Practice Spread Betting

⚡ ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Practice Spread Betting

Best spread betting strategies and tips

Becca Cattlin | Financial writer , London

What is the number one mistake traders make?

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. High volatility increases the risk of sudden, large or rapid losses.

To prioritise the service we give our existing clients, IG is not currently allowing any new positions on GameStop and AMC Entertainment.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Spread betting enables you to execute a range of trading strategies, thanks to the range of benefits it offers traders. Discover some of the most popular spread betting strategies and some tips for getting started.

A trading strategy is nothing more than a predefined methodology for how a trader will enter and exit the market. It will identify specific market circumstances and price points during which a trader will look to execute and close their trade.

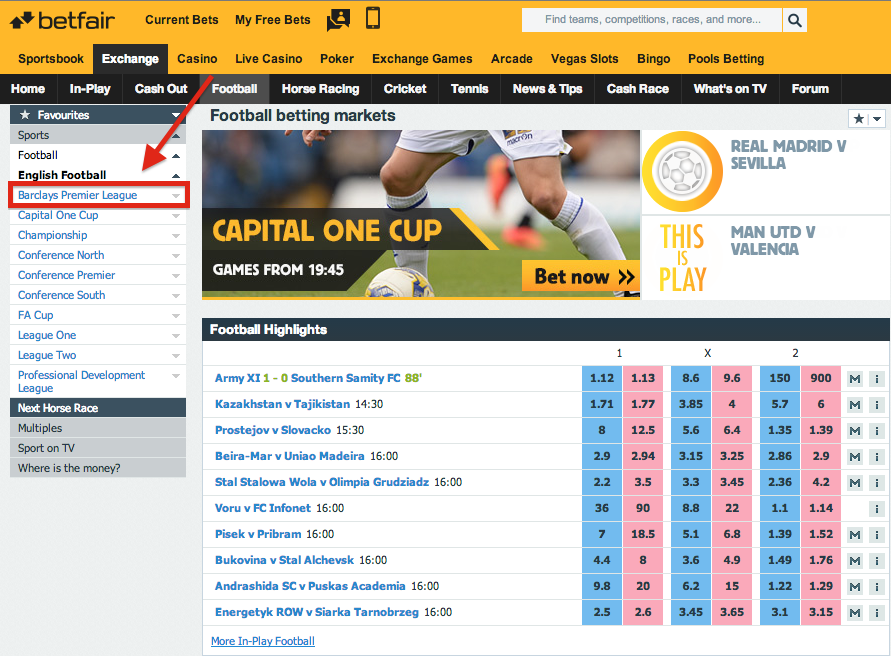

We’ve taken a look at some top-level strategies, and the way they would be carried out using spread bets .

This is by no means a full list of all of the trading strategies that can utilise spread bets. In fact, as long as the platform you are using has the appropriate technical analysis tools, most strategies are suited to using this popular derivative product.

A trending market is one that is reaching higher highs or lower lows. Trading with a trend is usually the practice of those who adapt the ‘ position trading ’ style, and is considered a medium-term strategy.

A trend trader’s strategy would use charts and technical analysis to identify the beginning and end of market movements. This often includes the use of indicators such as moving averages and the moving average convergence/divergence (MACD) to identify where to open and close their spread betting positions.

Trend trading is a popular strategy among spread betters, as they can follow the market momentum regardless of whether they are going long or short.

For example, if the price of soybeans was thought to be in an uptrend, with higher peaks and troughs, a trader might open a long spread betting position. They’d do this by opening a spread bet to buy soybeans. Once the trader has reached their profit target or acceptable loss, or analysis has shown the trend will soon be reversing, they would close their position by selling soybeans.

On the other hand, if the soybean market was in a downtrend, meeting lower highs and lower lows, a trader might decide to open a short spread betting position. They would do so by opening a position to sell soybeans.

Consolidating markets are range bound – so instead of reaching price extremes like trending markets, they remain within lines of support and resistance . This is why consolidating market strategies require traders to use indicators to identify entry and exit points within the range bound market, such as the relative strength index (RSI) .

An important part of a consolidating market strategy is volume analysis. When a market is trading within a range, the volume of trades is usually low and flat, but if the range is about to break there will usually be a rise in volume. This can be a clear indication that it is time for traders to think about closing their positions and, potentially, switching to a different strategy.

Although consolidating markets don’t provide the opportunity for running profits, they can create plenty of opportunities for short-term traders, such as scalpers.

Scalping is a trading style that is designed to profit from small and frequent price changes. Although traders might not make the large, long-term gains you’d see with other styles, they enter and exit far more trades, with the aim of taking smaller profits more often.

Many believe taking such short-term positions might not produce the same results as longer-term strategies but spread betting can help capital to go much further. This is because spread betting is a leveraged product, which means that traders can open positions that are much larger than their initial deposit. It is important to remember that while leverage can magnify your profits, it can also magnify your losses. This makes it crucial to have a suitable risk management strategy in place.

Breakout trading involves entering a trend as early as possible, ready for the market price to ‘break out’ from a consolidating or trending range. Breakout strategies are based on the idea that key price points are the start of a major movement, or expansions in volatility – so by entering the market at the correct level, a trader can ride the trend from start to finish.

Typically, traders looking to take advantage of a breakout will need to identify support or resistance levels – as once these have been met or surpassed, they will need to enter the market. Most breakout trading strategies will utilise volume trading indicators , and RSI or MACD technical indicators to find these levels.

One strategy used to spread bet breakouts is to place limit-entry orders at key price points, so that if the market moves through the support or resistance level, the order is executed automatically.

For example, let’s say you wanted to open a spread betting position on gold, which is currently trading at $1255. Although the market has been trading in a range for two weeks, you believe it is due to breakout into a downward trend. Looking at historic levels of support, you can see that $1250 is a key price point. So, you decide to place an entry order to open a short spread betting position if the price of gold falls below $1249. If the market did fall below this price, your spread bet would be executed, and you could ride the breakout until your analysis indicated the downtrend was over. If the market didn’t fall to this price, your trade would never be executed.

Reversal trading strategies are based on identifying areas in which trends are going to change direction. Reversals can be both bullish or bearish, giving a signal that the market is either at the top of an uptrend, or at the bottom of a downtrend. Traders using this strategy would open a spread betting position in the opposite direction to the current market trend, ready to take advantage of the reversal. This can also be known as ‘contrarian trading’.

When trading reversals, it is important to ensure that the market is not simply experiencing a retracement – a more temporary move. Retracement levels are commonly identified using the Fibonacci retracement tool. If the price goes beyond the levels identified by the tool, it is taken as a sign the market is reversing.

Although reversals can be a complicated spread betting strategy, with the use of indicators, there can be a wealth of opportunities. In order to execute a reversal strategy, a trader will need to utilise a confirmation tool. These can include:

For example, let’s say you wanted to create a FTSE 100 spread betting strategy and decided to focus on reversal trading. Although FTSE 100 has been in a downtrend for the last week, you believe that following positive earnings announcements for major FTSE constituents, the trend will reverse. You decide to enter a position if you identify the double bottom candlestick pattern, in the hopes of taking advantage of the upcoming price increase. If the market did reverse, you would be in a position to profit from the upswing. However, if the market continued to decline, you would suffer a loss.

There are a few key things every trader needs to know before they implement a spread betting strategy. It is important to:

Before you start to spread bet, it is crucial to have an understanding of what spread betting is and how it works .

When you spread bet, you can speculate on the future price movements of a range of global markets, such as forex, commodities, indices and shares. And because you don’t own the asset, you won’t have to pay tax on any profits you make. 1 These are just some of the benefits of spread betting , others include hedging, out-of-hours trading and no commission.

Prior to even thinking about which strategy you are going to implement, you should create a trading plan that will give your time on the markets clear direction and purpose. Your plan should always be unique to you, but most plans include:

When you’re building your trading plan and spread betting strategy, you might already have a market in mind. But if you don’t, it’s important to choose which assets you want to focus on before you start spread betting.

Most people will choose to trade a market that they already have an interest in, so they have prior knowledge that they can fall back on. With IG, you can trade over 16,000 markets, including indices, forex, shares, commodities and many more.

Before you open any spread betting position, it is important to be aware of exactly how much you could stand to lose if the market turned against you. Especially as spread bets are leveraged, you could stand to lose – or win – much more than your initial deposit. It is always wise to think about your trade in terms of its full value, rather than the amount you pay to open it.

One way of mitigating risk and locking in profits is by setting an automatic stop or limit, which will define the level you’d like to close your trade at. Stop-losses will close a trade if the market moves against you, while limit-close orders will close your position once it has reached a certain amount of profit.

Footnote

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Publication date : Friday 24 May 2019 15:11

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary .

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.

We reveal the top potential pitfall and how to avoid it. Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts.

For more info on how we might use your data, see our privacy notice and access policy and privacy webpage .

Find out what charges your trades could incur with our transparent fee structure.

Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs.

Stay on top of upcoming market-moving events with our customisable economic calendar.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Past performance is no guarantee of future results.

CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

What Is Spread Betting ?

Best Spread Betting Strategies and Tips for 2021 | IG UK

What is Spread Betting and How Does it Work? | CMC Markets

Spread Betting For Maximum PROFIT! - Learn 2 Trade January 2021

Spread Betting Guide for Beginners

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Insights

Learn to trade

Learn spread betting

What is spread betting?

You can sell (go short or short sell) if you think the price of an instrument is going to fall

You can trade on margin, so you only need to deposit a small percentage of the overall value of the trade to open your position. Remember, this means that your potential return on investment is magnified, as are your potential losses

Spread betting profits are tax-free*

You can trade on indices, forex, cryptocurrencies, commodities, global shares and treasuries

There is no separate commission charge to pay on spread bets

You get access to 24-hour markets

There is no stamp duty* to pay

Join a trading community committed to your success

Create a relevant trading plan and stick to it

Keep emotions aside from your trading

Evaluate market analysts’ news and write-ups as part of your analysis

Be aware of the macro environment through news outlets

Avoid recommendations and tips from unreliable sources, such as internet forums

Cut your losses short and let your profits run

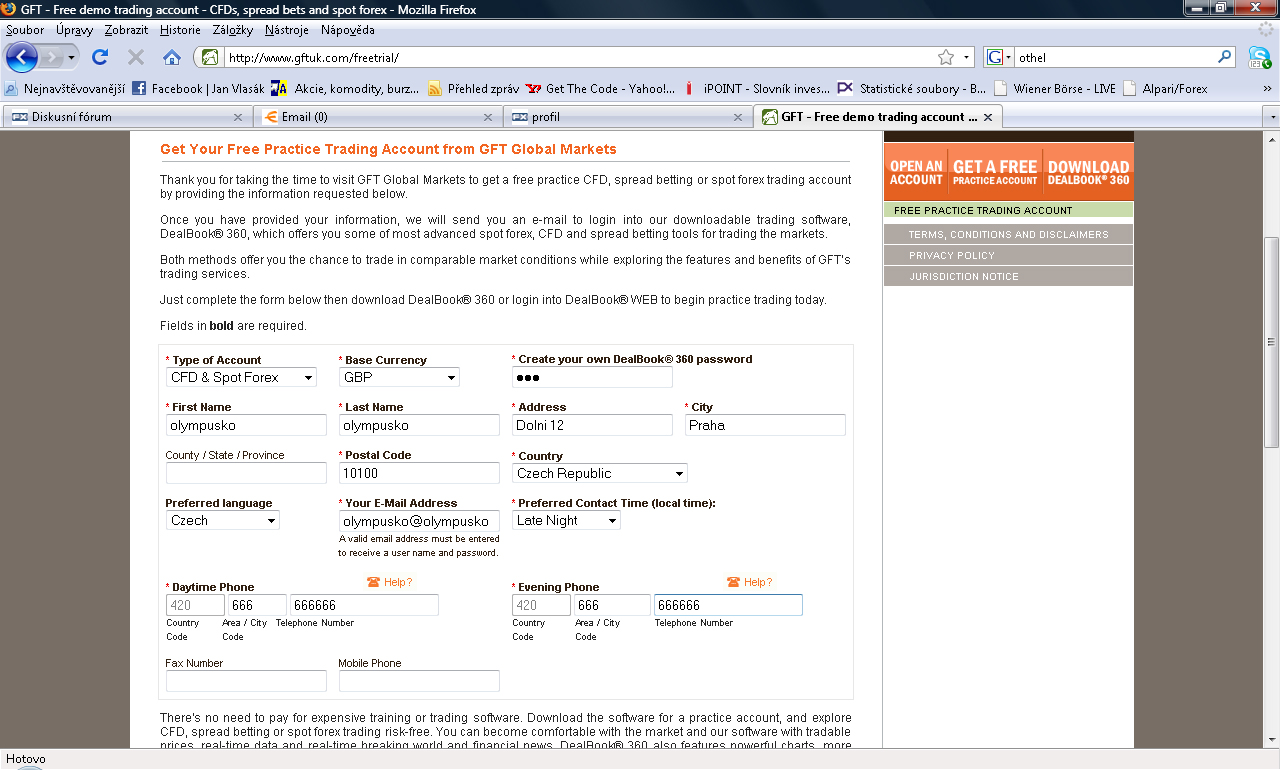

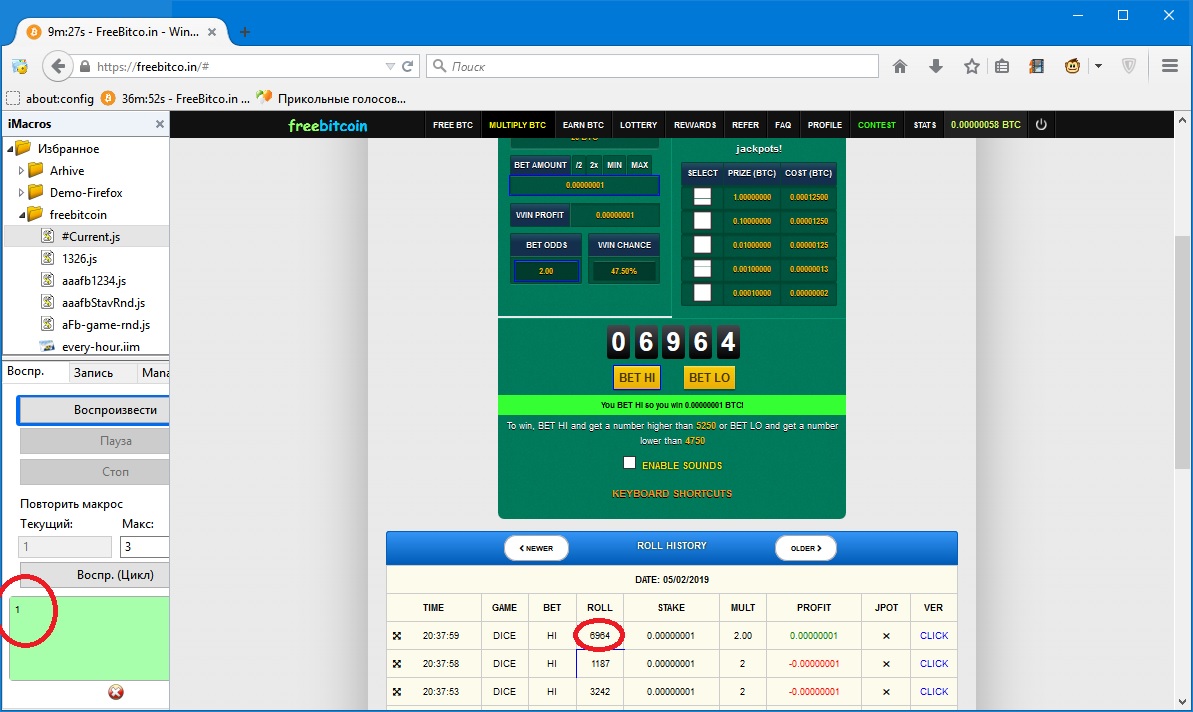

Test new strategies on your spread betting demo account

Open a spread betting

demo account or

live account .

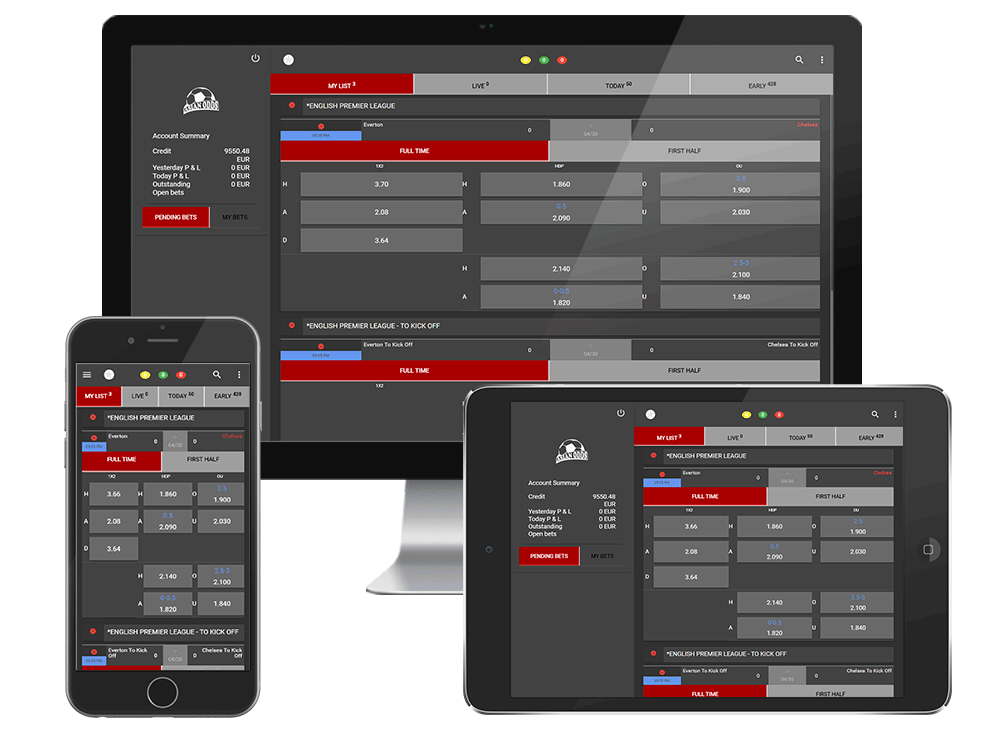

Accounts can be opened via our website or mobile app. Deposit funds if you have chosen to open a live account.

Research financial instruments to trade. Browse our news and analysis section, and check the insights, market calendar and chart forum platform modules. Live account holders can also access Reuters news and Morningstar fundamental analysis for inspiration.

Go long and 'buy' or go short and 'sell'. Go ahead and ’buy’ the asset if you think the price will rise, or ’sell’ the asset if you think the price will fall.

Follow your spread betting market entry and exit strategy. Based on your trading plan, enter the market at a defined time, and use your risk mitigation strategies like stop-loss orders.

Enter your position size and place your trade. When placing a spread bet, be aware of the full trade value, and don’t forget to add stop-loss and take-profit orders.

Monitor your trade. Keep track of the open trade on your mobile or PC, and close the position as defined in your trading plan.

In this article, we’ll cover the essentials of spread betting , including strategies, tips and examples of a spread bet. This article should guide you towards understanding if spread betting is a suitable trading method for you. Watch the video below to get started.

Spread betting is a tax-efficient* way of speculating on the price movement of thousands of global financial instruments , including spread betting forex , indices, cryptocurrencies, commodities, shares and treasuries. Spread betting is one of the most common ways to trade on price action over several asset classes in the UK and Ireland. Spread betters can trade in both directions (‘buy’ or ‘sell’), and can make use of financial leverage to increase their trade exposure. With a spread betting account, you can choose between trading from home and on-the-go, as our platform is very flexible for traders of all experience levels.

With spread betting trading in the UK, you don't buy or sell the underlying instrument (for example a physical share or commodity). Instead, you place a spread bet based on whether you expect the price of an instrument to go up or down. If you expect the value of a share or commodity to rise, you would open a long position (buy). Conversely, if you expect the share or commodity to fall in value, you would take a short position (sell). You will make a profit or loss based on whether or not the market moves in your chosen direction.

With spread betting, you buy or sell a pre-determined amount per point of movement for the instrument you are trading, such as £5 per point. This is known as your spread bet 'stake' size. This means that for every point that the price of the instrument moves in your favour, you will gain multiples of your stake times the number of points by which the instrument price has moved in your favour. On the other hand, you will lose multiples of your stake for every point the price moves against you. Please note that with spread betting, losses are based on the full value of the position. See our spread betting examples for more information on how to spread bet.

The difference between the buy price and sell price is referred to as the spread. As one of the leading providers of spread betting in the UK, we offer consistently competitive spreads. See our range of markets for more information about our spreads.

Spread betting is a leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position (also called trading on margin ). While margined (or leveraged) trading allows you to magnify your returns, losses will also be magnified as they are based on the full value of the position.

Many investors choose to spread bet on the financial markets as there are advantages of spreading betting over buying physical assets:

Before placing your trade, remember to make sure that you have followed risk-management guidelines as part of your strategy.

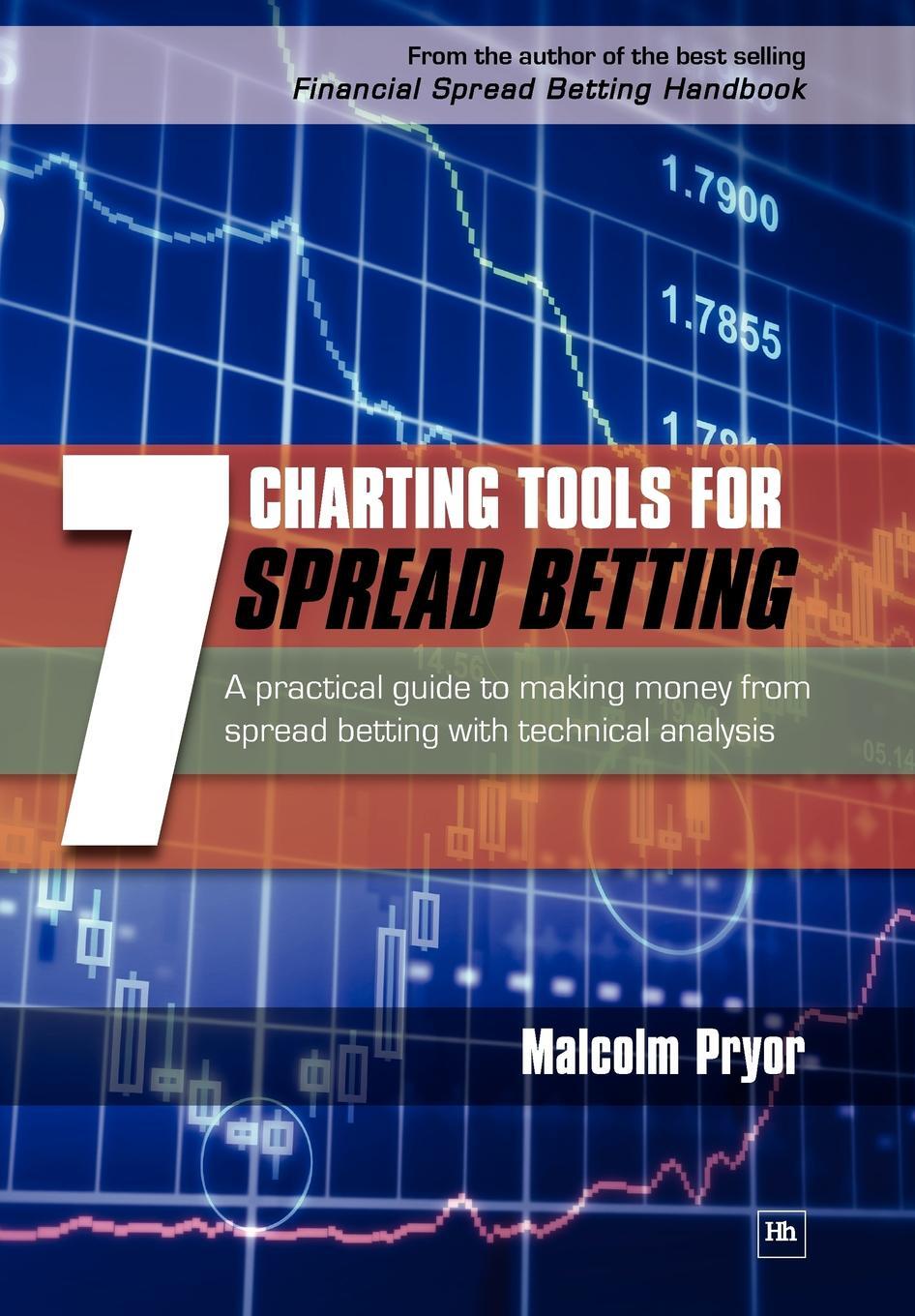

A spread-betting strategy is a pre-determined plan that helps you to define your market entry and exit points, and accompanying risk-management conditions such as stop-losses. When utilising a trading plan as part of your wider trading strategy, you aim to create a process in which you can monitor and forecast trade outcomes.

When trading with a spread betting account, it’s best practice to outline and follow your own trading strategy template relative to your needs. Strategy templates define a set of rules you should follow for every trade, helping you to remove emotions and irrational responses from your trading strategy. This helps to keep consistency within your trades, and can help improve your trading mindset. Visit our article on creating a trading strategy template , where you can follow an example to help define your strategy.

Every trader utilises different methods and strategies to suit their trading style. There are, however, some common spread betting tips a trader can utilise in order to maximise their trading potential:

See our article on spread betting tips and strategies , where we cover the topic in more depth.

It's a good idea to keep up to date with current affairs and news because real-world events often influence market prices. As an example, let's look at the UK government’s help to buy housing scheme.

Many believed that this scheme would boost UK home builders' profitability. Let's say you agreed and decided to place a buy spread bet on Barratt Developments at £10 per point just before the market closed.

Let's say that Barratt Developments was trading at 255 / 256 (where 255 is the sell price and 256 is the buy price). In this example, the spread is 1.

Let's assume that you opened a long position at £10 per point because you thought the price of Barratt Developments would go up. For every point that Barratts' share price moved up or down, you would have netted a profit or loss multiplied by your stake amount.

Let's say your spread betting prediction was correct and Barratt Developments' shares then rose to 306 / 307. You decide to close your buy bet by selling at 306 (the current sell price).

The price has moved 50 points (306 sell price – 256 initial buy price) in your favour. Multiply this by your stake of £10 to calculate your profit, which is £500.

Unfortunately, your spread betting prediction was wrong and the price of Barratt Developments' shares dropped over the next month to 206 / 207. You feel that the price is likely to continue dropping, so to limit your losses you decide to sell at 206 (the current sell price) to close the bet.

The price has moved 50 points (256 – 206) against you. Multiply this by your stake of £10 to calculate your loss, which is £500.

Learn more about spread betting for beginners and how to get started, and see our detailed spread betting examples. If you're ready to trade, open an account now.

Seamlessly open and close trades, track your progress and set up alerts

Spread betting works by traders speculating on whether a financial instrument’s price will rise or fall. Spread betters can go long (buy) if they believe the price of an asset will go up, or go short (sell) if they believe the market will start a downtrend. Learn more about spread betting .

Spread betting can be profitable, depending on multiple factors, but it’s also possible to make a loss. Most successful traders manage to make profitable trades by following a systematic trading plan, including in-depth fundamental and technical analysis, risk-management systems and several years of applicable knowledge. Try out a spread betting demo account to practise your trading plan.

Is spread betting taxable in the UK?

If you’re a resident in the UK or Ireland, profits from spread betting are free from capital gains tax (CGT). Additionally, spread betting transactions are exempt from stamp duty. Learn more about the risks of spread betting and the advantages of spread betting here. Please note tax treatment depends on your circumstances and tax laws are subject to change.

Spread betting providers are regulated by the Financial Conduct Authority (FCA) in the UK. It’s compulsory for all UK spread betting providers to be FCA regulated. Find out more about regulations at CMC Markets .

Losses above are based on the full value of the position. Past performance is not indicative of future performance.

^Prices are taken from our platform. Our prices may not be identical to prices for similar financial instruments in the underlying market.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 9,300+ instruments

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Pussy Fucked Hard Pics

Big Ass Spread Solo

Hot Oral Sex

Ormonde Jayne Sensual

Xvideos Sex Toys