Market outlook for May 11

Good short covering was seen in the market today on the basis of strong signals from foreign markets, due to which the market managed to close in the green.

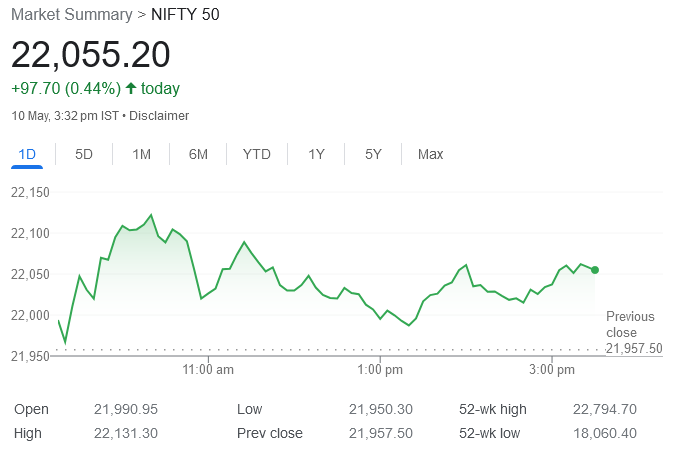

Stock market: Today the trend of decline in the market stopped. Sensex-Nifty managed to close on gains today.

A rise of about 90 points was seen in Nifty. Along with the biggies, small and medium stocks also witnessed a rise. The midcap index has gained about 1 percent. FMCG, metal, oil-gas and power sectors have seen growth.

Auto, pharma and consumer durables stocks have also seen a rise. Buying has been seen in most of the sector indices of BSE. At the same time, there was pressure for profit booking in IT, realty and banking stocks.

Sensex has risen 360 points and closed at 72664. At the same time, Nifty has increased by 98 points and closed at 22055. Bank Nifty fell 67 points and closed at 47,421. Midcap rose 423 points to close at 49,532.

There is buying in 21 out of 30 Sensex stocks. At the same time, buying was seen in 36 out of 50 Nifty stocks. There was buying in 8 out of 12 shares of Bank Nifty.

On weekly basis, Sensex and Nifty have declined by 1.8 percent and 2 percent. BSE Midcap and Smallcap have seen a decline of 3.5 percent and 3.9 percent. Out of 50 Nifty stocks, 13 have given positive returns.

Hero MotoCorp, Britannia Industries and HUL have been the top gainers. Whereas, Shriram Finance, Dr. Reddy's Lab, Titan have been among the top losers of Nifty this week.

How can the market move on May 11?

Vinod Nair of Geojit Financial Services says that the Indian market was broadly positive today. However, given the expensive valuations in the market and low voting percentage, there is election nervousness in the minds of investors. Due to which there has been selling.

Financial stocks witnessed weakness due to signs of decline in net interest margin and regulatory actions by RBI. FIIs are selling in the Indian market due to delay in rate cut, inflation concerns, weakness in corporate results and expensive valuations.

Now the market will keep an eye on US inflation data and the possibility of US tariff action on Chinese electric vehicle companies.

Vipul Bhowar of Waterfield Advisors says that the market expects the Narendra Modi-led NDA to get an easy majority in the current Lok Sabha elections.

Analysts are hopeful that if the NDA wins majority, there will be policy stability, continuity and new reforms in the country. But there is also concern that if the current government does not get sufficient majority, there may be panic in the market in the short term.

The market is currently in a state of uncertainty, mainly due to low turnout in the third phase of elections. The market is keeping an eye on political developments especially the election results and its possible impact on various sectors and the market.

Investors and traders are advised to exercise caution given concerns over expensive valuations and market volatility.

Prashant Tapse of Mehta Equities says that on the basis of strong signals from foreign markets, good short covering was seen in the market today, due to which the market managed to close in the green.

However, given the sharp intraday fluctuations, the overall trend of the market is still to remain cautious. Investors will continue to keep an eye on their equity exposure during the next few weeks as any negative news coming from the election front could lead to massive selling in the times to come.