More About Investment Calculator - Indorama Ventures

Investment Calculator Template For Numbers - Free iWork Templates

Investment Calculator Template For Numbers - Free iWork TemplatesThe Facts About Investment Calculator - American Funds - American Funds Uncovered

Casual savers might select a lower total up to contribute. The quantity you regularly contribute to your investments is called your contribution. You can likewise choose how often you want to contribute. This is where things get fascinating. Some individuals have their investments instantly subtracted from their income. Depending upon Try This , that could indicate month-to-month or biweekly contributions (if you get paid every other week).

Image credit: i, Stock/kutaytanir, When you've picked your starting balance, contribution amount and contribution frequency, your putting your money in the hands of the market. So how do you understand what rate of return you'll earn? Well, the Smart, Property investment calculator default is 4%. This may appear low to you if you've read that the stock market averages much greater returns throughout years.

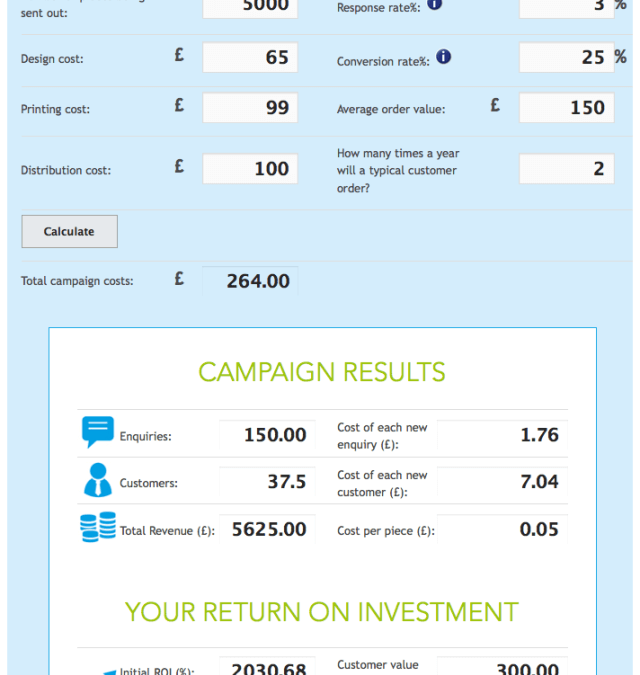

Return on Investment Calculator - Plan Projections

Return on Investment Calculator - Plan ProjectionsThe Ultimate Guide To Investment Calculator - Medtronic

When we figure rates of return for our calculators, we're presuming you'll have a possession allowance that includes some stocks, some bonds and some money. Those financial investments have differing rates of return, and experience ups and downs with time. It's always much better to utilize a conservative estimated rate of return so you don't under-save.

That, my buddy, would cause undersaving. Undersaving typically leads to a future that's economically insecure. The last element to consider is your investment timespan. Consider the variety of years you anticipate will elapse prior to you take advantage of your financial investments. The longer you have to invest, the more time you have to take advantage of the power of compound interest.

The Main Principles Of Future Value Calculator - Fisher InvestmentsYou may consider investing as something just old, rich individuals do, however it's not. Keep in mind that most mutual funds have a minimum initial financial investment of just $1,000? It's a good concept not to wait to begin putting your cash to work for you. And keep in mind that your financial investment performance will be better when you select low-fee investments.

Sure, investing has dangers, but not investing is riskier for anyone who wishes to accumulate retirement cost savings and beat inflation.

The Basic Principles Of Investment Calculator - Investment UAre you on track to reach your investment goal? Discover out utilizing Bankrate's financial investment calculator listed below.

Annuity Investment Calculator Spreadsheet

Annuity Investment Calculator SpreadsheetConstant investments over a variety of years can be an efficient method to accumulate wealth. Even small additions to your cost savings accumulate with time. This calculator shows how to put this cost savings method to work for you.