Meta Materials & Torchlight, An Interpretation of a Short Squeeze Through a Unique RTO

Jamie VincentDisclaimer

Nothing in this article is advice and I am not a financial advisor, any views and/or ideas expressed in this article are my opinions. Furthermore I am invested into MMAT and therefore there is the potential for bias.

Let's start with what makes a short squeeze so special.

there has been a lot of hype around short squeezes lately, there are even squeeze chasers like in Twister...dangerously bouncing from holding to holding looking for the next thrill. But what's the basic working of a short squeeze? is it as simple as people just buying and holding? Well, no...Let’s just say that you're a hedge fund and are of the opinion that no one knows what META is/does and bet that the price will fall (betting against the current price of the holding when one opens the short position). One way to express your opinion is to "sell short" META, which means that you sell the security without actually owning any. To facilitate this short sale, you would have to borrow the shares to "sell short" from someone else. If you bet right and prices fall, then you can buy them back at a lower price, or you can return the securities that you borrowed and pocket the difference as profit. It may sound tricky, I know, but essentially the process is selling high and buying low, instead of buying low and selling high. If you’re wrong and prices actually rise, you’re going to lose money because you will have to buy the Securities back at a higher price than you sold them for earlier.

Note:

If you bet correctly you can only make 100% of the current stock value as a maximum; or shorting it into the ground, the ground being $0.00. On the other hand, if you wager incorrectly and the stock goes up your losses can be infinite as the stock can continue to go up.

My dad used to say, Neither a borrower nor a lender be, and he was right because the process is further compounded with complications if you’ve borrowed money to bet against the security. If the bet isn’t going your way, well then the person that lent you the money sees the value of their collateral depreciating and have the ability to force you to exit the trade, even if you don’t want to...sounds scary right, stock market shylock coming to bust up your holdings if you can't make good. So let's say, using your own eligible securities as collateral, borrow an eff load of cash and used that to "sell short" a security you don't own. However the bet goes sour and the price starts to skyrocket because you are short the securities, meaning you never owned them, you have to buy them back. Unfortunately for you, the guy that loaned you the money against your eligible securities as collateral is forcing you to exit the trade at any price because he is afraid your eligible securities you used as collateral are not worth enough anymore. If you’re a whale and the market knows what's up everyone will raise prices because they know that you are forced to buy the securities back at any price.

That’s the gist of a short squeeze and these mechanics are important because you don't want to be the guy rushing to buy shares if you don't have to be...in a short squeeze scenario the shorts sellers covering create the buying pressure. Retail buyers could continue to buy to inflate the price and cause lenders to force you out of your position, but this method comes at a great cost for retail investors.

The Prelude To a Short Squeeze

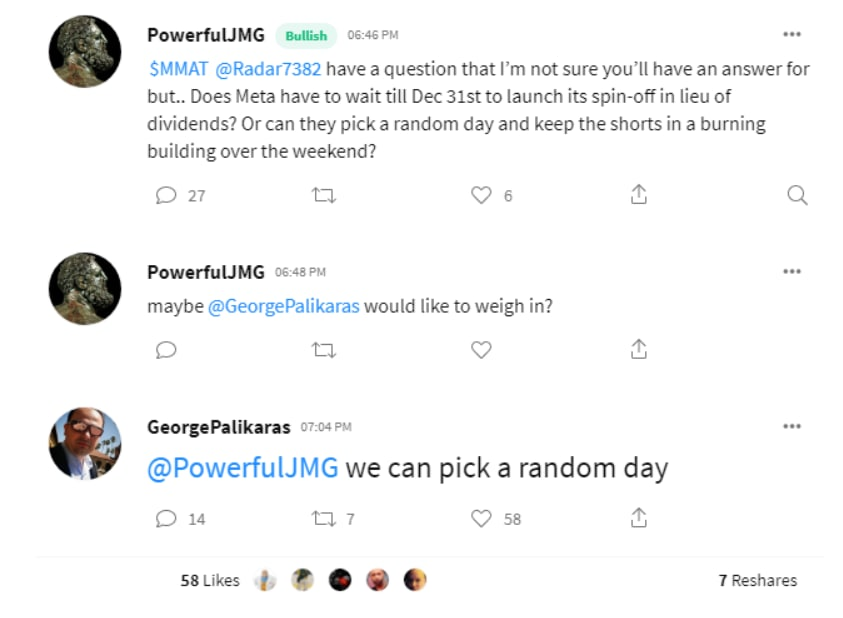

Not only have most people never even heard of the Overstock Short Squeeze but many also didn't know it squeezed twice, the first time it squeezed it was on the run up to the record date and then again upon the announcement of the dividend distribution which then continued for approximately three months. The first squeeze was in September of 2019 leading up to the record date, I believe this to be a prelude to a squeeze, like in OSTK, there was a pre squeeze a few months before the actual squeeze... I'm using OSTK as a datum because TRCH has a semi locked up dividend, a Cusip change and had a prelude to a squeeze just like OSTK. A few months ago I had noticed this similarity, and, now many are also taking notice too...Please take note of the dates on the OSTK chart before the squeeze (Figure 1), the price drop was maintained until the distribution was approved then announced and the squeeze started. Once the distribution was issued the squeeze had already begun and would be unlikely to stop until trapped short positions had been covered. Important note: Whereas OSTK's dividend was locked-up for 6 months (the date was delayed), MMAT's can be any random day.

The Events That Lead To That First OSTK Short Squeeze

In July 2019, the CEO of Overstock learned that some personal news was about to be leaked. He thought he wouldn't be the CEO for much longer so after he realized that he would soon be gone he abruptly announced that Overstock would issue a Locked-up Dividend to draw users onto the tZERO platform. The Dividend however, was a newly employed tactic to artificially inflate Overstock’s share price by engineering a technical short squeeze. Instead of a traditional cash payout or issuance of common stock, OSTK investors were forced to access the dividend via a blockchain-based digital “security token” issued by Overstock, which it called the “Digital Voting Series A-1 Preferred Stock.” The record date for the Locked-up Dividend would be September 23, 2019. Shareholders on that date would receive, for each 10 shares of Overstock common stock, Series A-1, or Voting Series B Preferred Stock.

Overstock didn't register it as a security with the SEC and Short sellers would not receive the dividend themselves because that short seller must pay any dividend paid on the stock to the lender (usually via a broker). Furthermore, because that the dividend was locked-up, there was no way for short sellers to purchase it on any available market. The dividend itself was unprecedented and therefore lending agents (the guys that lend shares to shorts) recalled their shares. As a result, a short seller’s only choice to avoid breaching their contractual obligations to their lending broker was to close or cover their Overstock positions before the Locked-up Dividend's record date (all covering had to be completed by September 18, two trading days prior to the Locked-up Dividend’s record date of September 23). Therefore the dividend artificially altered Overstock's price by forcing a huge group of investors to purchase Overstock shares to cover their positions in a very short time, those whom closed may not have otherwise done so, and therefore that collective rush to cover artificially spiked the stock price.

Very similar to TRCH's squeeze in June of 2021

Meta Material's Locked-up Dividend Through The Sale Torchlight Energy Resources' O&G Assets

The comparison of MMAT & OSTK is all about a "locked up dividend", which MMAT has, however ours is locked up in a little bit of a different way. META's dividend distribution is locked up into the sale of TRCH's (very valuable) O&G assets. Personally, I believe those assets are already sold, but that's another story altogether. When the sale of TRCH's O&G assets are announced and the distribution set, I believe that MMAT will react in a very similar way to OSTK, but why?

On Dec. 14, 2020, it became official. Torchlight Energy Resources, Inc. and Metamaterial Inc. announced the signing of a definitive agreement negotiated at arm’s length for a business combination of Torchlight and Metamaterial by way of a statutory plan of arrangement. It was announced that Torchlight shareholders on the record date will be entitled to receive a preferred stock dividend, payable immediately prior to the closing of the Transaction, that entitles them to their pro-rata share of any proceeds resulting from any sale of Torchlight’s oil and gas assets that occurs on the earlier of December 31, 2021 or six months from the closing of the Transaction. as the closing of the transaction was June 28th, the earlier of Dec 31st and six months IS six months from the closing, therefore the sale expiration date is Dec 28th.

TRCH had agreed to delist and through an RTO with META, the new entity would be listed under a new Ticker and new Cusip. This is very important because TRCH no longer exists, any contracts that hadn't been closed cannot be close and therefore must be deferred to the closest thing, MMAT...I'll get more into that later.

Why can't these contracts be closed and how are the shorts trapped?

- TRCH doesn't exist anymore (CUSIP changed through the RTO), so there is no security to purchase to deliver to their lending broker so their contractual obligations cannot be met.

- like in OSTK, the dividend is tied to the lending broker's contracts, therefore there is an unknown variable which is the value of the dividend to be distributed. The lending broker would certainly want to claim the full value of the contract before allowing it to be closed.

So, how can short sellers deliver on contracts if TRCH doesn't exist anymore?

MMAT is TRCH's next of kin, it says right here (Figure 2) on the company profile: Meta Materials Inc is formerly Torchlight Energy Resources, Inc. So, in lieu of TRCH shares to purchase what is the ONLY available fungible securities lender broker's could accept to close short sellers contractual obligations? That would be MMAT.

Of course we have to talk short interest and I need to prove out that on the Record date there was heavy shorting for any of this to make sense. The Record date observed a T+2 rule, so you had to hold the security for 2 days to qualify for the record date (June 22 was the last day to buy and you had to hold through the 24th, see figure 3). Therefore if we find any one day with a high short interest we can safely assume there are trapped shorts and therefore no amount of MMTLP trading could ever change that or un trap short sellers, the idea of being trapped is there is no escape.

It's noteworthy, TRCH was a very heavily shorted stock, and on the run up to the record date short sellers were rushing to cover their position before being locked up. So, on the record date of TRCH, a naked short seller whom had an open position in TRCH and didn't cover was caught and that the dividend they were bound to was structurally incompatible with short selling and would cause a technical short squeeze. meaning, any naked shorts would have to return to the broker the dividend (that has yet to be distributed) and that short seller must pay any dividend paid on the preferred stock to the lender (usually through a broker). Normally that's is not a problem because traditional dividends are issued as cash or as a tradeable security like a common stock, which is fungible, so short sellers can easily just pay cash or the freely tradeable security to the brokerage firm from whom they borrowed the shares from originally. However, unlike a typical dividend that's either in cash or freely tradeable stock, the TRCH O&G assets sale has yet to be determined. As of now, the only thing we know is naked shorts were trapped in on the Record date and will be forced to close out their contracts upon distribution.

The O&G Assets Have The Potential To Include a Nonfungible Element within Dividend Distribution.

Now an all cash distribution will have a stinging effect on short sellers whom would be having to close out their position because they will have to cover the value of the preferred shares and close out their TRCH position and there is no more TRCH, leaving MMAT as the only available security to purchase to close contractual obligations to lender brokers, I'm sure they would happily take MMAT too after all even the TRCH executives thought MMAT>TRCH... So, this establishes how an all cash distribution would also benefit META's share price because there is a very limited float and Wall Street will smell the blood in the water just like I do and maybe some would decide that positions could be exited at inflated prices instead of reasonable ones.

However, what if the distribution of the dividend also has a nonfungible element attached? Now here when I say fungibility I am referring to the interchangeability of an security. Anything fungible is replaceable with something equal in value, like how 1 Canadian Dollars is fungible and can be exchanged for equal value in other currencies. So I mean nonfungible as in something that cannot be exchanged, like shares in Oilco Holdings, a Private company the CEO of META opened privately, and not like a baseball card or an NFT.

If the dividend was cash, upon distribution the clearing houses could easily cover and cash could be moved around to account for the buying pressure that MMAT would receive. However, if just 1 share of Oilco was distributed along with cash, then the clearing house would incur and operational impossibility to deliver and would have no way to effectively deliver on their contracts and the nonfungible shares in a private company would need to have a cash equitant to be determined to the contracts could be close....and even then the only fungible security they could use that cash to close out on would be MMAT.

Final Thought

The monks say, water only rises to overflow; if the waters are to be bloodied the sharks that come should be wary in the north; the orcas patrol these waters.

Thanks for reading!

Twitter @jamesavinvent1 (chunkylover87)

Telegram @chunkylover87

Youtube chunkylover87