Private Banking

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Private Banking

Copyright TheBanks.eu © 2012-2021. All Rights Reserved.

Private banking refers to banking, investment and other financial services generally provided

by banks to its clients , usually to high-net-worth individuals who enjoy

high levels of income or invest sizable assets. "Private" means that

products and services provided by the bank

are rendered on a more personal basis than in mass-market retail banking, and delivered

to the client via dedicated bank advisers. Essentially, private banking is similar

to wealth management and asset management ;

premium banking is usually a subset of private banking services.

Private banking is a process , which starts with defining of a client's investment profile and objectives and elaborating of a proper investment strategy, then executed according to the selected model , with regularly conducted follow-ups and performance reviews.

There are several parameters to be considered when choosing a bank for private banking , awards received by the bank can also be taken into account.

In general, private banking in provided to high-net-worth individuals , but several banks also offer private banking to institutions .

Deutsche Bank, offers its private banking services to both private clients and their families and insitituions (including public and private pension funds, national and supranational entities, corporations, charities and foundations).

While an individual may be able to conduct some private banking starting with $50,000 or less in investable assets, some exclusive private banks only accept clients with more than $1,000,000 worth of investable assets.

RBS Private Banking is a available to all customers with a sole income of at least £100,000 paid into their RBS account, or minimum outstanding mortgage borrowings with us of £300,000 , or savings and investments of at least £100,000 held with RBS.

Focusing on the high end of the market, KBC Private Banking sets a minimum investment threshold to €1,000,000 in investable income.

As mentioned above, "private" refers to providing products and services, tailored to meet investment goals of a particular client. Because investment goals vary substantially among the clients, the banks offer a broad range of private banking products to their clients, for example:

Banks can offer either proprietary products or third-party products. To distinguish between there two options, two types of product platforms are used:

Because of the diversity of clients' investment goals and existing private banking products, a bank can not meet the needs of the clients by offering solely proprietary products. That is why most of the banks now follow an open architecture product platform.

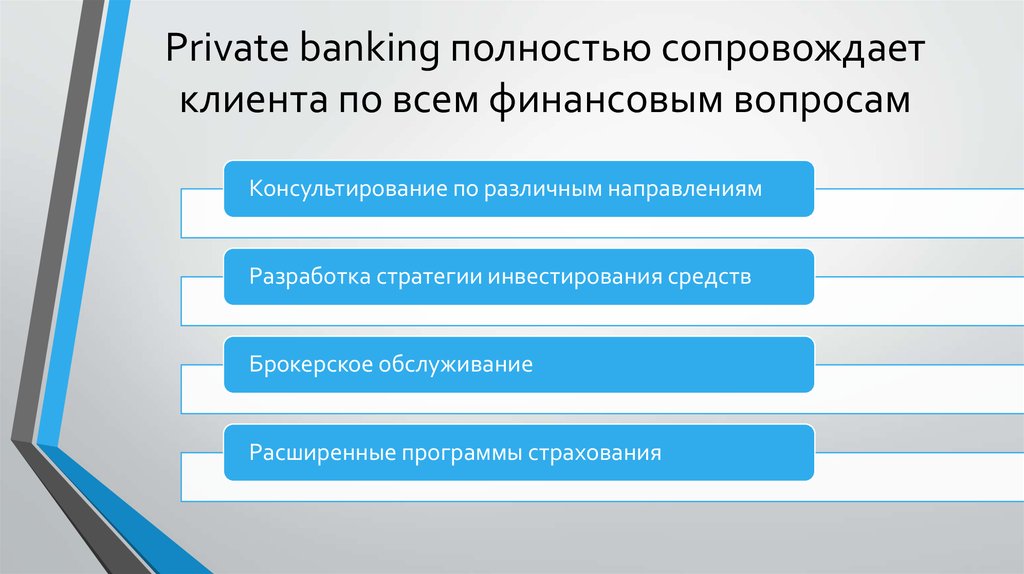

Private banking services can be subdivided into 2 broad categories: asset management and financial advising. Examples of services from each category are shown below:

Private banking is a continuous process of interactions between a client and his/her bank, and this process can be broken down into several phases.

When determining the investment profile and objectives, the bank must understand each client individually: the bank studies the individual situation of a client in detail, looking to understand his/her investment horizons, liquidity needs and the levels of risk he/she is willing to assume. This analysis is reviewed periodically, based on the evolution of the market and of the client's needs.

As far as the bank's role in decision-making and service, there are three private banking models , each guided by the investment profile and designed to meet clients different needs.

The definition of the asset allocation is the fundamental pillar of the investment strategy and guides us to the successful achievement of a client's goals.

This strategic asset allocation is modified, from time to time, according to the market conditions and perspectives.

Access to the most complete selection of financial products is crucial for a successful execution of the investment strategy. At this stage, products offered by the bank are used to implement the client's investment strategy.

At this stage, the bank along with the client, performs a thorough and frequent revision of the client's profile, objectives and results, seeking to keep the investments within the established parameters.

In order to identify possible deviations in the strategic positions from the investment profile, automated monitoring systems may be used.

Furthermore, a client may be offered direct access to his/her positions through a private access site on the Internet, enabling them to view the evolution of their investment strategies, independently of the bank's controls.

Depending on the roles of the bank and the client in decision making when implementing the investment strategy, three models of interaction between the client and the bank exist.

In this model a client delegates management of his/her investments to professional asset managers. The bank , in turn, defines, implements and controls the investment strategy based on the client's profile and objectives.

Decision making is adopted by the bank based on the investment profile of the client.

In portfolio advisory model, a client receives active, frequent advisory services from the bank's specialists. The client can benefit from using this model, when he/she has time and interest to follow the markets.

Decision making is performed by the client with active advisory services of the bank.

A client manages his/her assets directly with one-off advisory services from the bank. The bank suggests investment proposals and provides instruments to help the client select.

Decisions are made by the client based on his/her investment profile.

While private banking is one of the major banking services (along with retail, corporate and investment banking), premium banking is an extension of retail banking services to provide additional convenience and advantages to the bank's clients. Premium banking can provide basic private banking services as well. Several examples of premium banking services from retail and private banking are listed below.

Like private banking, premium banking is usually available to a bank client upon meeting eligibility criteria, however, the criteria for premium banking are less strict than for private banking.

To be eligible to use Barclays premium banking , a client should have an annual gross income paid into a Barclays current account of over £75,000 or have over £100,000 saved or invested with Barclays. Barlcays private banking services are available to clients who wish to establish an investment portfolio of £500,000 and above.

Essentially, private banking and welth management are the same: some banks call their private banking divisions "Wealth Management", "Private Wealth Management" or "Global Wealth Management". Several examples are given below:

In finance, the term asset managent covers broader area than private banking: for exampple, asset management doesn't restrict its clients to wealthy individuals.

Offshore banking refers to providing banking services to a client in jurisdictions where the client doesn't have a tax residence.

Hence, as a part of private banking investment strategy, a bank can offer a client to make offshore investments.

There are several parameters to be considered when choosing a private banking services provided by a particular bank, for example:

Awards in private banking are also can be taken into account.

Several awards exist for private banking. European banks, awarded by

PWM/The Banker

in 2014 are shown below.

Most of global banks provide private banking service, leveraging the parent brand to gain a client’s trust and confidence.

There are several countries in Europe, where many banks provide private banking service:

asset allocation

risk management

fiduciary solutions

protecting and growing assets in the present

investment counseling

market analysis

tax counseling

estate planning

retirement planning

inheritance planning

priority handling of the client's banking transactions with minimum waiting time

possibility for numeric accounts and other options for increased confidentiality

preferential conditions on the bank's products and services, such as the possibility to withdraw higher amounts in cash without pre-advice

preferential tariff on selected products and services, such as higher than the standard interest rates

a personal manager, who can be contacted at any time

investment counseling

periodical analysis of the client's investments

regular market information and analyses

Best Global Private Bank, Best Private Bank for Philanthropy Services, Best Global Brand in Private Banking

Best Private Bank in Central and Eastern Europe, Best Private Bank in Austria

Best Private Bank in the Netherlands

Best Private Bank in the Baltic Countries

Best Private Bank in the Baltic Countries

Best Private Bank in the Baltic Countries

Best Private Bank in the United Kingdom

Best Private Bank in the Czech Republic

Private Banking Directory Wealth Management Offshore Banking Investment

Private Banking

Private Banking Definition

What Is Private Banking ? Here's How It Works | Bankrate

Private banking : What is it, and how does it work? - Business Insider

Private banking is an enhanced offering for the high-net-worth individual (HNWI) clients of a financial institution. Private banking consists of personalized financial and investment services and products from a dedicated personal banker. Private banking clients typically receive discounts or preferential pricing on financial products. However, the range of products and investment expertise offered by a private bank may be limited compared to other providers.

Sponsored

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our

FREE Stock Simulator.

Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money.

Practice trading strategies

so that when you're ready to enter the real market, you've had the practice you need.

Try our Stock Simulator today >>

Relationship banking is a strategy used by banks to strengthen customer loyalty and provide a single point of service for a suite of products and services.

A bank is a financial institution licensed as a receiver of deposits and can also provide other financial services, such as wealth management.

Asset management is the direction of all or part of a client's portfolio by a financial services institution, usually an investment bank, or an individual.

A commercial bank is a financial institution that accepts deposits, offers checking and savings account services, and makes loans.

Retail banking consists of basic financial services, such as checking and savings accounts, sold to the general public via local branches.

A high-net-worth individual is a classification used by the financial services industry to denote an individual with liquid assets above a certain figure.

#

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

R

S

T

U

V

W

X

Y

Z

Investopedia is part of the Dotdash publishing family.

Private banking consists of personalized financial services and products offered to the high-net-worth individual (HNWI) clients of a retail bank or other financial institution. It includes a wide range of wealth management services, and all provided under one roof. Services include investing and portfolio management , tax services, insurance, and trust and estate planning .

While private banking is aimed at an exclusive clientele, consumer banks and brokerages of every size offer it. This offering is usually through special departments, dubbed "private banking" or "wealth management" divisions.

Private banking includes common financial services like checking and savings accounts, but with a more personalized approach: A "relationship manager" or "private banker" is assigned to each customer to handle all matters. The private banker handles everything from involved tasks, like arranging a jumbo mortgage , to the mundane like paying bills. However, private banking goes beyond CDs and safe deposit boxes to address a client's entire financial situation. Specialized services include investment strategy and financial planning advice, portfolio management, customized financing options, retirement planning , and passing wealth on to future generations.

While an individual may be able to conduct some private banking with $50,000 or less in investable assets, most financial institutions set a benchmark of six figures' worth of assets, and some exclusive entities only accept clients with at least $1 million to invest.

Private banking offers clients a variety of perks, privileges, and personalized service, which has become an increasingly prized commodity in an automated, digitized banking world. However, there are advantages to both the private bank clients as well as the banks themselves.

Privacy is the primary benefit of private banking. Customer dealings and services provided typically remain anonymous. Private banks often provide HNWIs with tailored proprietary solutions, which are kept confidential to prevent competitors from luring a prominent customer with a similar solution.

Private banking clients typically receive discounted or preferential pricing on products and services. For example, they may receive special terms or prime interest rates on mortgages, specialized loans, or lines of credit (LOC) . Their savings or money market accounts might generate higher interest rates and be free of fees and overdraft charges. Also, customers who operate import-export ventures or do business overseas might receive more favorable foreign exchange rates on their transactions.

If they are managing a client's investments, private banks often provide the client with extensive resources and opportunities not available to the average retail investor. For example, an HNWI may be given access to an exclusive hedge fund or a private equity partnership or some other alternative investment .

In addition to the customized products, there is the convenience of consolidated services—everything under one financial roof. Private banking clients received enhanced services from their private banker that acts as a liaison with all of the other departments within the bank to ensure that the client receives the best possible product offerings and service.

The bank or brokerage firm benefits from having the clients' funds add to their overall assets under management (AUM). Even at discounted rates, the private bank's management fees for portfolio management and interest on loans underwritten can be substantial.

In an environment where interest rates in the U.S. have remained low, banks have been unable to charge higher loan rates to grow their profits. As a result, fee income has become an increasingly important financial metric in helping banks diversify their revenue stream. Banks have made strides in expanding beyond traditional banking products, such as loans and deposits, to more service-oriented and fee-based offerings like private banking.

One-stop shopping for financial affairs

Concierge services and dedicated employees

Favorable rates, discounted charges

Options limited to proprietary products

Possible conflict-of-interest for employees

Although there are many advantages to private banking, drawbacks do exist to this exclusivity.

Employee turnover rates at banks tend to be high, even in the elite private banking divisions. There may also be some concern over conflicts of interest and loyalty: The private banker is compensated by the financial institution, not the client—in contrast to an independent money manager.

In terms of investments, a client might be limited to the bank's proprietary products. Also, while the various legal, tax, and investment services offered by the bank are doubtlessly competent, they may not be as creative or as expert as those offered by other professionals that specialize in various types of investments. For example, small regional banks might provide stellar service that beats out the larger institutions. However, the investment choices at a smaller, regional bank might be far less than a major player such as JPMorgan Chase & Company ( JPM ).

Lucrative as private banking can be, it can pose challenges for the institution, as well. Private banks have dealt with a restrictive regulatory environment since the global financial crisis of 2008. The Dodd-Frank Wall Street Reform and Consumer Protection Act , along with other legislation passed in the U.S. and around the world, has resulted in a higher level of transparency and accountability. There are more stringent licensing requirements for private banking professionals that help ensure customers are appropriately advised about their finances.

UBS, Merrill Lynch, Wells Fargo, Morgan Stanley, Citibank, and Credit Suisse are all examples of financial institutions with substantial private banking operations. Another bank that offers private banking is TD Bank ( TD ), with its TD Wealth® Private Client Group. 1

Available to clients with at least $750,000 in assets, it offers many services to its clients. Services include money management, strategies for business owners, real estate financing, and custom lending solutions. The private banking team also offers retirement, succession, and estate planning, which help reduce taxes.

The TD website promises that beyond the product offerings, each private client will receive a local relationship manager that will deliver exceptional, customized service as outlined in the quote below.

Andrew Powell A Little Bit Nasty

Free Porn Outdoor

Nudist Page

Junior Nudist Porno

Amateur Fucked Outdoor