Mastering Stock Backtesting: A Step-by-Step Guide for Effective Analysis

Backtesting stocks is a process used by investors and traders to evaluate the performance of a trading strategy or investment approach based on historical market data. Essentially, it involves simulating how a particular strategy would have performed in the past using historical data. This simulation helps assess the viability and effectiveness of the strategy under various market conditions before committing real capital.

Backtesting is crucial for several reasons:

- Strategy Evaluation: It allows investors to assess the profitability and risk of a trading strategy before implementing it in live markets. By analyzing past performance, investors can determine whether the strategy has the potential to generate positive returns over time.

- Risk Management: Backtesting helps identify potential risks associated with a trading strategy, such as drawdowns (losses from peak to trough) and volatility. Understanding these risks allows investors to make informed decisions about position sizing, stop-loss levels, and other risk management techniques.

- Optimization: Through backtesting, investors can fine-tune their trading strategies by adjusting parameters and variables to maximize returns or minimize risks. This process helps optimize the strategy for current market conditions and improve its overall effectiveness.

- Confidence Building: Backtesting provides investors with confidence in their trading strategies by demonstrating how they would have performed historically. This confidence can help investors stick to their strategies during periods of market volatility or drawdowns, reducing emotional decision-making.

- Learning and Improvement: By analyzing backtest results, investors can gain insights into the strengths and weaknesses of their strategies. This allows for continuous learning and improvement, leading to the development of more robust and profitable trading approaches over time.

In summary, backtesting stocks is essential for investors and traders to evaluate, refine, and improve their trading strategies, ultimately enhancing their chances of success in the financial markets.

How to Backtest your Stock Strategy?

Backtesting is a crucial step in refining and validating your stock trading strategy. By analyzing historical data, you can assess the viability of your approach and make informed decisions. In this guide, we'll walk you through the process of backtesting your strategy using finquota.com, a powerful platform that allows you to run up to 2 backtests every day for free.

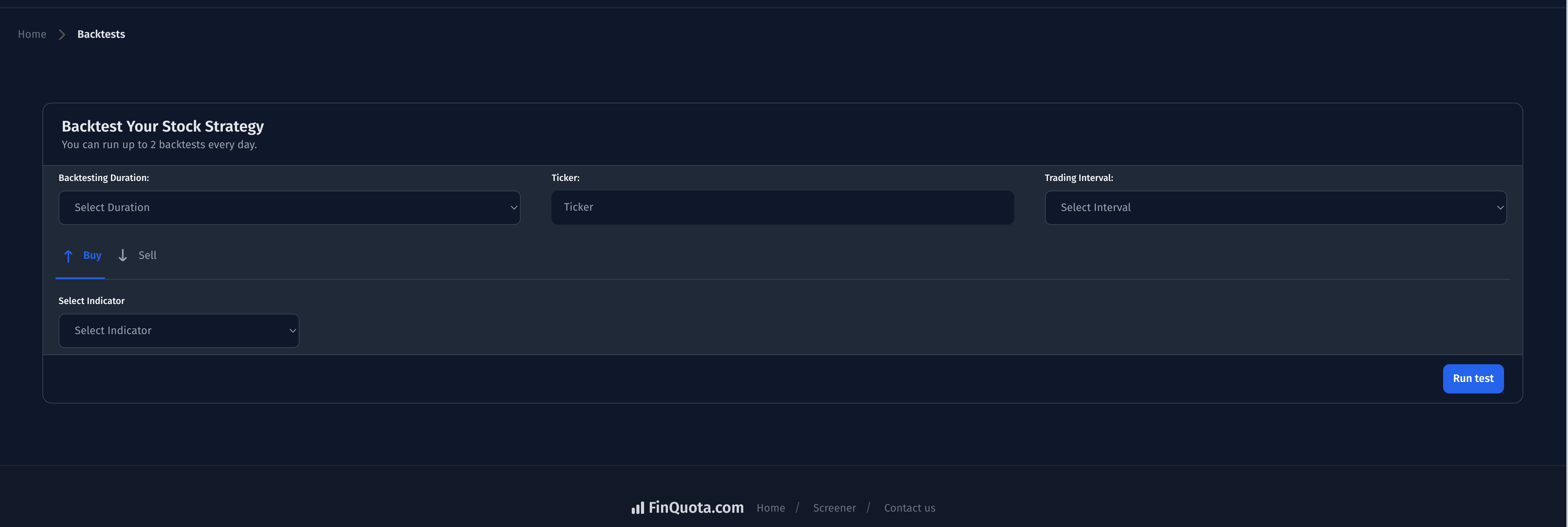

Step 1: Setting Up Your Backtest:

Begin by navigating to https://finquota.com/backtest/ and logging into your account (optional). Once logged in, locate the backtesting tool and select the option to start a new backtest. You'll be prompted to input various parameters for your backtest.

Step 2: Setting the Backtesting Duration:

Choose the duration for your backtest. Consider the timeframe that aligns with your trading strategy. Whether you're a short-term trader or a long-term investor, selecting the appropriate duration is crucial for accurate analysis.

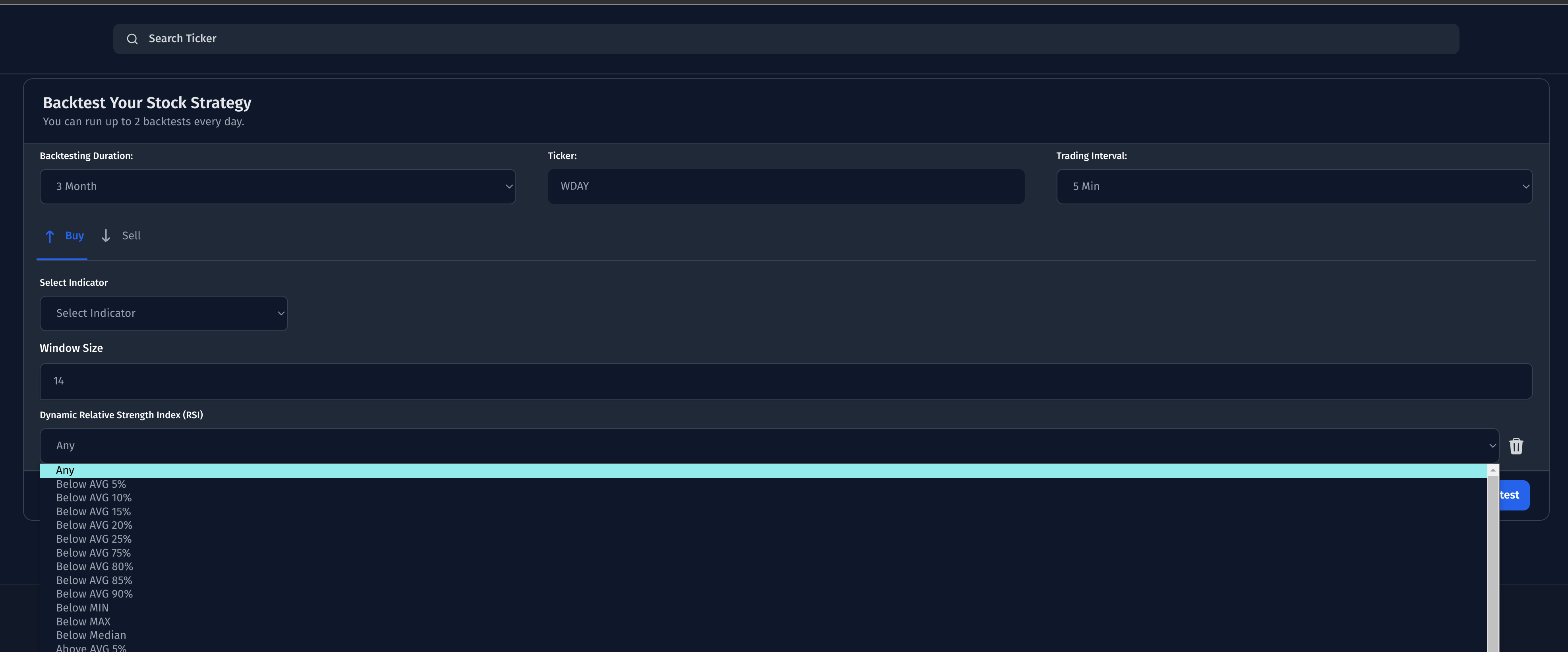

Step 3: Selecting the Ticker and Trading Interval:

Enter the ticker symbol (WDAY as an example) of the stock you want to backtest. This could be a specific company (AAPL, NVDA, NET, MSFT, SNAP) or any other. Next, choose the trading interval that matches your strategy, whether it's 2 min, 5 min, 15 min, 30 min, hourly or daily, or another timeframe.

Step 4: Defining Buy and Sell Signals:

Outline the criteria for when to buy and sell the stock. This could involve technical indicators, fundamental analysis, or a combination of both. Finquota offers a range of indicators to choose from, such as moving averages, relative strength index (RSI), and MACD.

Step 5: Running the Test:

Once you've set up all the parameters, initiate the backtest. Sit back and let FinQuota analyze the historical data based on your strategy. The platform will generate results, including performance metrics like returns and win-loss ratio etc...

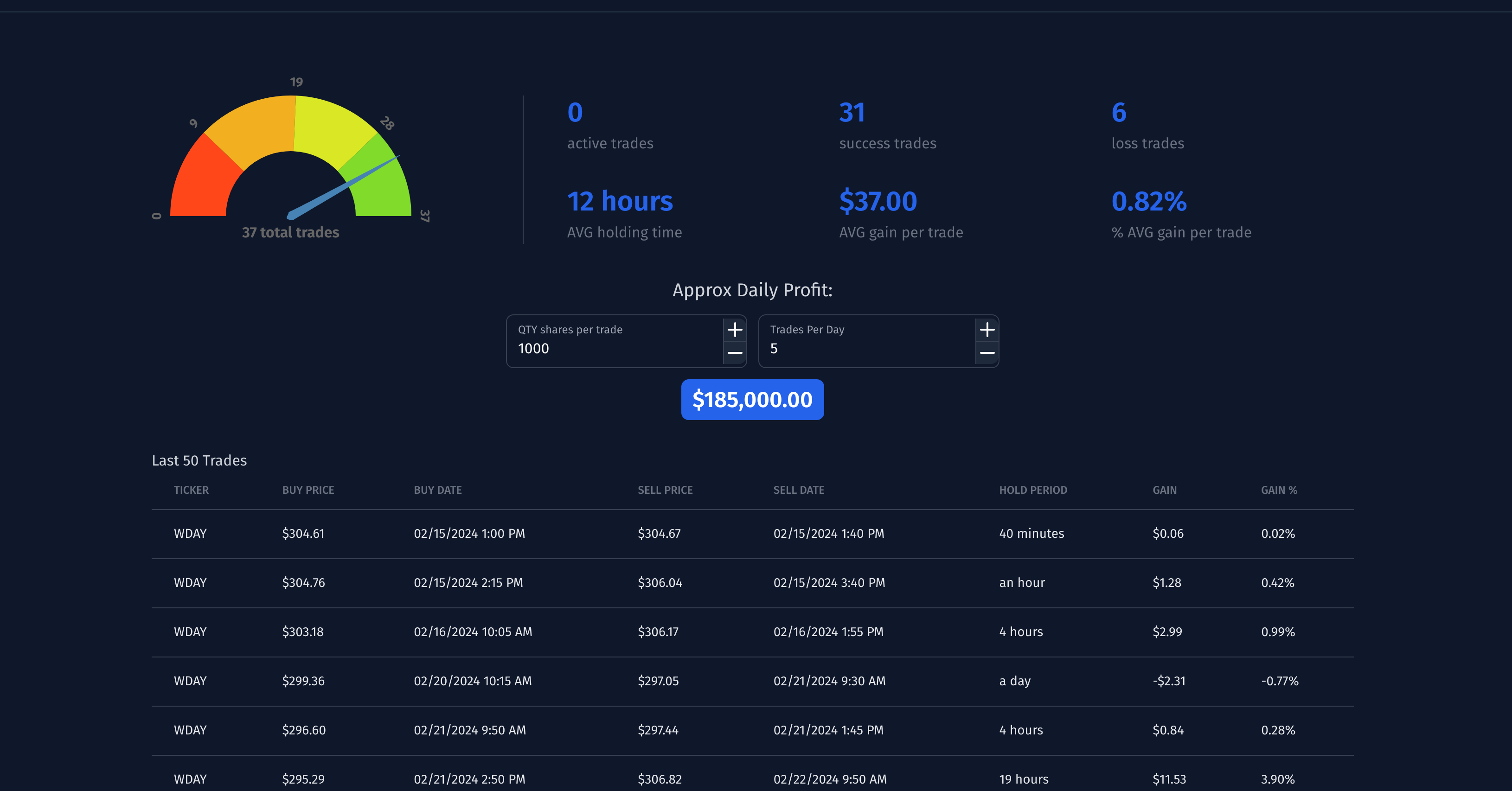

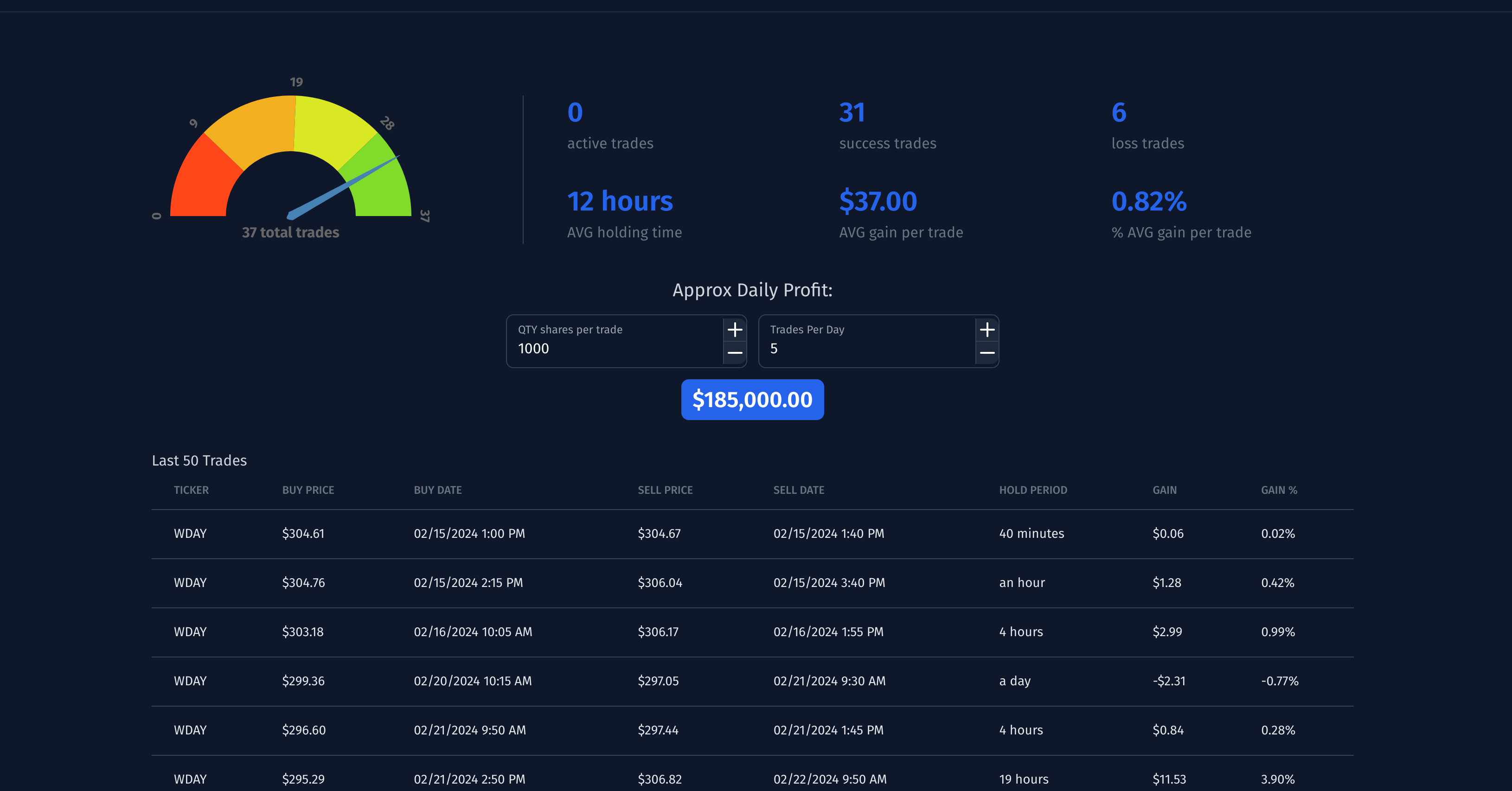

Step 6: Analyzing the Results:

Review the results of your backtest carefully. Pay attention to key performance metrics to assess the effectiveness of your strategy. Identify strengths and weaknesses, and consider potential areas for improvement.

Step 7: Iterating and Refining Your Strategy:

Based on the results of your backtest, refine your trading strategy as needed. This might involve tweaking parameters, adding new indicators, or adjusting your risk management approach. Continuously iterate and test your strategy to optimize performance.

Conclusion:

Backtesting is an essential tool for any stock trader or investor looking to improve their strategy. With FinQuota, you have the power to analyze historical data and refine your approach with confidence. By following the steps outlined in this guide, you can backtest your stock strategy effectively and make more informed trading decisions.