LendLedger: Decentralized Blockchain Crypto Lending Market

sulek1010

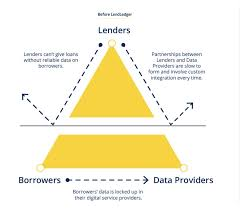

LendLedger connects Lenders with untapped records to bridge the multi-trillion-dollar hole between economic establishments and casual Borrowers. It brings collectively Borrowers, Data Providers, and Lenders in an open and cozy worldwide surroundings constructed on allotted ledger generation. Through the LendLedger Protocol, all people can be part of lending markets. The protocol’s APIs1 permit parties that don’t know every other to trade information and value. And it uses Stellar’s blockchain era to capture loan disbursement and reimbursement data in real-time. This steadily consequences in obvious and irrefutable reputations for all individuals. By searching at the blockchain, Lenders can see Borrower conduct and fee danger correctly.LendLedger will help small organizations and informal Borrowers relaxed inexpensive credit score from economic institutions. Its open requirements and depended on shared ledger will growth data sharing, marketplace interactions, and lending volumes.

LendLedger permits a more efficient, affordable, and inclusive lending market.

Video presentation of LENDLEDGER

The lending enterprise incorporates of about ninety% of the employment of the casual marketplace in many nations. But in the present economic system, lenders find it very hard to offer credit score centers to small borrowers because of lack of right facts and documentation records to assess their credit score worthiness. As a end result of which most of the small-time businessman can’t borrow from the traditional economic establishments. For example, a small grocery keep owner may additionally use different virtual structures like cellular wallet or debit or credit score cards to pay for his transactions. Now those monetary info can also show his creditworthiness, but are invisible to the conventional financial creditors or institutions. So, even though the grocery store might also have a very profitable business, however he has to get financial resource from circle of relatives, pals, and loved ones or from small lenders however at excessive interest fees. Moreover, the lending technique is time ingesting and complicated and plenty of creditors do not need to take the danger to lend small-time agencies as they may be worried approximately the repayment of their loans. Introducing LendLedger, based on Stellar Blockchain a good way to bridge the gap among small business and lending establishments.

What is lend ledger

LendLedger connects Lenders with untapped facts to bridge the space among economic establishments and informal Borrowers. It brings together Borrowers, Data Providers, and Lenders in an open and comfy worldwide environment constructed on allotted ledger generation. Through the LendLedger Protocol, absolutely everyone can be a part of lending markets. The protocol’s APIs permit parties that don’t understand each other to exchange information and value. And it uses Stellar’s blockchain generation to capture loan disbursement and compensation facts in real-time. This step by step results in obvious and irrefutable reputations for all contributors. By searching on the blockchain, Lenders can see Borrower conduct and rate threat accurately. LendLedger will help small companies and informal Borrowers relaxed inexpensive credit score from monetary institutions. Its open standards and depended on shared ledger will growth information sharing, marketplace interactions, and lending volumes.

Features of Lend Ledger

Borrowers now have get entry to to severa numbers of creditors at competitive quotes.

Lenders now can access a formerly untapped marketplace.

Borrowers have complete power to share and control their records securely.

The open APIs standardize the gadget with the aid of decentralizing it.

An environment built on consider each from the debtors and the creditors factor of view.

A common platform connecting borrowers, lenders and information companies.

A public Blockchain ledger makes all of the transactions obvious and comfortable.

Every transaction is recorded in Blockchain with unique identifier of the participant. So it builds a recognition of the borrower, lender in addition to DPs that's seen to all.

All the economic transactions are completely recorded inside the ledger.

All credit score facts of borrower is saved strictly private and is only seen to the involved events.

The machine is open to all.

The Loan Digital Asset is the mortgage Tokens of the system.

All the encrypted facts is verified for its genuineness and validity.

It removes intermediaries and any relevant authority.

The machine is cheaper and fee of transactions is low in comparison to centralized structures.

A quite simple interface which anybody can use and does not require technological know-how.

An possibility of increase for small commercial enterprise sectors.

THE LENDLEDGER LOAN TOKEN

The LendLedger LOANtoken (LOAN) is the different way for network participants to get right of entry to the functions of the LendLedger community. LOAN serves a couple of functions:

For Lenders: Ability to access the community, make loans, and pay for offerings associated with lending.

For Data Providers: Opportunity to learn how to monetize and percentage data.

For Borrowers: Permission to look and apply for loans

For Credit Nodes: Ability to stake LOAN which will trouble Ledger Credit.

LOAN is a Stellar-issued virtual asset that is predicated on the Stellar Consensus Protocol. It without problems integrates into an existing,

decentralized infrastructure, such as digital wallets and the built-in Stellar alternate.

Technical Information

LOANtokens are LendLedger’s virtual asset. Credit Nodes ( as described in white Paper) stake LOANtokens to trouble the fiat-pegged LedgerCredit utilized by Lenders, Borrowers, and different Participants to transact on the network. LedgerCredit is the protocol’s inner accounting unit. It is denominated in phrases of government-issued (fiat) currency and acts as an IOU at the part of the provider.

Financial Information

Token info

Token LOAN

Platform Stellar

Token Price 0.05 USD

Token for sale 150,000,000 LOAN (15%)

Token supply 1,000,000,000 LOAN

Investment info

Hard cap 5,000,000 USD

Accepting ETH, BTC, XLM, USDT

Restricted countries China, United Kingdom, United States of America

Know Your Customer Yes

LendLedger Roadmap

Onboard Indian Lending Business

LendLedger's Indian lending business Happy Loans is currently disbursing loans at a run rate of $30million annually. By the end of the year we hope to have this entire lending business onboarded onto the LendLedger platform.

Expand into other markets - Q1 2019

LendLedger will expand into other emerging markets in Q1 of 2019. Kenya being one prevalent target due to the experience of our Community Experts and Advisors.

LendLedger Team

Gautam Ivatury

Co-Founder and CEO

Manish Khera

Co-Founder

Greg Deforest

Head of Product

Blockchain Network Governance

Sanachit Mehra

Blockchain Architect

Daniella Loftus

Communications Manager

Nick Hughes

Advisor

Alberto Jimenez

Advisor

For more information click below links:

Website: http://www.lendledger.io/

Medium: https://medium.com/lendledger

ANN: https://bitcointalk.org/index.php?topic=4424652.0

TechPaper: https://lendledger.io/images/LendLedger_TechPaper.pdf?pdf=LendLedger%20Tech%20Paper

Telegram: https://t.me/lendledger

Twitter: https://twitter.com/lendledger/

Author

sulek1010

Bitcoin profile: https://bitcointalk.org/index.php?action=profile;u=2274930

ETH: 0x1b8E697dA9D4b6687B8a6Ad8a3bF351d3C29dFFe