MXC AMA Recapitulation- Leveraged ETF

Yity@MXC

Guest: Simon, global operation manager

Host: Molly

Introduction:

I'm one of the team members of MXC. I worked for MXC for 2 years, responsible for operation businesses. In this bull season, great to share something I know about Leveraged ETFs for you guys.

Questions from community:

Molly: Q1.What is leveraged ETF?

Simon:

Leveraged ETF is a very popular financial product in traditional finance market. In crypto cycle, leveraged ETF is a product that tracks the daily movement of the underlying assets (e.g. BTC) with given leverage times (3 times for instance).

Leveraged ETF enables users to buy long or sell short for an asset with certain times. Take BTC3L and BTC3S leveraged ETFs as an example. BTC3L means 3x leverage long for BTC, while BTC3S means 3x leverage short. Suppose BTC rises by 1% on Nov.24, correspondingly BTC3L will rise by 3% and BTC3S will drop by 3%, vice versa.

In simple, leveraged ETF is a product that allows users exposure to higher leverages for both longs and shorts, so that users can utilize smaller fund to earn greater yield if the market direction is right.

Molly: Q2. What are the advantages of leveraged ETFs?

Simon:

There are 5 distinctive advantages of leveraged ETF on MXC.

First of all, leveraged ETFs are very easy to trade. Users can just login MXC website (www.mxc.com) and enter “ETF zone” to buy/sell the leveraged ETFs you are interested with like spot trading. There’s no such complex steps as opening margin account, transferring asset, making loan, repayment, etc. in margin trading.

Second, by adopting re-balance mechanism, there’s no liquidation for leveraged ETFs. Take BTC3L (3x leverage long for BTC) as an example. If BTC falls by 33%, the BTC 3x leverage long contract will be definitely liquidated, while with the existence of re-balance mechanism, there’s will be some BTC3L asset left.

Third, compound interest. Leveraged ETF will include the profit into the principal automatically. Specifically, if a user earn some profit by buying a leveraged ETF, the profit will be added into the principal automatically on the next day. This forms a compound interest mode.

Fourth, MXC supports leveraged ETFs for over 78 digital assets, not only top-market-cap coins like BTC, ETH, EOS, etc., but also DeFi, PolkProjects, platform tokens like YFI, COMP, DOT, KSM, BNB, OKB, MX, etc. Users are able to find virtually every popular assets available for leveraged ETFs. What’s more, in addition to 3x leverage ETFs, MXC also supports 4x & 5x leverage ETFs for top-market-cap coins, like BTC, ETH, EOS, BCH, XRP, etc.

Last but not the least, Leveraged ETFs are especially suitable for one-directional market trend, like bull or bear market. For example, in the bull season, XLM3L leveraged ETFs on MXC gains nearly 2 times today, and XRP3L rose by 10 times in just 4 consecutive days.

Molly: Q3.What is leveraged ETF rebalance mechanism?

Simon:

The regular rebalance will be performed at 00:00 (UTC+8) daily to guarantee the agreed leverage times. However, when an asset’s daily percentage change exceeds 15%, the rebalance mechanism will be triggered for the losing ETFs.

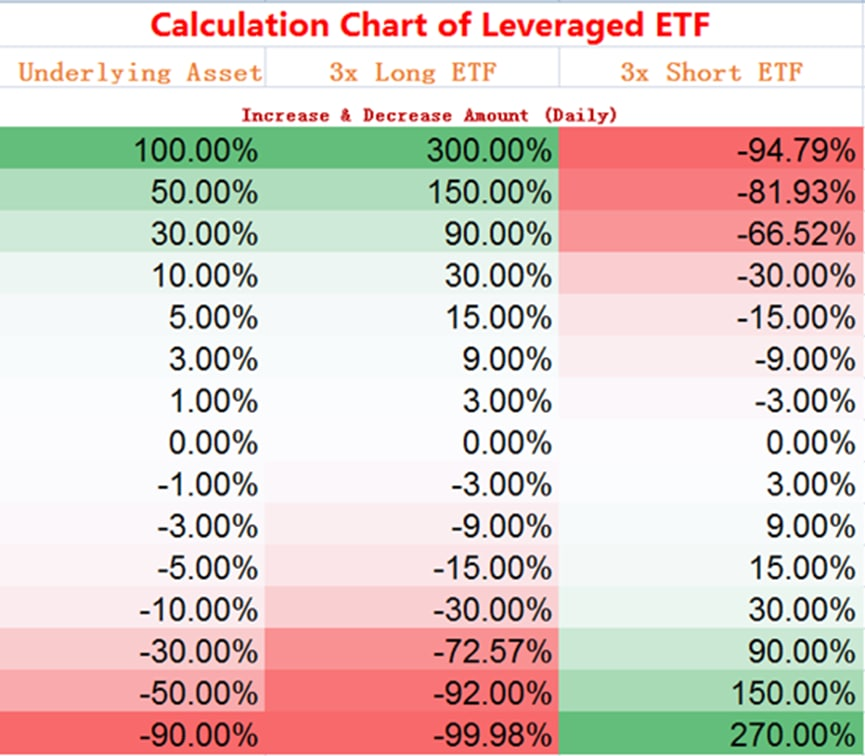

For example, if BTC rises 15% on Nov.24, the BTC3S (3x leverage short for BTC) leveraged ETF will be rebalanced to avoid greater loss, while BTC3L will not. See the form below.

From the form we can see if BTC rises by 30%, BTC3L ETF gains 90%, while with rebalance mechanism in place, BTC3S drop by 66.52% instead of 90%.

Molly: Q4. What are the fees for leveraged ETFs?

Simon:

There will be trading fee and daily management fees. The trading fee rate is 0.02%, and the daily management fee varies with different leveraged ETFs. The management fee rate is usually 0.3% each leverage, which will only be charged at 00:00 (UTC+8) each day. If you do not have at the timepoint, no management fee will be charged.

Molly: Q5.1. What should users pay attention to when trading leveraged ETFs. What users shall be cautious of?

Simon:

Though small fund may rake larger profit by using leveraged ETF tool, it also brings greater risks if the market goes against you.

Besides, please check the net value first before buying a leveraged ETF product. If the real-time price is much deviated from the net value, please be cautious of the risks.

Alongside that, the mechanism of leveraged ETFs make it not suitable for users to hold for a long period. The abrasion and daily management fee may make your long-term leveraged ETF position not profitable.

Another thing should keep in mind is that because of the rebalance mechanism, Leveraged ETFs is particularly suitable for one-direction market trend. It’s not suitable for choppy market.

For more information about leveraged ETFs, please refer to:

https://support.mxc.me/hc/en-001/categories/360002640591

https://support.mxc.me/hc/en-001/articles/360038484492

Free-asking Session

Q1.What can we expect to see from etf in the short-term (at some point in 2020) and 2021 and beyond (long-term goals)?@Asriyana0

Simon:

Hi Nurul, for your information, Leveraged ETF is especially for one-directional market trend, not suitable for long-term holding coz of re-balance system and daily management fee rate.

Q2.Why do I need leverage trading?@luckydraw66

Simon:

It's based on your risk tolerance. Leveraged ETF enable users to leverages, so that some traders may rake greater profit with smaller fund.

Q3.Is there any tutorial for using Leveraged ETF?@drzy16

Simon:

yes, for the details, you can refer to

https://support.mxc.me/hc/en-001/categories/360002640591

https://support.mxc.me/hc/en-001/articles/360038484492

Q4.Which area are you focusing on at the moment? (DeFi, Stake,Dapps..) and what is your goals in this year ??@zzcuna

Simon:

not very connected with leveraged ETFs, but mxc is now focusing not only spot market, but also deriavtives, like leveraged ETFs, contract, margin trading etc. We are the first exchange to launch the largest amount of DeFi projects. and PoS pool supports staking, saving and loan services. We are also seeking to expand our global presence at the moment.

Q5.How is leveraged etf trading differemt from spot trading?@notulu

Simon:

The trading steps are the same with the spot trading. Leveraged ETF track the daily change of the underlying assets with, let say, 3x times. Simply, ETF allows users to earn larger profit with the leverage tool. MXC supports over 80 leveraged etf assets now. If you are very confident of a coin, why not try the leverage tool to expand your profit, right.

Follow us:

Telegram: https://t.me/MXCEnglish

MXC trading: https://t.me/MXCtrade

Twitter: https://twitter.com/MXC_Exchange

https://twitter.com/MXC_Fans

Reddit: https://www.reddit.com/r/MXCexchange/

Facebook: https://www.facebook.com/mxcexchangeofficial/

Discord: https://discord.gg/zu5drS8