Low Spreads

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Low Spreads

Risk Warning: Your capital is at risk. Statistically, only 11-25% of traders gain profit when trading Forex and CFDs. The remaining 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

Forex Brokers

> Low Spread Forex Brokers

Saint Vincent and the Grenadines (FSA)

Risk Warning: Your capital is at risk. Statistically, only 11-25% of traders gain profit when trading Forex and CFDs. The remaining 74-89% of customers lose their investment. Invest in capital that is willing to expose such risks.

© 2021. TopBrokers.com — All Forex Brokers at one place.

Copying of materials is allowed only with the presence of an active link to a source page

All information presented on TopBrokers.com website, including charts, quotes and financial analysis, is informational and doesn`t imply direct instructions for investing. TopBrokers.com will not accept any liability for loss or damage as a result of reliance on the information on this site. Forex pairs, cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. You should carefully consider whether you understand how these instruments work and whether you can afford to take the high risk of losing your money. TopBrokers.com would like to remind you that the data contained in this website is not necessarily real-time nor accurate.

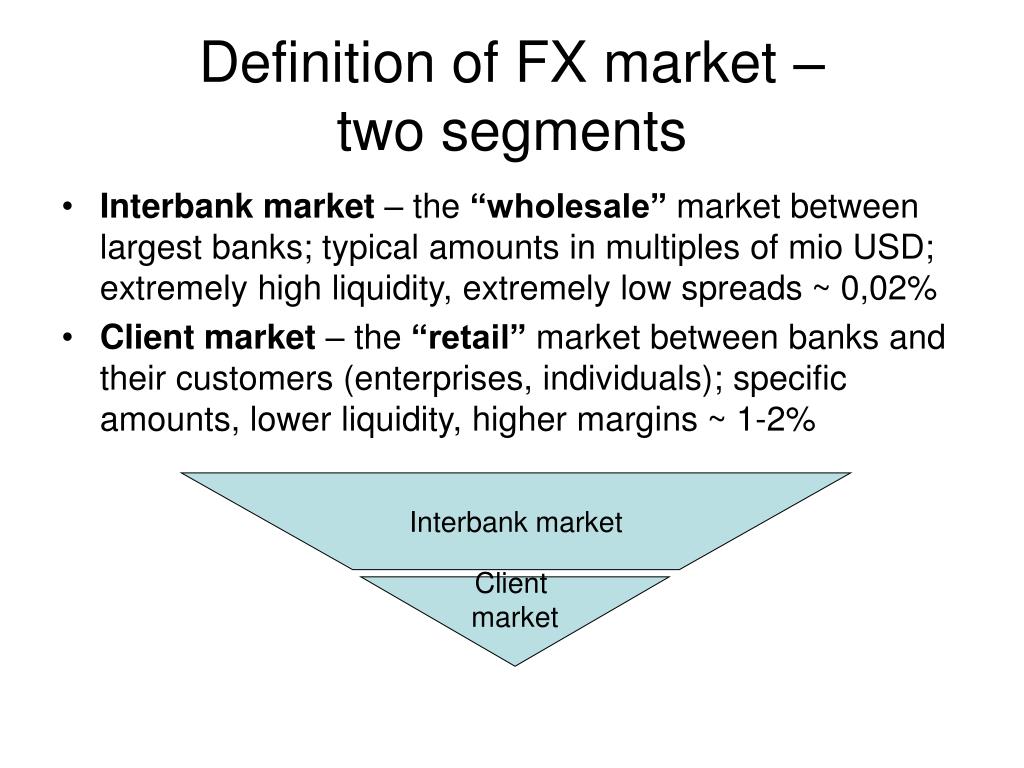

The term ‘spread’ is very common on the lips of any experienced forex trader and one which new traders need to become familiar with. A spread is simply defined as the difference between the price at which a currency pair is bought and that at which it is sold. The spread is the cost paid to the Forex broker for allowing the trader access to the currency trading market. Forex brokers with the lowest spread are usually the post popular ones among traders.

There are two practical explanations, it means that every Forex transaction entered into will be making a loss equivalent to the spread and that each time the trade is done and this amount is added to losing trades but deducted from winning trades. A low spread means that the cost of trading is low whether you’re dealing with a Market Maker or Electronic Communication Network Forex broker . If you are looking for Forex brokers offering the lowest spreads - check the table below.

Tradable Protection 50% is available no matter the first deposit. On the next deposits you can receive it from 300$. The extra funds of Tradable Protection are not written off even during “drawdown”.

From now on, clients of JustForex can increase their deposit with the help of Double benefit bonus. Deposit your account with at least 100 USD and double your opportunities for trading!

Welcome Bonus is credited to the micro account after making the minimum deposit.

Fortrade offers a welcome bonus, amounting to 30% of the first deposit (up to €3000). The deposit must be €100 as a minimum and the bonus expires within 90 days. Bonus monies may be used for tr

As a warm welcome to our newest traders, we are offering a 30% bonus on top of your initial deposit into your first AAFX live account.

The bonus is charged on any account replenishment without restrictions. The promotion is valid indefinitely.

Hurry up to get a bonus! Up to $ 5000 on first deposit!

Deposit bonus can only be credited to a verified account. Deposit bonuses can only be credited to any MT4 | MT5 account.

Increase your trading opportunities. Get up to a bonus on all deposits up to $ 2000

Компенсация издержек при переводе депозита из других компаний (брокеров, фондов и т.д.). Компенсируется до 100% издержек при транзакции депозита.

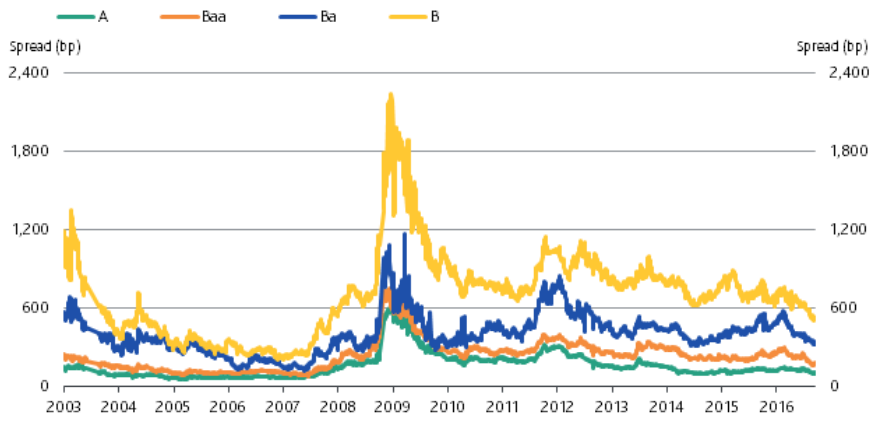

The spreads for different currency pairs vary depending on the jurisdiction in which the broker is based as the spread for one broker may be higher than of another. It is wise to look at the spreads for various currency pairs that you intend to trade other than EUR/USD which is the commonly traded pair and usually which brokers offer the lowest spread for. Deciding which forex broker to trade with can be a difficult task. Being able to find the right partner that will charge a fair price to give you access to the currency trading market, secure your investment throughout with appropriate dealings and that will efficiently respond to your concerns isn’t simple more so when dealing with someone online and you never get to meet them “one-on-one” because they may be based abroad.

The major mistake most traders make when choosing a broker is to focus mainly on the cost factor. Many traders look for those that offer ‘the tightest’ spreads available or ‘near zero’ spreads on most major pairs. The reality on ground is that brokers are aware of their cost structures and would never go into such business ventures. A broker’s main target is always to recover costs in any way possible, this means that for every subsidy of spreads they make, they are sure to recover and make up for it somewhere else in terms of other fees possibly, slippage and poor execution, or low-quality customer service and support.

There exist two main types of forex brokers; ECN brokers and brokers that are market makers. An ECN broker runs the traders orders directly to its liquidity providers to be executed at their prevailing spreads. These fluctuate overtime according to supply and demand but are usually very minimal. Much as they offer lower spreads, the ECNs have various ways through which they recover their costs such as through transaction-based pricing and commissions. Depending on the trader’s style and level of activity, an ECN’s pricing structure may turn out to be lower as compared to the typical market maker broker on the overall.

Market makers on the other hand rely on the ”Bid/Ask” spread to make their income, this is multiplied if the trader chooses to use leverage in their trading strategy. A market maker acts as an intermediary between you, their client, bank or liquidity providers, and prefer to “arbitrage” for profit the spread that they offer to you against what they can trade in the market on their own behalf. The market maker keeps an instantaneous accounting of the “overs” and “shorts” for each currency pair on a daily basis. If he is losing at a certain point, he will slightly increase the spread to compensate the difference over time. However, the market maker’s ultimate objective is to make a specified profit for each pair by the end of the business day.

Businesses always compete in either providing low costs or offering of quality services. A business cannot offer the most affordable services and not compromise on quality assurance. This means that when a forex broker offers the lowest spreads in the market, then it definitely has to cut back on quality in some other department. It may happen to charge extra fees that will usually be hidden and not easily detected or it may indulge in bad business practices to hide its unscrupulous recovery of costs.

The trader must be concerned how the broker will recover their costs whenever low spreads are offered. The quality of services offered and whether extra fees are being charged are evident if you do your due diligence review and compare the broker’s offers to the competitors’, going through customer testimonials and independent reviews of the broker. The difficulty is identifying a broker involved in bad business practices which are usually covered up leaving you at the mercy of your broker. The only sound course of action to take option you have in such a situation is to halt your business arrangement and withdraw your account balance without any delay.

Bad business practices usually reveal themselves in a number of ways. The first could be in constant re-quoting, you may see a quote and gain interest and act upon it with an execution order then get a server message with a different quote asking you to try again. This certainly means that the broker might have chosen to block your request for his own profit reasons. However, if you took an unacceptably long period of time to act, then the broker may have acted appropriately to re-quote.

Slippage is also another common practice could spoil one’s trading experience and lead to loss losses of capital. Slippage is caused by having your stated order executed at a price other than the one you stated. Your broker will defend himself by stating that the market is volatile or that you delayed to act or that some major data release caused an abrupt change in the market. If these indicators are not present and yet slippage occurs frequently then it means that it’s about time you questioned your choice of broker.

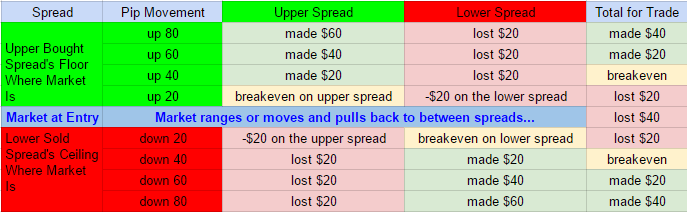

The last and probably, most frustrating bad business practice is spread manipulation. If your broker is a market maker, he can post whatever quotes are in his best interest at that point in time. Market makers are all about setting spread quotes, however, some unscrupulous ones may decide to quote rates that do not reflect anywhere in the market, they may for instance use quotes from an independent Reuter’s quote feed or even another broker. This type of spread manipulation is common when the market is in a tight range. Under such conditions brokers can’t make profits so they manipulate the spreads. When traders place orders for the big move the quotes may take a plunge roughly 20 to 30 pips. This is just the right amount to clear out any stop-loss orders and to prevent traders from benefiting from the move. The unscrupulous broker then cashes in on the profit from those closed client positions in this case.

The truth is that not all low spread brokers are bad. However, you should be aware that a low spread broker must make good of their loss one way or another. You may not need education materials or customer support and if at all you want a broker that truly focuses on a low spread and is ready to compromise in other areas. The most important thing is that the brokering firm adheres to good business practices in its execution of your orders. A spread is very important in your choice of the broker, but you must strive to understand what other costs might be hidden and if the quality of service might be low. The best advice to a trader is that they should take time to choose their broker wisely.

There are obviously several benefits for trading with lower spreads and the following are reasons for opening an account with a brokerage company that offers low spreads.

Some traders insist on lowest spreads possible as a prerequisite before choosing to trade with any particular broker. It is important for traders who open and close several positions each session they trade to get the tightest spread possible so that they can be able to minimise losses. Some brokers provide either low fixed or a variable spread with very attractive minimum and typical values. The downside to such low spreads is that the brokers may require high-deposit accounts. Some of the best international forex brokers offer pretty low spreads with mini or even micro Forex accounts but these are not to be confused with zero-spread accounts.

Low spread forex brokers are preferred especially by traders who use the scalping strategy because this trading strategy allows them to open and close several deals per day and with low spreads, the commissions may add up to even 100 pips

In order to cut costs on forex operations, traders usually opt for dealing desks that can avail low spreads. For traders who use this criterion, financial losses are limited and this is what every trader looks forward to, being able to make profits and secure their principle invested amount.

Are you new to the forex bandwagon and seek a forex broker who will hold your hand as you start trading? This is one of the best brokerage firm for beginners as you can understand in Forex.com detailed Review . It offers a myriad of education resources, a reliable customer support, seminars and multiple guides. Furthermore, it also offers 24/7 broker support for six days including Saturdays and a social trading features that is available in 25 languages.

PLUS 500 is a highly acclaimed CFDs trader that specializes in such financial instruments as Forex, commodities, ETFs, and stocks. The firm also has one of the most competitive market capitalizations, currently valued at over $1 Billion, and operating through multiple subsidiaries across the world. Though the broker is registered and headquartered in London, it maintains an active office in Australia under the ASIC’s regulations.

This will help other traders to know in advance about advantages and disadvantages of the company, as well as compel brokers to provide better services for all of us.

Why You Should Use Low Spread Scalping Strategies

Lowest Spread Forex Brokers 2021 | Best FX companies with Low Spreads

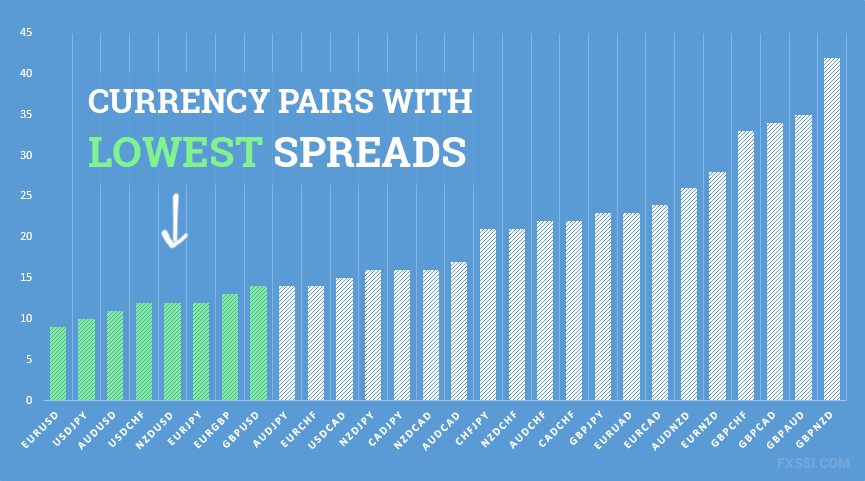

Low Spread Currency Pairs to Trade on... | FXSSI - Forex Sentiment Board

Lowest Spread Forex Brokers [Compare January 2021 Spreads ]

Top 10 Best Lowest Spread Forex Brokers 2021 [Tight Spread Brokers]

Best Currencies to Invest in (2021 Edition)

I don't need an answer (no email required)

Type of feedback

Other

Suggestion

Compliment

Problem

Question

© 2021 fxssi.com All Rights Reserved

Forecast and Analytics

Forex Forecasts

Daily forecast

Weekly forecast

Forex news

Sentiment Tools

Current Ratio

DOM Snapshots

Ratios

pro

Order Book

pro

Profit Ratio

pro

Trading Activity

pro

Open Interest

pro

MT4 Products

Indicators 19

Sentiment 9

Signal 5

Utilities 5

Learn basic Sentiment Strategy Setups

In Forex, the spread is essentially one part of the cost for you as a trader to open any trades. It counts into the total price of trading.

As in life, the price for common things is lower compared to other, more exotic and in demand. The same applies to low spread currency pairs that are commonly traded on Forex.

Low spread is very important for frequent traders for which every part of the pip movement makes a difference.

Let's start with the most commonly traded currency pair, EUR/USD.

Spread / Daily Range = 1.5% (the lower the better)

The most traded pair with around 20% of total trading volume on Forex. This also makes EUR/USD the pair with the lowest spread .

Variable spreads for this currency pair, in normal trading activity, range from 0.1 to 3 pips, depending on the broker. For fixed spreads, they go from 0.3 to 5 pips (excluding commission).

Table for Euro-Dollar spreads across different sessions (investing.com):

Volatility in this pair is known to spike during the news events, and EUR/USD is the most popular. News events, economic calendar, social media activity, and political events are frequent for the USD (United States). In addition, if we take that EUR (European Union) is composed of many countries, any crisis in one may affect the Euro.

Having this mix of trading sessions and volatility spikes makes this currency pair interesting to trade, even though it is the pair with typically the lowest spread.

If we compare the Daily Average Range (ADR), we can see if the spread is in line with the potential of the currency pair.

For the EUR/USD Daily Average Range (14) at the moment is around 58 pips. If we take an average 0.9 pips spread for EUR/USD pair it means (0.9/58=1.5%) spread takes 1.5% off our maximum potential profits in one trade.

The two economies, one exporting type (Japan) and one big importer (US). Two distinct trading sessions. Combine this with typically low spreads and you have some trading opportunities here.

You can download the Spread Indicator to control the spread widening.

The variable spread for this currency pair is from 0.2 to 2 pips. Because of the big gap between trading sessions, it is great if you want to focus on one economy. A broker with three digits, average 1 pip spread accounts 2.1% off your maximum daily potential profit.

This pair is specific because of the big movements of the British pound. If you combine this with great liquidity and therefore low spreads, you get opportunities for low spread strategies that do not work on other pairs.

Nowadays if you follow the news, you will understand the obvious downfall of the GBP.

Variable spreads for this currency pair go from 0.3 to 2.7 pips excluding commissions. With high daily average range (68 pips) of the GBP/USD pair, the spread (1.4 pip) will eat your maximum potential profit by around 2.0% per trade, which is lower than USD/JPY pair.

The Swiss Franc has close to zero inflation and the banking system is regarded as one of the best in the world for the investors. It is one of the most traded currency pairs on Forex with low spread.

Stability is one of the traits of the CHF but it does not mean that there are no opportunities for trading.

It is an easy-to-follow currency pair with low spreads that range from 0.5 to 5 pips. The average spread (1.2 pip) to profit ratio is 2.6% on the daily average range (45 pip).

This currency pair is more sensitive and has big movements. Since the economies involved in this pair are smaller, one can expect bigger changes in the market caused by any events.

The spread may not be the lowest offered but low enough to boost the potential of this pair for frequent traders.

It is the perfect mix of low spread and opportunity. This can be seen by ADR (14) of 63 pips, spread range from 0.5 to 5.7 pips and average spread (1.2 pip) to potential profit ratio of 1.9%.

This currency pair is also interesting because it is rarely ranging, or moving sideways.

Even though the broker may offer low spreads, the commission may mask the total cost. If we take this into consideration, finding the broker with the right offer may be easier with this spreads table from Myfxbook:

Finally, you should understand that all the major 8 currency pairs combinations are liquid enough to have low spreads.

IE Pashkevich A.G.

TIN 503227185281

PSRNSP 317502400021247

Leveraged trading in foreign currency carries a high level of risks and may not be suitable to everyone.

We do not imply or guarantee that you will make a profit and you agree that our team will not be held responsible for your possible losses.

We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.

Mom Massage Sex Hd

Sensual Pov Blowjob

Naughty America Marie

Sensual Jane Danny D Porn

Sporting Ass