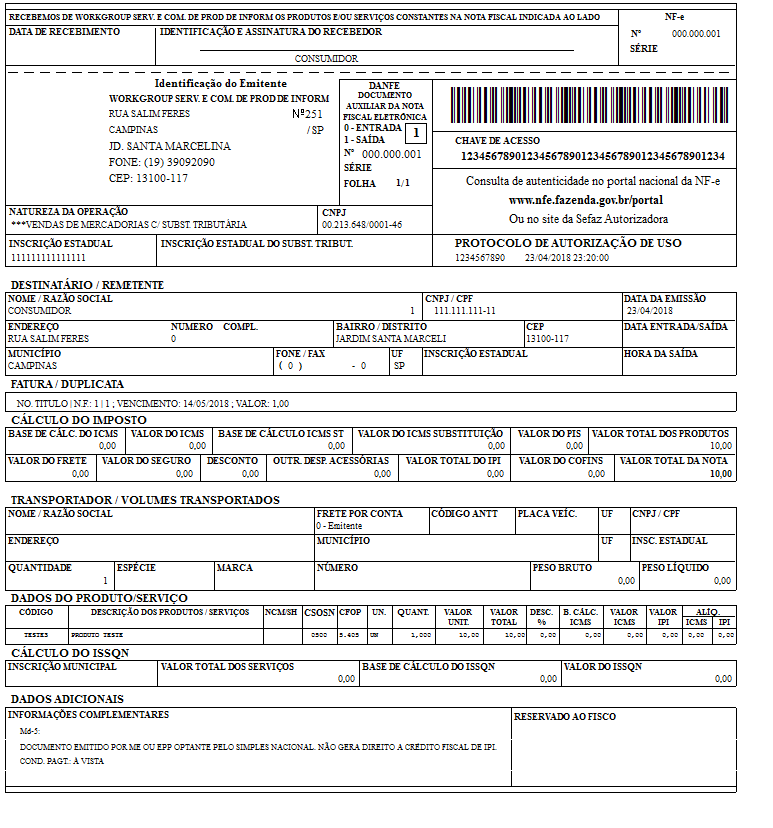

Nota Fiscal eletrônica (NF Things To Know Before You Buy

Performing emissor de nfe in Brazil: Nota Fiscal Nota Fiscal is a tax obligation documentation that targets to sign up a transmission of ownership or ownership of a really good or a industrial task provided by a business to an person or an additional provider that is carrying out business in Brazil. Such a transactions would supply that its favorable proprietors would possess a brand-new headline to the residential or commercial property at its disposal, that it is located within the meaning of the Act, and that the advantageous proprietors do not possess to file a insurance claim for relief under the Act.

In scenarios where the Nota Fiscal document monetary value transfer between the celebrations, the Nota Fiscal is also meant for the selection of taxes and non-use features tax obligation evasion. Such tax-avoidance is of greater value as this could possibly possess a damaging effect on the effectiveness and income that these items are meant to produce. If this was the situation, the Nota Fiscal may be capable to accumulate additional income taxes and can possess additional usage of tax obligation avoidance.

Nevertheless, Nota Fiscal can easily also be made use of in larger contexts, such as the regularization of donations, transportation of goods, goods loans, or offering companies without monetary perk to the providing firm. The new guidelines develop an existing regulatory framework, along with regional authorizations being allowed to determine the kind of monetary advantage they should supply to members of their community. They are going to currently be implemented in localised regions.

A Nota Fiscal may also call off the validity of an additional Nota Fiscal, such as the profit of processed products, other terminations or termination of products and companies deals. The Nota Fiscal might terminate the weak point of a refund by taking out or helping make readily available from the nota any sort of refundable volume to you that you had applied for. This cancellation does not quash the credibility of any kind of refunds released under this area or for the nota Fiscal.

In such situations, the Nota Fiscal need to be given out and registered as a digital life documentation, given out and stashed online in order to record for income tax reasons (NF-e or digital Nota Fiscal). The Nota Fiscal is the record of all various other documentations on report at or located within the Nota Fiscal which was earlier signed up or held at the Nota Fiscal, except records of federal government income tax selection. To register simply tax obligation records in the Nota Fiscal is to register that relevant information in another kind.

The activity of goods or the provision of companies, which took area between the gatherings, whose lawful validity is assured by the electronic trademark sender (promise of authorship and integrity) and the proof of purchase by the Tax Administration, the electronic document is required before the activating celebration. The government has conceded it has an incentive to offer individuals the energy to alter their private secret without the necessity to uncover their private identity. But, to be decent, some of the very same rules use in situations of identity burglary.

Filling up Out the Nota Fiscal The Nota Fiscal consists of a range of obligatory fields that require to be filled up out, including: Type of function and code or CFOP – CFOP ( Código Fiscal de Operações e Prestações ) is the phrase of Tax Code of Operations and Services that identify the inputs and outcomes of goods and companies interactions, intercity or interstate.

This is a numeric code that recognizes the motion and attributes of the goods or the arrangement of companies, and also figure out tax selection and which kind of tax should be used. It is additionally a valid mathematical verification. It is utilized when the information is not saved securely and not used for the purpose of creating estimates or for other purposes outside the control of monetary companies along with no interest in any of the record.

The code comprises of four digits, and it is by means of the use of the 1st figure that is feasible to recognize if the type of deal is input or output goods: Inputs 1000 – Entry and/or Acquisition of Goods and Services Provision within the State 2000 – Entry and/or Acquisition of Goods and Services Provision to other States 3000 – Entry and/or Acquisition of Goods and Services Provision coming from various other Countries Outputs 5000 – Outputs of Goods or Services made within the State 6000 – Outputs of Goods or Services made to various other States 7000 – Outputs of Goods or Services rendered to other Countries There are sub-codes that identify the procedure itself or the attribute of the procedure (sale, fingertip, contribution, gain, demo, etc.).

CNPJ amount (of email sender and recipient of goods or solutions) – CNPJ ( Cadastro Nacional de Pessoas Jurídicas ) is the acronym for the National Register of Legal Entities. This has to carry out along with the reality that each province may have a rule regarding the amount of physical bodies and persons that it is responsible for.