Mortgage Loans - Wings Financial

The Greatest Guide To Current Mortgage Rates Today - Rocket Mortgage

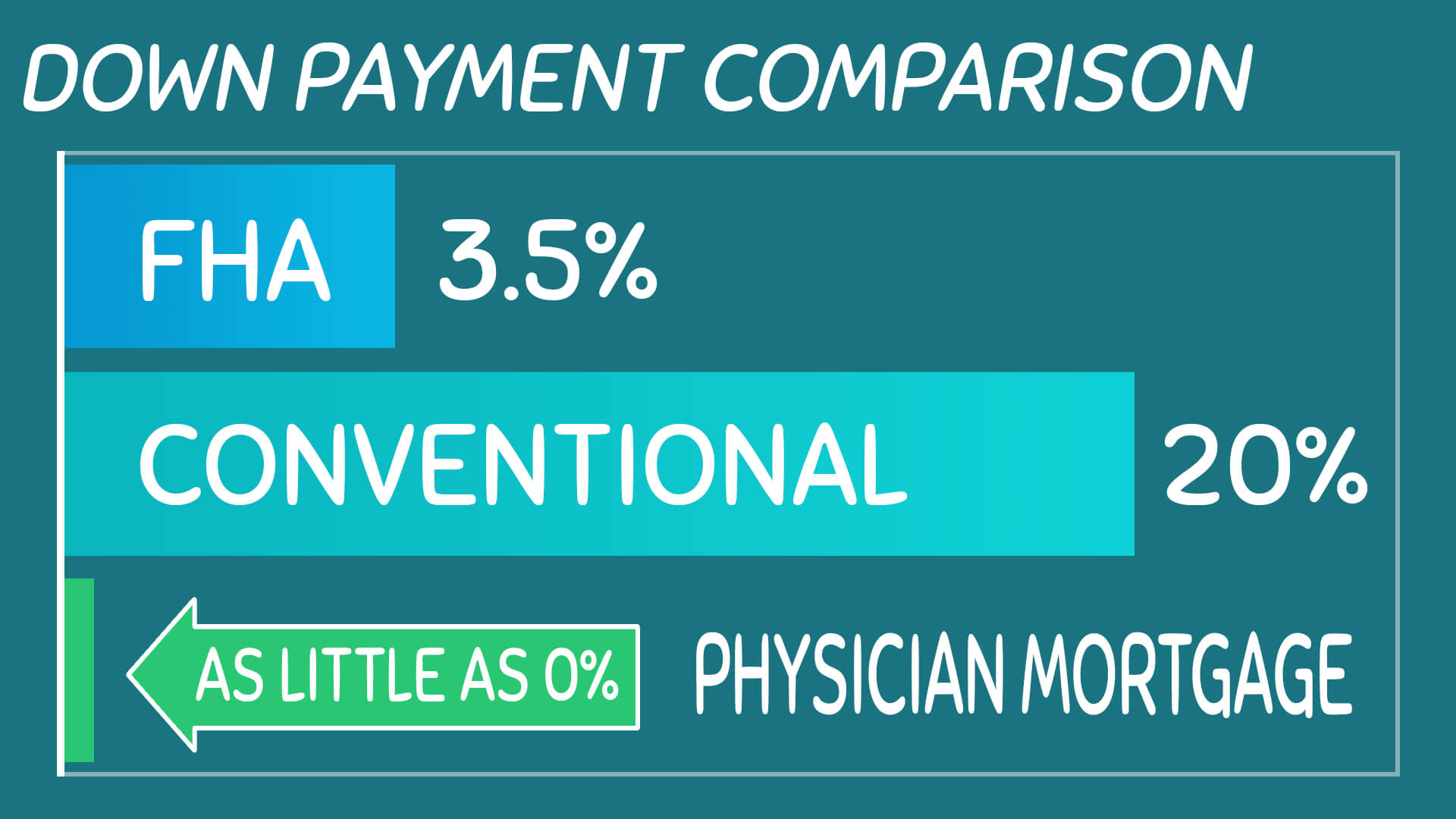

You need not be a novice buyer. The program provides $7,500 toward a down payment or closing expenses, and the quantity is forgivable after five years, supplied you remain in the house. To certify, the house price limitation is $510,400. Your income must not surpass $98,500. The minimum credit history needed is 660 for an FHA loan, 640 for a VA or USDA loan.

Current Mortgage Rates: Average US Daily Interest Rate Trends for FHA Home Loans, Prime & Other Mortgages

Current Mortgage Rates: Average US Daily Interest Rate Trends for FHA Home Loans, Prime & Other MortgagesAct fast if you're considering this program House Is Possible for Educators ends Sept. 30, 2020. Solution Can Be Seen Here refinancing, The Nevada Real Estate Department does not presently use any home mortgage refinancing programs. Nevertheless, Nevada locals who are dealing with home loan distress due to the coronavirus pandemic may receive help through the Nevada Affordable Real Estate Help Corporation (NAHAC).

Department of the Treasury. The maximum assistance is $9,000 over 3 months. The funds can be utilized to pay your home mortgage principal, interest, taxes, insurance or house owners association fees. To certify, you must be getting joblessness insurance gain from Nevada, and your family earnings can not go beyond $98,500. You can not have liquid assets (consisting of checking account, CDs, stocks and bonds) greater than three months of mortgage payments to receive the assistance.

To use, call (888) 320-6526. Nevada home mortgage resources.

Historical Mortgage Rates in Nevada, Picture Credit: Deng, Median Home Value: Loan Financing Rate: Homeownership Rate: Median Monthly Homeownership Expenses: Nevada is popular for bright Las Vegas lights surrounded by vast desert, however there are lots of other lovely parts of the state to call your own yard. The large majority of Nevada's population call Clark County house.

A monetary advisor in Nevada can help you plan for the homebuying procedure. Financial consultants can likewise aid with investing and financial plans, including tax, retirement and estate planning, to make certain you are getting ready for the future. Nevada Historic Home Mortgage Rates * Year, Nevada Rate, U.S. Rate20007. 997.8620016. 986.9420026. 446.4420035. 745.6720045.

What are the different types of mortgage loans available? - Fox Business

What are the different types of mortgage loans available? - Fox BusinessFascination About Compare Today's Nevada Mortgage Rates - Interest.com

825.8520066. 566.5420076. 516.4220086. 096.0620095. 195.0520104. 934.8120114. 754.5620123. 903.6520133. 973.8420144. 324.1320154. 003.8820163. 833.7320174. 154.0320184. 704.56 Nevada's average house values are typically greater than the average home value for the U.S., according to U.S. Census Bureau data. That implies you can anticipate to have higher monthly mortgage payments if you move here from a location with cheaper houses.