Liquidity pools on the PancakeSwap crypto exchange.

The Open NetworkBelow is an explanation of how liquidity pools work when using a decentralized crypto exchange. For our step-by-step guide, we’ll be using PancakeSwap.

We’ll be discussing:

- What’s a decentralized exchange (DEX)?

- What are liquidity pools, and why are they important?

- How can users interact with liquidity pools?

- What are the risks associated with liquidity pools?

Decentralized exchanges (DEX)

In simple terms, a decentralized exchange is self-executing code on a blockchain that performs trade operations for users.

Therefore, DEXs have no point of centralization like a company or centralized exchange, which means they have no means to use, confiscate, or freeze your assets.

What’s a liquidity pool?

A liquidity pool can be thought of as a “reservoir of cryptocurrencies.” If a user wants to trade their Bitcoin for Toncoin, for example, the DEX protocol withdraws Toncoin tokens from the liquidity pool, transfers them to the trader, and deposits the Bitcoin into another pool.

This ensures a seamless and lightning-fast trading experience on DEXs.

Admittedly, we’re simplifying the process, but DEXs don’t “take” anything — the code performs all of these transactions automatically.

The code of DEXs is open-source, meaning anyone can read it and identify potential security vulnerabilities, for example.

Where does the liquidity for these pool pairs come from?

Liquidity providers deposit token pairs into pools, thus creating liquidity for other users.

Why should people deposit their crypto into a liquidity pool?

DEXs would be unable to function properly without liquidity pools.

That’s why DEXs offer financial incentives to liquidity providers. By providing liquidity, users are rewarded a percentage of the transaction fees within liquidity pools.

In a sense, it’s a form of passive income.

“I have 10 Toncoin. Can I become a liquidity provider and earn rewards?”

The short answer is no. In fact, there is no “single pot of cryptocurrencies” where there’s a wide variety of tokens coming and going.

A liquidity pool always comprises a trading pair.

For example, there might be Toncoin/Bitcoin, Bitcoin/Ether, or Toncoin/USDT pools. Each of these pairs is an individual pool.

To become a liquidity provider for the Toncoin/Bitcoin pool, you’ll need to deposit both Toncoin and Bitcoin. Different DEX protocols have different pair ratios set for users to meet before they are to deposit their crypto into a pool.

Having deposited your crypto into the Toncoin/Bitcoin liquidity pool, you’ll receive a fraction of every transaction fee within this specific pool.

If someone wants to trade Toncoin for Ether, then this is done in a completely different pool, and you won’t receive transactions fees because your tokens are in the Toncoin/Bitcoin liquidity pool.

How to use liquidity pools

Now we’re going to explain to you step-by-step how to become a liquidity provider on the PancakeSwap DEX for the Toncoin/USDT pair. You can choose any other pair for which to provide liquidity, but the Toncoin/USDT pool is one of the most liquid.

Instructions:

- You’ll need a cryptocurrency wallet that is compatible with the DEX. We recommend using MetaMask because it’s one of the most popular and securest crypto wallets in the world.

You can download MetaMask here.

2. Before doing anything, you’ll need to buy some Binance Coin (BNB) since it’s the native currency of the Binance Smart Chain and is required for transaction fees. About $1 should be enough.

Buying cryptocurrencies is easy on the Binance crypto exchange.

3. Once you’ve bought BNB, go to PancakeSwap and connect your wallet by clicking on “Connect Wallet” at the top right corner of the page.

4. Connect your wallet. For this guide, we’ll be using MetaMask.

5. Click “Trade Now” to get started.

6. Now you need to add Toncoin to your list of supported cryptocurrencies. Copy Toncoin’s smart contract address from the official site.

7. Go back to PancakeSwap and click in the “To” box:

8. Paste the copied smart contract address in this field:

9. Click on “Import.” Toncoin will appear in the list of available cryptocurrencies for trading:

10. Swap your BNB for Toncoin:

11. Now you’re ready to deposit your Toncoin into a liquidity pool, but remember, you can only add it as a pair. In our example, we’ll be using USDT as the pair’s second token, so make sure you have some in your crypto wallet as well. To enter a pool, you must need equal amounts of both tokens in terms of dollars. For instance, if you have $10 worth of Toncoin, then you must have at least $10 worth of USDT to continue.

Go to the “Liquidity” section and click on “+ Add Liquidity”:

12. Select the Toncoin/USDT token pair and click on “Supply.” You will have to give permission to the smart contract to spend or use your assets within the liquidity pool. (This happens in 3 transactions.)

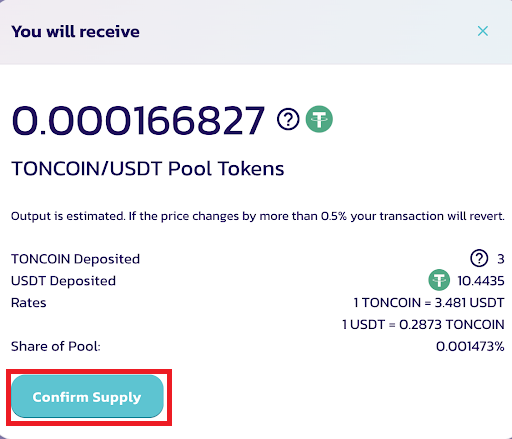

13. Click on “Confirm Supply”:

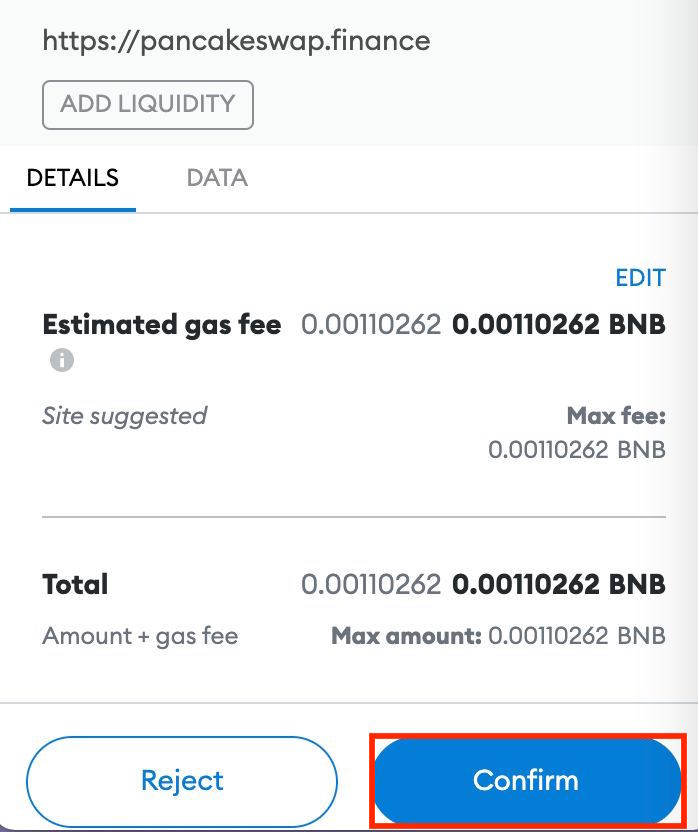

14. Confirm the transaction in MetaMask.

15. That’s it! Your tokens are now in the Toncoin/USDT pair liquidity pool, and you’ll be earning commission from the pool’s transaction fees.

Risks associated with providing liquidity

There are two main risks:

- Impermanent loss

- The possibility of smart contract exploits

Impermanent loss

This is a common occurrence in liquidity pools because crypto markets are volatile, but we’ll spare you the confusing technical details.

That’s not to say you should ignore this issue, however. If you are interested in becoming a liquidity provider, then you should read this article.

Let’s look at what impermanent loss means in simple terms:

Impermanent loss is when the value ratio of your initial token pair fluctuates.

Crypto market volatility is infamous and can cause even the most seasoned investors some serious stress. Although earning commission from transactions in liquidity pools sounds enticing, simply “hodling” your crypto can sometimes earn better returns than providing liquidity.

The possibility of smart contract exploits

In the world of DEXs, there’s always the possibility that your liquidity pool’s smart contract gets exploited by hackers, from which no one is safe or protected.

In 2020 alone, DeFi users lost a combined $100 million as a result of smart contract exploits and hacks.

Conclusion

Liquidity pools are an interesting yet vital component of DeFi ecosystems across all blockchains that offer potentially lucrative financial incentives.

As always, be aware of the risks when investing in crypto and do your own research.

This guide does not constitute financial advice.