Market outlook for May 16

The market remained under pressure throughout the trading session today due to profit-booking in banking, auto and FMCG stocks. In the end it closed with a decline.

Stock Market: After 2 days of rise, consolidation was seen in the market today. With this the market closed in the red today.

Today maximum buying was in consumer goods and power shares. Limited trading has been seen in the market. There has been buying in midcap and smallcap stocks. Midcap index has risen by more than 450 points today.

A rise of about 1 percent has been seen in the midcap index. Nifty Metal Index hits record high. There has also been buying in oil-gas and realty shares.

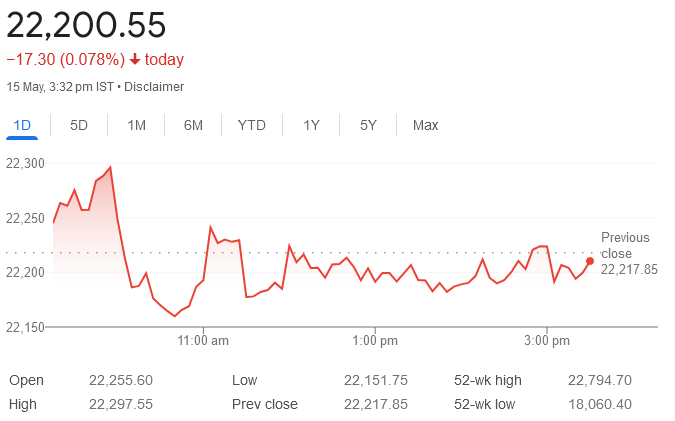

Sensex fell 118 points and closed at 72,987. At the same time, Nifty fell 17 points and closed at 22,201. Bank Nifty fell 172 points and closed at 47,687. Midcap has gained 483 points and closed at 50708.

Today there was selling in 16 out of 30 Sensex stocks. There was selling in 27 out of 50 Nifty stocks. There was selling in 6 out of 12 shares of Bank Nifty. The rupee strengthened by 1 paise against the dollar and closed at Rs 83.50 per dollar.

How can the market move in future?

Sunil Damania, Chief Investment Officer, MojoPMS, says that the uncertainty related to the voting percentage and its impact on the election result is troubling the market. The market is assuming that lower turnout means that BJP may get fewer seats than in the 2019 elections.

Pankaj Carde, President and Head-Institutional Equities, Asit C Mehta Investment Intermediates, said he strongly believes that any correction in the market should be used as a buying opportunity.

Carde further said that the market may decline regardless of the election outcome and may fall to 21,800 levels. If the BJP government does not return to power, there may be further correction in Nifty 50.

Ajit Mishra of Religare Broking says that after three days of rise, the market took a break today and closed flat. There was bullishness in the beginning but the pressure on some big stocks pushed Nifty down.

There is a need to maintain a cautious view on Nifty. Resistance for Nifty is visible in the zone of 22,300-22,400.

At this time, bet only on selected quality stocks. Apart from local factors, it is advisable to keep a close eye on the American markets also.

Prashant Tapse of Mehta Equities says that the market remained under pressure throughout the trading session today due to profit booking in banking, auto and FMCG stocks. In the end it closed with a decline.

However, buying in realty, oil and gas and power stocks limited the decline. Market sentiment has deteriorated due to further delay in rate cut by the US Fed and selling by FIIs.

Due to this, investors are getting nervous and are adopting a cautious approach amid increasing uncertainty.