Private Capital Forum

👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

EURUS is a foremost international private capital forum bringing together top-tier funds, asset managers, institutional and private investors, visionary executives and entrepreneurs with interests in the broader European private markets. A forward-looking senior-level platform, EURUS offers a highly engaging, content-rich programme for leaders in private equity, venture capital, real estate, private debt and infrastructure.

Breaking down silos across geographies and asset classes for accelerated growth, innovation and more efficient private markets

Industry change-makers and seasoned investors imparting key insights and strategies for benchmark-beating returns and operational know-how

Mid-market landscape in Europe, buyouts, minority investments, co-investing, special accounts, deal-flow, fund strategies, exits, secondaries, performance, talent, fundraising, LP-GP relationships, returns and distributions, first-time funds, regulatory environment, compliance, transparency, reporting, deal structuring, sub-sector analysis, regional and global economic trends, risk management, cross-border transactions

Allocation trends, commercial and residential real estate, niche assets (self-storage, retirement) hotels, market cycles, socio-demographic trends, e-commerce and implications for retail, strategies across geographies and asset types (core, core+, value add, opportunistic), liquidity, closed ended funds, JV partnerships, cross-border transactions, deal structuring, fundraising, pooled and deal-based funds, debt and equity financing, proptech, crowdfunding

A diverse group of LPs representing institutional and private funds, leading family offices and HNWIs deploying capital in private markets in Europe and beyond

EURUS serves as a match-making platform for GPs, LPs, entrepreneurs and various private equity groups seeking to engage in profitable transactions

Innovation trends, smart technologies, consumer behavior, experience design, e-commerce, business software/SaaS, fintech, regtech, startup acceleration, capital raising, corporate venture capital (CVC), valuation, unicorns, early stage investing, portfolio strategies, marketplace development, deal scouting, management, performance, returns, growth strategies, artificial intelligence (AI), big data analytics, media and telecommunications

Whether fundraising, seeking off-market deals or strategic co-investors, EURUS enables quality connections and resources for its stakeholders to succeed

1. Direct access to investors, fund managers, entrepreneurs, and corporate decision-makers from a few dozen countries.

2. An international crowd of private capital leaders sharing global experiences and perspectives in a highly interactive social setting.

3. Consult peers and deliberate innovative approaches to recurring and evolving challenges in your business and industry.

4. Hear from a roster of dynamic and distinguished speakers imparting key insights, authoritative research and experiential knowledge in private equity, venture capital, and real estate.

5. Immerse in insightful and solution-focused conversations: what’s hot and trending, risks, opportunities and practical takeaways.

6. Tackle key issues related to growth, value creation, fundraising, performance, regulation, technology to help you gain a competitive edge in fast-evolving markets.

7. Equip yourself with cutting-edge research. macro and sector analyses supported by globally recognized alternative assets data and intelligence sources.

8. Enhance your awareness of industry best practices, operational tools, talent and resource management.

9. Leading technology and software solutions providers at TeXPO offering a range of products and services for optimizing business processes.

10. Ample networking/mingling opportunities with top investors, entrepreneurs accompanied by a riveting social programme.

PrivCap Resources Group

250 Yonge Street, Suite 2201

Toronto, ON, M5B 2L7

Canada

Tel: +1 888-880-3205 | US-CA

Tel: +41 43 508 9385 | Europe

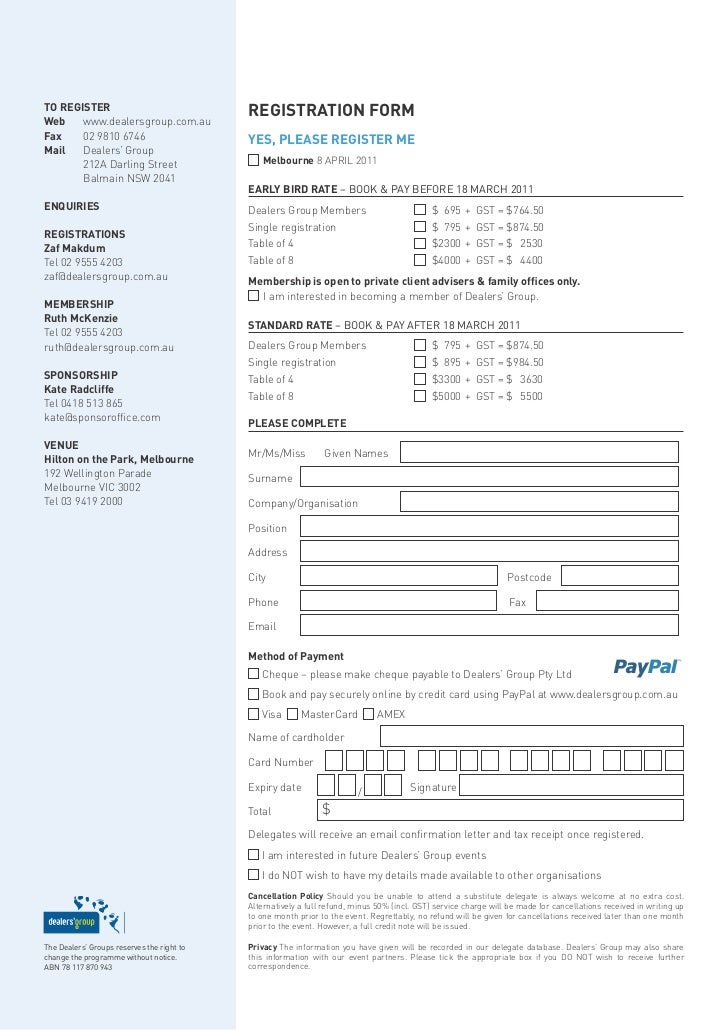

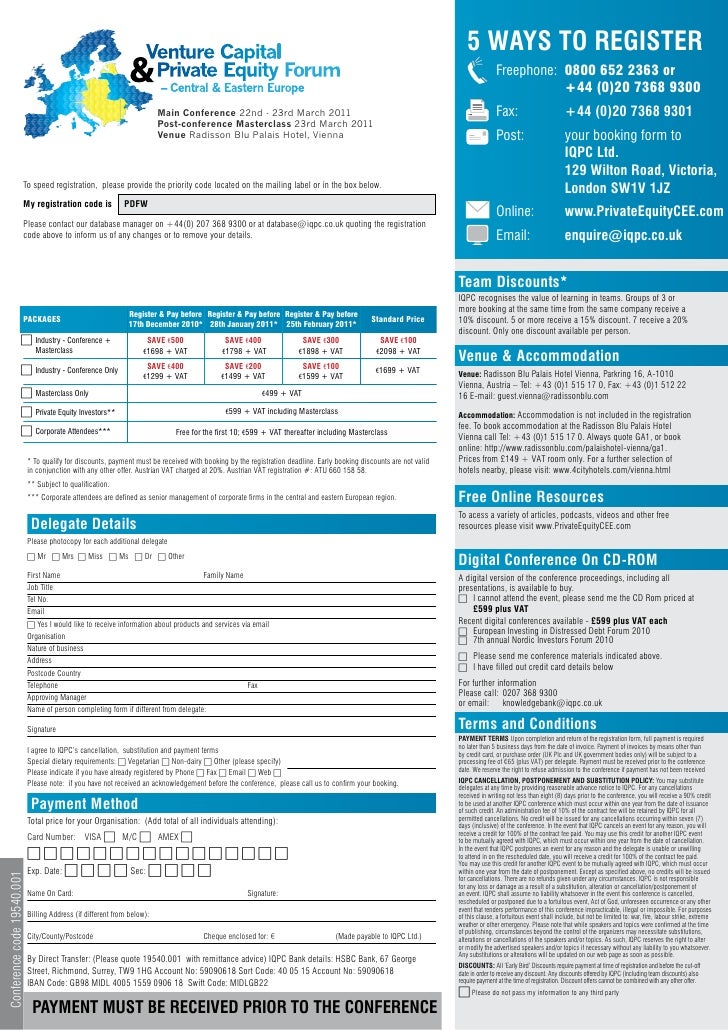

Registration

Opens: Date TBA

Early Bird

Expires: Date TBA

Registration

Closes: Date TBA

Cancellation

Refunded by: Date TBA

Sign up to receive news and updates.

© 2016-2020 PrivCap Resources Group. All Rights Reserved.

Napa Valley Marriott Hotel & Spa, Napa, CA

October 20, 2019

With the changing landscape among numerous industries due to COVID-19, the need to meet is more relevant than ever. Each Opal agenda contains a comprehensive list of seasoned speakers and leaders who are closely watching the impact of COVID-19 and its relation to industry trends. Opal is eager to keep education and networking a priority amongst this community.

At Opal, we understand that the current environment makes the prospect of travel complex. However, the desire to meet and engage with your industry peers hasn't diminished.

We are hoping to make your decision to attend the upcoming event an effortless one. We are proud to announce that the upcoming event will check all the boxes and be presented as a Hybrid event, to include both a "live" in-person event alongside a "virtual" online component. Over the next few months, we will all undoubtedly learn more about the course of the COVID-19 pandemic, and should circumstances require; the event will run solely virtual.

We hope to see you in person, but understand that may not be realistic for all of our clients. We are ready to welcome you in whatever manner it may be.

Information updates will be sent promptly should any details of the event change.

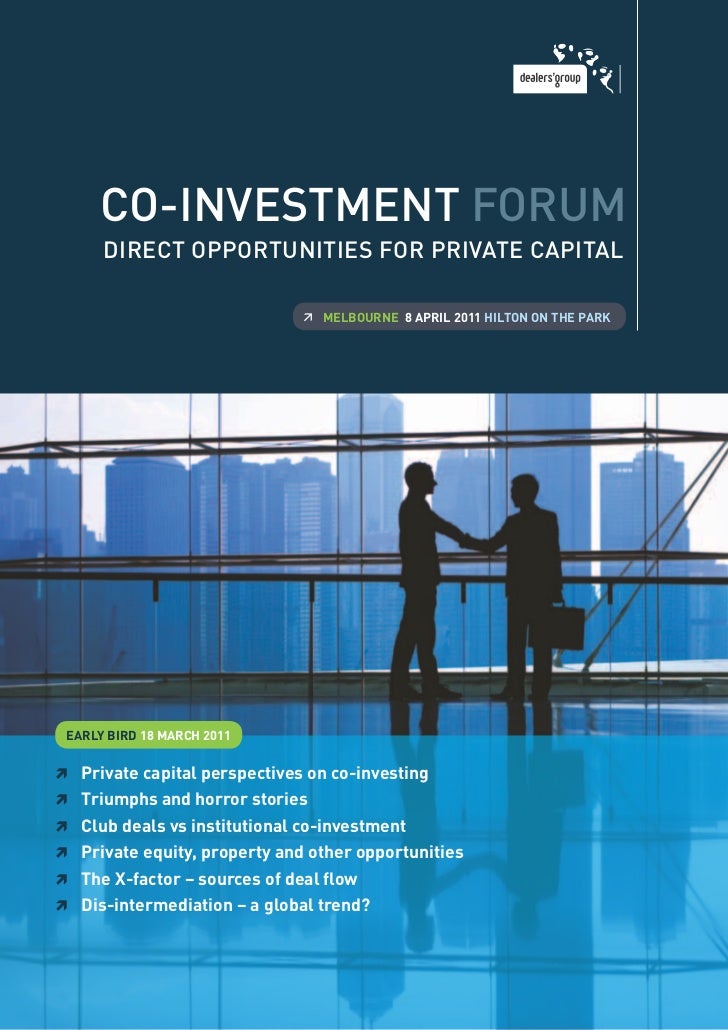

Opal Group is proud to launch the LP/GP Private Capital Forum. Join leaders in private equity and venture capital to explore investment opportunities in the largest market for private capital. The event offers you unrivaled opportunities to grow your connections in a competitive market. It is the most efficient way to meet private equity experts, leaders, and practitioners.

Come meet senior executives in private equity, secondaries, healthcare, technology, private credit, venture capital, and many more. Hear data-rich presentations, expert-led panels and interactive Q&A with industry leading speakers. The event also provides due diligence opportunities for pension funds, foundations, endowments, fund of funds, family offices, wealth managers, consultants, sovereign wealth funds and many other institutional LP allocators interested in direct research on private investment opportunities.

Session topics cover the entire spectrum of private equity investments. From sector specific sessions on venture capital to discussions on global buyout opportunities and roundtables of global institutional investors discussing their specific investment interests.

Overview of the Real Estate Economy

Regulatory/Tax Issues: What Are The Realized Effects Of The New Tax Laws?

Opportunity Zones 201

Value-Add and Opportunistic vs. Core and Core Plus Investments

Real Estate Debt and Alternative Financing Strategies

Analyzing Direct vs. Co-Investment vs. Commingled Funds

Finding Deal Flow, Acquisitions & Acquisition Due Diligence

Real Estate Disrupters 2020: The Future Culprits?

Family Office Discussion: What Are You Looking For In This Cycle?

Accounting Firms

Alternative lending funds

Blockchain

Cannabis Firms

Chief investment officers

Corporate pensions

Direct Lenders

Endowments

Fee-only investment advisors

Foundations

Fund of Funds

Head and directors of fund selection

Heads and directors of due diligence

Heads and directors of research

Infrastructure investment funds

Insurance firms

Investment consultants

Investment officers

Law Firms

Multi-family offices

Outsourced chief investment offices

Pensions (Public, Corporate, Taft Hartley)

Performance measurement and reporting vendors

Portfolio managers

Private Debt/Credit

Private equity funds

Private equity portfolio companies

Private equity real estate funds

Private Placement Agencies

Private Portfolio companies

Real Estate Firms

Research analysts

Research/Data firms

RIA’s

Risk Management firms

Single-family offices

Technology firms

Third-party private fund administrators

Venture Capital

Wealth management technology platforms

© 2021 Opal Group - All Rights Reserved

The link has been copied to clipboard.

Your message has been sent successfully, thanks!

This site uses cookies for proper functioning and to enhance your user experience. OK We’ve updated our Privacy Policy and Terms - Read More

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the ...

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

Mature Lesbian Squirt Orgy

Double Jointed Pussy

Xxx Fanta Site

Black Bbw Videos Xvideos Com

Horse Sex Di Dapur

EURUS Private Capital Forum – An insightful, interactive ...

Why EURUS? – EURUS Private Capital Forum

privCAP - Private Capital Forum, Toronto, Canada ...

AVCJ Private Equity & Venture Forum: Premier Private ...

Forum Capital

Intax Private Capital Forum 2019 в Киеве ...

Fi FORUM

Private Capital - Events - Informa Connect

Αναζήτηση στο Forum - Capital.gr

Private Capital Forum