Little Known Facts About "Decoding Novated Leases and Salary Sacrifices: Which Is Right for You?".

Novated Lease or Salary Sacrifice? Making the Right Choice for Your Funds

When it comes to handling your finances, creating the appropriate choices is vital. One choice that many employees experience is whether to opt for a novated lease or compensation sacrifice setup. Each choices may deliver notable tax advantages and aid you spare funds on your automobile expenses. However, it's essential to know the variations between these two possibilities and review which one match your economic objectives and conditions.

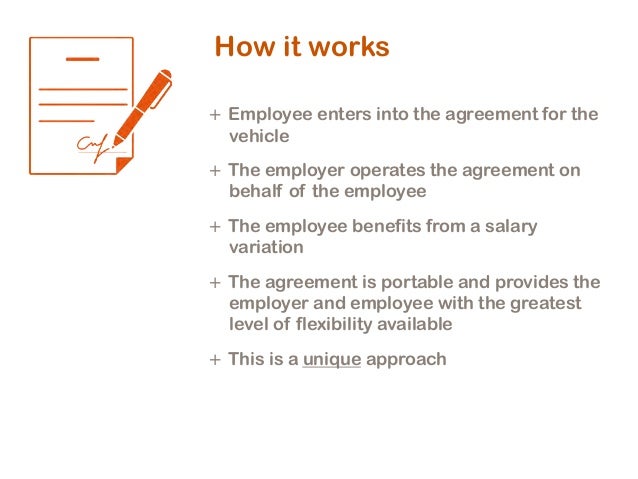

A novated lease is a three-way deal between an staff member, their company, and a financial business. Under this setup, the staff member leases a auto of their choice making use of pre-tax profit. The employer takes on the accountability of creating lease repayments straight coming from the worker's salary before income tax reductions are administered. Furthermore, the employer covers various other costs linked along with car ownership such as insurance policy, sign up, and servicing.

One of the primary advantages of a novated lease is that it allows employees to access squadron discounts discussed through their company. These markdowns can easily lead in notable financial savings when acquiring or leasing a lorry. Moreover, as lease payments are subtracted from pre-tax earnings, employees lessen their taxable income and likely pay for much less earnings tax obligation.

On the other palm, salary reparation includes an agreement between an employee and their company to reroute part of their pre-tax earnings towards details expenses such as car car loans or leases. With wage sacrifice, employees can easily decrease their taxed income through allocating funds in the direction of vehicle-related expense before tax obligations are calculated.

While both novated leases and compensation reparation plans supply prospective tax obligation advantages and financial savings on car expenses, there are some key variations between them that need to be taken into consideration when making a choice:

1. Adaptability: Novated leases use even more adaptability in phrases of car option reviewed to compensation sacrifice agreements. With a novated lease, employees have more independence in deciding on any sort of make or design that meets their needs within particular suggestions prepared by employers or financial business.

2. I Found This Interesting : Novated leases are typically utilized for leasing vehicles, which suggests the worker does not possess ownership at the end of the lease condition. In comparison, earnings reparation arrangements may be utilized for auto lendings or leases, allowing workers to at some point have the motor vehicle outright.

3. Danger and Responsibility: With a novated lease, the company presumes obligation for producing lease settlements and dealing with various other costs associated along with car possession. In a earnings reparation agreement, the worker takes on these tasks themselves.

4. Firing: Novated leases may be terminated if an worker modify jobs or leaves behind job. In this case, the obligation of producing lease payments and other connected expense moves back to the worker. Earnings reparation arrangements are usually much more versatile in this respect as they can be readjusted or ended without considerable monetary outcomes.

Before making a decision between a novated lease and income reparation plan, it is essential to consider your economic objectives, lifestyle needs, and long-term planning. Seeking advice from with a financial expert or specialist who specializes in motor vehicle money management can deliver valuable insights modified to your specific scenario.

In conclusion, both novated leases and salary reparation plans use tax advantages and prospective financial savings on motor vehicle expenses for workers. Having said that, understanding their differences is vital in producing an informed decision that lines up with your financial objectives. Consider factors such as versatility in auto choice, possession inclinations, threat allotment, and discontinuation disorders before picking between these two possibilities. Through assessing these factors meticulously and seeking specialist recommendations when needed, you can easily make an informed decision that match your funds most ideal without risking on your private requirements or objectives.