Mastering Your Finances: Top Credit Consolidation Tips Revealed!

In today's fast-paced world, managing your finances effectively is crucial to achieving financial stability and freedom. One powerful tool that can help you take control of your debt is credit consolidation. By consolidating your debt, you can simplify your financial obligations and potentially save on interest payments. If you find yourself struggling to keep up with multiple credit card payments or loans, credit consolidation may be the solution you need to streamline your finances and work towards a debt-free future.

Benefits of Credit Consolidation

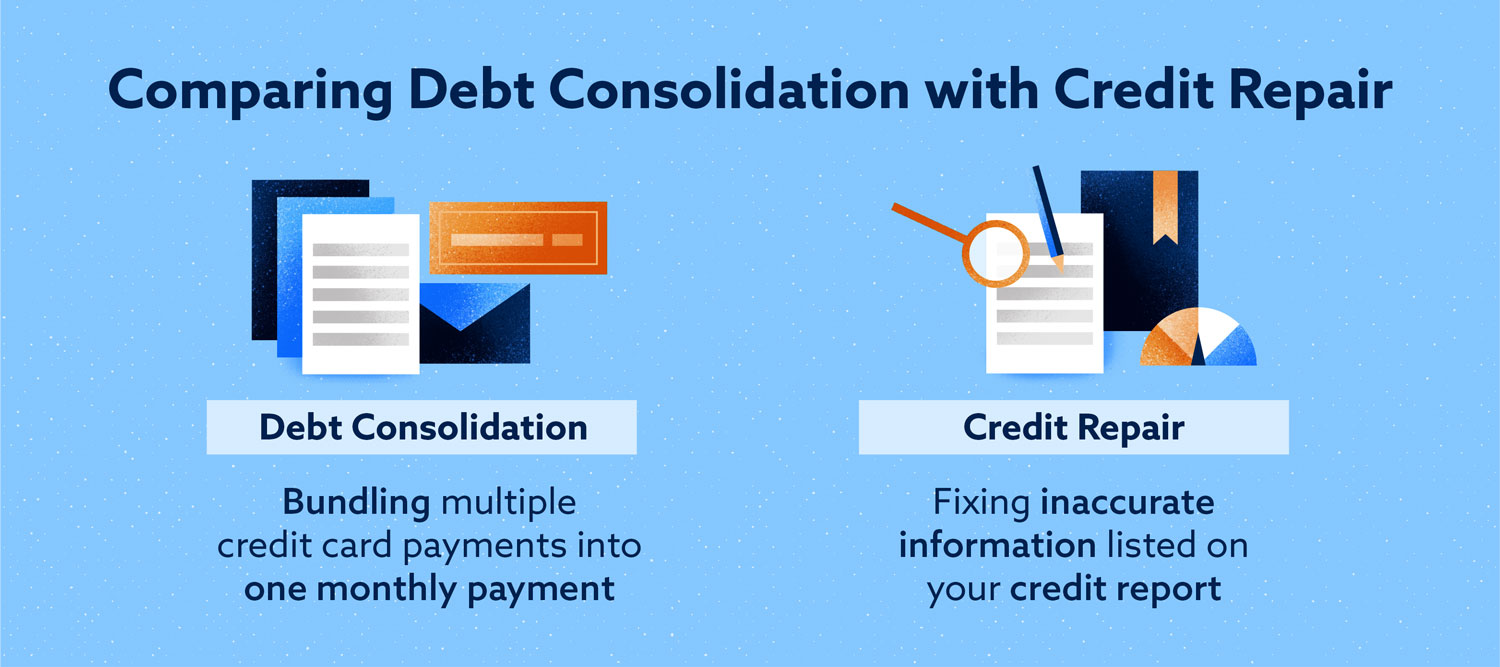

One of the key benefits of credit consolidation is the simplification of your finances. By combining multiple debts into one, you can streamline your monthly payments and eliminate the hassle of managing various accounts and due dates.

Another advantage of credit consolidation is the potential for lower interest rates. When you consolidate your debts, you may be able to secure a lower overall interest rate, which can help you save money in the long run and pay off your debts more efficiently.

Additionally, credit consolidation can have a positive impact on your credit score. By reducing your overall debt and making consistent payments, you demonstrate responsible financial behavior to creditors, which can improve your creditworthiness over time.

Steps to Successfully Consolidate Credit

First, gather all your credit statements in one place. pretx.fr will give you a clear picture of the total amount you owe and help you determine the best consolidation method. Next, research different consolidation options such as balance transfer credit cards, debt consolidation loans, or working with a credit counseling agency.

Once you have chosen a consolidation method that suits your needs, apply for it and transfer all your balances to the new account or loan. Make sure to close the old accounts to avoid the temptation of running up more debt. Finally, create a payment plan that you can stick to. Make timely payments and avoid using credit cards excessively to prevent falling back into debt.

Best Practices for Maintaining Good Credit

First, it's essential to make all your credit card payments on time. Late payments can negatively impact your credit score and make it harder to consolidate your debt in the future.

Next, keep your credit card balances low relative to your credit limit. Aim to use no more than 30% of your available credit to show lenders that you can manage your debt responsibly.

Lastly, regularly monitor your credit report for errors and discrepancies. By staying informed about your credit history, you can quickly address any issues that may arise and maintain a healthy credit profile.