Life after ICO: LAToken turned out scam not blockchain (+Bonus: Valentin Preobrazhenskiy and the Biznes Molodost) — part 3/3

Криптокритика / Cryptocritique// English translation of the original article (http://telegra.ph/ZHizn-posle-ICO-Okazalsya-LAToken-ne-blokchejnom-a-skamom-ch3-04-06) ///

First part of the story: https://telegra.ph/Life-after-ICO-LAToken-turned-out-scam-not-blockchain-Bonus-Valentin-Preobrazhenskiy-and-the-Biznes-Molodost--part-13-01-16

Second part of the story: https://telegra.ph/Life-after-ICO-LAToken-turned-out-scam-not-blockchain-Bonus-Valentin-Preobrazhenskiy-and-the-Biznes-Molodost--part-23-01-17

Now, we all know that LAToken came out with usual scammed shitcoin with a bunch of “pivots” in the process. Its CEO — Valentin Preobrazhensky was typical liar and “face seller”, but it is not the end of digging in crypto shit yet.

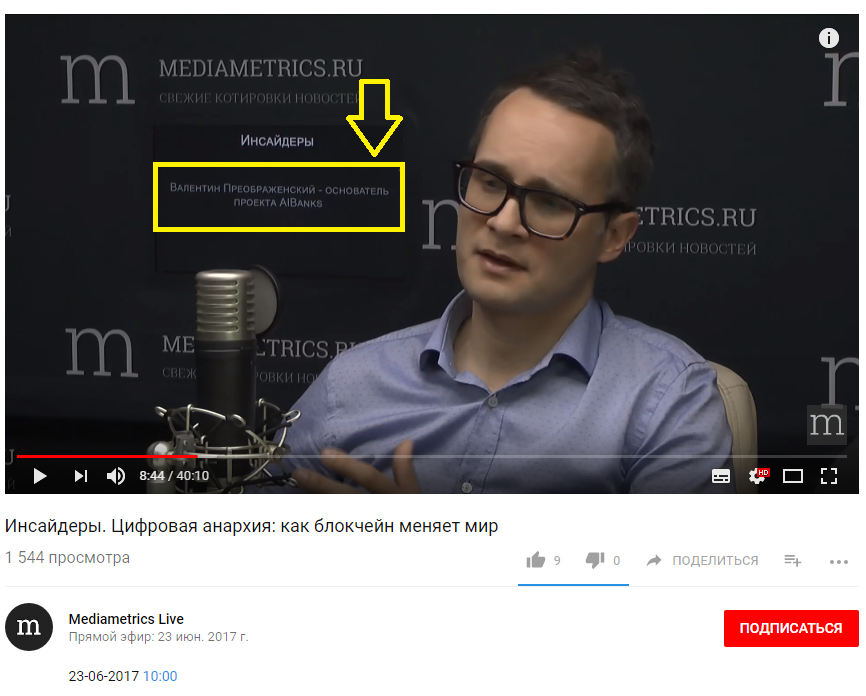

For instance, you can watch Valentine, when he was not pretending to be serious and very busy starter following the link: https://www.youtube.com/watch?v=wiUTFjFA354. Of course, Valentin would be really needed oratory coach, because it is physically hard listening to him.

Besides, at 8:45 Valentin confused “hashtag” with “hashrate”, at 14:49 he gave a non-trivial definition of the Pre-ICO, at 22:19 Valentin was convinced in the 10x growth of his project, at 23:22 all banks would use Valentin’s tokens for transactions and issue loans with those tokens, at 24:40 we found out that the blockchain would replace the market regulator monitoring — well that would not be easy for you watch that video if you have any financial background. And of course there was artificial intelligence in place!

Don’t you think, friends, that Valentin Preobrazhenskiy is a classic corporate guy who memorizes a bunch of buzzwords, who mentions those definitions in place and out of place, and who does not understand it’s meaning and how it works? As for me, I have that impression: I have seen those characters a lot.

=====

By the way, Valentin can joke still on April first: https://www.facebook.com/valentin.preobrazhenskiy/posts/10156290064569154

=====

However, looking at the credits to the video, one notes the name “AI Banks”.

It is very curious what Preobrazhenskiy another project that preceded LAToken was about. Yeah, here it is: http://ai-banks.com/

Well, that was again, everybody pivot, guys! It appeared again that “the concept has changed” — the standard condition for Valentin. “Due to regulatory demands and the presence of (then inaudible, but probably about the presence of assets, that differ from bank loans)”. Whatever that means. Then let’s dig into the guts of AI banks here:

https://youtu.be/wiUTFjFA354?t=1825 here https://www.youtube.com/watch?v=o246eU6Qph4 (we will return to this video later)

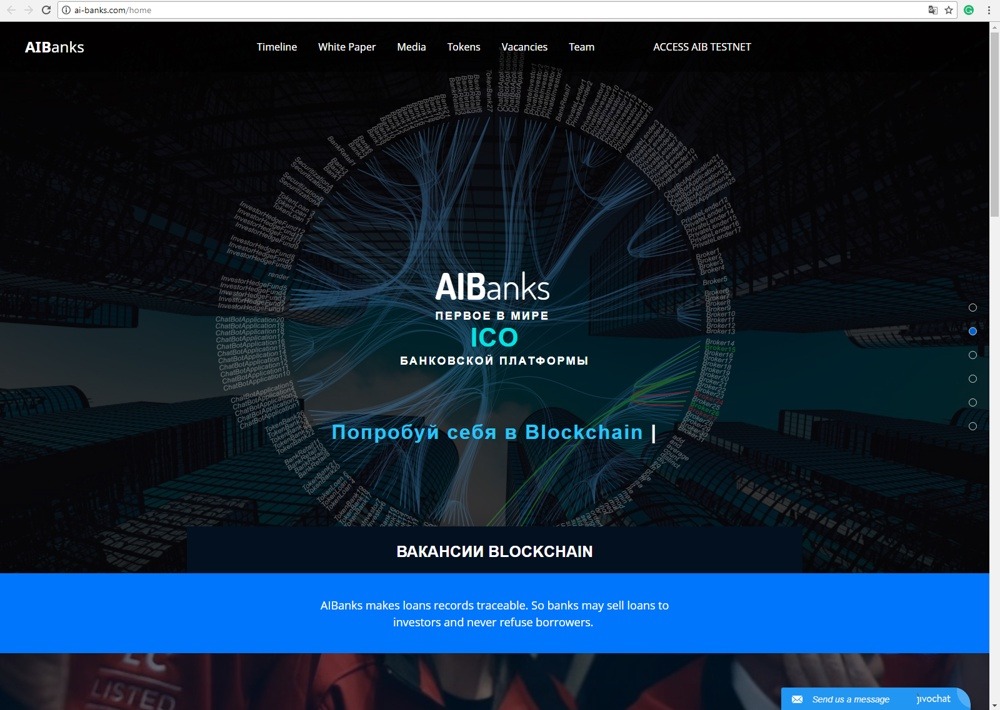

and here: http://ai-banks.com/home (http://ai-banks.com/ico_confidential)

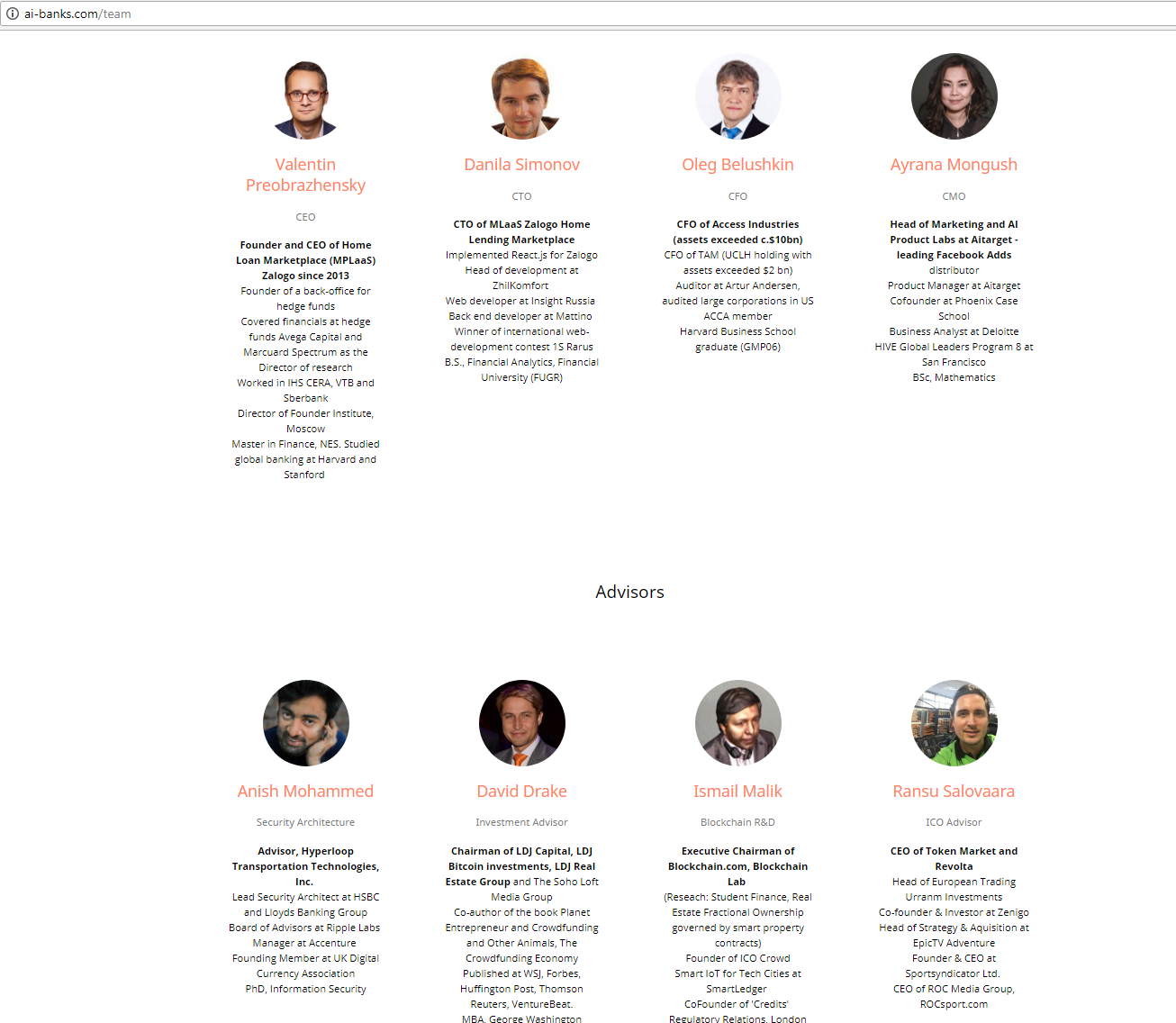

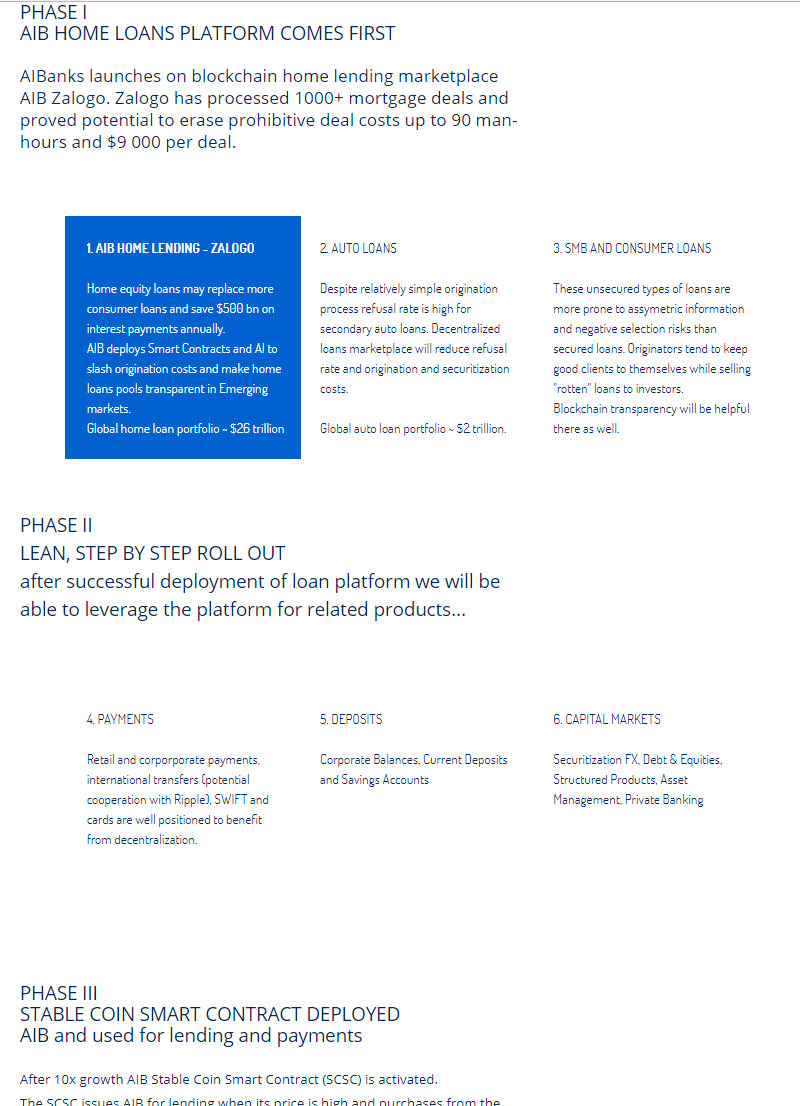

The essence of the AI Banks project was that banks were facing problems with scoring and the credit histories reliability, so the costs had increased due to fraud and regulatory compliance, so they had been forced to add it to the rate of the loan or just to take those risks onto the costs. Pleasant enough, but then Preobrazhenskiy Valentin came as superhero in AI Banks suit with blockchain in hand, the API behind, and with artificial intelligence underarm. Well, then he had loans via chatbots and smart contracts, loans refinancing, and the blockchain on guard against fraud in place. And of course, there was selling tokens secured by loans and mortgages instead of “valuable” derivatives, which were well told in the book / movie “The Big Short”.

API and software solutions are for banks; loans through the platform of the issuance of mortgages and loans are for workers (another project pivot of Preobrazhenskiy — from Zalogo [https://www.zalogo.ru/] to AI banks), and land is for farmers. As Lenin bequeathed many years ago. Here is a little more about mortgage crypto communism on the blockchain:

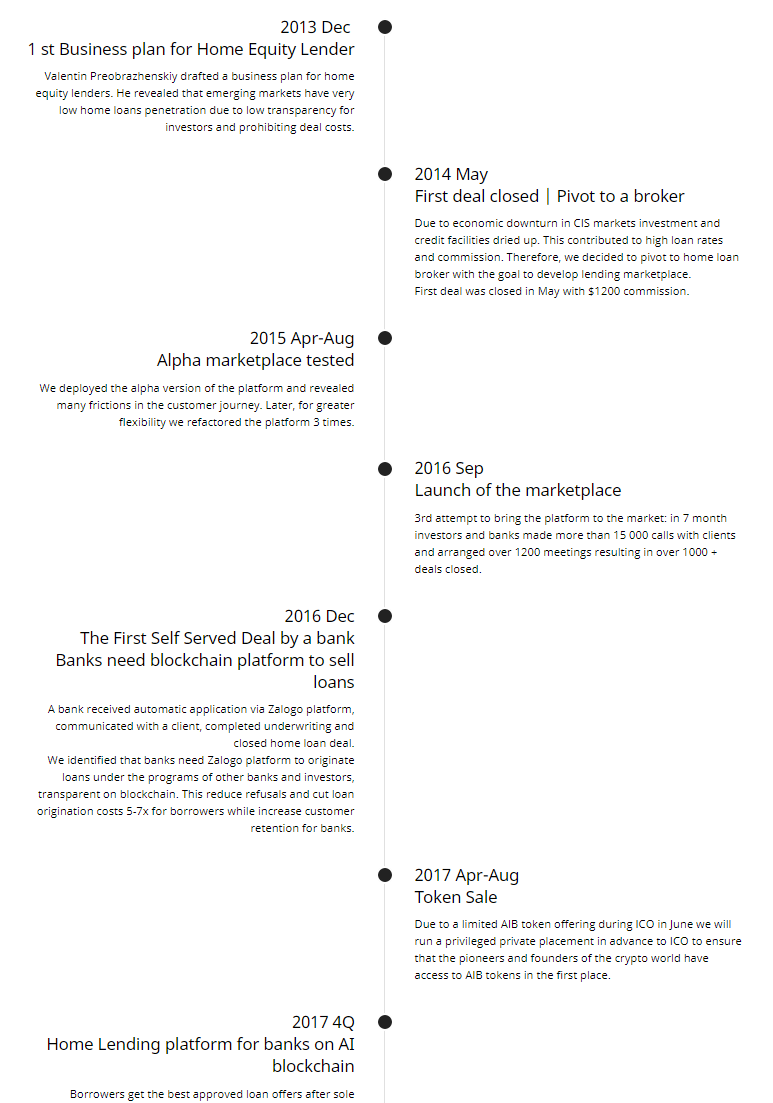

Please, mention ANOTHER PIVOT in 2014. Valentin without pivot — money for nothing.

In general, everything would be fine to AI banks, if an explicit project-mongering with another platform and ecosystem on the blockchain had not happened (without holy blockchain, “hamsters” (= naive investors) are not conducted on ICO even still), the lack of any legislative base + the lack of any coherent business model (classic!) + initiation of the ICO with the industry B2B solution (which is almost always a scam by definition).

It was not surprising that the entire mortgage communism went into the trashcan and changed the concept to LAToken, that changed the concept a few times too then. It was strange that Valentin Preobrazhenskiy following that approach did not change his name several times still.

By the way, who is Mr. Preobrazhenskiy? Well, that’s a lot of pivots. This behavior is similar to the founders of two fake-funds (the first case and the second). They were also absolute serial entrepreneurs — who make “startup” every year.

Thus, the career of the current LAToken CEO consists of:

Zalogo — https://www.zalogo.ru/. “Loans for 13% a year. Mortgage without any references and credit history” (just like in microfinance business). The founder of the project.

AI Banks — about the project see above. The founder of the project.

====

A little more info about incorporation of the projects:

https://zachestnyibiznes.ru/company/ul/1157746015591_7725259300_OOO-ZALOGO

https://zachestnyibiznes.ru/company/ul/5167746463319_7714965110_OOO-ZALOGO-MENEDGhMENT

====

“I have been trading stocks for over 15 years, 7 of them in hedge funds, where I was Director of Research… in the Swiss hedge Fund [managed] $200 mln portfolio, traded my Hedge Fund, created a back office for hedge funds, profitable marketplace for mortgages …” — https://youtu.be/9FVHy-GZisg?t=540

“I was engaged in this marketplace for 3.5 years (Zalogo / Ai Banks), we made more than 1000 transactions… I came into this business after 7 years of working in hedge funds. I started as an analyst, [then] became the Director of Research at the Swiss Hedge Fund Marcuard Spectrum (more precisely “in Spectrum Partners” from 2007 to 2009 — approx.), in the crisis, we closed it (Hedge Fund) and saved investors money. I launched my [own private] Hedge Fund, and during the break I did consulting on loan portfolio optimization for one of the largest banks. In my Hedge Fund, I set up a back office that other hedge funds use. Seeing that the Russian market will stagnate due to increased risks, I began to look for more entrepreneurial projects that are growing during the crisis in Russia and have international potential… I made more than 100 meetups [as a part of the Founders Developers project], many leaders of Silicon Valley visited me… There I met blockchain” — https://www.youtube.com/watch?v=o246eU6Qph4

Let’s look at his LinkedIn profile (https://www.linkedin.com/in/vpreobrazhenskiy/).

RAO UES of Russia (2002–2006) — from Consultant to a Leading Specialist

CERA (2005–2007) — Senior Associate

Spectrum Partners (2007–2009) — Director of Research

VTB (2009–2010) — Strategy Consultant

Avega Capital (2010–2014) — Managing Partner

Founder Institute — Director

Zalogo (2013–2017) — founder and CEO

First, it started as a typical corporate career, and then after the office routine it had began to itch somewhere and it had been wished something new and business. Well, somewhere I’ve seen that before… Zhenya Nazarov and his fake Fund! I think I know where to look, but more on that later.

What this Valentin’s career list lacks are:

- https://zachestnyibiznes.ru/company/ul/5107746000775_7714824824_OOO-HOChURU — Had Valentin launched the online store?

- https://zachestnyibiznes.ru/company/ul/1137746266140_7714901557_OOO-TA — Nobody knows what was that

- Model of the World (http://worldmodel.co/) Founders and Developers. More details here: https://incrussia.ru/concoct/u-nas-v-klube-7-biznes-soobshchestv-kotorye-nam-nravyatsya-i-poetomu-tuda-deystvitelno-stoit-vstupit/

- The initiator of the Global Education program in the Association of Strategic Initiatives (by the way, it was the right thing could be) — https://www.kommersant.ru/doc/1802174

- Letters against corruption, support of Navalny political opposition, meetings with Posner (famous russian journalist and TV Host) and so on. He had active public life.

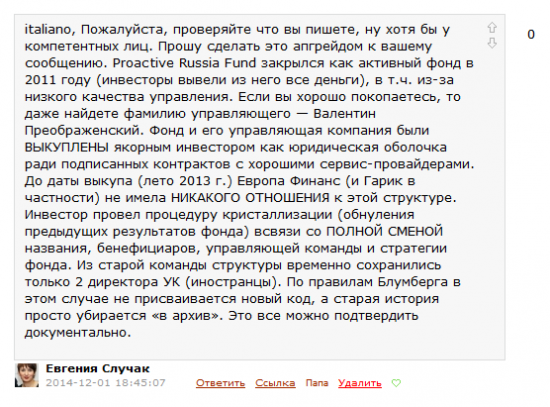

- Proactive Capital (mentioned here — https://moikrug.ru/valentin-p and then — http://finparty.ru/market_parties/15995/). There is a little story about it here: https://smart-lab.ru/blog/219593.php / https://smart-lab.ru/blog/219652.php See comments

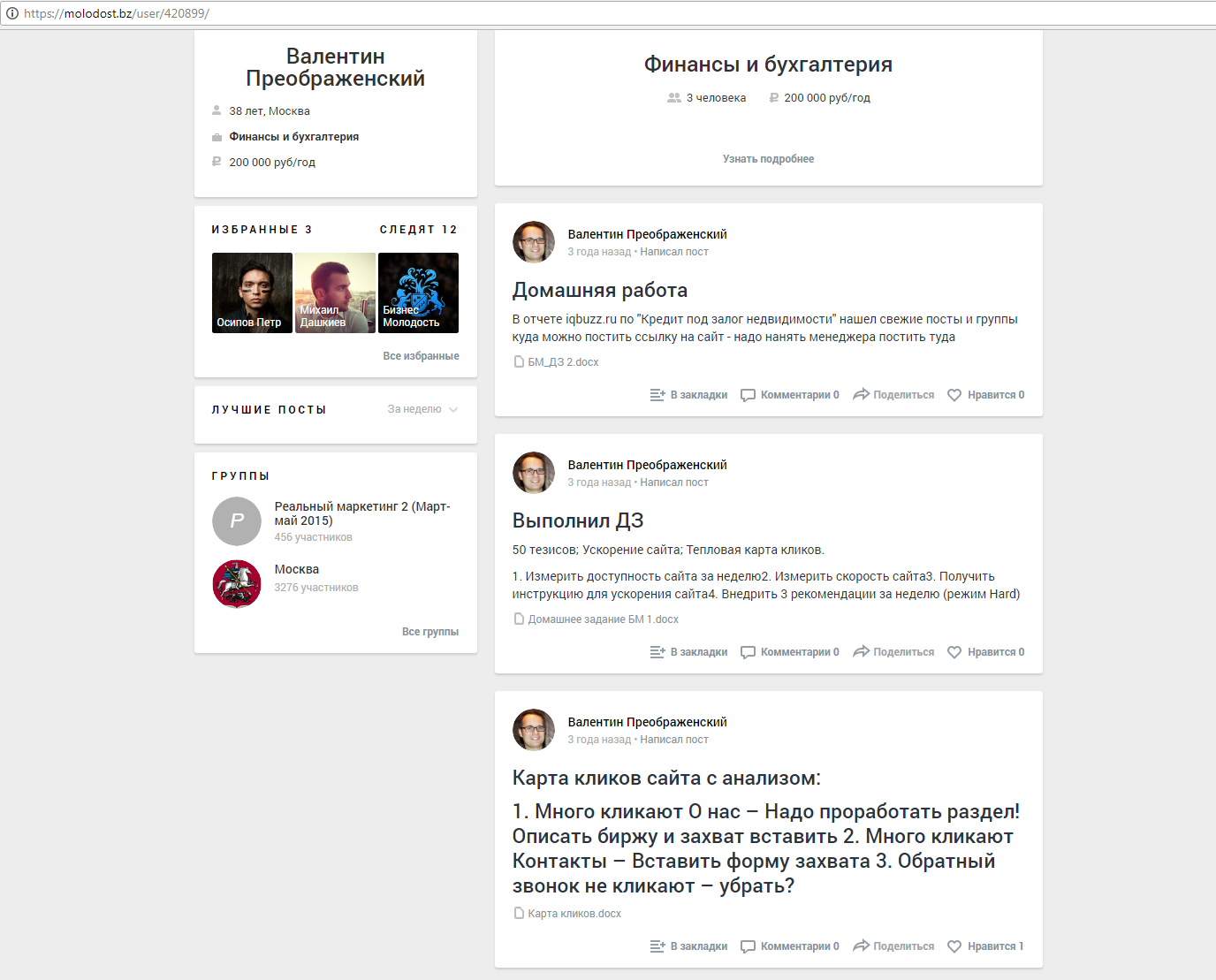

But the most interesting thing is here (I knew where to look!) — https://molodost.bz/user/420899/

Do you remember another king of startups / pivots and a graduate of “Business Youth” (“Biznes Molodost” / BM)? Yes, that was Zhenya Nazarov! And as we remember, the most of Eugene biography was much exaggerated (classics for BM alumni), and fake-Fund had become the first-class trash. So it is also necessary to recheck everything after Valentin’s words. He had learned to say lie for good in his corporate life. And the fact that LAToken is crypto trash and shitcoins’ warehouse, you might guess to the point. If might not — write yourself in the camp of crypto losers, those are also needed.

P.S. By the way, Valentin writes articles too. http://www.forbes.ru/finansy-i-investicii/358707-token-kak-predchuvstvie-chto-dast-investoram-novyy-vid-aktiva

But the rumors say — not by himself ;)

(c) Cryptocritique [ t.me/cryptocritique ]