"Navigating the Boardroom: Understanding the Relationship Between Private Equity and Corporate Governance" for Beginners

Steering Change: The Impact of Private Equity on Corporate Governance Strategies

Exclusive capital has developed as a substantial power in the company yard, steering change and improving corporate control techniques. Along with its one-of-a-kind method to investing and management, exclusive equity companies have had a great impact on the way companies are function and controlled. In this short article, we are going to look into the crucial ways in which exclusive capital has influenced corporate administration methods.

One of the major methods in which exclusive equity has influenced business governance is through its emphasis on operational improvements. Unlike standard entrepreneurs who primarily look for monetary returns, exclusive equity firms actively interact with the business they invest in to steer working performances and boost functionality. Key Reference -on method commonly entails extensive restructuring attempts, cost-cutting measures, and strategic initiatives striven at boosting earnings.

Through prioritizing functional remodelings, personal capital firms carry a heightened level of examination to company control strategies. They highlight transparency, responsibility, and productivity throughout all levels of the organization. This enhanced concentration on control aids impart finest practices that can easily possess long-lasting effects even after the private capital organization exits its investment.

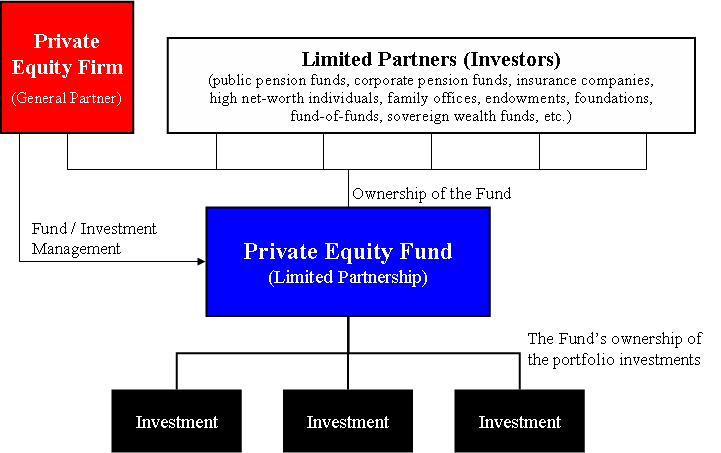

On top of that, private equity real estate investors generally look for panel portrayal as component of their financial investment agreements. This permits them to actively participate in decision-making methods at the highest possible degree of business governance. Their existence on boards brings a new point of view and varied experience that may benefit providers through challenging traditional thinking and steering development.

Personal capital investors likewise position substantial emphasis on straightening motivations between administration teams and shareholders. They frequently implement performance-based compensation designs that tie corporate commission straight to company performance objectives. This placement ensures that managers are motivated to act in the ideal interests of shareholders while also encouraging a culture of obligation within associations.

In addition to determining internal control structures, exclusive equity has likewise participated in a function in molding external governing structures. The excellence of personal capital expenditures has caused regulators to revise existing regulations regulating disclosures, document standards, and investor rights. As a result, there have been enhanced initiatives to boost company administration rules to a lot better safeguard shareholder passions and ensure openness.

Nevertheless, the effect of private capital on corporate control techniques is not without its doubters. Some assert that the short-term emphasis of private equity real estate investors might lead to a forget of long-term maintainable growth strategies. They compete that extreme cost-cutting procedure and threatening economic engineering may damage business in the long run, weakening their potential to innovate and invest in research and development.

Another concern is the possible conflict of passion between personal equity capitalists and various other stakeholders. Movie critics claim that private equity organizations frequently focus on their very own economic increases over the rate of interests of workers, distributors, and local area neighborhoods. This has elevated questions about the social task of exclusive equity investors and their duty in promoting sustainable organization practices.

In conclusion, exclusive equity has possessed a considerable influence on corporate administration practices by steering functional renovations, determining board dynamics, aligning rewards, and forming regulative structures. While there are legitimate issues relating to short-termism and disputes of rate of interest, it is crystal clear that private equity has delivered about beneficial adjustments in how companies are regulated. As this fad continues to grow, finding the best balance between monetary returns and responsible service techniques will be critical for both private equity companies and the companies they spend in.