NFT Loans, Collateral and Liquidity - How Does It Work?

fastandy

NFTs are digital assets representing ownership rights in physical objects. They're called "nonfungible tokens" because each token represents something unique. The first NFT was created by CryptoKitties, an Ethereum based game where users collect and breed cats. Now there are many other games using NFTs, and new ones are being developed all the time.

What Are NFTs?

NFTs are nonfungible tokens. Each one represents a unique item. You can't just buy them at any store; you need to go through a process to obtain them. This means that they aren't fungible, meaning that they can't be easily exchanged for another asset.

Why Do You Need an NFT Loan Platform?

There are several reasons why you might need an NFT loan platform. First, there's the fact that NFTs are not yet widely available. Second, NFTs are still relatively new, so there isn't much liquidity in the market. Third, some people prefer to keep their NFTs as investments rather than spend them. Finally, some people simply don't trust the current financial system.

How Does the NFT Loan Platform Work?

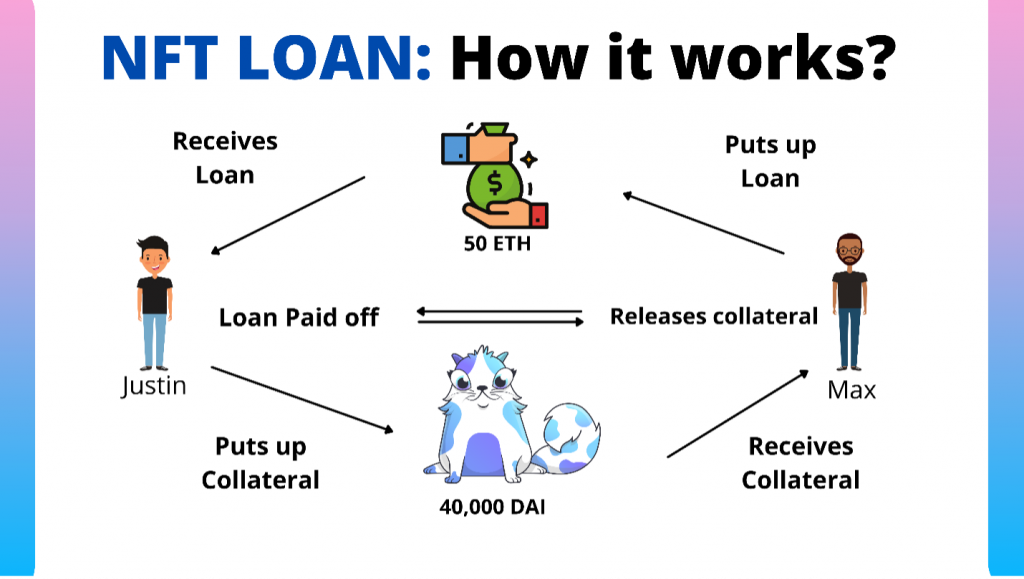

The NFT Loan platform allows users to borrow NFTs by pledging them as collateral against a loan. Users can then use these funds to purchase other NFTs, pay off existing loans, or even invest in other cryptocurrencies, in effect considered nft liquidity.

Is There Anything I Should Know About NFT Loans?

The NFT Loan Platform has been designed with transparency in mind. All transactions are recorded publicly on the blockchain so anyone can see what happens when an asset is pledged as collateral. This means that there is no need for third party escrow services, which often charge high fees.

What is DeFi?

DeFi applications are designed to replace traditional financial systems such as banks and exchanges with cryptocurrency. The majority of these applications run on Ethereum blockchain. John Wu, president and CEO of Ava Labs (a company that supports the development of DeFi applications using the Avalanche Blockchain), said the difference. DeFi lending allows users to lend cryptocurrency out, just like traditional banks do with fiat currency. also earns interest being a lender. While lending and borrowing are the most popular DeFi application use cases, there are more complex options available, including becoming a liquidity provider for a decentralized exchange. The interest rates offered by DeFi are generally lower than those of traditional banks and the entry barrier is lower than that for traditional systems. The only requirement for a DeFi loan is to be able to provide collateral using other crypto assets. Depending on the DeFi protocol, users may offer their nonfungible tokens (NFTs) as collateral. These factors are also why DeFi is more risky than traditional banks.

What are the 3 Main Risks for DeFi?

1. Technology risks

DeFi applications cannot function without smart contracts. These are collections of code that execute a set number of instructions on the Blockchain. If a DeFi protocol is not running properly, it could be due to a problem with the code of a developer. Demirors stated that software is only as good and reliable as the coding done. Sometimes, however, there are undiscovered errors in the code that governs the protocols.

2. Asset risk

You can offer other crypto assets as collateral when borrowing from DeFi. DeFi protocol Maker, for example, requires that borrowers secure their loan 150% below the loan amount. Because cryptocurrencies are volatile, they can fluctuate in value. In the event of a downturn, crypto assets that are used as collateral could see their value drop sharply and some might even lose their positions. Some people use stablecoins to protect themselves. They are supposed to be tied to fiat and less volatile.

3. Product risk

Demirors stated that "typically, less mature pools and newer protocols will have greater yields because it's untested." There is a lot of risk in how the yield you earn is generated. You should also note that DeFi is not regulated or insured like traditional banks. DeFi loans can be secured with crypto assets. However, DeFi borrowers cannot be held responsible if they fail to pay the loan back. Experts warn that you should only invest what you can afford to loose and suggest doing thorough research before making a purchase.