Learning How To Spread Bet

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Learning How To Spread Bet

The margin for UK 100 trading is 5 percent, which means you would deposit £1,413.25 (£5 x 5653 x 5%) to open a trade.

© 2020 Capital Com SV Investments Ltd Regulations Terms and Policies

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

By using the Capital.com website you agree to the use of cookies .

Learn how to spread bet with Capital.com. Read our ultimate spread betting trading guide and explore the real examples to build your own trading strategy.

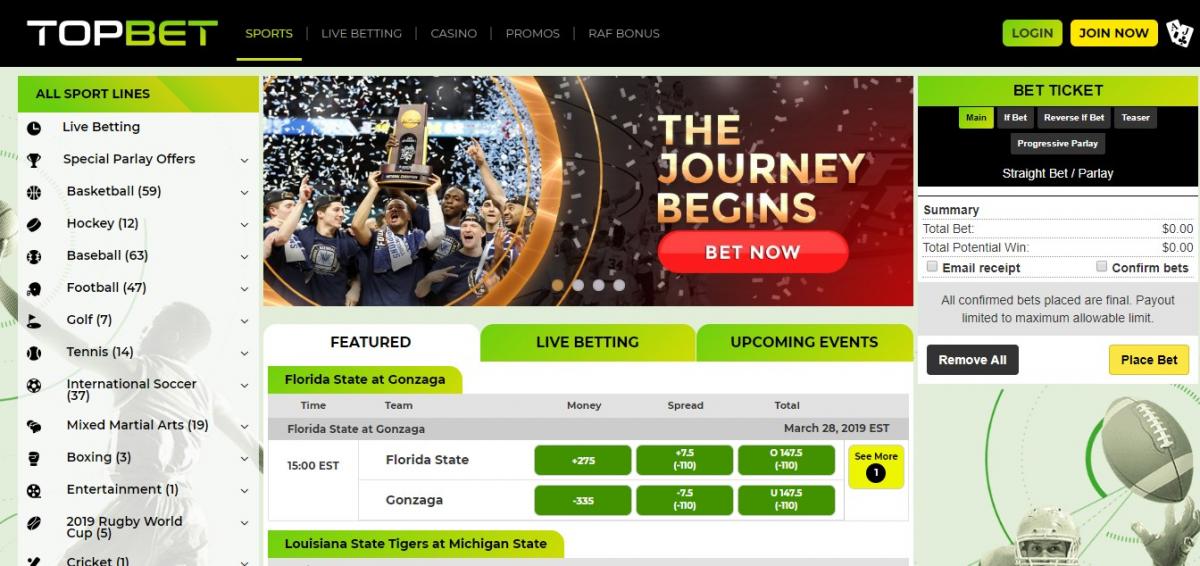

Learn how to spread bet with Capital.com . Follow our step-by-step spread betting guide covering everything you need to know from opening an account to making your first bet. Read the detailed examples and build your own spread betting strategy.

Financial spread betting is another popular type of derivatives trading that enables traders to speculate on a wide range of markets, including forex , shares , commodities and indices . A tax-free derivative product, spread betting is available for residents of the UK and Ireland.

As with CFD trading , when you spread bet, you decide whether the price of an asset is likely to go up or down and take a long or a short position accordingly. Spread betting is flexible as you can potentially profit from rising or falling markets.

Having downloaded the Capital.com AI-powered app you get a trusted spread-betting partner ensuring you get the ultimate trading experience. At Capital.com you can open an account in just a few minutes.

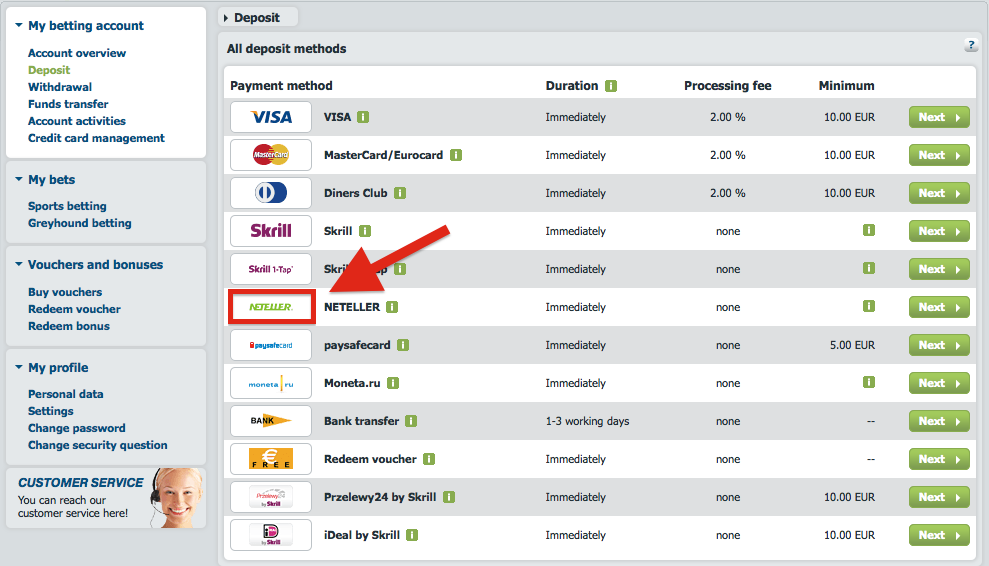

Verify your identity, make an initial deposit with a credit/debit card or via bank transfer, and voilá – you are good to open your first trade.

Getting deeper into trading you’ll encounter various spread betting strategies. Although you may find them effective, only practice will show what works best for you. Building a trading plan, you will have to develop your own approach, considering the following parameters:

Some of the benefits of making your own trading strategy is to eliminate emotional trades and add a clear structure to your decision-making process.

Capital.com spread betting app gives you access to more than 2,000 popular markets, including forex, stocks, indices, commodities and cryptocurrencies.

There is an AI-powered newsfeed full of analytical articles and info-rich videos, earnings reports and IPO announcements; an economic calendar with a full schedule of global economic events that could move markets and may help you find your next trade.

Advanced charts, drawing tools and 70+ technical indicators will enable you to conduct a thorough technical analysis of the selected market and spot the best levels to enter and exit trades.

Effective risk management tools, including instant price alerts, stop-loss and take profit orders, and negative balance protection will help you to protect your capital and minimise risks.

Once you have chosen the market you would like to trade today, you will have to decide which direction to choose. Whether you believe the price is going to go up and open a long position (Buy), or you think the price will go down and take a short position (Sell).

To open a spread bet you also need to define the size of your position. In spread betting, the amount you want to bet per point of the asset’s price movement is your stake.

Please, never forget to manage your risk before entering the market. Remember that many traders feel it is important to place stop-loss and take-profit orders to reduce the risks associated with derivatives trading.

When you feel ready, open a short or a long position on the chosen market. Track the performance of your trade to close it in profit, or with a minimum loss if the market turns against you.

How to spread bet in practice? Let’s take a closer look at spread betting trading through several examples with different outcomes for traders.

In our example, Sainsbury's stock (SBRY) is trading at 202.7/203.5, where 202.7 is the sell price and 203.5 is the buy price. The spread in this example is 0.8.

Spread betting trades on the Sainsbury’s stock are executed in £x per penny price movement.

For example, if the SBRY price moves up or down by 50 pence (50 points) you would make or lose 50x your stake depending on whether you had sold or bought to open the position.

Let’s say you believe that the Sainsbury’s stock’s price will appreciate and decide to open a buy position – going long at £10 per point. Let’s assume that the margin rate for Sainsbury is 20 percent. This means you will deposit only 20 percent of the full trade’s value. In this example the total position is £10 x 203.5, which gives an overall exposure to Sainsbury's of £2,035.50. Position margin will be 20% of this amount, which means that £407.10 will be allocated from your account against this trade.

Assuming your prediction was correct and the Sainsbury’s shares jump sharply in value in the next couple of days to 253.5/254.3, you decide to exit your buy bet by selling at 253.5, which is the new sell price.

In this case the price has moved in your favour by 50 points (253.5 – 203.5), which means your profit will be £500 (50 x £10).

Unfortunately, in spread betting like in any other type of trading, you can’t always be right. Losses are an inevitable part of trading and your goal is to minimise the risks by developing an effective risk management strategy.

Looking back at our example, let’s assume your buying spread bet was incorrect. Instead of rallying further, Sainsbury’s stock went down by 50 points to 153.5/154.3. To exit your trade you decide to close it by exiting at the sell price of 153.5.

The market moved against you by 50 points (203.5 - 153.5). In this case you will bear a loss of £500 (50 x £10).

If you want to spread bet on indices, you could choose the UK 100. Let’s assume it is trading at 5653/5654. You believe the index price will go down and decide to open a sell position on the UK 100 at £5 per point.

If your forecast is right and the price falls down to 5602/5603, you may decide to close your sell bet by buying at 5603.

In this case the price moved 50 points (5653-5603) in your favour. To calculate your profit you should multiply your stake by the number of points. The profit from this trade will be £250 (£5 x 50).

If your prognosis is wrong and the price of the UK 100 index goes up, you will make a loss. Let’s assume the price reaches 5702/5703 and you feel that the price will continue to rise. To limit your loss, you decide to close the trade by buying at 5703, which is the new buy price.

In this case the price moves 50 points (5703-5653) against you, which means a loss of £250(£5 x 50).

The stop-loss order is the number-one risk management tool to prevent the market from moving against you too far. Many traders view it as absolutely essential, as markets can move very sharply. If you can’t constantly follow markets, the stop-loss and take-profit orders can give you some freedom and confidence to manage your profits and losses.

Once you have opened a spread bet, you can watch its performance and the possible profit or loss in real time. You can exit the trade any time the market is open. When you tap the “close” button your order is executed and your profit or loss is reflected on your account balance. Try how to spread bet in practice, and learn more about its benefits, with Capital.com .

*Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Historic Bitcoin price drop Don't miss your trading opportunities

Start trading global markets by creating an account

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read our Risk Disclosure statement .

Risk warning: transactions with non-deliverable over-the-counter instruments are a risky activity and can bring not only profit but also losses. The size of the potential loss is limited to the size of the deposit. Past profits do not guarantee future profits. Use the training services of our company to understand the risks before you start operations.

Capital Com (UK) Limited is registered in England and Wales with company registration number 10506220. Authorised and regulated by the Financial Conduct Authority (FCA), under register number 793714. Capital Com SV Investments Limited is regulated by Cyprus Securities and Exchange Commission (CySEC) under license number 319/17. Capital Com SV Investments Limited, company Registration Number: 354252, registered address: 28 Octovriou 237, Lophitis Business Center II, 6th floor, 3035, Limassol, Cyprus.

Closed joint-stock company “Capital Com Bel” is regulated by National Bank of the Republic of Belarus, registered by Minsk city executive committee 19.03.2019 with company registration number 193225654. Address: 220030, the Republic of Belarus, Minsk, Internatsionalnaya street 36/1, office 823. Certificate of inclusion in the register of forex companies No. 16 dated 16.04.2019.

What is Spread Betting and How Does it Work? | CMC Markets

How to spread bet | Capital.com | Learn how to spread bet

Spread betting - Wikipedia

How to Spread Bet | Learn Spread Betting | City Index UK

What Is Spread Betting ?

From Wikipedia, the free encyclopedia

^ The Sunday Times : "World Cup to kick off boom in spread betting"

^ "The perils of spread-betting" . The Times . Sep 20, 2007. Archived from the original on July 19, 2008.

^ "Gambling Commission - Home" . www.gamblingcommission.gov.uk .

^ Gambling Times: What are the Odds? Archived 2011-02-04 at the Wayback Machine

^ The Sunday Times: Spread betting

^ "Income Tax – Assessable income derivation of income – spread betting" . Australian Government ATO. 3 March 2010 . Retrieved 26 January 2011 .

^ Budworth, David. "Spread-betting fails investors in trouble" . thetimes.co.uk . Retrieved 11 October 2013 .

^ Pfanner, Eric. "Spread-bets on Cup venture into bizarre - Technology - International Herald Tribune" . The New York Times . Retrieved 11 October 2013 .

^ Rayman, Richard. "White Paper on Spread Betting" (PDF) . Cass Business School . Retrieved 11 October 2013 .

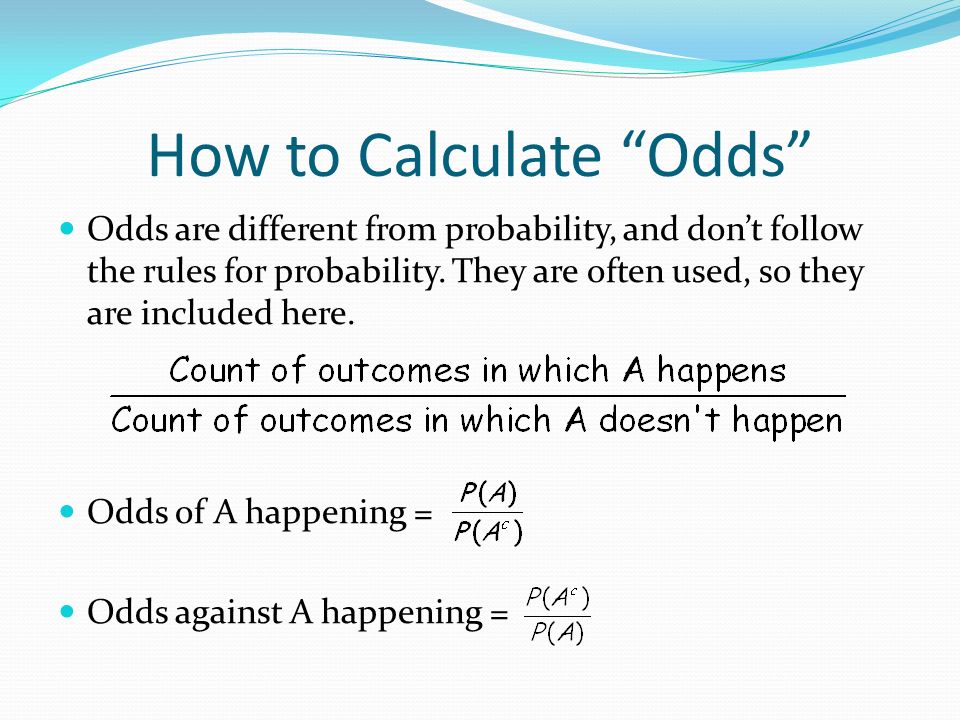

Spread betting is any of various types of wagering on the outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple "win or lose" outcome, such as fixed-odds (or money-line) betting or parimutuel betting .

A spread is a range of outcomes and the bet is whether the outcome will be above or below the spread. Spread betting has been a major growth market in the UK in recent years, with the number of gamblers heading towards one million. [1] Financial spread betting (see below) can carry a high level of risk if there is no "stop". [2] In the UK, spread betting is regulated by the Financial Conduct Authority rather than the Gambling Commission . [3]

The general purpose of spread betting is to create an active market for both sides of a binary wager , even if the outcome of an event may appear prima facie to be biased towards one side or the other. In a sporting event a strong team may be matched up against a historically weaker team; almost every game has a favorite and an underdog . If the wager is simply "Will the favorite win?", more bets are likely to be made for the favorite, possibly to such an extent that there would be very few betters willing to take the underdog.

The point spread is essentially a handicap towards the underdog. The wager becomes "Will the favorite win by more than the point spread?" The point spread can be moved to any level to create an equal number of participants on each side of the wager. This allows a bookmaker to act as a market maker by accepting wagers on both sides of the spread. The bookmaker charges a commission , or vigorish , and acts as the counterparty for each participant. As long as the total amount wagered on each side is roughly equal, the bookmaker is unconcerned with the actual outcome; profits instead come from the commissions.

Because the spread is intended to create an equal number of wagers on either side, the implied probability is 50% for both sides of the wager. To profit, the bookmaker must pay one side (or both sides) less than this notional amount. In practice, spreads may be perceived as slightly favoring one side, and bookmakers often revise their odds to manage their event risk.

One important assumption is that to be credited with a win, either team only needs to win by the minimum of the rules of the game, without regard to the margin of victory. This implies that teams in a winning position will not necessarily try to extend their margin—and more importantly, each team is only playing to win rather than to beat the point spread. This assumption does not necessarily hold in all situations. For example, at the end of a season, the total points scored by a team can affect future events such as playoff seeding and positioning for the amateur draft, and teams may "run up" the score in such situations. In virtually all sports, players and other on-field contributors are forbidden from being involved in sports betting and thus have no incentive to consider the point spread during play; any attempt to manipulate the outcome of a game for gambling purposes would be considered match fixing , and the penalty is typically a lifetime banishment from the sport; such is the lack of tolerance for manipulating the result of a sporting event for such purposes.

Spread betting was invented by Charles K. McNeil , a mathematics teacher from Connecticut who became a bookmaker in Chicago in the 1940s. [4] In North America , the gambler usually wagers that the difference between the scores of two teams will be less than or greater than the value specified by the bookmaker , with even money for either option. An example:

Spreads are frequently, though not always, specified in half-point fractions to eliminate the possibility of a tie, known as a push . In the event of a push, the game is considered no action , and no money is won or lost. However, this is not a desirable outcome for the sports book, as they are forced to refund every bet, and although both the book and its bettors will be even, if the cost of overhead is taken into account, the book has actually lost money by taking bets on the event. Sports books are generally permitted to state "ties win" or "ties lose" to avoid the necessity of refunding every bet.

Betting on sporting events has long been the most popular form of spread betting. Whilst most bets the casino offers to players have a built in house edge, betting on the spread offers an opportunity for the astute gambler. When a casino accepts a spread bet, it gives the player the odds of 10 to 11, or -110. That means that for every 11 dollars the player wagers, the player will win 10, slightly lower than an even money bet. If team A is playing team B, the casino is not concerned with who wins the game; they are only concerned with taking an equal amount of money of both sides. For example, if one player takes team A and the other takes team B and each wager $110 to win $100, it doesn't matter what team wins; the casino makes money. They take $100 of the $110 from the losing bet and pay the winner, keeping the extra $10 for themselves. This is the house edge. The goal of the casino is to set a line that encourages an equal amount of action on both sides, thereby guaranteeing a profit. This also explains how money can be made by the astute gambler. If casinos set lines to encourage an equal amount of money on both sides, it sets them based on the public perception of the team, not necessarily the real strength of the teams. Many things can affect public perception, which moves the line away from what the real line should be. This gap between the Vegas line, the real line, and differences between other sports books betting lines and spreads is where value can be found.

A teaser is a bet that alters the spread in the gambler's favor by a predetermined margin – in American football the teaser margin is often six points. For example, if the line is 3.5 points and bettors want to place a teaser bet on the underdog, they take 9.5 points instead; a teaser bet on the favorite would mean that the gambler takes 2.5 points instead of having to give the 3.5. In return for the additional points, the payout if the gambler wins is less than even money , or the gambler must wager on more than one event and both events must win. In this way it is very similar to a parlay . At some establishments, the "reverse teaser" also exists, which alters the spread against the gambler, who gets paid at more than evens if the bet wins.

In the United Kingdom , sports spread betting became popular in the late 1980s by offering an alternative form of sports wagering to traditional fixed odds , or fixed-risk, betting. With fixed odds betting , a gambler places a fixed-risk stake on stated fractional or decimal odds on the outcome of a sporting event that would give a known return for that outcome occurring or a known loss if that outcome doesn't occur (the initial stake). With sports spread betting, gamblers are instead betting on whether a specified outcome in a sports event will end up being above or below a ‘spread’ offered by a sports spread betting firm, with profits or losses determined by how much above or below the spread the final outcome finishes at.

The spread on offer will refer to the betting firm's prediction on the range of a final outcome for a particular occurrence in a sports event, e.g., the total number of goals to be scored in a football (US: soccer) match, the number of runs to be scored by a team in a cricket match or the number of lengths between the winner and second-placed finisher in a horse race.

The gambler can elect to ‘buy’ or ‘sell’ on the spread depending on whether they think the final outcome will be higher than the top end of the spread on offer, or lower than the bottom end of the spread. The more right the gambler is then the more they will win, but the more wrong they are then the more they can lose.

The level of the gambler's profit or loss will be determined by the stake size selected for the bet, multiplied by the number of unit points above or below the gambler's bet level. This reflects the fundamental difference between sports spread betting and fixed odds sports betting in that both the level of winnings and level of losses are not fixed and can end up being many multiples of the original stake size selected.

For example, in a cricket match a sports spread betting firm may list the spread of a team's predicted runs at 340 – 350. The gambler can elect to ‘buy’ at 350 if they think the team will score more than 350 runs in total, or sell at 340 if they think the team will score less than 340. If the gambler elects to buy at 350 and the team scores 400 runs in total, the gambler will have won 50 unit points multiplied by their initial stake. But if the team only scores 300 runs then the gambler will have lost 50 unit points multiplied by their initial stake.

It is important to note the difference between spreads in sports wagering in the U.S. and sports spread betting in the UK. In the U.S. betting on the spread is effectively still a fixed risk bet on a line offered by the bookmaker with a known return if the gambler correctly bets with either the underdog or the favourite on the line offered and a known loss if the gambler incorrectly bets on the line. In the UK betting above or below the spread does not have a known final profit or loss, with these figures determined by the number of unit points the level of the final outcome ends up being either above or below the spread, multiplied by the stake chosen by the gambler.

For UK spread betting firms, any final outcome that finishes in the middle of the spread will result in profits from both sides of the book as both buyers and sellers will have ended up making unit point losses. So in the example above, if the cricket team ended up scoring 345 runs both buyers at 350 and sellers at 340 would have ended up with losses of five unit points multiplied by their stake.

In addition to the spread bet, a very common "side bet" on an event is the total (commonly called the over/under or O/U ) bet. This is a bet on the total number of points scored by both teams. Suppose team A is playing team B and the total is set at 44.5 points. If the final score is team A 24, team B 17, the total is 41 and bettors who took the under will win. If the final score is team A 30, team B 31, the total is 61 and bettors who took the over will win. The total is popular because it allows gamblers to bet on their overall perception of the game (e.g., a high-scoring offensive show or a defensive battle) without needing to pick the actual winner.

In the UK, these bets are sometimes called spread bets, but rather than a simple win/loss, the bet pays more or less depending on how far from the spread the final result is.

Example: In a football match the bookmaker believes that 12 or 13 corners will occur, thus the spread is set at 12–13.

In North American sports betting many of these wagers would be classified as over-under (or, more commonly today, total ) bets rather than spread bets. However, these are for one side or another of a total only, and do not increase the amount won or lost as the actual moves away from the bookmaker's prediction. Instead, over-under or total bets are handled much like point-spread bets on a team, with the usual 10/11 (4.55%) commission applied. Many Nevada sports books allow these bets in parlays , just like team point spread bets. This makes it possible to bet, for instance, team A and the over , and be paid if both

(Such parlays usually pay off at odds of 13:5 with no commission charge, just as a standard two-team parlay would.)

The mathematical analysis of spreads and spread betting is a large and growing subject. For example, sports that have simple 1-point scoring systems ( e.g., baseball , hockey , and soccer ) may be analysed using Poisson and Skellam statistics.

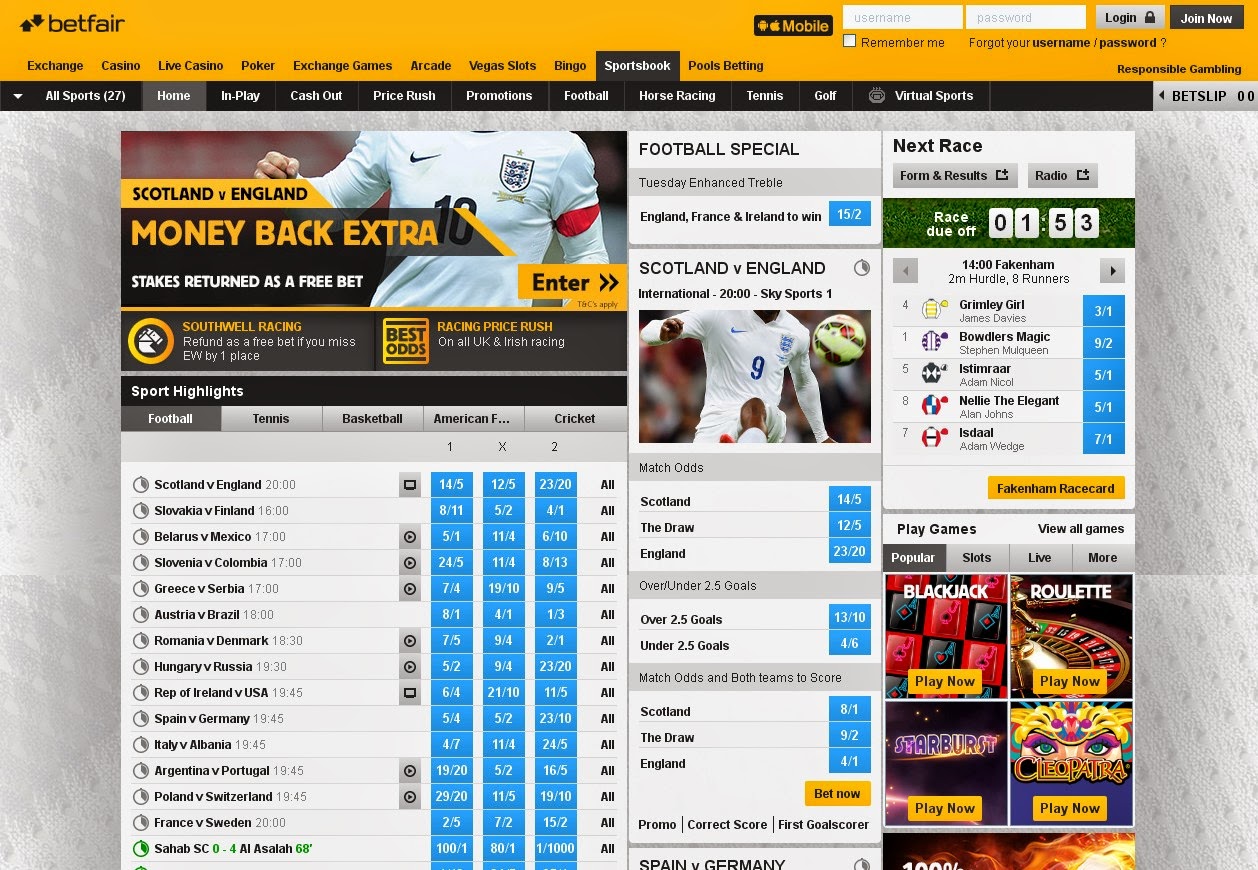

By far the largest part of the official market in the UK concerns financial instruments; the leading spread-betting companies make most of their revenues from financial markets, their sports operations being much less significant. Financial spread betting in the United Kingdom closely resembles the futures and options markets, the major differences being

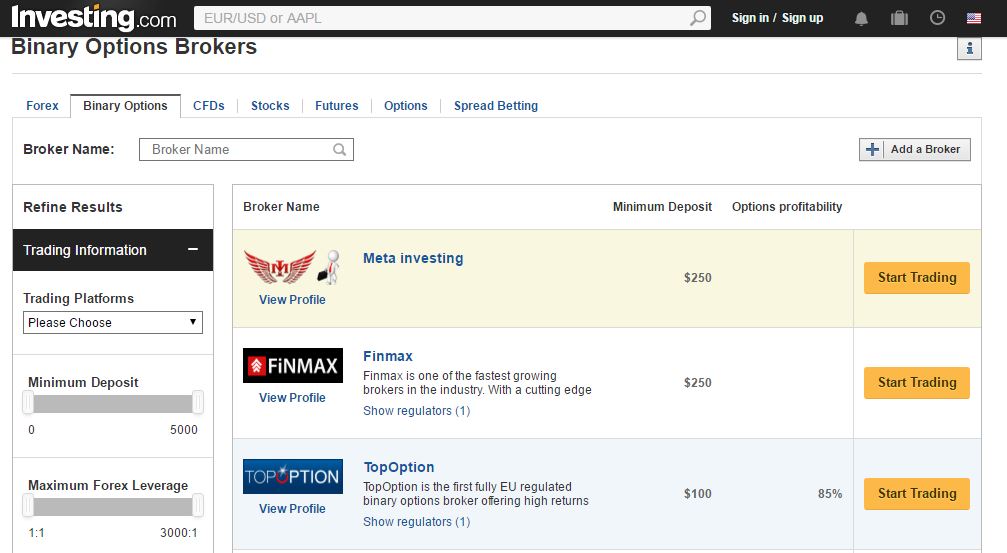

Financial spread betting is a way to speculate on financial markets in the same way as trading a number of derivatives . In particular, the financial derivative Contract for difference (CFD) mirrors the spread bet in many ways. In fact, a number of financial derivative trading companies offer both financial spread bets and CFDs in parallel using the same trading platform.

Unlike fixed-odds betting, the amount won or lost can be unlimited as there is no single stake to limit any loss. However, it is usually possible to negotiate limits with the bookmaker:

Spread betting has moved outside the ambit of sport and financial markets (that is, those dealing solely with share, bonds and derivatives), to cover a wide range of markets, such as house prices. [5] By paying attention to the external factors, such as weather and time of day, those who are betting using a point spread can be better prepared when it comes to obtaining a favorable outcome. Additionally, by avoiding the favourite-longshot bias , where the expected returns on bets placed at shorter odds exceed that of bets placed at the longer odds, and not betting with one's favorite team, but rather with the team that has been shown to be better when playing in a specific weather condition and time of day, the possibility of arriving at a positive outcome is increased.

In the UK and some other European countries the profit from spread betting is free from tax. The tax authorities of these countries designate financial spread betting as gambling and not investing, meaning it is free from capital gains tax and stamp duty , despite the fact that it is regulated as a financial product by the Financial Conduct Authority in the UK. Most traders are also not liable for income tax unless they rely solely on their profits from financial spread betting to support themselves. The popularity of financial spread betting in the UK and some other European countries, compared to trading other speculative financial instruments such as CFDs and futures is partly due to this tax advantage. However, this also means any losses cannot be offset against future earnings for tax calculations.

Conversely, in most other countries financial spread betting income is considered taxable. For example, the Australian Tax Office issued a decision in March 2010 saying "Yes, the gains from financial spread betting are assessable income under section 6-5 or section 15-15 of the ITAA 1997". [6] Similarly, any losses on the spread betting contracts are deductible. This has resulted in a much lower interest in financial spread betting in those countries.

Suppose Lloyds Bank is trading on the market at 410p bid, and 411p offer. A spread-betting company is also offering 410-411p. We use cash bets with no definite expiry , or "rolling daily bets" as they are referred to by the spread betting companies.

If I think the share price is going to go up, I might bet £10 a point ( i.e., £10 per penny the shares moves) at 411p. We use the offer price since I am "buying" the share (betting on its increase). Note that my total loss (if Lloyds Bank went to 0p) could be up to £4110, so this is as risky as buying 1000 of the shares normally.

If a bet goes overnight, the bettor is charged a financing cost (or receives it, if the bettor is shorting the stock). This might be set at LIBOR + a certain percentage , usually around 2-3%.

Thus, in the example, if Lloyds Bank are trading at 411p, then for every day I keep the bet open I am charged [taking finance cost to be 7%] ((411p x 10) * 7% / 365 ) = £0.78821 (or 78.8p)

On top of this, the bettor needs an amount as collateral in the spread-betting account to cover potential losses. Usually this is either 5 or 10% of the total exposure you are taking on but can go up to 100% on illiquid stocks. In this case £4110 * 0.1 or 0.05 = £411.00 or £205.50

If at the end of the bet Lloyds Bank traded at 400-401p, I need to cover that £4110 – £400*10 (£4000) = £110 difference by putting extra deposit (or collateral) into the account.

The punter usually receives all dividends and other corporate adjustments in the financing charge each night. For example, suppose Lloyds Bank goes ex-dividend with dividend of 23.5p. The bettor receives that amount. The exact amount received varies depending on the rules and policies of the spread betting company, and the taxes that are normally charged in the home tax country of the shares.

According to an article in The Times dated 10 April 2009, approximately 30,000 spread bet accounts were opened in the previous year, and that the largest study of gambling in the UK on behalf of the Gambling Commission found that serious problems developed in almost 15% of spread betters compared to 1% of other gambling. [7] A report from Cass Business School found that only 1 in 5 gamblers ends up a winner. [8] As noted in the report, this corresponds to the same ratio of successful gamblers in regular trading. [9] Evidence from spread betting firms themselves actually put this closer to being 1 in 10 traders as being profitable. [ citation needed ]

Peeing Free

Ass Watch

Mature Nylon Pics

Porn Sleeping Creampie Compilation

Scroller Overwatch