Navigating GST Calculations Made Easy by using GSTCalculator

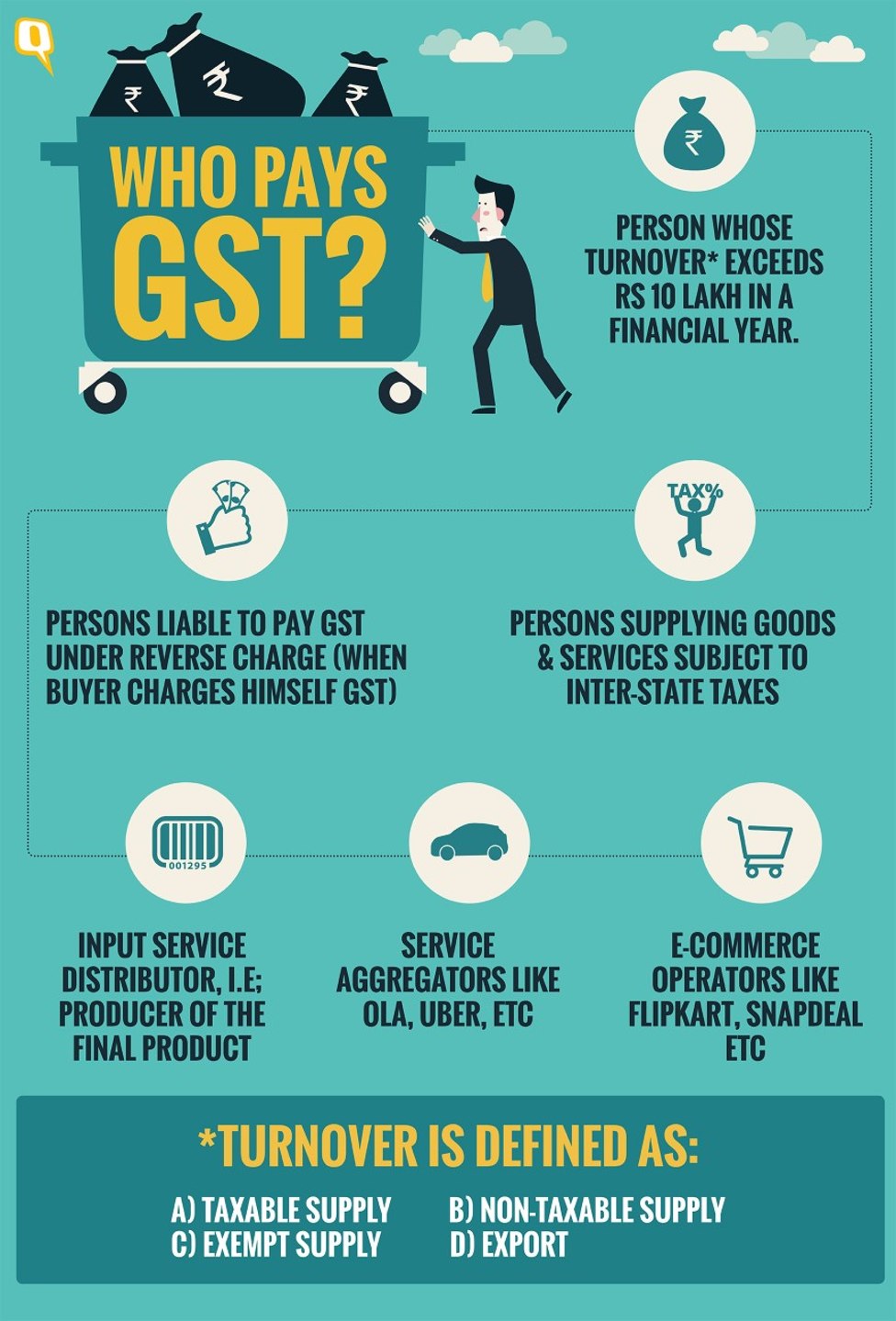

In the tangled world of taxation, Goods and Services Tax (GST) stands as an important element of the global economic structure. The value-added tax, which is imposed on most goods and services that are sold to consumers in the domestic market is an essential source of revenue for governments as well as is a major consideration for businesses as well as consumers. Amidst this intricate fiscal landscape, GSTCalculator.tax emerges as an indispensable tool, simplifying the difficult task of GST calculations.

Understanding GST and its Global Application

GST, a comprehensive multi-stage tax based on destination, has been embraced by many countries, each with its own distinct rate and structure. GST is a tax imposed on the final consumption of products or services, with the end consumer bearing the cost. Countries such as Australia, New Zealand, Canada, and India have included GST into their tax systems, albeit with differing rates and rules. For instance the Australia's GST rate stands at 10%, while India uses a multi-tiered tax system that varies from 5% to 28%, based on the item's nature. This variation underscores the need for a versatile tool capable of navigating these diverse tax environments.

GSTCalculator.tax - Your Comprehensive GST Solution

GSTCalculator.tax is an essential solution to ensure accurate and efficient GST computations. This online tool was specifically designed to serve companies and individuals, allowing users to calculate GST on various transactions in multiple countries. It's more than just a calculator; it's a comprehensive guide through the complexities of global GST rates and regulations.

The user-friendly interface on the platform permits the simple input of transaction numbers, from which it calculates the relevant GST. It's a tool that not only saves time but also guarantees accuracy in these vital financial calculations.

Calculations of GST for specific countries

Each country's own GST framework poses specific issues, which makes GSTCalculator.tax's ability to adapt to any situation beneficial. In Australia For instance, the tool helps businesses include or exclude the 10 percent GST from their pricing, ensuring compliance with specific tax legislations in the country. In Canada, where GST is in conjunction alongside Provincial Sales Tax (PST) and Harmonized Sales Tax (HST), the calculator is able to navigate these complicated issues.

Businesses operating in India due to its GST system that is multi-tiered it is a valuable tool in determining the correct tax rate applicable to various items and services. Similar to New Zealand and Singapore, with GST rates of 15 percent and 7% and 7% respectively GSTCalculator.tax makes sure that both businesses as well as individuals are able to accurately record the tax in their financial dealings.

GST along with Business Operations

In the business world, a precise GST calculation isn't just a matter of compliance. It's a vital element of financial management. GST impacts pricing accounting, as well as the flow of cash for businesses. A precise GST calculation is crucial to determine the proper price of services and goods, preparing tax invoices, and filing tax returns.

GSTCalculator.tax plays an essential role helping businesses in effectively managing their GST obligations. It allows businesses to quickly calculate tax due on their transactions, keep accurate financial records, and stay compliant with tax laws. The accuracy of tax computation and reporting is especially critical for businesses dealing with large volumes of transactions.

GST and Digital Tools: The Future of GST and Digital Tools

As the world economy continues change, so will the world of GST along with taxation software. Digital solutions like GSTCalculator.tax have been at the top of this change, offering more than just basic calculations. https://www.gstcalculator.tax/ signal a transition to the age of tax compliance that is digital, which is where efficiency, accuracy, and accessibility are essential.

Future enhancements in GST calculations tools can be anticipated to provide even more sophisticated options, such as the connection to accounting programs, instant updates on tax law changes and even AI-powered advice on tax issues. These improvements will not just streamline tax calculations but change the way that businesses and taxpayers approach taxation.

Conclusion

In a world where taxation is just as dynamic as the markets that it regulates, tools like GSTCalculator.tax aren't just tools for convenience They are essential. By simplifying the complex process that is GST calculation across a variety of global jurisdictions, GSTCalculator.tax stands as an invaluable ally for businesses accountants, individuals, and businesses. No matter if you're managing an international company or want to determine the tax on your latest purchase, this program makes sure that you're only a few clicks away from precise GST calculations.

In conclusion, GSTCalculator.tax is more than a calculator - it's a bridge over those turbulent tax waters. It guides users towards the right level of compliance, clarity and confidence in their financial decisions.