan immediately. These loans may be refinanced into a PPP loan if the next phase of the bill is expanded to allow tax-exempt private clubs to take advantage of the PPP.

Private clubs are eligible for a 50 percent refundable payroll tax credit on wages paid up to $10,000 per employee during the crisis. This credit is available to all private taxable and non-taxable clubs whose operations were disrupted due to virus-related shutdowns. The credit is available for employees retained but not currently working due to the pandemic, for private clubs with more than 100 employees, and for all employees of private clubs with 100 or fewer employees.

PKFOD Observation: This is a payroll tax, therefore private clubs who utilize a payroll service should proactively reach out to their payroll providers to learn more about receiving and calculating this credit. In general, private clubs have very little credits that they are able to take advantage of since they don’t pay much in the way of income taxes. Since the credit in the CARES Act applies to payroll taxes, this is a great opportunity for private clubs to benefit as well.

This credit is not available to any private club who applies for and receives a loan under the Paycheck Protection Program. Since tax-exempt private clubs are not currently eligible for the PPP loan, they are able to take advantage of this credit.

Government-provided relief also provides benefits to employees who are on leave due to issues surrounding the virus.

Provides for up to 80 hours of paid sick leave if the employee cannot work or telework because the employee:

FMLA benefits have been expanded so that Emergency FMLA (EFMLA) leave is now available to an employee unable to work (or telework) due to a need for leave to care for a child under age 18 if the school or place of care has been closed, or the childcare provider of such son or daughter is unavailable due to a public health emergency.

Tax-Free Financial Assistance to Employees

The President declared a national emergency on March 13, 2020 and invoked the Robert T. Stafford Disaster Relief and Emergency Assistance Act (Declaration) in response to the COVID-19 pandemic. This Declaration allows employers to provide tax-favored financial assistance to employees who are impacted, directly or indirectly, by the coronavirus.

Employers may now provide assistance, whether in cash or services, to employees affected by COVID-19 and that assistance shall be treated as tax-free to the recipients, exempt from federal income and employment taxes. In addition ‒ because there are no mandatory administrative requirements under this provision and it does not require itemized receipts from employees ‒ employers can react promptly to provide financial support and help alleviate the immediate needs of their employees.

Some examples of financial assistance include:

The payments may be made to all of the company’s employees, regardless of how long they have worked there, and there is no cap on the amounts that can be paid to any individual employee or to all employees in the aggregate. These payments cannot be a replacement of wages.

At this point, most private club operations are fully put on hold. Tax-exempt private clubs traditionally would record food-to-go as unrelated business taxable income (subject to gross receipt limitations) since it falls into the non-traditional revenue category. Right now, in order to keep providing amenities to members, more private clubs are providing food-to-go to their members. Typically, nontraditional revenue, such as carryout, must be limited to a de Minimis amount – this means, small, insignificant, and non-recurring. However, due to the current pandemic situation, private clubs have been informing members that they will be delivering to homes and elderly members as well as providing members the option of picking up food for carryout.

PKFOD Observation: Although the IRS has not released guidance, many experts have agreed that due to the current pandemic situation, it is not likely to become an issue with the IRS in relation to nontraditional activities (UBI). When the stay-at-home orders are lifted, tax-exempt private clubs should go back to maintaining their food-to-go limitations to a de minimis amount.

A fix of the qualified improvement property drafting error in the Tax Cuts and Jobs Act (TCJA) has finally made its way to the CARES Act allowing taxable private clubs to take a full deduction for qualified improvement property by using bonus depreciation. Under this correction, the useful life for property under the qualified improvement category would change to 15 years, versus the original 39. Taxable private clubs with large renovations may want to go back and amend their 2018 tax return for the additional deduction.

Not knowing how long the sequester will last and what life will be like on the other side, the club Board and its management may find the following suggestions of some value.

All private clubs will need to find new ways to interact with its members. Virtual communications and interactions with members can be accomplished in various ways, including;

During this uncertain time, private club management is focused on budgeting short-term cash flow and determining what sources of cash are available. With proper cash budgeting, many private clubs could maintain a three-month period of adequate club operations while being shut down. Consider these steps to preserve your cash and create liquidity for your private club:

Private clubs can use the current down time to get creative and plan for a more enjoyable club experience when members and employees return. Start surveying members prior to re-opening to see what activities and amenities they’d be interested in. With Board approval, the club can focus time and cash in these areas, while giving serious consideration to:

Visit our COVID-19 Resource Center for more news and insights on related topics.

For additional information on Disaster Loans, contact the SBA disaster assistance customer service center. Call 1-800-659-2955 or e-mail disastercustomerservice@sba.gov or, visit www.sba.gov.

For additional information on developments regarding payroll tax relief, call your payroll service or visit, if applicable, ADP’s website.

If you would like further information on any of the topics covered in this article, please contact the partner in charge of your account or:

Kerri Rawcliffe, CPA

Senior Manager

krawcliffe@pkfod.com

Ned McCrory, CPA

Partner

nmccrory@pkfod.com

Geoffrey Benedict, CPA, CGMA

Partner

gbenedict@pkfod.com

Service

Accounting and Assurance

Accounting Outsourcing

Agreed-Upon Procedures

Audits Reviews and Compilations

Elite Accounting Services

Employee Benefit Plans

Employee Stock Ownership Plans

Endowment Fund Accounting

International Financial Reporting Standards IFRS

IT Audit and Cybersecurity Reviews

Public Company Accounting Oversight Board PCAOB

Public Sector Audits and Compliance

Administration Services

Fund Administration Services

Outsourced CFO Services

Outsourced Portfolio Company Accounting Services

Advisory Services

Bankruptcy and Restructuring

Cybersecurity & Privacy Advisory Services

Dark Web Monitoring Services

Digital Forensic Services

Virtual Chief Information Security Officer Services (vCISO)

Family Advisory Services

Forensic, Litigation and Valuation Services

Matrimonial Services

Management Advisory Services

PPP Loan Forgiveness Services

Risk Advisory Services

Specialty Industry Advisory Services

Transaction and Financial Advisory Services

Wealth Services

Credit Card Claims Services

Family Office

Accounting and Reporting

Advisory

Charitable Giving

Family Advisory Services

Investment Monitoring and Oversight

Lifestyle Support

Personal Financial Management

Tax Planning

Wealth Planning

International Services

China Desk

General Data Protection Regulation (GDPR)

German Desk

German Desk

Transfer Pricing Services

Investment Banking

Acquisition Advisory

Exit Readiness and Transaction Planning

Sell-Side Advisory

TalentConnect Services

Tax Compliance and Planning

Employee Benefit Planning and Tax Compliance

International Tax Services

IRS Representation and Tax Controversies

Personal Financial Planning

Private Foundation Services

State and Local Tax SALT

Tax Compliance and Reporting

Tax Research and Strategic Planning

Tax-Exempt Organizations

Trust and Estate Planning

Service

Industry

Affordable Housing

Architecture and Engineering

Banking

Business Solutions

Cannabis

Cemeteries

Construction

Consumer Products and Retail

Education

Charter Schools and Charter Management Organizations (CMOs)

Higher Education

Independent Schools

Employee Benefit Plans

Employee Stock Ownership Plans

Family Office

Financial Services

Health Care

Hedge Funds

Hospitality

Life Sciences

Manufacturing and Distribution

Medical and Dental Practices

Not-for-Profit Organizations

Private Clubs

Private Equity

Private Foundations

Professional Services

Professional Trade, Membership Associations and Societies

Public Sector

Real Estate

Shipping and Logistics

Sports and Entertainment

Technology

Transportation Industry Services

Industry

Select Month

July 2021 (9)

June 2021 (15)

May 2021 (15)

April 2021 (11)

March 2021 (20)

February 2021 (25)

January 2021 (24)

December 2020 (29)

November 2020 (19)

October 2020 (17)

September 2020 (21)

August 2020 (21)

July 2020 (18)

June 2020 (25)

May 2020 (31)

April 2020 (54)

March 2020 (38)

February 2020 (11)

January 2020 (11)

December 2019 (12)

November 2019 (5)

October 2019 (13)

September 2019 (5)

August 2019 (8)

July 2019 (12)

June 2019 (5)

May 2019 (10)

April 2019 (9)

March 2019 (14)

February 2019 (12)

January 2019 (13)

December 2018 (13)

November 2018 (11)

October 2018 (10)

September 2018 (14)

August 2018 (10)

July 2018 (13)

June 2018 (11)

May 2018 (6)

April 2018 (9)

March 2018 (8)

February 2018 (17)

January 2018 (29)

December 2017 (17)

November 2017 (11)

October 2017 (6)

September 2017 (12)

August 2017 (10)

July 2017 (9)

June 2017 (8)

May 2017 (8)

April 2017 (4)

March 2017 (11)

February 2017 (7)

January 2017 (21)

March 2016 (1)

October 2015 (1)

September 2015 (1)

© 2021 PKF O'Connor Davies, LLP All Rights Reserved.

Amy Rose Bikini Boobs

Celeb Sex Turkes

Sestra Brazzers Sekis Vidyo

Specagent69 Anal Free

Hairy Mom Com

Privat club social assistance Ваше мнение о сайте?

privat club social assistance | NifigaSebe.net | №1 в ...

Impact of Government-Provided Relief on the Private Club ...

What is a Private Club? | Private Club Rules & Regulations

Start Your Own Private Social Club - Unusual Investments

III−1.6000 Private clubs

Social Clubs | Internal Revenue Service

Is the 2017 Social Private Assistance Package a Scam ...

Private Clubs Ideas & Insights - RSM US

Private club legal definition of Private club

Private Club Social Assistance

/cdn0.vox-cdn.com/uploads/chorus_image/image/47907617/yaleclubinterior.0.jpg)