Palm oil daily price 19 October

Aleksey UdovenkoCPO futures snapped five days of steady rise to erase just over 50 points on the most active month after reversing course in the second half weighed by losses in related bean oil on Dalian and E-CBOT. Easing crude oil prices was also spooking traders to hit the sell button. Earlier palm made steady gains rising to six weeks high propelled by escalating exports and a weaker ringgit. Malaysia’s 1-20 Oct export is expected to post 9-10% increase to the same time in Sept, an improvement from 1-15 Oct export rise. The ringgit moved 0.42% lower to the dollar, closing at over two decades low pummeled by strengthening US dollar. Though ringgit is weak, it was not sufficient to sustain higher palm futures. Easing production and rising exports should trigger clearer pricing guidance. On a macro level—geopolitical risk will continue to add volatility to crude and equities market, indirectly influencing CPO futures.

Palm Oil Price Closing Market FOB Malaysian Ports CPO 783 USD

Crude Palm Oil CIF Rotterdam 935 USD

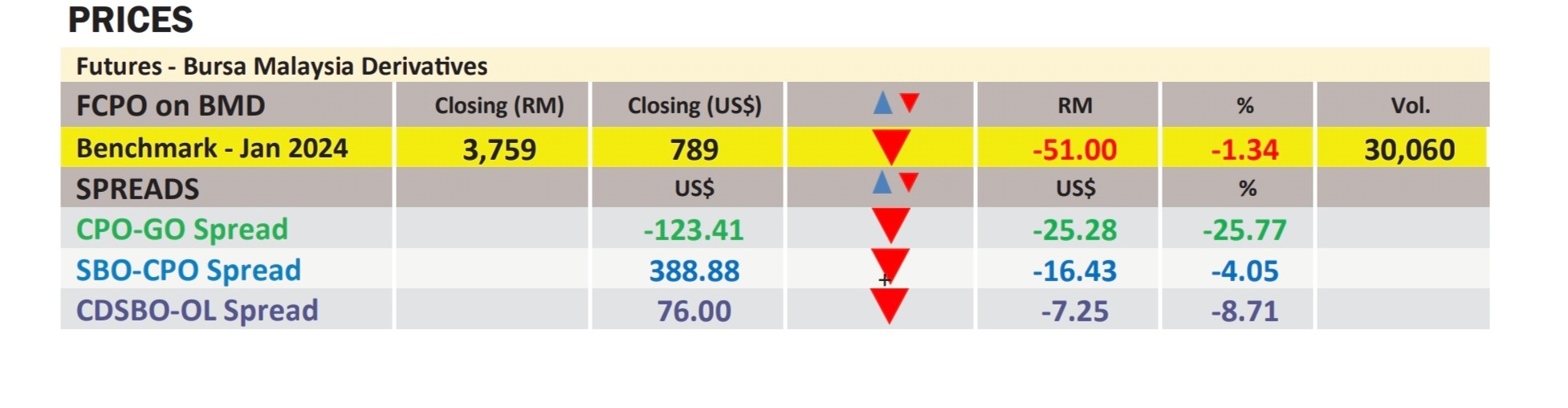

Crude Palm Oil Futures FCPO 3768 MYR