Messari Fund Analysis H1'22

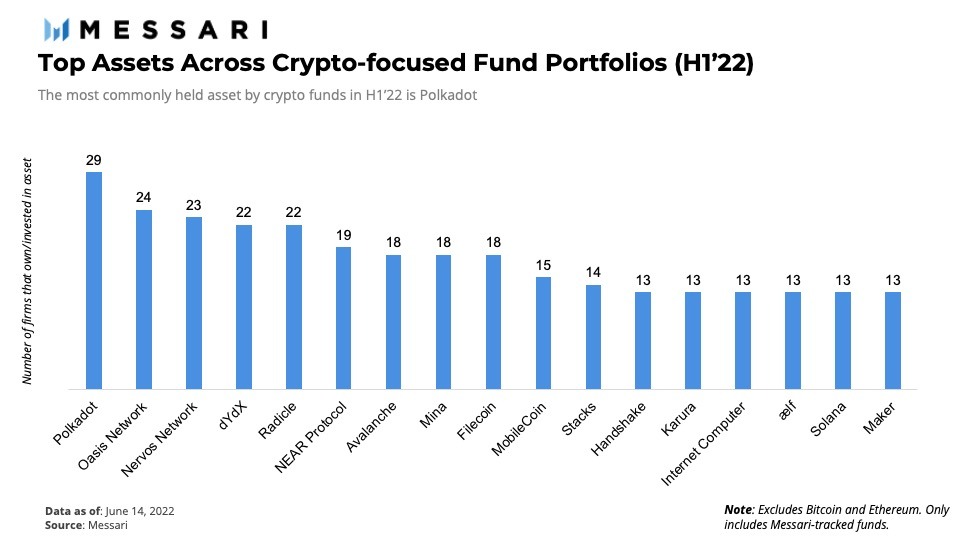

Tamilbtc@Polkadot is once again the most commonly held asset of the 82 funds we've tracked. In second is @OasisProtocol followed by @NervosNetwork. Tied for fourth are @dYdX and @radicle. @NEARProtocol takes fifth place.

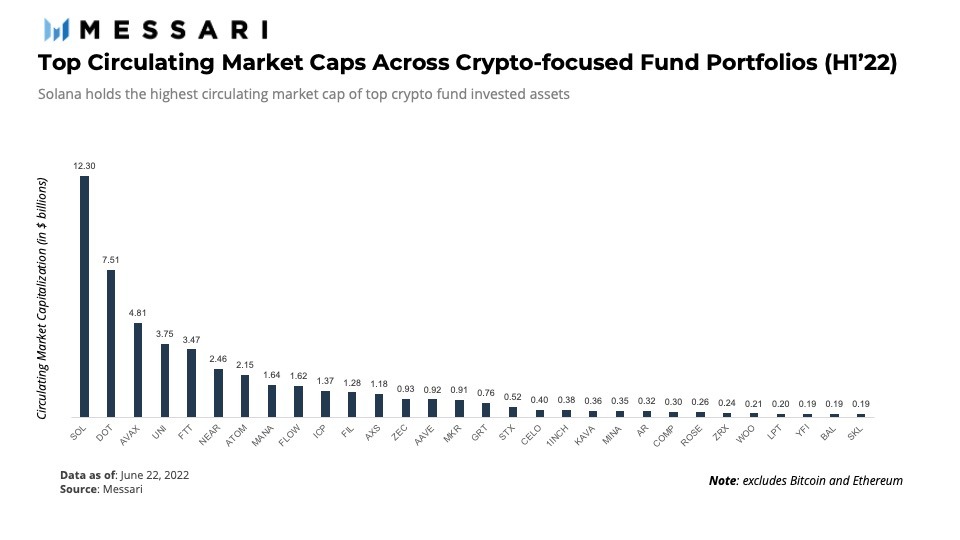

Of the top 30 invested assets, @solana has the highest circulating market cap. Solana was second in market cap in the last analysis, behind only Terra (🪦). $DOT surpassed $AVAX while $UNI and $FTT moved past $NEAR and $ATOM.

The smart contract frenzy remains active as smart contract platforms are once again the most heavily invested market sector. Evidently, the top three invested assets this quarter are all smart contract platforms.Outside of the top 50, there has been a heavy emergence of investments in gaming, metaverse, and NFT infra. Investments like these expand the opportunities for funds to hold non-traditional crypto assets such as native NFTs or digital land.Messari Pro comes with access to our full list of community screeners, including our VC portfolio screeners. To view full investment portfolios, search for the fund’s organization page on Messari.

https://t.co/x71YBUvgPy