Mortgage Brokers Described: A Comprehensive Guide to Smarter Home Loans

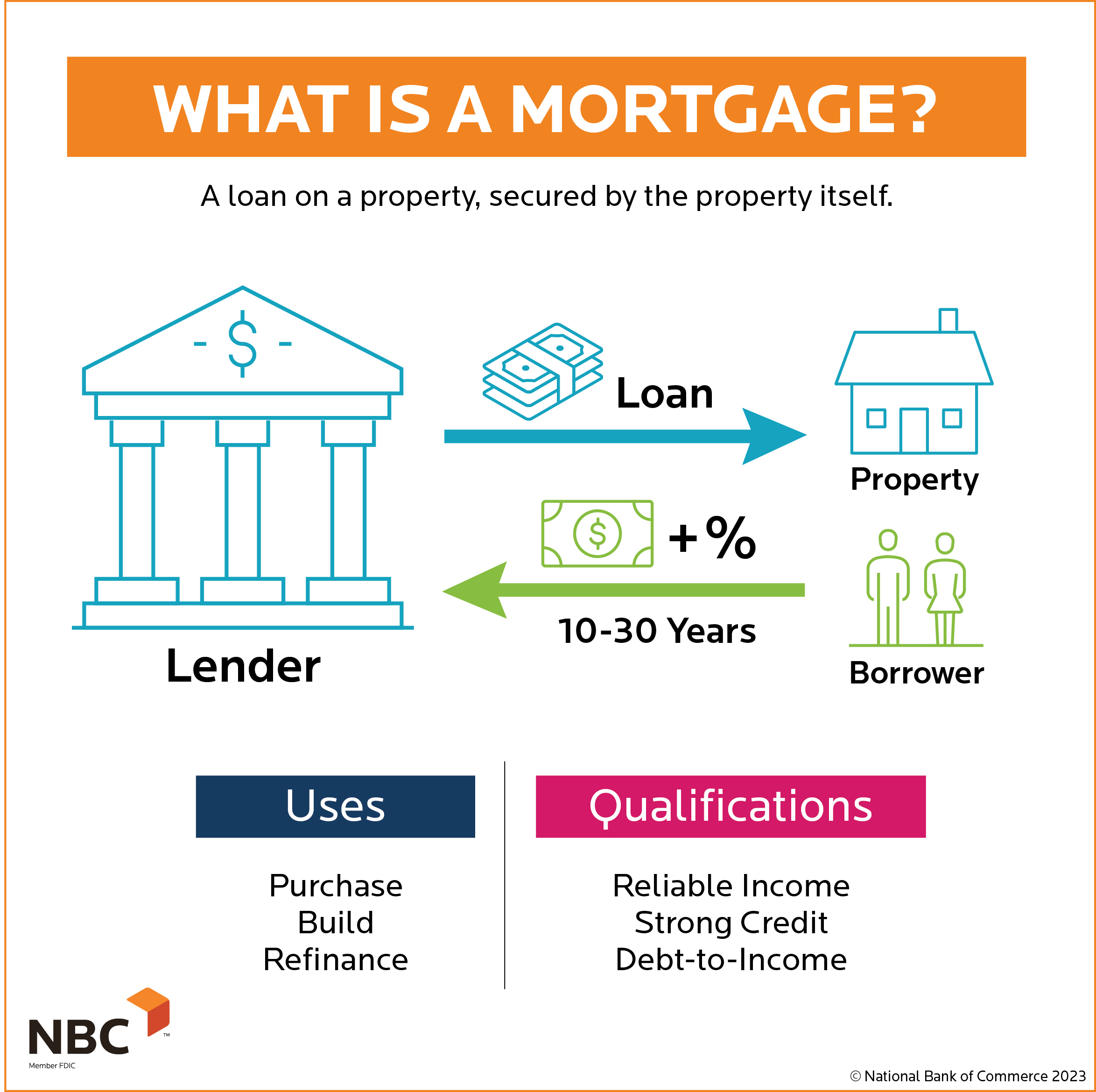

Navigating this realm of home mortgages can seem intimidating, especially for new buyers. With so many options available, grasping the mortgage process is vital to ensuring informed decisions. This is wherein a mortgage broker comes into play. Acting as a intermediary between borrowers and lenders, mortgage brokers can streamline the loan process and enable you get the best possible rates.

In this guide, we will examine the different aspects of engaging a mortgage broker, the benefits they offer, and why they can be an invaluable part of your home buying journey. Whether you are beginning to think about purchasing your initial home or considering refinancing an existing mortgage, knowing how to utilize the knowledge of a mortgage broker can save you both time and cash. Join us as we investigate key topics such as mortgage broker fees, common myths, and important questions to ask during choosing the right mortgage broker for your needs.

Advantages of Using a Home Loan Broker

Using a mortgage broker delivers substantial benefits for homebuyers maneuvering through the intricate landscape of home loans. One of the primary benefits is the ability to access a more extensive range of loan products. Unlike conventional lenders, who may have a narrow selection of mortgage options, brokers have affiliations with numerous lenders. This means they can connect you with a loan that best fits your financial needs and homeownership goals, helping to ensure you get the most competitive rates and terms available.

Another essential benefit is the expertise and guidance brokers offer throughout the mortgage process. They have thorough knowledge of the various available products, requirements, and potential pitfalls. This expertise empowers them to give you personalized advice, assisting you grasp the details of different mortgage options, and making the process easier and less overwhelming. Their know-how allows them to predict challenges, recommend solutions, and assist with paperwork, ultimately conserving you both time and stress.

Finally, mortgage brokers can commonly negotiate improved rates on your behalf. Their strong relationships with lenders give them leverage when discussing terms and conditions. This can lead to likely savings on interest rates and lower fees over the life of your mortgage. By using a mortgage broker, not only can you lower expenses, but you also gain reassurance knowing that a professional is representing your best interests in securing your home financing.

Crucial Factors During Picking a Mortgage Broker

When selecting a mortgage broker, it is important to take into account their experience and reputation in the market. Look for https://md.entropia.de/j5_4MXPmSnaWT7nDgeK8LA/ who have been working for multiple years and have a strong track record in obtaining favorable terms for their customers. Checking digital reviews, testimonials, and asking for referrals can offer understanding into a broker’s reliability and expertise. A broker with a good reputation is more likely to be aware about the various loan products available and skilled in bargaining the best rates.

One more significant factor to consider is the range of lenders that the broker works with. A broker who has relationships to a wide set of lenders can offer you with a greater array of mortgage options tailored to your particular financial situation. This versatility may lead to better rates and terms, as contrasted with working with a broker who only works with a limited selection of banks. Make sure to inquire about their lender network and how they determine which lenders to work with.

Additionally, it is important to understand how the broker is remunerated. Some brokers levy fees straight to clients, while others may receive commissions from lenders. Being transparent about these costs is crucial for building trust. Make sure to ask about any fees initially, as well as how these costs measure with the services rendered. Knowing the economic aspects of your relationship with the broker will guide you make an informed decision and confirm that you receive value for the service you are investing in.

Steering the Mortgage Process with a Mortgage Advisor

Working with a finance advisor can greatly streamline the mortgage process. A broker functions as an intermediary between you and prospective lenders, managing the intricate landscape of loan choices available. By evaluating your financial status and homeownership goals, a broker can advise on appropriate loan products that meet your needs. This customized service takes the stress out of evaluating different lenders and conditions, allowing you to dedicate on your home search.

The efficiency of a mortgage broker extends beyond just finding the right loan. They manage much of the paperwork required for securing a mortgage. This comprises preparing your loan application, gathering necessary documentation, and liaising with lenders throughout the process. As a consequence, you can conserve valuable time and minimize the chance of mistakes that could delay your mortgage approval.

Ultimately, a knowledgeable mortgage broker can provide insights and guidance customized to your situation. They help you comprehend the nuances of mortgage interest rates, conditions, and requirements, ensuring you make well-considered decisions. By utilizing their expertise and network, brokers can often negotiate better rates and terms than a client might find on their own. This guidance is particularly beneficial for first-time buyers who may be uncertain with the processes involved in acquiring a mortgage.