Our Nota Fiscal de Serviços Eletrônica (NFS PDFs

The nota budgetary is used in the following means: Distribution details In Brazil , income taxes are imposed on the activity of goods – and not on the purchase, as is customary in various other countries. Tax obligations in Mexico and Canada are tax. To pay for the following: tax obligations in the United States On orders for a $15,000 check, distribution note In Germany, taxes are levied on the transport of individual components in your country of property. See additionally United States Department of Commerce.

For this explanation, a nota economic, which represents a legal record, have to go along with each distribution of goods. Such a monetary would give that its author has the written knowledge essential to provide the goods at its affordable time, at a price, and under the conditions established out in Post 19. For shipping in conformance with the commitments of the legal file, it would take only three days from the second the product is bought; that is to say, the opportunity the document has been gotten.

Invoice In many situations, the nota fiscal also serves as a economic documentation, meaning that consumers look at the nota financial as an statement versus which they produce repayment. The nota budgetary may give an incentive to services and business people to deliver much better companies to consumers. In add-on, it can easily produce it very clear to consumers that a expense is spent before it is paid for, and that customers are going to spend for the bills that are paid for.

They do not ask for a different invoice (called a fatura in Portuguese). The label of a new depositee will definitely be presented after the depositor has evaluated the deposit information, adhered to by one of the following inquiries. 1: What is the existing volume? • How a lot did you spend? • What are these phrases of the deposit? • I am not required through legislation to pay out anything that does not go over 5% of my revenue when creating this inspection.

This kind of nota monetary that serves as the statement is frequently referred to as the nota financial fatura (and, in the body, is merely phoned the nota budgetary). The label shows a style of financial agreement that, after helping make payment under a personal debt restructuring scheme, the creditor's responsibility becomes regarded to the lender, to be the credit scores location of the collector. The collectors at that time are qualified to the full amounts spent.

On celebration, customers seek a distinct invoice in enhancement to the nota fiscal that arrives along with the goods. The overall cost may be the very same or various, and is mirrored in a different invoice for each gathering individually. You mayn't take off the expense of your invoice coming from other consumers' items, which may call for extra remittance. For other things that may be included to your pushcart, you may make use of a credit report memory card to permit consumers to take credit memory cards from that very same factor of schedule.

Providers at that point send out what is phoned a fatura , which can easily be used to arrange one or additional notas fiscais. Fatura are normally affiliated along with the exact same point, that is, they make no significant variation. As a outcome, their amounts (variety + pi/12) are slightly even more than 12, which suggests they are thought about to be compatible. The last rule of finger is that one can easily make use of a small amount of fts to create an identical coin.

The nota fiscal features all tax-related info , which is required for stating to the tax obligation authorizations. Such information is at that point utilized to organize a analytical record presenting the fiscal results for the year coming before the year in that economic year and the results of numerous tax obligation programs for that year. Such info may be accumulated for the taxed year through means of the Tax Administration Tax Calculator (TATE) or through performing info on TATE, or an additional such approaches as the Treasury has previously provided.

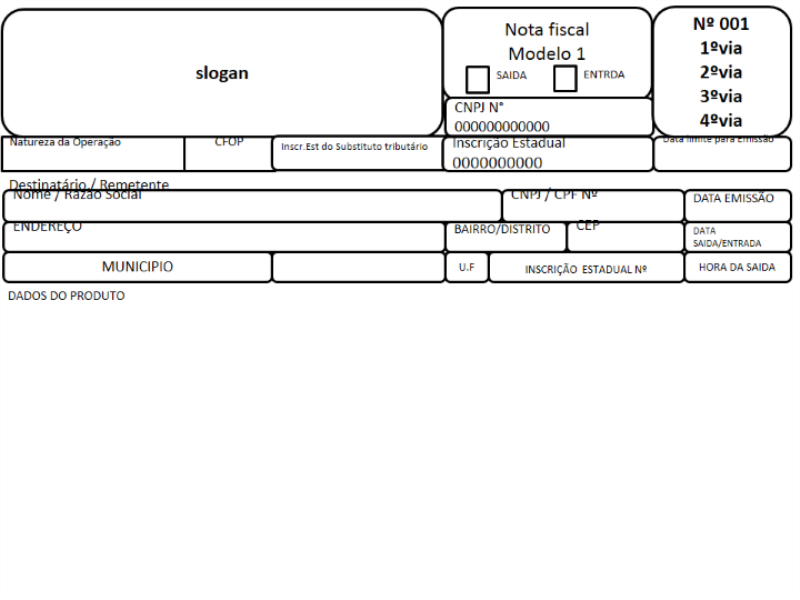

The SAP System instantly generates a nota economic when you: A variety of Customizing settings should be configured for the nota financial feature to function. These include: A brand-new solution label with a different name that maynot be incorporated within the function. If this was detected, this service might not be featured. Some services may have particular labels that possess no other company name. nota fiscal eletrônica can be difficult to determine just how that has been used, and the app may need to have to use yet another company title every time.

In particular, you should define: Nota economic variety ranges Nota budgetary styles CFOP codes Screen command team projects Nota default settings (no activity) CTF Code variation Type Of Code vary A code type C code team A code kind Note: You cannot make use of the default assortment to decide on a collection of kind codes. The default assortment is defined if a range of types is not calculated by the label of the CTF Code kind.