OKSCHAIN is an easier and safer money management platform for everyone in the world.

DEWI08

Introduction

Digital assets and cryptocurrencies are rapidly becoming an integral part of our lives. However, there is still a lack of user-friendly digital asset management services today. Unfamiliar interfaces cause difficulties, and each action requires a separate service. The OKSCHAIN ecosystem provides its users with a wide range of functions for managing digital assets, making payments and providing access to investments in modern technologies and start-ups. In addition, the OKSCHAIN team is going to develop a line of payment solutions for massmarket. The OKS token will be used by members of the ecosystem for daily payments. High transaction speed, reliability and security are the hallmarks of OKSCHAIN.

Becoming a user of OKSCHAIN, you get a convenient financial service that unites the world of cryptocurrencies and the world of traditional finance. Moreover, our users can become investors of venture and technological startups, OKSCHAIN partners.

We are a universal financial service of a new generation. Store digital assets in a secure wallet, exchange them as convenient to you and earn with OKSCHAIN!

Market analysis

Financial services market

The introduction of new technologies has become a common practice in financial services: payment solutions, mobile payments, biometric identification, artificial intelligence, cryptocurrencies, blockchain and others. Traditional companies actively employ with these technologies and introducing them into their business processes, new start-ups and business areas appear due to fintech.

According to KPMG, the amount of investments and transactions in the financial sector in 2018 was $111.8 billion, which is twice as much as in the previous 2017 - $50.8 billion, in total, 2196 deals were made in 2018.

The diagram above shows that investment in the financial sector has been growing rapidly over the past 10 years. Thus, it can be stated that the projects in the field of fintech have a high attractiveness for venture investors and are in demand in the market.

Loan market, P2P lending

At the same time, the development of p2p-crediting allows lenders to lend directly to proven borrowers and earn more on this than on bank deposits.

Getting a loan from a company operating in this market is easier than traditional financial institutions, so p2p-crediting is beneficial for borrowers. This is one of the elements of sharing economy in the field of financial services, which are in demand in the modern world. The p2p-crediting market has existed since 2005 and is dynamically developing. According to analysts' forecasts, from 2016 to 2022 the market volume will grow by an average of 51.5% and by 2022 will amount to $460.312 million.

Cryptocurrency market

Blockchain technology is becoming an important part of the global economy and big business. Today it is used by world-renowned financial corporations such as JPMorgan Chase, Goldman Sachs, Barclays, UBS, Credit Suisse, Societe Generale, Commerzbank5 , as well as governments of the UK6 , Germany7 and India8 . Central Banks of Canada and Singapore9 turned their attention to the cryptocurrencies and global IT giants: Facebook and Telegram..

As of May 2019, the capitalization of the cryptocurrency market amounted to $270 billion. Despite a significant market correction in 2018, the volume of investments instart-ups through tokensales in the first quarter of 2019 amounted to $837 million.10 The cryptocurrency market, which is closely linked to the blockchain market, has already developed its own infrastructure in the image and likeness of a stock market: its own banks, brokers, regulators, specialized investors, cryptocurrencies, specialized hedge funds. In 2018, the cryptocurrency market underwent a strong correction due to a sharp influx of speculative funds. The beginning of the decline coincided with the appearance of the official Bitcoin futures on two major US exchanges, which had a positive impact on the establishment of a market-validated price for cryptocurrencies.

Cryptowallets

Today, there are dozens of cryptowallets in the world: mobile, desktop, web, cold and paper11 . Their numbers continue to grow. The market for mobile cryptowallets has just begun to develop. Most of all in the market of web wallets. The developers introduce QR codes in order to make it easier to send cryptocurrencies from the user to the user. Nevertheless, at the present moment UX of modern mobile cryptowallets (the most convenient in use) still needs improvement and web wallettes have a number of serious vulnerabilities. In addition, modern cryptocurrencies are still poorly integrated with fiat currencies: the user has to work separately with cryptocurrencies and fiat in different applications.

Venture capital market

According to a study conducted by the Yostartups accelerator, in 2018, 23,000 investment transactions with start-ups were concluded for $407 billion. Based on these data, the volume of investment in start-ups in 2018 increased by 23.3% compared to 2017. These figures do not include 6,752 transactions for which there are no investment data.

Problems and solutions

Problems

1. Cryptocurrencies do not yet perform their function as a means of payment.

2. Loan against pledge of cryptocurrency is not available

3. High commissions for the exchange of digital assets

4. Low usability and legal restrictions on the exchange of digital assets.

5. Little options for investing cryptocurrencies in P2P lending

6. Today's cryptowallets are uncomfortable and poorly integrated with traditional payment systems

7. Most cryptowallets have security vulnerabilities

8. Investments instart-ups are not available to most people.

9. Due to lack of knowledge about start-ups, people often invest in fraudulent projects.

OKSCHAIN solutions

1. Convenient wallet for digital assets and cryptocurrency with the possibility of conversion

2. OKSCHAIN user can quickly arrange a loan online

3. Low fees for digital asset exchange

4. Convenient and secure service for the exchange of digital assets without legal restrictions

5. Issuance of loans secured by cryptocurrency

6. Integration with modern payment systems

7. State-of-the-art security system

8. Millions of people will gain access to venture capital investments

9. Appropriate selection of venture and technology projects

OKSCHAIN ecosystem

OKSCHAIN is a decentralized financial ecosystem for a wide range of stakeholders. The ecosystem partners use it to store digital assets, pay for goods and services, accept payments, use the service to exchange digital assets and P2P loans, and invest in start-ups. In the near future, OKSCHAIN plans to create an infrastructure for operations with cryptocurrencies and digital assets and to advance in the field of hard-tech, eco-technology and AI.

Target audience

The OKSCHAIN payment system allows its members to pay directly for a wide range of goods and services and is aimed at a wide audience, which includes the following target groups:

• Crypto-enthusiasts;

• Users of financial services and investment services;

• People without access to banking services

OKSCHAIN mission

The purpose of OKSCHAIN is to create a set of convenient and inexpensive financial services for our clients. First of all, we are focused on providing financial services to mass audiences. As pilot markets we consider those countries where cryptocurrencies are popular and where there are a large number of people without access to the banking system. We want to simultaneously provide our users with access to a number of traditional financial services and become a gateway to the world of cryptocurrencies for them.

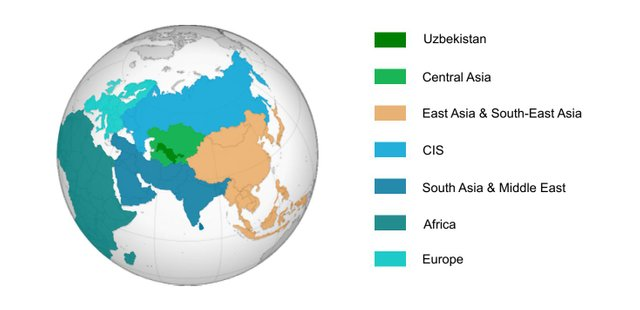

OKSCHAIN geography

First of all, we focus our development on the countries of Asia and the CIS. Uzbekistan will become a pilot country for the project launch, after which OKSCHAIN will enter the market of Central Asia, CIS, East Asia and SouthEast Asia, Europe and South Asia. Then it is planned to start work in the Middle East and Africa.

Okschain capabilities

The Okschain ecosystem provides its members with a wide range of financial services for digital assets and investments.

OKSCHAIN payment system

The OKSCHAIN ecosystem combines traditional financial services with cryptoservices. It is based on the OKS and stablecoins payment system, which uses the OKS and stablecoins to settle accounts with each other and purchase goods and services from ecosystem partners.

OKSCHAIN blockchain infrastructure

OKSCHAIN is creating a financial ecosystem that will unite millions of users. This ecosystem requires a blockchain infrastructure that can handle large numbers of transactions in a short time and with low fees. OKSCHAIN has chosen SCP-based blockchain Stellar to achieve this goal. The Stellar fork will be used to create the OKSCHAIN payment system and the blockchain infrastructure of the ecosystem. An OKS token is issued on the basis of the fork Stellar

Advantages of OKSCHAIN blockchain solutions

• High speed of transactions

OKSCHAIN blockchain is able to perform several thousand transactions per second simultaneously

• Transparency

All transactions of the system are available for viewing in the distributed ledger. Blockchain Stellar has open source code.

• Proprietary Blockchain Solutions

In the future, the OKSCHAIN development team will improve Stellar'solutions to increase network capacity while maintaining its decentralized nature.

• Security

Blockchain Stellar is resistant to Byzantine attacks

• Wide functionality and versatility

Blockchain Stellar supports the creation of smart contracts and decentralized applications.

• Suitable for payment solutions

OKSCHAIN blockchain can be used to send or exchange any currency, digital asset and quickly performs these operations, it is compatible with traditional and cryptocurrency financial systems.

• Convenient for creating stablecoins

Leading IT companies such as Wirex and IBM are already working on stablecoins of the Stellar blockchain. OKSCHAIN keeps up with the industry and will create a wide range of stablecoins.

• Easy integration

Third party services and partners can connect to the OKSCHAIN ecosystem via API. The SCP protocol is used when conducting transactions within the OKSCHAIN ecosystem, and a commission of 0.00001 OKS is charged.

OKS token

OKS is the unit of account of the OKSCHAIN ecosystem based on the Stellar Fork. Members of the ecosystem will be able to use OKS to settle accounts with each other, the OKS token is not a stock or security and does not give ownership of shares in the OKSCHAIN services

OKS token functions

Conduction transactions between OKSCHAIN network members

• Access to premium functionality

• Discounts on commissions and services

• Reinforcing the community and ecosystem actors

Guarantee fund

15% of the platform's quarterly profit will go to the guarantee fund. The fund will automatically buy cryptocurrencies at the market price of TOP-5 through smart contracts. Every six months each owner of OKS tokens will be able to exchange them for cryptocurrencies in the guarantee fund, pro rata with their share of the total OKS token issue. Every quarter, OKS tokens will be redeemed and burned with the help of the guarantee fund. The number of burnt tokens will be determined by the company's management bodies.

Digital Wallet

Terminal for storing and transferring digital assets by OKSCHAIN users. Both traditional fiat currencies and cryptocurrencies are available to users. Each wallet address is a unique identifier that you use to send digital currency to another OKSCHAIN user.

At the moment the next stablecoins will be issued in the payment system:

• OUSD

• OEUR

• OKZT

• OUZS

• OTJS

• OKGS

• OAZN

• OCNY

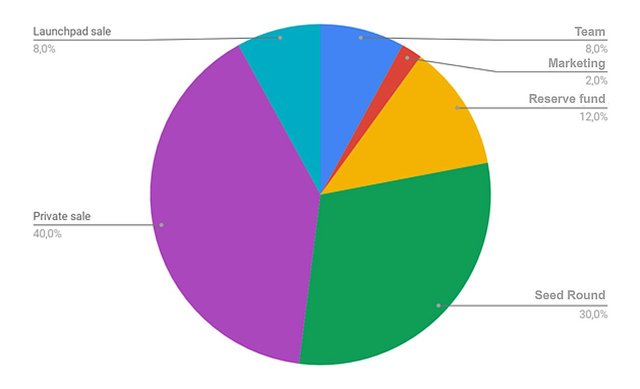

Terms of tokensale

OKS tokens will be distributed according to ICO terms and conditions, in proportion to the amount transferred by users during ICO.

• Ticker token: OKS

• Initial token price: $ 0,001

• Total token emissions: 17 360 000 000

• Number of bonus tokens: 1 860 000 000

• Tokens without bonuses: 15 500 000 000

• Launchpad Sale: 1 240 000 000

• Seed round: 4 650 000 000

• Private Sale: 6 200 000 000

• Total number of tokens on sale: 12 090 000 000

• The start date of the seed round: 25.11.2019

• End date seed round: 25.12.2019

• Date of start of private sale: 26.12.2019

• End date of private sale: 26.01.2020

• Date of launchpad sale: 12.02.2020

• Planned fee for seed round: $ 4 725 000

• Planned fee for private sale: $ 6 300 000

• Planned fee for launchpad sale: $ 1 260 000

• Hard cap: $ 12 090 000

• Permissible form of payment: ETH, BTC, USDT, USD, EUR

• Starting a smart contract: 02.02.2020

• Expected date of listing: 20.02.2020

• Minimum redemption volume of OKS token: 1 000 000

TOKEN

If you continue your acquaintance with OKSCHAIN through its internal system token, which in principle will act as a token for any transactions within OKSCHAIN. It is important to note that the OKS coin will be presented on the basis of the Stellar Protocol, therefore it will meet all its best indicators, namely: low cost, scalability and security.

As for the total amount of supply tokens that will make it the whole 17 360 000 000 OKS tokens. Most of which are distributed by ICO funds. The last stage of which will be completed on February 12, 2020.

ROADMAP

• August 2019

Launch of desktop MVP multicurrency wallet, development of mobile version, launch of decentralized stock exchange.

• September 2019

Development of a P2P digital asset exchange service, development of a p2p-credit service, launch of its own mining center.

• November 2019

API merchant service development.

• March 2020

Alternative energy project development, commercial data center design.

• May 2020

Commencing creation of AI-tech development center, construction of a commercial data center.

• September 2020

Obtaining a license for cryptomerchants in the EU.

• 2021

Completion of the data center construction. Obtaining a license for the issue of “e-money” (electronic money) in the UK. Starts AI-hub OKSCHAIN.

• 2022

Issue of OKSCHAIN debit card

Introduction of OKSCHAIN AI solutions in medicine in Uzbekistan.

TEAM

1. GAPPOROV BEHKZOD: CEO, FOUNDER

2. AHROR MAKHMUDOV: COFOUNDER, COO

3. MUTIKOV FARKHAD: ANALYST RESEARCHER, INNOVATOR

3. KARIMOV MIRFAZIL: HEAD OF LEGAL DEPARTMENT

5. NURIDDIN RASHIDOV: MAIN TEAM LEAD

CONCLUSION

Concluding my review, I would like to note once again the high level of preparation and implementation of all the previously listed functions and tools available in OKSCHAIN. At the same time, the developers themselves intend to actively develop their system in the countries of Asia and the CIS, where there is a particularly acute shortage of high-quality and so many-sided payment services.

FOR MORE INFORMATION CLICK LINKS BELOW:

- WEBSITE: https://okschain.com

- TELEGRAM: https://t.me/okschain_en

- WHITEPAPER: https://okschain.com/documents/okschain_wp_ru_1.0.pdf

- ANN THREAD: https://bitcointalk.org/index.php?topic=5212442

- FACEBOOK: https://www.facebook.com/Okschain-107247530682357

- TWITTER: https://twitter.com/okschainfintech

- MEDIUM: https://medium.com/okschain

AUTHOR

Bitcointalk Username: Dewi08

Telegram Username: @ dhewio8

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=894088

Wallet address (eth): 0x53D1Ea8619E638e286f914987D107d570fDD686B