Permanent risk-free long BTC grid-bot with dynamic averaging

ApitradeEarlier, we published an example of risk-free trading by levels with buying only at the very bottom of the daily and weekly range. The disadvantage of such a strategy is that when a coin has a stable uptrend, it is not always possible to buy at the bottom of the daily and weekly range, so there may be no trades for a long time, so you have to launch several coins at once, including less promising ones.

Today we are publishing an example of another strategy that is free of this shortcoming: Permanent long grid-bot with dynamic averaging using indicators.

We remind you that the key to success is diversification. It is necessary to use many sub-accounts with different strategies, and not "keep all your eggs in one basket."

It is recommended to launch this strategy on the top coins, the growth of which in relation to fiat currencies in the long term (several years) is inevitable (regardless of temporary corrections during extreme fear in the market), and, first of all, it's BTC, due to the fact that the finite number of bitcoins is only 21 mln. If long-term growth is inevitable, then it makes no sense not to trade for a long time and wait for the best entry point, it is better to constantly earn on volatility, the main thing is to temporarily stop the bot later when the position is almost closed, and the rate is close to All-time-high.

As collateral, you can use both USDT (if the position is less than the deposit, then liquidation is impossible) and BTC, but you need to remember that in the case of collateral in BTC, the risks increase (see the exchange liquidation calculator), and the deposit grows along with the price of bitcoin. In any case, the profit from trading is accrued in dollars, it is recommended to regularly withdraw it from the futures account and, if desired, change it to BTC or use it to launch other strategies. To launch this strategy, it is enough to select BTC or BTCBUSD in the list of coins in the terminal and click the "Bots", "Launch Grid Bots", "System Templates" button and select the first template "Main Algorithm: Permanent risk-free long BTC grid-bot with dynamic averaging":

Trades using this strategy occur on average once every few minutes, depending on the volatility of bitcoin. In the case of a bitcoin pump, the position will close and new trades will not be opened until the end of the pump due to the “auto-detect” function, but you can always add a position using a market order in the Apitrade terminal for its gradual sale or increase the first order in case of a strong uptrend (it's not obligatory).

You can use the pair with USDT or BUSD (but there is a little less volatility in BUSD-BTC pair).

Initially, the strategy is without liquidation risk (because the maximum position is less than the deposit), but if you want to increase income and risks, then it is less risky to run several bots on different coins with the same deposit than to greatly increase the size of the order or reduce the distance between orders. You can use the limit of the maximum size of all long positions (combined anti-liquidation) in the amount of your deposit. For reliability, you can change the leverage on the exchange to 1x, in this case the position will definitely not exceed your deposit.

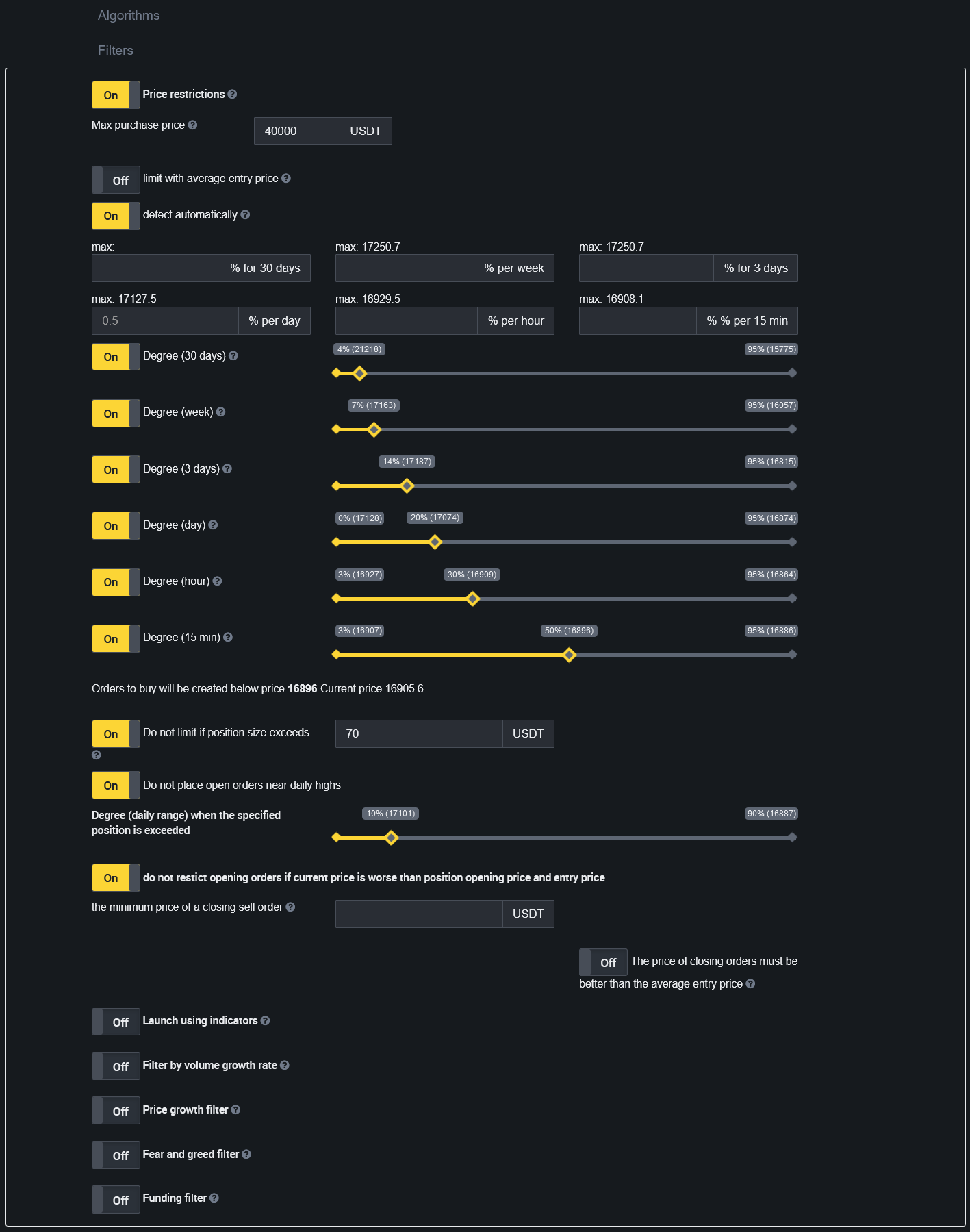

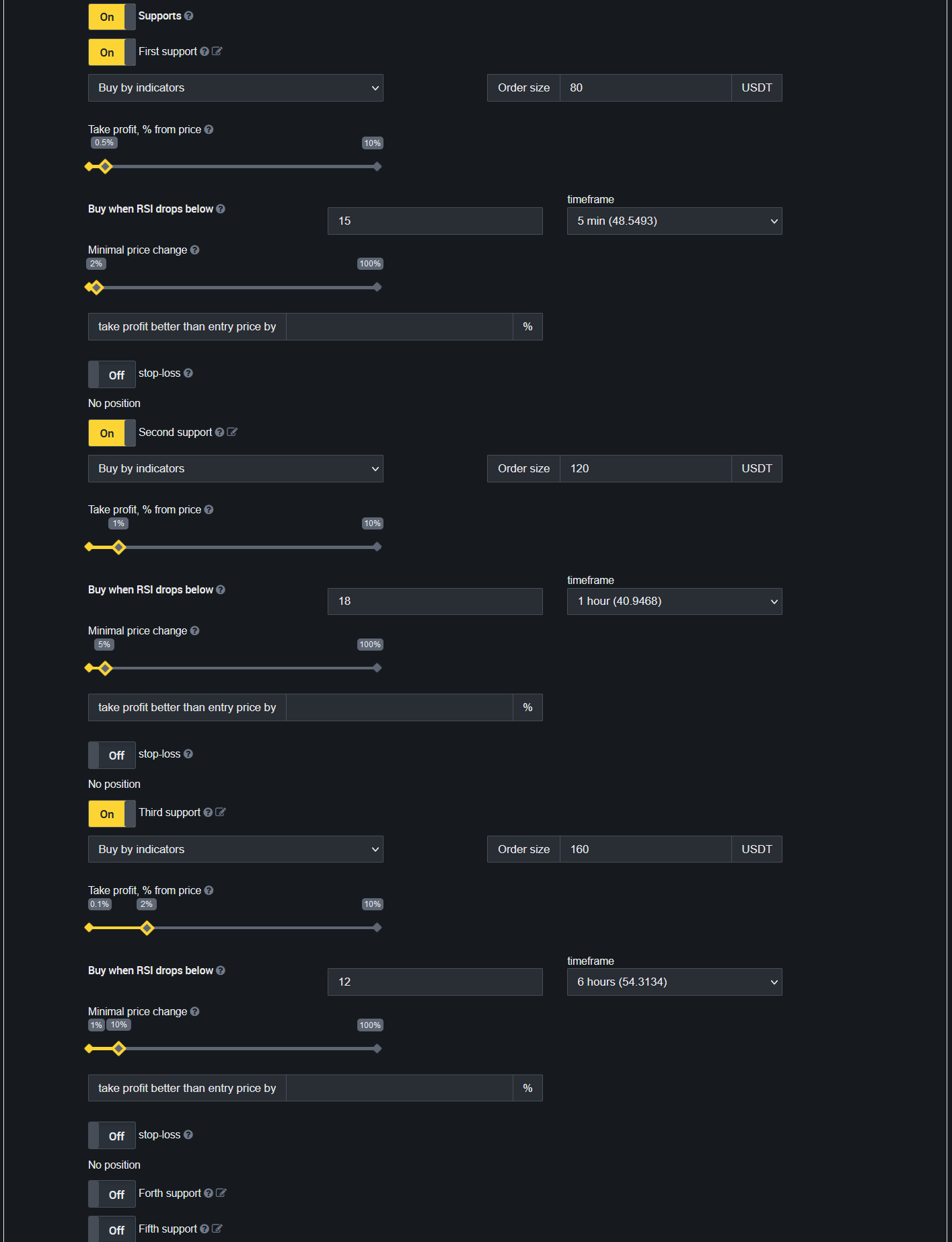

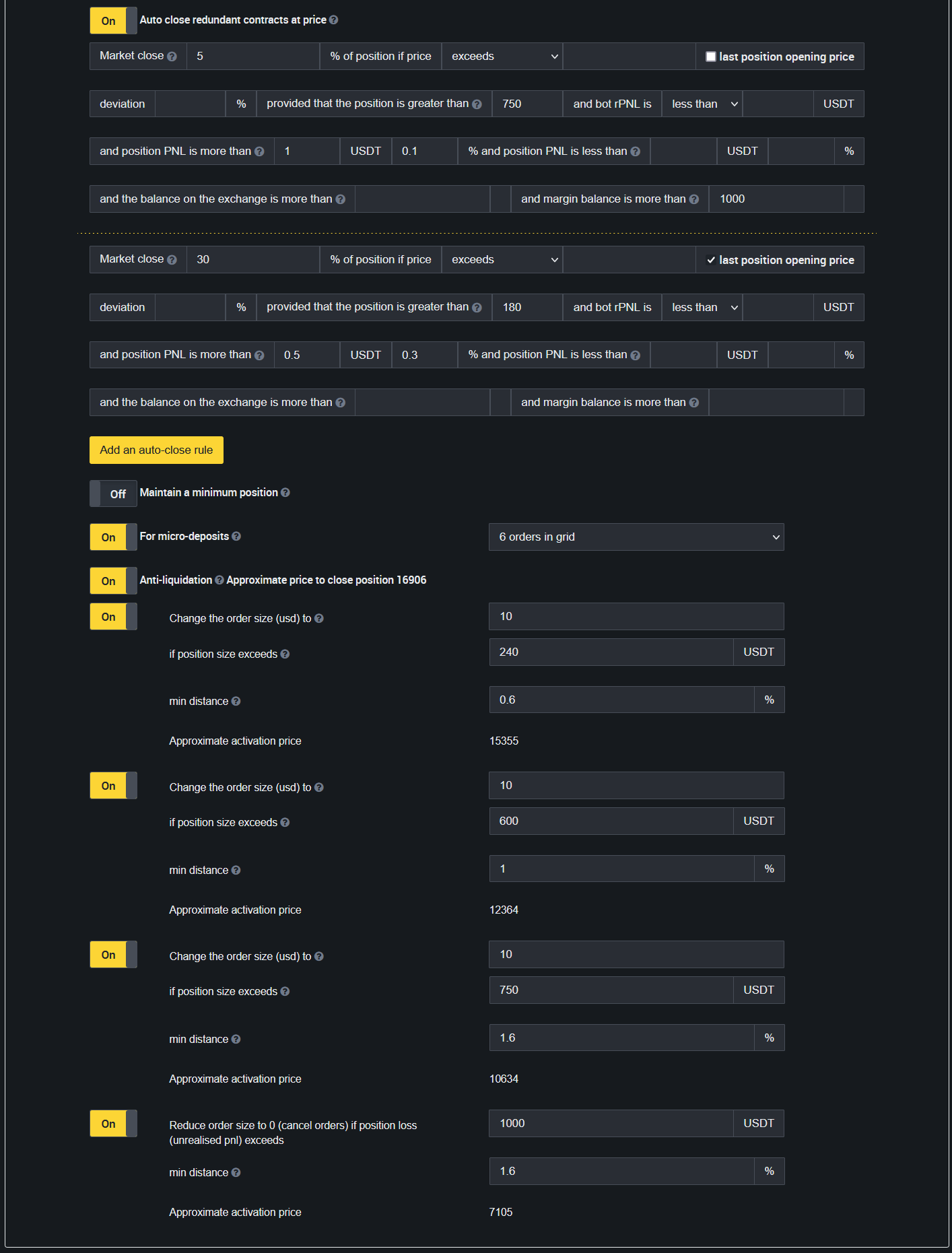

The strategy has several dynamic averagings using indicators (very low RSI) to increase income and improve the entry price as quickly as possible. You can change the sizes and distances of the averagings as you wish: perhaps you will find better options compared to our example. Our option is rather low-risk, averaging will occur very rarely. The first averaging in our example is approximately 6 times the standard order size and is placed on the condition that the value of the RSI indicator on the 5 minute timeframe exceeds 25, at a distance of at least 2% from the average entry price with a take profit after 0.5% (you can increase the take profit percent, in this case the profit will be higher, but averaging will also occur less often). The second averaging in our example is approximately 8 times the standard order size and is placed provided that the value of the RSI indicator on the 60 minute timeframe exceeds 20, at a distance of at least 5% from the average entry price with a take profit after 1%. The third averaging in our example is approximately 10 times the standard order size and is placed provided that the value of the RSI indicator on the 6 hour timeframe exceeds 20, at a distance of at least 12% from the average entry price with a take profit after 2%. Automatic partial closure of extra contracts occurs above the open price for any position over $180 with a position PNL above $0.5 (or 0.3%) above the position open price or with a position over $950 with a position PNL above $1 (or 0.1%). You can also manually close extra contracts from time to time when the frequency of trades becomes too low due to a large accumulated position with a large positive PNL and if the account margin balance is larger than the initial one.

Stop Losses: An upper stop loss is placed 1% above the opening price as at the first $100 order, the position should be closed with limit orders anyway. Also, the stop loss is placed above the opening price, but 0.2% below the maximum price for the last 7 days, because a rebound is very likely from this resistance.

It is advisable to stop the bot only when the position is almost closed (and the margin balance is higher than the initial one). If you stop the bot earlier, then some of the purchased contracts will close at a price lower than they were purchased. It also makes sense to launch a similar strategy for the top and most promising altcoins (like BNB, ATOM, ALGO), especially if your deposit is less than $1000 and does not allow you to launch a risk-free strategy for bitcoin.