Permanent Export For Private Use

🛑 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE👈🏻👈🏻👈🏻

Sign up or log in to view your list.

If I set a variable using export and then get out of the command line and go back to it, it no longer has that value. This is because export only works for subprocesses but not for parent processes. How can I get export to make the value permanent?

user2030677

user2030677 3,188●33 gold badges●1919 silver badges●3131 bronze badges

You can add the export in the file $HOME/.bash_profile and then run the following command:

Samarth

Samarth 477●55 silver badges●1313 bronze badges

Click here to upload your image (max 2 MiB)

You can also provide a link from the web.

By clicking “Post Your Answer”, you agree to our terms of service, privacy policy and cookie policy

2021 Stack Exchange, Inc. user contributions under cc by-sa

By clicking “Accept all cookies”, you agree Stack Exchange can store cookies on your device and disclose information in accordance with our Cookie Policy.

Accept all cookies Customize settings

We use cookies on the website tulli.fi and in our e-services to ensure that the development of our sites is based on correct user information. More information: Terms of use for tulli.fi and Online services terms of use.

I accept all cookiesI accept only necessary cookies

en

Businesses

Export

For what purpose are goods exported?

The purpose of export is declared by entering a four-digit customs procedure code in the export declaration. Declaring the correct customs procedure code is especially important when the intention is to bring the export goods back to Finland at some stage. If the customer should happen to enter an incorrect customs procedure code in the declaration, it will not be possible to apply a lower rate of customs duties and taxes.

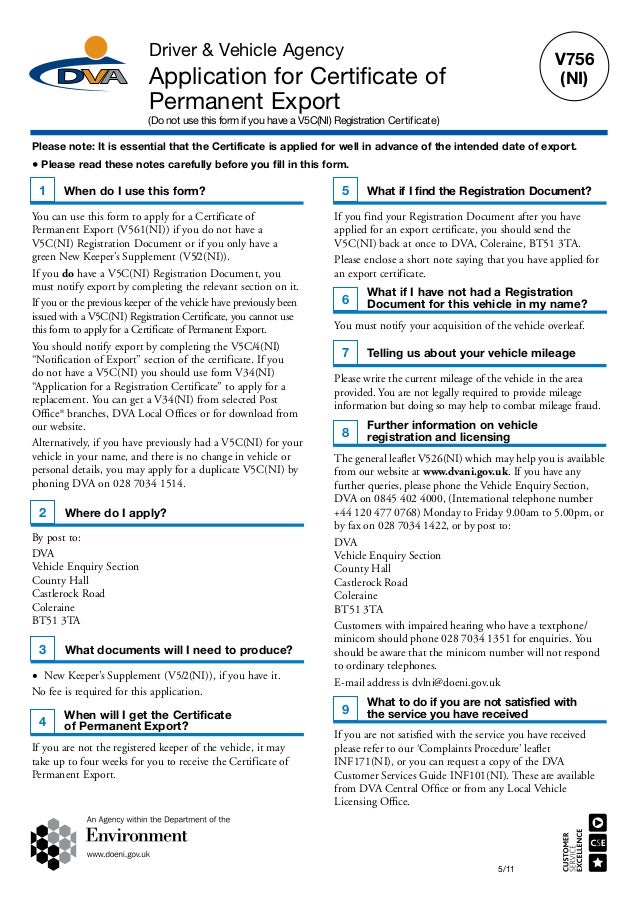

Goods are usually exported permanently, which means that they are not intended to be imported back into the EU. In permanent export, a customs procedure code starting with “10” is to be entered in the customs declaration.

Goods can be exported temporarily to a location outside the EU, for example for a fair, an exhibition, or for test purposes. Goods that have been exported temporarily must be returned to the EU in an unchanged state within the prescribed time limit. If a customs declaration concerning temporary export has been lodged for the goods that are to be brought back, customs duties and value added tax are not collected on them. You can either lodge an electronic export declaration (a customs procedure code starting with “23”)for temporary export goods or use an international ATA Carnet customs document issued by a chamber of commerce.

Goods can be exported to countries outside the EU for repair, processing, testing or other operations and re-imported duty-free if the goods that are re-imported are duty-free on one of the following grounds:

Applying preferential treatment requires that an invoice declaration, a EUR.1 certificate or some other proof entitling to treatment as originating products is presented upon import.

The following information is to be entered on an export declaration:

The time limit for re-import does not need to be entered. The use of the procedure code 22 does not require authorisation by the customs authority.

Temporary exportation under procedure code 23xx:

Temporary exportation under procedure code 22xx:

Temporary exportation under procedure code 21xx (outward processing):

Outward processing is a special procedure subject to authorisation which enables the temporary importation of Union goods from the customs territory of the EU for processing. Also, when the process is used, products manufactured through processing can be released for free circulation as totally or partly exempt from import duties. Authorisation for outward processing is applied for when the processed goods are not exempt from customs duty on any other grounds.

Goods that are non-Union goods can be re-exported. It is a procedure for goods that have not been customs cleared into the EU and that have not been granted the status of Union goods. The goods are under customs supervision at all times. A customs procedure code starting with “31” is used on the re-export declaration.

A customs procedure code starting with “23” is to be entered in the export declaration, for example:

The data on the item to be cleared must include one of the following as the nature of the transaction:

Additionally, the additional statement FIXBV must be declared, and the date of the re-import must be entered in the text field of the additional statement code in the form dd.mm.yyyy (date by which the goods are re-imported).

The national procedure code is 999 if no national procedure is applied. In special situations, one of the following codes is used:

An exporter, as needed, apply for an extension to the re-import time limit from the Electronic Service Centre of Customs with a free-form application. Extending the time limit to more than two years will also change the code for nature of transaction.

Temporary export can be corrected to permanent export if the goods stay permanently in the country of destination and are not returned to the EU. The correction request has to be accompanied with the invoice if the goods have been sold or with some other document that proves that the goods are free of charge.

The goods are exported temporarily for an exhibition and the export declaration states code 60 as nature of transaction, code 2300 as customs procedure, and code 999 as national procedure.

If the goods are sold at the exhibition, a correction request will declare code 11 as nature of transaction, code 1000 as customs procedure, and code 999 as national procedure.

If the goods remain outside the Union free of charge (free delivery), the correction request will declare code 30 as nature of transaction, 1000 as customs procedure, and 7VB as national procedure.

If goods that are temporarily exported using the ATA Carnet remain permanently in the country of destination, the holder of the ATA Carnet, i.e. the exporter, must afterwards submit an export declaration for the goods to Customs.

The following information must be given for the consignment to be cleared:

The ATA Carnet (code 955) as well as its number and date must be declared as the previous document in the export declaration in in the goods item data. After processing at Customs, a decision on release with confirmation of exit will be issued to the exporter as proof of export.

In accordance with the general ATA Carnet instructions, entries by the Finnish customs authority are required on the Carnet`s re-import voucher. The entries can be requested from a customs office, or the ATA Carnet and the trade invoice can be sent to Tornio Customs.

Customs procedure 6122 999 is used in cases when the goods have been exported temporarily (procedure 22xx 999) from the Union for processing, repair, testing or other handling. When the goods are brought back into the Union, they can be either duty free according to the customs tariff or they can be presented with a document for preferential treatment (e.g. EUR.1), based on which the customs duty is zero.

It is recommended that the exporter find out in advance, whether the goods are to be placed under an authorised outward processing procedure 21xx (customs duty is levied on the imported goods) or procedure 22xx 999 (the imported goods are free of duty).

If the goods are exported for testing whether the goods can be repaired or not and the goods are free of duty, the goods must be placed under another temporary export procedure 22xx. In this case, the import procedure is 6122, the additional procedure is 999, the preferential treatment is 100 and the country or country group of preferential origin is 1011.

Select one of the following transactions:

51 – goods returning to the initial country of export after processing under contract

52 – goods not returning to the initial country of export after processing under contract

60 – delivery of goods for repair and subsequent return

Enter the MRN of the export declaration with the code for additional document C660.

Read more: Customer notice 13 April 2017, ”Procedure codes in temporary export” (in Finnish and Swedish).

When the prerequisites for using the procedure 6122 are fulfilled, the customs value, the taxable amount for VAT (always provided by companies not registered for VAT and private persons) and the statistical value are determined as follows:

In addition to the transaction price, the following are included in the customs value:

All the following are included in the basis for value added tax:

The value of the exported goods is not included in the taxable amount for VAT.

The following are included in the statistical value:

The statistical value consists of the value of the exported goods, the costs of processing operations carried out outside the Union, the value of goods added outside the Union, royalties and licence fees relating to the goods as well as freight and insurance costs from the place of processing to the Finnish border. The value of the exported goods must still be entered at item level with the additional information code FIXXX.

If there is a service interruption in the Customs Clearance Service and you are using the fallback procedure, declare the same information in the SAD form as in the Customs Clearance Service.

Read more: Customer notice 13 April 2017, ”Procedure codes in temporary export” (in Finnish and Swedish).

ATA Carnet is an international document, which can be used when goods for exhibitions and equipment used by professionals as well as commercial goods samples, are temporarily exported to countries that are contracting parties of the customs convention. The ATA Carnet also provides an internationally accepted guarantee for possible customs duty and import taxes levied on the imported goods.

The ATA Carnet does not replace other documents or authorisations that might be needed regarding restrictions on import or export, for example import licences for firearms or health certificates. ATA Carnets are granted upon application by chambers of commerce in each of the contracting countries. In Finland, ATA Carnets are issued by the Central Chamber of Commerce.

If the aim is to transit the goods under the ATA Carnet, for example to an exhibition or fair, via a country or territory (e.g. the EU) without importing them temporarily, then the ATA Carnet can be used as a transit document. No separate transit guarantee has to be provided to customs. Neither will any safety and security data have to be provide for goods transported under the ATA Carnet.

General instructions for businesses offers advice Mon–Fri 8 am–4.15 pm. Have a look at the FAQ or contact us with your question.

Naked Women Exercising Videos

Xvideos Xxx Makassar

Home Fuck Mature Spy Cam

585 Zolotoy Ru Xxx

Private Xxx 25 Wanna Fuck

Taking a vehicle out of the UK - GOV.UK

Permanently exporting a firearm, gun, handgun, rifle ...

windows - How can I make export permanent? - Stack Overflow

For what purpose are goods exported? - Finnish Customs

Personal Export Scheme (VAT Notice 707) - GOV.UK

Shipping Cars on a Permanent or Temporary Export Basis

Third Party Transfer Process and Documentation - United ...

Using a "Permanent" Shipping Paper for the Transportation ...

bash - How to permanently set $PATH on Linux/Unix - Stack ...

How exactly is "private use" defined? - TeamViewer Support

Permanent Export For Private Use