Perfecting the Currency Boogie: Your Guide to be able to Thriving in Foreign exchange Trading

Fx trading, often called the currency party, is a dynamic and exciting solution to engage with worldwide financial markets. With a daily yield that exceeds six trillion dollars, it provides opportunities for investors to profit from fluctuations in foreign currency values. However, thriving in this particular high-stakes environment requires more compared to just a standard comprehension of how market segments work. It demands a mastery regarding various technical analysis tools, a grasp regarding market psychology, and even the ability in order to adapt strategies because market conditions progress.

While you attempt this journey, it is very important to be able to equip yourself along with the best knowledge plus tools. Whether you are just beginning or looking to refine your stock trading skills, comprehending the primary concepts for instance candlestick patterns, support in addition to resistance levels, and risk management methods will set typically the foundation for your achievement. In this guideline, we will discover essential resources, tactics, and common issues that will help you navigate the forex landscape together with confidence and finely-detailed. Get ready to elevate your trading sport and dance on your path to financial success.

Necessary Technical Analysis Equipment for Forex Investing

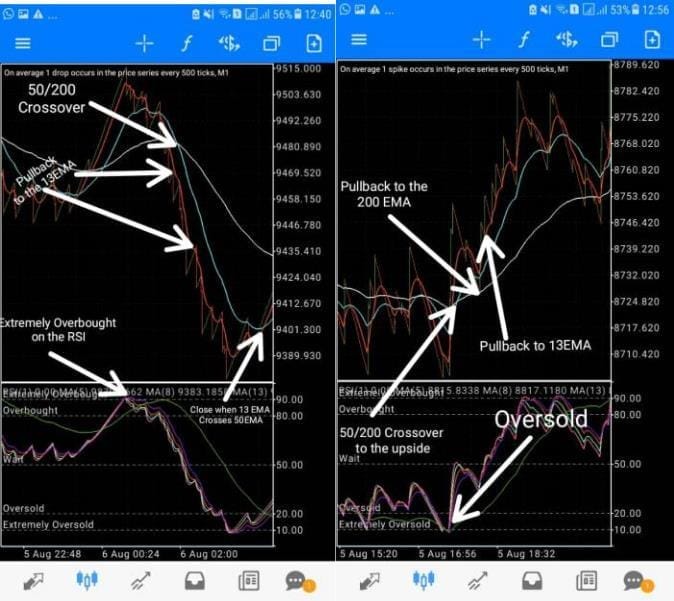

Technical analysis is the crucial aspect associated with successful currency trading, delivering traders using the resources to make informed decisions based upon price patterns and trends. Among typically the top tools available, moving averages stick out as a basic resource. These indicators help traders determine the direction of the market tendency by smoothing out there price data over a specified time period. Simple Moving Averages (SMA) and Rapid Moving Averages (EMA) are the most commonly used, each offering unique observations into market mechanics. By observing crossovers between short-term plus long-term moving averages, traders can place potential entry in addition to exit points.

Another powerful analysis tool is definitely the Relative Strength Index (RSI), which usually measures the rate and alter of cost movements, indicating overbought or oversold circumstances. An RSI price above 70 typically suggests that a forex pair is overbought, while a worth below 30 indicates it may always be oversold. This details aids traders in timing their investments effectively by signaling when to enter into or exit the marketplace. Understanding how to interpret RSI in conjunction with various other indicators can boost trading-strategies significantly.

Lastly, Bollinger Bands offer the dynamic approach to examining market volatility in addition to price levels. Containing a middle music group (SMA) and two outer bands that represent standard deviations, these indicators assist traders understand price action relative to be able to its recent overall performance. When prices touch the top band, this may indicate overbought conditions, whereas splashes on the decrease band can signal oversold conditions. With the use of Bollinger Bands, investors can adapt to changing market problems and make more educated decisions based on the subject of price movements and even volatility.

Psychology and Style in Currency trading

The psychological and emotional factors of trading tend to be overlooked, yet they will play an essential role in a trader's success. Emotions like fear in addition to greed can lead to impulsive decisions, causing traders to exit positions too early or even hold onto losing deals for too extended. Understanding your personal internal triggers and how that they impact your investing behavior is essential. Developing self-awareness can help you recognize when feelings are affecting the decisions, allowing you to implement strategies to maintain a rational mindset.

Maintaining discipline is essential for long-term good results in Forex investing. best mt4 brokers requires sticking to your trading approach, following your established strategies, and fighting off the temptation to be able to deviate out of your tips during periods of emotional upheaval. Effective traders often generate a structured program that includes environment clear goals plus sticking with risk administration practices. By fostering discipline within your stock trading approach, you construct consistency that could prospect to improved functionality and reduced pressure.

Lastly, incorporating mindfulness techniques such as deep breathing can greatly improve your trading psychology. Taking time and energy to clean your mind in addition to focus on the particular present will help lessen anxiety and enhance concentration. Regularly examining your trading mentality and making a practice of reflection may also contribute to better decision-making. By simply prioritizing psychological durability and maintaining self-control, you place the base for a more fortunate Fx trading journey.

Navigating Typical Pitfalls and Faults in Forex

One regarding the most substantial pitfalls many forex traders encounter is the overreliance on specialized indicators without fully understanding their fundamental principles. While tools like Bollinger Bands and Fibonacci retracements can be powerful regarding analyzing market trends, traders often help to make the mistake of using them in solitude. It is crucial to combine technical analysis with a strong knowledge of market fundamentals and economic indications. This holistic approach can be useful for making well informed decisions rather compared to reactive trades dependent solely on what a new chart indicates.

Another common mistake is neglecting risk management techniques. Many traders are really drawn to the potential for great rewards in forex trading, but they frequently disregard essential tactics like setting prevent losses and placement sizing. Failing in order to assess risk tolerance can lead to significant losses that will might jeopardize not necessarily only capital but in addition trading confidence. It's vital to generate a risikomanagement plan that aligns with individual financial goals and to stick to it even in volatile industry conditions.

Finally, the psychological aspect of stock trading is usually underestimated. Thoughts like fear in addition to greed can push traders to create impulsive decisions, major to mistakes such as overtrading or keeping losing positions regarding too long. Successful fx trading requires some sort of disciplined mindset, in which traders comply with their particular strategies and keep calmness amidst market variances. Keeping a trading journal is usually an efficient way to observe successes and problems, helping to enhance positive habits whilst minimizing the impact of emotional responses on trading effects.