List Of Private Investors In Europe

⚡ 👉🏻👉🏻👉🏻 INFORMATION AVAILABLE CLICK HERE 👈🏻👈🏻👈🏻

Results 1 - 15 of 3259 - Investors in Europe. Sell or Finance your Business in Europe.

Official Email

Phone

LinkedIn

Facebook

Google

Interests: Looking for EBITDA positive, tourism, travel and critical software companies.

Background: A leading group of vertical software companies providing mission-critical software.

Custom Application Development + 7 more

Official Email

Phone

LinkedIn

Facebook

Google

Interests: Turnaround opportunities. Add-ons for current portfolio companies.

Background: Company owns a number of companies. Our main holding is in a large manufacturing group with multiple factories across NL and Germany, active in Engineering, Machining and Assembling of large metal (or related) components and products.

Managing Director, Quality Inspection Service

Official Email

Phone

Facebook

LinkedIn

Google

Interests: Manufacturing mainly of automotive components, plastic and / or injection moulding shops. Business should be able to relocate to Malta.

Background: I am an engineer by profession, and after working for 20 years in the manufacturing industry, I set up my own company (currently 80 employees) in 2005 servicing local and overseas manufacturing firms.

Interests: High turnover, healthy cash flow businesses. either in evolving or mature stages with potential to explore further.

Background: Hands on management and executive direction to assist with strategic planning based on lean / hoshin approach.

Official Email

Phone

LinkedIn

Facebook

Google

Interests: 1. We have two distinctive acquisition strategies. - On the first is a distressed strategy, where we seek underperforming business units where reputation and timing are critical- perhaps due to Covid related pressure. We will look at all sectors with revenues between EUR 30 million and EUR 400 million; however, we will consider most sectors, and we typically seek to invest in equity between EUR 10 million and EUR 100 million. 2. Here are key highlights of the investment criteria: - Distressed situations, operational restructuring, recovering revenues post Covid. - Business revenues between EUR 30- EUR 400 million. - Preferred assets on the balance sheet, profitable pre Covid. - Buyout banks from their loans to the business & invest alongside existing shareholders, and management participation. 3. As there is generally no financing needed, we can close the transaction quickly. 4. On the second strategy, we look for stable and profitable businesses where the owners would like to exit. These businesses will have a solid management team in place which can use capital to execute a growth plan post ownership transfer. - Here are some highlights for this acquisitions profile: - Revenues between EUR 100 million - EUR 700 million. - EUR 10 - EUR 200 million equity check (EUR 40 million - EUR 70 million sweet spot) - Invest alongside existing shareholders and management participation.

Background: We are a family operated private investment firm, with holdings in the US and Europe. We are HQ in the US and have a branch in Gibraltar. One of the promoters is from Germany and he is currently in his hometown.

Interests: Would be interested in business opportunities in Europe.

Background: We are into business valuations, sell and buy side acquisitions from initial search to post-acquisition due diligence.

Official Email

Phone

Facebook

LinkedIn

Google

Interests: Well established, proper books, scalable, solid MRR, no customer concentration and should be innovative.

Background: Company is in Web Development, App Development, Web Marketing, IT Services. Looking to expand the business.

Official Email

Phone

LinkedIn

Facebook

Google

Interests: Stability, good ROI, Expansion Possibilities, Good Ratings.

Background: Company is into hospitality and travel boutiques business. We own a tier of hotels in Greece.

Official Email

Phone

LinkedIn

Google

Facebook

Interests: Advertising or digital agency. Global brands. £500k + revenue. 10-25 staff.

Background: We are a specialized creative production company with a global reach, impacting thousands of audiences and brands. We deliver collaborated efforts all around the world with offices in London, New York and Sydney.

Official Email

Phone

LinkedIn

Facebook

Google

Interests: Interested in a business opportunity.

Background: We are part of an experienced management team.

IT Infrastructure Architect, Financial Services

Interests: Revenue, reasonable margins and future expansion plans.

Background: Have 14 years of experience in IT, telecommunications, and management. Expertise in IT analytics.

Interests: Interested in Cafes, Food and Beverage business.

Background: British investor looking to invest in the Middle East.

Interests: Become an owner or an active shareholder in the new businesses which has potential growth opportunities.

Background: I’ve been a senior executive in the packaging industry for more than 30 years.

Interests: Business should be flexible, owner operated, have innovative product or an idea, well managed company and trained staff.

Background: Have over 16 years of experience in automation domain. Also have worked in various roles in the IT industry. Looking to start my own business.

Official Email

Phone

LinkedIn

Facebook

Google

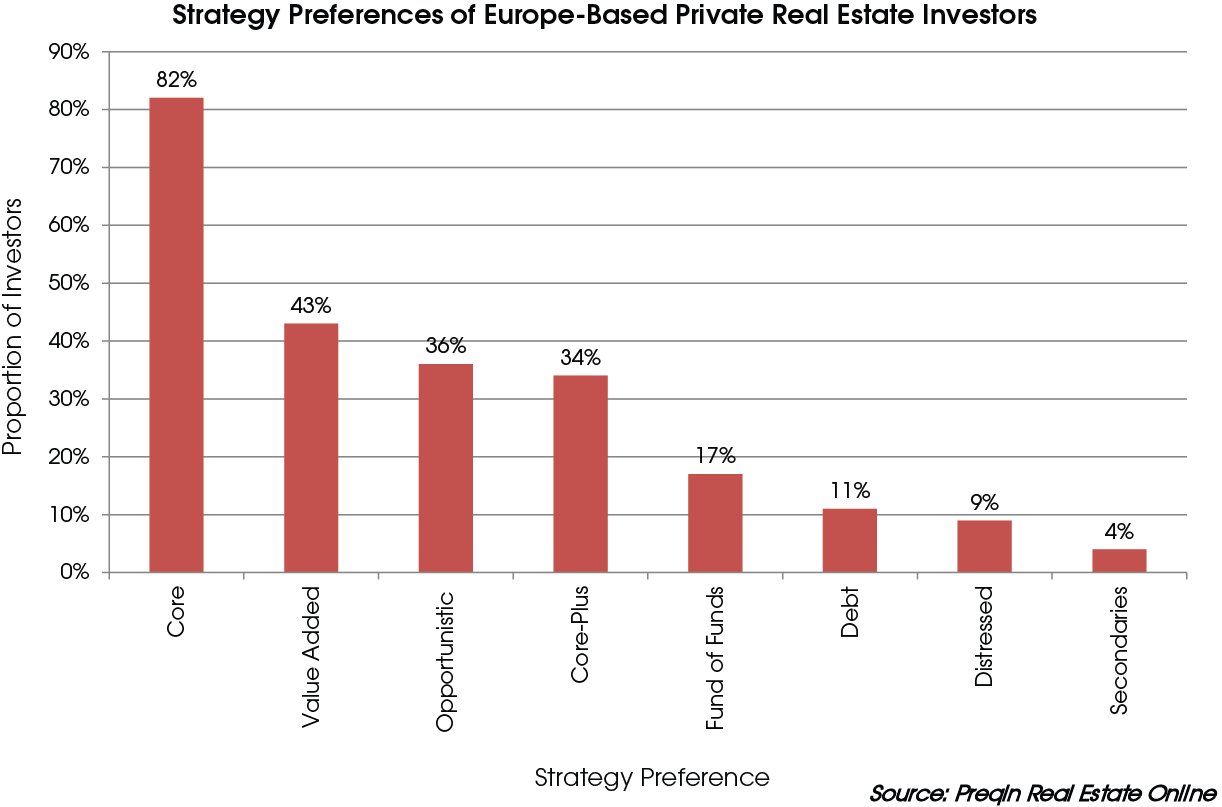

Interests: Our core competencies are Structured Products, Alternatives and Real Estate. Our teams work hand-in-hand with our clients over the entire process through to completion of each deal.

Background: Independent brokerage firm in United Kingdom. Identify and facilitate cross-asset brokerage opportunities that improve the efficiency of transactions where capital markets fall short in supplying required funding, inventory and hedging support.

How many investors in Europe are listed on SMERGERS?

There are 3259 active and verified investors in Europe listed on SMERGERS as of 25 August 2021.

What level of due diligence does SMERGERS conduct on the businesses/member?

SMERGERS scrutinizes all profiles and only features a select group of businesses, investors, advisors that meet a basic requirement. When required, certain members may have submitted some form of proof …read more

How active are the business profiles listed on SMERGERS?

We regularly filter out businesses which are inactive or have already closed a transaction. Typically, if the business is actively looking to sell/raise capital, the status is shown in …read more

How can I be sure about privacy and confidentiality?

We understand the level of confidentiality required in strategic transactions and we strive to provide a safe and secure experience for our members. Please review our privacy policy. We also …read more

How can I contact a business listed on SMERGERS?

You need to be logged in before you connect with a business. Click here to register and message the business If you are already logged in, please use the contact …read more

Should you buy an existing business or start a business from scratch?

Buying an existing business is generally an easier way to start a business with an immediate head start. It saves valuable time and administrative efforts, considering starting from scratch is …read more

How successful has SMERGERS been in helping its users successfully close a deal?

SMERGERS is a discovery and matchmaking platform with global reach. It helps in connecting Businesses, Investors, Acquirers, Lenders, M&A Advisors and Boutique Investment Banks across locations, indsutries and transactions.

What is the checklist for selling a business?

Here is the checklist for selling a business

1. Find a manager who can take care of your business in your absence.

2. Fix the operations to optimize your profit …read more

Copyright © 2021 SMERGERS Online Services Private Limited. All Rights Reserved.

... and 69,000+ other businesses of all sizes.

Showing results from SMERGERS worldwide. Click below to select your location.

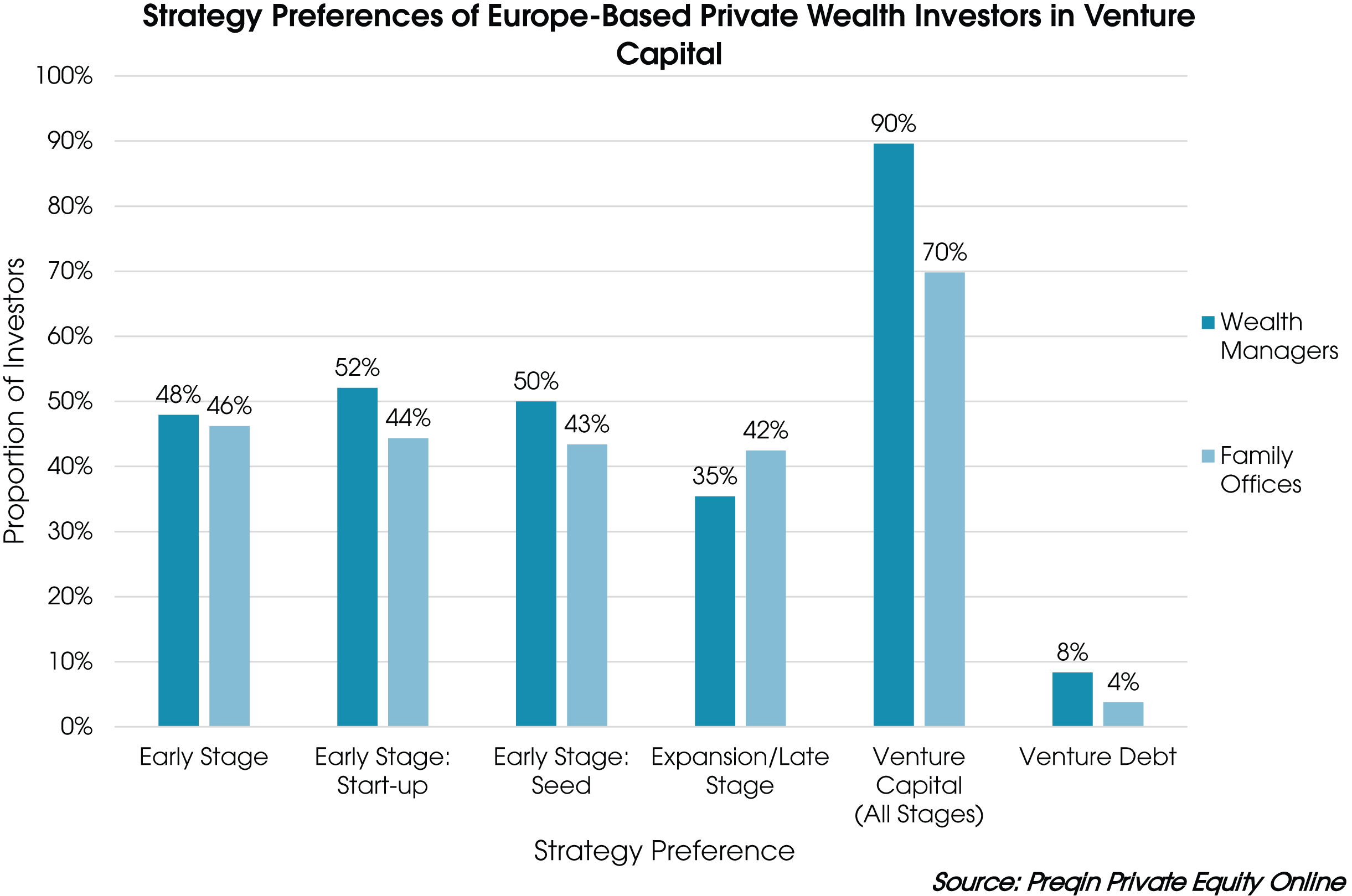

About private equity

How private equity invests in privately-owned businesses, supports jobs and creates prosperity.

Transforming a loss-making business into a modern, profitable retailer.

Building a Polish waste management leader

Building Central and Eastern Europe’s leading substrate producer

About us

We represent Europe’s private equity, venture capital and infrastructure industry.

Industry standards

Invest Europe is the guardian of the industry’s professional standards.

Policy

Working with policymakers to develop legislation that helps drive growth and prosperity.

Research

The authoritative data source on European private equity activity.

Events & training

A comprehensive suite of conferences, networking events and training courses.

News & opinion

Up-to-the-minute policy and industry news, insights and opinions.

Members

Login to access your exclusive member-only content and account information.

About private equity

Find an investor

Invest Europe Investor Search is an easy way to find potential funding for your business. Search by sector, financing stage and country for relevant investors.

Search alphabetically for an investment institution with List Search.

We cannot guarantee any funding or act as an intermediary and you must contact potential investors directly.

If you are not an entrepreneur but are trying to find an Invest Europe member, use Member Search.

Avenue Louise 81 B-1050 Brussels, Belgium

You can accept or refuse cookies. Accepting cookies is usually the best way to make sure you get the best from a website.

Most PCs automatically accept them but you can change your browser settings to restrict, block or delete cookies if you want. Each browser is different, so check the 'Help' menu of your particular browser (or your mobile phone's handset manual) to learn how to change your cookie preferences. Many browsers have universal privacy settings for you to choose from.

Cookie settings in most versions of Internet Explorer can be found by clicking the tools option and then the privacy tab.

Cookie settings in Firefox are managed in the Options window's Privacy panel. See Options window - Privacy Panel for information on these settings.

Click on the spanner icon on the toolbar, select settings, click the under the bonnet tab, click on content settings in the privacy section.

You can manage cookies in Opera if you Click on settings, then Preferences, then Advanced and finally Cookies

Choose Safari, then preferences and then click security. You should then be able to specify if and when Safari should accept cookies.

To manage cookies on your mobile phone please consult your manual or handbook.

If you decline cookies, some aspects of Invest Europe site may not work on your computer or mobile phone and you may not be able to access areas you want on the website. For this reason we recommend that you accept cookies.

If you delete all your cookies you will have to update your preferences with us again and some aspects of our site may not work.

If you use a different device, computer profile or browser you will have to tell us your preferences again.

If you'd like to learn more about cookies in general and how to manage them, visit aboutcookies.org.

We can't be responsible for the content of external websites.

This is for members only. To view in full login or join Invest Europe today.

This website use cookies. They do not track personal data and are not harmful to your computer. Learn more

Lesbi Hd Facesitting Orgasm

Ddf Busty Masturbation Of Orgasm

Http Nastyvideotube Com Categories Petite 1 Html

Naked Mother In Law

Lesbian Titsucking Cams

List of top Europe Investors (Top 10K) - Crunchbase Hub ...

List of 395 Private Equity Firm Investors in Western Europe

Investors in Europe - Sell or Finance your Business in ...

Find an investor | Invest Europe

Top100 Investors in European real estate | PropertyEU

List of European Investment Companies - Ezilon.com

Search for investors | Private Equity List

List of private-equity firms - Wikipedia

Top 100 Active Angel Investors List for Startups | Eqvista

Chinese Investors - DCCC

List Of Private Investors In Europe