L-Pesa blockchaine platform financial technology for africa!

@HiddenFist

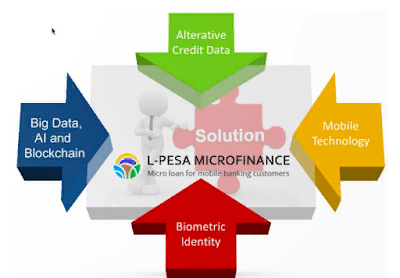

L-Pesa creates blockchain-based, smart contract loans enabling people across the internet to grow their businesses and become thriving entrepreneurs. Hopeful visionaries can take loans in Ether or Bitcoin and then participate in L-Pesa’s curated marketplace facilitating peer-to-peer lending: the first crypto loan service in Africa. L- Pesa is a company that has validated its operation model over the last 18 months and has built advanced technology, automating most operations. about 25%. There are four important market forces gathered for scaling. Among them are Big Data, Artificial Intelligence and Blockchain, alternative credit data, mobile technology, biometric identity. However, traditional microfinance has limited reach, and the solution is targeted to poor farmers and small business owners. The middle class consumers and business owners in developing countries can not apply for credit, but the current financial infrastructure in these countries

L-Pesa is based in Delaware and is a microfinance institution based on the idea that by affecting the increasing penetration of mobile phones, large data extensions and mobile technology in In developing markets, they can easily reach a significant number of mobile users who need immediate microloans who have never been eligible for a loan. borrow. Whether these mobile users request for a personal loan, business, or group, all are available through mobile phones. A L-Pesa user pays a timely loan and has a good credit history that can take advantage of higher loans at lower interest rates. L-Pesa brilliant idea has changed many lives.

L-Pesa - Growth of the Company

Like all business trips, there are triumphs and sorrows along the way. Today, L-Pesa is operating in two countries with an increasing number of customers over 150,000. The dream continues to expand as they plan to open branches in Uganda and India in the short term and expand across Africa and Asia in the long run.

There is no doubt that the need for affordable loans in developing countries is enormous.

About 4 billion people living in developing countries and emerging economies do not have basic financial services such as credit, savings and insurance, according to one Rabobank study. To reach this core group, not only a company needs solid infrastructure, but also access to funds. It is not saying that unsecured loans are a risky business venture that needs an appetite for risk but with the right strategy in place, the losses can be substantially mitigated and risky. can be overwhelmed enjoy.

Since L-Pesa has been launched, in Tanzania (2016) and Kenya (2017), they have issued more than 25,000 unsecured loans. For both countries, the refund rate was above 90%. The painful part is that the amount of loan issuance can be much higher if they have enough money to meet their needs and enough staff to handle loan applications for customers without a credit history. They can help life more. The bottom line is that even if our customers need reinforcement, we need a simple push to reach them.

Solution

Large Data, Artificial Intelligence, and Blockchain The new tool enables the storage of large amounts of data and extensive data analysis at a fraction of the cost some years ago.

Advances in Artificial Intelligence provide a new opportunity for automated loan underwriting. Blockchain technology allows for faster, more secure, and

exchange rate is cheaper. Blockchain technology has just begun to revolutionize financial services and will result in enormous efficiencies over the next ten years - the blockchain has been described

as internet money and will do for internet financial services for information and

trading.

Alternative Data Credits. Just a decade ago, there was little data available in most people in the world. This has changed with the emergence of social media and related trends of new tools that have been developed to make this data useful for decision making in underwriting loans. L-Pesa has developed a unique exclusive credit with

a model based on user behavior combined with traditional and alternative credit data. L-Pesa competitors have developed their own proprietary models. The experience over the next decade will lead to revise best practices, which ultimately become the industry standard.

Mobile technology. The rise of mobile phones over the past two years has been one of the most profound, technological and market changes in human history. Most humans now have mobile phones, and many own-owned smartphones. Mobile financial services such as M-Pesa have been available in many countries and support both banked and unencumbered populations. Based on market penetration of mobile phones (smartphones and feature phones), mobile money services like M-Pesa, Tigo Pesa and Paytm have very fast growth and have enabled L-Pesa.

Biometric identity. Traditional microfinance relies heavily on large branch networks since identity verification, online and directly. India's Aadhaar biometric ID system leads

world and has registered 99% of India's 1.2 billion people. Other countries that are expected to successfully follow India for the implementation of biometric ID will be generated dramatically reducing the cost and ability to provide financial services without a physical branch of the network.

Target market

The L-Pesa market target is a market of 40% of the population in the continent of Africa, India and southeast Asia. Its population is 3 billion and the population is growing very fast. India

is at 92% penetration and many African countries are above 70%. L-Pesa

work on smartphones and feature phones. L-Pesa relies on mobile money service providers for liquefaction and collection, making the process quick and efficient. Many countries were initially targeted by L-Pesa to have a high proportion of un-banked service populations

on mobile money like M-Pesa is a good choice. India has a higher level

percentage of population with bank account, and Aadhaar biometric ID

The database is now connected to the bank account, making the disbursement and

Collections in India are potentially very efficient in the near future.

Dependency on African money service users restricts L-Pesa users

basis for users with mobile money service wallet. Until mid-2017, there

about 170 million wallets are used in Africa. In India, more than 1 billion

Aadhaar users have connected their bank account.

The available L-Pesa market will far exceed L-Pesa's loan capacity

and all its competitors in the future. Limiting factor for

Growth is not expected to users will want to try L-Pesa but vice versa

availability of capital for loans.

L-Pesa Service System

The key business model of L-Pesa is:

● A highly automated back office system that allows virtually complete task automation tasks

● Integration with mobile money providers to obtain efficient loans

disbursement and collection of payments.

● The process of loan origination is very efficient - fully online and almost

fully automatic

● Model of customized credit rating that has been adjusted

The first 35,000 loans issued by L-Pesa resulted in a loss ratio below 10%.

Advantages

L-Pesa customers have access to affordable financing options

helping them improve their lives

Provider of third party capital L-Pesa may use its capital

get interesting results

Shareholders and employees of L-Pesa can obtain reasonable returns on their investment and workforce

L-Pesa ICO

Now, L-Pesa is trying to raise $ 25 million with an ICO. They believe ICO is the future for startups as they are refurbished and provide overall transparency. Do you want anything else? Better still, their customers will have the opportunity to own a part of the company and hopefully one day take part in the profit generated.

L-Pesa believes that their token, The L-Pesa Coin, will receive widespread acceptance as it is the only cryptosystem that can simultaneously address a problem in the world. In fact, they have called it "Bitcoin of Africa". They did not need a crystal ball to imagine the time when L-Pesa Coin would be chosen as the African cryptocurrency from Capetown to Cairo.

L-Pesa to create a world where L-Pesa Coin will not only be used as a medium of exchange, but also to provide Africa's advanced crypto peer-to-peer lending platform.

L-Pesa may be your way to stop talking about changing the world and starting to work. L-Pesa ICO is proceeding as smoothly and openly as possible and their super heroes are committed to bringing the best results for businesses, investors and developing countries.

L-Pesa Conclusion

I am very interested in this ICO on a personal level. I have made many trips to underdeveloped countries. This could really be Bitcoin of Africa and beyond.

I really like what L-Pesa has to say about how it can empower people who have not been liberated in the developing world.

You have a lot of time to do your work. Join the telegram group. Ask question. Do homework. I always say. Never go into anything blind and always do good through research until you are very comfortable with your investment.

L-Pesa's website has a lot of information. I would really suggest you set up a free account and take a good look around. I am sure it will answer any questions you may have. I will personally invest with L-Pesa. I evaluate this project to 8 out of 10 points.

Website: https://kriptonofafrica.com/

White Paper: https://kriptonofafrica.com/static/pdfs/L-Pesa%20ICO%20white%20paper%202018.pdf

Telegram: https://t.me/lpesaICO

https://bitcointalk.org/index.php?action=profile;u=1092445;sa=summary

Author: HiddenFist

https://bitcointalk.org/index.php?action=profile;u=1178847