ICODrops review: Blockstack

https://icodrops.com/

https://t.me/IcoDropsReport - ICO reviews channel

https://twitter.com/ICODrops - Twitter

https://t.me/joinchat/FoisO0k4-XXBkPEikfdgow - English chat

Blockstack - is a decentralized computational network and dApp ecosystem.

Timeframe:

The token sale will be conducted via Coinlist, the dates are to be specified after the decision of SEC.

Currently, the pre-registration on Coinlist is open.

Metrics

- The public token sale hard cap is $52,8 million USD (at the current prices);

- The project's market cap in two years will be $220 million USD (calculated by the sale prices);

- Token allocation for the public sale is 33%;

- The total amount of tokens in the Genesis block is 1 billion and 320 million;

- The allocation for accredited investors is 440 million tokens (vested for 2 years);

- The allocation for the network's users is 440 million tokens (vested for 2 years);

- The allocation for the team is 440 million tokens (vested for 7 years);

- Token emission isn't limited, which presents inflation;

- The amount of new tokens minted in the first year is 440 000 000;

- The block reward during the first year is 8000 tokens;

- The block reward will be reduced annually by 500 tokens until it reaches 2000 tokens;

- 25% of the block rewards will be distributed to dApps proportionally to the bonus points they have;

- The total number of tokens in roughly 10 years will be 4 702 500 000 if there are 144 blocks produced daily;

- It's estimated that the supply calculated above will present the annual inflation of about 2% after the 13th year of the network's uptime;

- The terms of token unlock: monthly for all of the investors for two years. The team promises to release a final version of the token economy (currently available paper is more than a year old). We strongly advise reading the new version once it gets published.

- The project has previously conducted a round of sales. The tokens sold at that time will be gradually released according to the same terms that are outlined for the current round.

Coinlist states that if a person invests more than 10% of their annual income, they will need to get accreditation. 'Blockstack Token sale Mechanics' states that this requirement applies for investments that exceed $3000 USD.

Non-accredited investors will invest through vouchers. A person will be able to purchase a voucher priced up to $3000 and redeem it for tokens.

More information about the token metrics and the terms of the token sale are available here and here.

Social metrics:

Daily visitor rate of the official website: 13 565 views and 3 340 users.

Alexa stats: the top countries by visitors are the USA - 43,2%, India - 12,8%, and the UK - 4,9%.

Twitter: @ blockstack was initiated in July 2015 and has 26 795 followers & 1 372 tweets. The activity on Twitter is high, the team frequently posts relevant content.

Telegram: the channel in English was created on February 3, 2018, and now has 2450 users (data captured on 28.06.2019) that actively ask questions.

Key players:

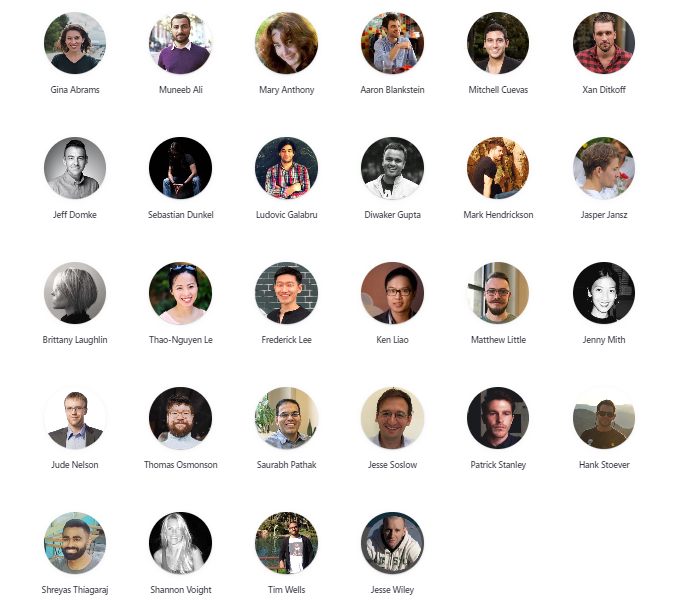

The team:

Muneeb Ali - CEO of Blockstack PBC from 2013. 500+ contacts in LinkedIn. Muneeb is a Ph.D. at Princeton University. From 2017 he acts as managing partner at Token LLC. He is a lecturer at Princeton University.

Aaron Blankstein - is in Blockstack from 2017. 38 contacts in LinkedIn. Aaron got his Ph.D. at Princeton University. He worked as a doctoral student at the networks lab of Princeton from 2011. Aaron underwent internships in Microsoft Research. He focuses on the systems for tracking data flows, caching algorithms, compilers, and applied cryptography for more than 10 years.

Mitchell Cuevas - Marketing Partner. 500+ contacts in LinkedIn. Mitchell works in Blockstack from 2018. He was a Head of Marketing at Techstars, UP Global, and Startup Weekend.

Jeff Domke - Head of Product. 500+ contacts in LinkedIn. Worked on a similar position at CompStak. Jeff founded Signal platform for analyzing interaction with clients and a messenger Capsule.me.

Sebastian Dunkel - Product Support. 500+ contacts in LinkedIn. Sebastian worked in Apple from 2013-2014 as the director of localization. Afterward, he worked in several companies as Product, Customer & Service Support. In Blockstack he works from February 2015.

Dr. Diwaker Gupta - Engineering Team Lead. Dr. Diwaker worked as a team lead at Dropbox for 4 years, where he was responsible for releasing new products. He was part of the group founded Maginatics - a next-gen cloud file system acquired by EMC in 2014.

Jude Nelson - in Blockstack from 2015. Jude got his Ph.D. at Princeton University, where he also acted as a doctoral student within PlanetLab. He underwent internships at IBM and Verivue. His research was focused on building global programmable storage systems. PlanetLab received the ACM SIGCOMM Test of Time award in 2013.

Saurabh Pathak - in Blockstack from 2018 года. Saurabh works as an auditor. Previously he worked at BlackRock for 10 years. Saurabh underwent internships in EY, Deloitte, and Touche. He is a certified accountant with 27 series license.

Jesse Soslow - Head of Legal and finance. 500+ contacts in LinkedIn. Before joining Blockstack Jesse worked at Everwise and Morrison & Foerster.

Patrick Stanley - Head of Growth from 2017. 500+ contacts in LinkedIn. Patrick has a successful track record at Earnest - online loans. With his help, the company expanded to 200 employees and $2 billion USD in revenue. Patrick also founded Ellison.

In addition, the team has 15 well-educated specialists: Gina Abrams (500+ contacts in LinkedIn.)- growth partner, Mary Anthony - technical writer, Xan Ditkoff (500+ contacts in LinkedIn) - growth executive, Ludovic Galabru (500+ contacts in LinkedIn) - engineer, Mark Hendrickson (500+ contacts in LinkedIn.) - product manager, Jaspen Jansz - designer, Brittany Laughlin (500+ contacts in LinkedIn.) - responsible for investor relations, Thao-Nguyen Le (500+ contacts in LinkedIn.) - operations executive, Frederick Lee - legal assistant, Matthew Little - software engineer, Thomas Osmonson - developer, Hank Stoever (233 contacts in LinkedIn) - engineer, and others.

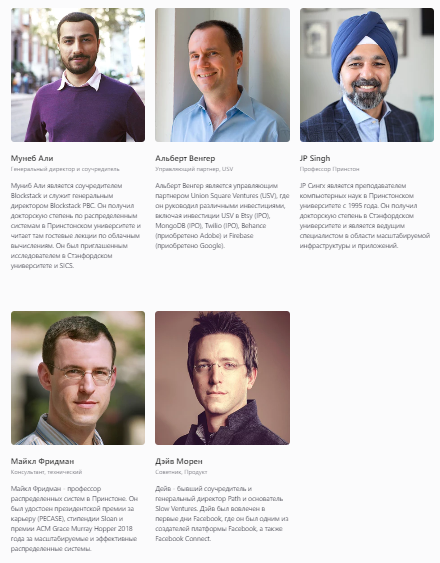

Advisors:

Muneeb Ali - CEO, also mentioned as an advisor.

Albert Wenger - Managing Partner at Union Square Ventures. Albert was in charge of various investment projects: ETSY, MongoDB, Twilio, Behance, and Firebase. He is a director of goTenna, Shippo, Skillshare, SimScale Gmbh, Biowink, Code Climate, Wattpad, Sift Science, Shapeways, Foursquare, and Union Square Ventures. Albert graduated from Harvard University and got a Ph.D. from MIT.

JP Singh - a member of the board of directors. JP Singh got a Ph.D. in Computer Science at Stanford University. He is a leading specialist in scalable infrastructures and apps. He also advises for Intel, Microsoft and the U.S. government. JP Singh co-founded FirstRain Inc., a business analytics company, where he acted as CTO. He was awarded PECASE.

Michael Freedman - Advisor. Michael is a professor at Princeton University. He also is a co-founder and CTO at TimescaleDB. He received PECASE and the ACM Grace Murray Hopper 2018.

Dave Morin - Advisor. Dave co-founded a social network Path. He previously co-founded and managed Facebook.

Investors:

The project is backed by more than 800 private parties and organizations, including Winklevoss Capital, Union Square Ventures (USV), Foundation Capital, Lux Capital, Blockchain Capital, Digital Currency Group, Y Combinator partner Qasar Younis, founder of Techcrunch Michael Arrington, Digg founder Kevin Rose, and Harvard University.

There is publicly available information about investors and token allocation (filing for SEC):

- Harvard University endowment $10 million USD

- Lux Capital & Foundation Capital 95 833 333 tokens

- Union Square Ventures owns 5% of the project's tokens and plans to purchase an additional batch for $1 million USD. It is one of the top performing U.S.-based venture funds.

- 323 million tokens were sold to 24 accredited investors for $0,00012 USD!!!

- 682 318 558 were sold from November 2017 to February 2018

- 2 million tokens were sold for $0.0132 USD in January 2019 and locked for 2 years.

- 40-80 million tokens are planned to be sold for $0.25 USD to investors who aren't U.S. citizens.

- The expected circulating supply at year 10 of the network's uptime is 4.073.500.000

- There was also a round of sales of 440 million tokens for around $50 million USD

Initially, Blockstack will get access only to $10 million USD and the rest of the funds will be locked up until some specific roadmap milestones are reached.

Another $20 million USD will be released once the consultation board will confirm the release of the updated version of the network, which has support for Stacks tokens. The remaining $20 million USD will be unlocked after one million users will join the network.

295 million tokens for $50 million USD are planned to be sold. 215 million of them will be offered for $0,12 дол. to voucher holders. The personal hard cap is $3000. 40 million tokens will be offered for $0,3 to accredited investors. 40 million is allocated for App Mining - the tokens will be distributed to those, who develop dApps for the network.

Technology and idea

Whitepaper:

Blockstack is an open-source project focused on constructing, developing and expanding a decentralized computational network, which should become an alternative to conventional cloud computing. It's a complex product with a web browser, blockchain-based domain registration system, user identification system and cloud infrastructure for data storage. The project is aimed towards decentralization of the Internet.

Blockstack utilizes an existing infrastructural layer of the Internet, basic communication protocols, removing centralized points on the applied level and Bitcoin level. The technological stack can be moved to other blockchains.

Blockstack offers developers a new model for application development that guarantees that the dApps will be decentralized by default:

- No transparent databases. Developers' major focus is around their applications' logic; users download apps and connect them to their own storages.

- No servers (applications are launched on a client's side and each new user contributes their computational resources and storage to the network instead of relying on app developers).

- Smart-contracts.

- Decentralized authentication.

- Native tokens. Users have direct ownership of tokens and can use them to register digital assets and smart-contracts or pay for smart-contract deployment.

Decentralized computational network Blockstack logically exists on the application level in traditional Internet stack. However, Blockstack network consists of several systems, which form components necessary for dApps:

- Stacks Blockchain. Blockstack network is based on Stacks blockchain, which allows users to register and control digital assets like users' domain names and register/deploy smart-contracts. The current Stacks blockchain is considered as «version 1», which represent the initial realization of basic functions. Stacks v1 blockchain utilizes the Bitcoin network for the deployment of its consensus algorithm and token transaction support. The Whitepaper outlines Stacks v2. This version supports the full functionality of the consensus and an execution environment, which is a significant update for the V1.

Stacks blockchain utilizes Tunable Proofs mechanism for leader election. Tunable Proofs is a leader election system, which can receive input data from several mechanisms and adjust relative weights for each of them. For instance, using Turnable Proofs allows merging Proof-of-Work with added functionality for reusing hashing power from another blockchain, which is more resilient. Tunable Proofs aims to securely launch a new blockchain and slowly transition to the proprietary PoW.

Peer-to-peer network Atlas. This layer stores routing data (so-called «zone files»), which point to the main data storage deployed on a higher level («Gaia storage»). Since zone files are verified by the p2p network, they cannot be tampered with or corrupted. The small size of files (4 kilobytes) allows storing full routing data copies and ensure protection from various attacks.

- Gaia storage is a user-operated storage system that allows dApps to interact with private data storage. Users will be able to deploy such storage of encrypted data in the cloud, on a local hard disc or remotely. It's worth mentioning that a user is in charge of choosing a provider. The data for Gaia is encrypted and signed on the client's size by using cryptographic keys.

- A blockchain authentication protocol is used for decentralized authentication within dApps. This protocol allows users to verify the validity of their signatures and provide information about which section of Gaia should be used by dApps for their data storage.

- Blockstack libraries and SDK. On top of the development stack, there are libraries and SDK built for developers to interact with Blockstack network's various components. For instance, Blockstack client software allows users to register their personal data and manage it.

- Blockstack also provides a domain naming service (BNS), defining operations on the virtual chain and storing routing data on Atlas p2p network. With support from base-layer blockchain's consensus protocol, virtual chain processes all BNS operations: name registration, updating, and relocation. Thus, the virtual chain reflects the overall state of BNS: “who owns a given name and what data is associated with that name”. BNS domain name structure resembles that of the conventional Internet. For example, «blockstack.id» consists of 2 parts: name= ”blockstack” and name range= “.id”;

- The implemented transaction verification mechanism requires users having full control of nodes, which means that they have to have enough disk space (currently it's roughly 1GB). The Stack protocol supports light clients for low-spec or mobile devices. Light clients can independently verify transactions through requests to Blockstack public nodes for receiving the state of consensus (latest hashes) and the complete list of transactions;

- Since on the blockchain layer only users' authentication, dApps almost don't have to interact with it. It's beneficial for developers that can build dApps in any languages. Blockstack promises a simple plug-and-play approach for installing various applications. Hence, developers will be able to simply connect to a user's API instead of a centralized API, which strips them from setting up servers, databases and user management systems;

- All the necessary computations are processed on Blockstack's architecture levels under users' supervision without the involvement of service providers' servers. This allows considering Blockstack-based dApps completely decentralized and server-less; albeit dApps don't process data on the blockchain layer like it's implemented in Ethereum.

Token economics:

- Blockstack will have its native token Stack. The supply of tokens is planned to be fixed at 1 320 000 000 in the Genesis block (the first block to be mined after the Stack protocol is activated).

- After Stack is launched, new tokens will be emitted through mining.

- There are 3 ways to get tokens:

- Proof-of-burn mining

- Apps-reward mining

- Web-of-trust mining

4. The current mining parameters are the following:

- The number of tokens issued during the first year is 440 000 000

- The block reward during the first year is 8000 tokens

- The mining reward will be reduced annually by 500 tokens until it reaches 2000

- 25% of the block reward will be distributed to the applications proportionally to their bonus points

5. The total supply of tokens in roughly 10 years is expected to be 4 702 500 000 if there will be 144 blocks mined daily

6. Inflation of about 2% is expected after the 13th year of the network's uptime

7. To operate within Blackstock users will need Stack tokens. Every protocol-level operation will 'burn' tokens, requiring users either buy or mine new tokens. Used tokens aren't refundable, which will decrease the total supply

8. Token use cases:

- Fee for creating a name in BNS

- Domain name trading

- Payments to namespaces' owners by domain owners

- Purchasing / exchanging domains via atomic swap

- Miner incentive for proof-of-burn

- DApp developers incentive

- Domain registration incentive

- DApp usage

- Protocol governance

9. Fees:

- Currently, Blockstack supports the following operations: domain name update, transfer, and removal. All of the operations on the mainnet require paying transaction fees

- In addition to user registration, saving a user account in Blockstack will be a paid service. This should diminish spamming. The currency for fees is Bitcoin, but the transition to Stack tokens after the network's launch is planned

- DApp testers will receive 2% of the reward allocated for application development. This will incentivize them to support the process throughout one year

Roadmap:

The milestones planned to be reached before the end of 2019 are:

- Transition to the new consensus algorithm;

- Launch of full support for smart-contracts within Stacks blockchain;

- Start of App Mining that will distribute STX to dApp developers;

- Allow launching dApps via BNS on Blockstack instead of DNS;

- Launch iOS and Android authentication apps for Blockstack.

Product/MVP:

Currently, there is a browser, Stacks V1 testnet, and a developer portal docs.blockstack.org. Everything looks comprehensive and functional. Users can download a browser and use it after creating a personal identifier. Third-party developers built over 150 applications, which is quite impressive in terms of the blockchain space.

Github looks solid and active. The development is constant, some of the repos are almost finished, others have daily commits. The core was developed by 39 users from January 2014 and has roughly 9000 commits. This makes the project look like one of the TOP-10.

Addendum / Summary / Opinions

Strengths

- The project has significant effort: more than three years of development, more than 10 thousand community developers.

- The token sale will conform SEC standards and conducted on Reg A+ terms.

- Fair unlock of token sale proceeds. The last $20 million USD will be released after the network reaches 1 million users.

- The team is very experienced and the project is seriously backed.

Weaknesses/Risks

- Lengthy lock-up of tokens. The trends and sentiment in the blockchain space change quite rapidly. However, we don't say that diversifying into fundamentally strong projects for long-term is a bad idea.

- The hard cap of the token sale is relatively high. In addition, the price for affiliates, where 323 million tokens were sold to 24 accredited investors for $0,00012 in 2017, is very concerning. Although they have the same lock-ups as everyone else, the price doesn't make sense. Answering to questions regarding this, the admins suggest reading the document by SEC.

Blockstack is a global and fundamental project with a solid proposition, team, investors and a compliant approach to the regulations. There are many more points in its favor besides what we've just mentioned and two evident drawbacks. While the first imperfection can be accepted, the second requires better clarification from the team's side in our opinion.

Finally, we should highlight that SEC regulation takes time and the process can either take longer than expected or transform.