Karatcoin: The decentralized Gold Mining Industry

Ever-young

Gold mining is one of the most lucrative business all over the world. buying and selling of financial products related to gold cannot be easier, faster, transparent, convenient and reliable without a decentralized gold mining platform. Gold miners are extremely uncomfortable with most of the challenging problems they are encountering in other gold mining industries such as follows;

· Difficulty in finding gold on the market

The demand is increasing and due to various factors, the gold mines cannot guarantee the necessary supply, especially for big orders.

· Bond value

In the centralized market, the bond right now is like a speedometer that is badly calibrated and therefore unreliable. It may be less useful than usual, and is not to be interpreted literally, but it’s still telling us something. And that something is that we should be worried about the possibility the world is in a nasty deflationary economic trap that won’t get better anytime soon.

· Backers defaulting

One of the major drawbacks in a traditional debt-backed currency system is the possibility of backers defaulting on their contractual obligations.

· Holding unused gold

The majority of investors who buy gold do so in the belief that it is "the one asset which is no-one else's liability." But there is a nasty legal subtlety that causes many of them hold it in such a way as to achieve the exact opposite, and they expose themselves to a hidden risk which may, in many cases, be exactly the same risk they were trying to avoid.

KaratCoin Solutions

· Directly linked to gold mines Karatcoin’s Platform is directly linked to operational gold mines that will receive financing to help increase their gold production. The more Karatcoin’s financing increases, so will the aggregated gold production of our mines, which in turn will increase the value of circulating Karatcoin tokens. All the mines selected by Karatcoin's technical and legal team have been carefully analyzed for their production ability, operational background, structural credibility, as well as their financial rating (no intermediaries are involved in the verification process). These mines will pay the interest due with physical gold extraction (doré gold bars, gold nuggets, gold dust, etc.) which will be stored at the official refinery and turned into gold ingots on our behalf. By leaving the raw material in its place of origin and protected in an authorized vault, we will be able to minimize the costs related to transport and related taxes, thus optimizing transactions on our blockchain and allowing a more advantageous price for gold.

· Bond yield ranging from 5 to 6%

In the decentralized market of Ethereum, it’s possible to purchase Karatcoin Gold Certificates with different maturity dates and associated semi-annual coupons with a bond yield ranging from 5 to 6% depending on its duration.

· The flexibility of smart contracts Smart contracts help you exchange money, property, shares, or anything of value in a transparent, conflict-free way, while avoiding the services of a middleman. One of the advantages of using a smart contracts platform is that the process can be automated. Consequently, if the threshold of funds is not met, then all the money is returned to investors.

· Decentralized is safer and cheaper

One of the fundamentals of the entire banking industry is custody. They provide people with a safe place to keep their own money. Karatcoin is even safer because it is a decentralized and automated system. Allocated Karatcoin tokens are gold deposited under a safekeeping or custody arrangement. It is held as numbered bars, on labelled shelves. Arranging for the physical security of bullion bars requires strong vaults, wise use of technology, carefully constructed systems for security, and the monitoring and control of human factors. The safekeeping to be absolutely secure must bear the security costs, which are attributed to the legitimate owners of gold bars. These costs are an important element that determines the nature of the relationship between custody and the owner. The courts accept that payment of a fee to the custodian is powerful evidence that the relationship is a custodial one and not a deposit into an account.

What is Karatcoin?

Karatcoin is a decentralized platform that allows the buying and selling of financial products related to gold. It has split its customers into five segments.

• Gold Customers - with very low fees compared to our competitors, Karatcoin is the perfect place for any investor who wants to keep gold safe in a vault.

• Traders – Karatcoin’s platform, with its blockchain based on DPoS consensus, is the perfect environment for traders who want to diversify their portfolio with a cryptocurrency that is also a crypto-asset.

• Young Workers - The Gold Accumulation Plan (GAP) is a general financial strategy that uses the same philosophy as a common savings plan where an investor intends to build the value of his or her portfolio to a desired size.

Vision of Karatcoin

To create a people-powered new economy that focuses on decentralized financial services that ensure both stable and aggressive investments linked to market fluctuations, and which also fuel the financial collateral needed for future projects. At the same time, we will also create an ecosystem for developers to utilize Karatcoin tokens as a framework for various Ðapp developments, thus accelerating adoption of blockchain technology. The Karatcoin Project is a consultancy system that focuses on the 8 development and mining growth of carefully selected gold mining companies. Our goal is to build a platform to trade gold certificates, exchange Karatcoin tokens, as well as save and exchange currency using gold cards.

Mission of Karatcoin

Karatcoin’s Platform is directly linked to operational gold mines that will receive financing to help increase their gold production. The more Karatcoin’s financing increases, so will the aggregated gold production of our mines, which in turn will increase the value of circulating Karatcoin tokens. All the mines selected by Karatcoin's technical and legal team have been carefully analyzed for their production ability, operational background, structural credibility, as well as their financial rating (no intermediary is involved in the verification process). These mines will pay the interest due with physical gold products (doré gold bars, gold nuggets, gold dust, etc.) which will be conferred at the official refinery of origin and turned into gold ingots on our behalf. Leaving the raw material in its place of origin protected in an authorized vault will minimize the costs related to transport and related taxes, thus optimizing transactions on our blockchain and allowing a more advantageous price for gold.

features Karatcoin

Our objective is to create a groundbreaking organization that blends the centralized and decentralized worlds perfectly. Our ambition is to create a multipurpose project destined to become a major market player that embraces constant and evolutionary growth.

Market Analysis

The decentralized world is remarkably new. The birth of the blockchain dates back to 2008, but it has only evolved with real applications in the last few years (especially with Ethereum). As such, it is identified as a project still in its infancy, but with enormous development opportunities in almost every sector of the economy. But being in a continuous state of evolution and process transformation also opens the door to constant and ever greater attempts to champion any kind of idea that very rarely turns into a valid project with long-term viability. Our objective is to create a groundbreaking organization that blends the centralized and decentralized worlds perfectly. Our ambition is to create a multipurpose project destined to become a major market player that embraces constant and evolutionary growth.

Key Products

· Gold asset certificate is used for fixed revenues;

• Gold asset card is used as wallet inside the Karat Blockchain to store certificates and tokens;

• Token is used for different functions inside the Karat Blockchain.

KCG (GOLD Token) is the token used in the Karat Blockchain.

It represents 1 gram of 99.99% LBMA standard gold secured in Safehouse Vaults, which means the gold is safe from political influence and will preserve and increase its value over time.

• Cost and buyback are 100% based on LBMA price of gold.

• Each KCG represents 1 gram of gold securely stored in a specialized, fully-insured, and audited vault.

• Backed by fully allocated gold bullion in vaults.

• Gold documents are publicly available for verification.

GENERAL INFORMATION

• Karatcoin DAO Token (KCD) is a fully ERC-20 compliant Ethereum utility token and will be available in exchange for Ethereum (ETH) contributions

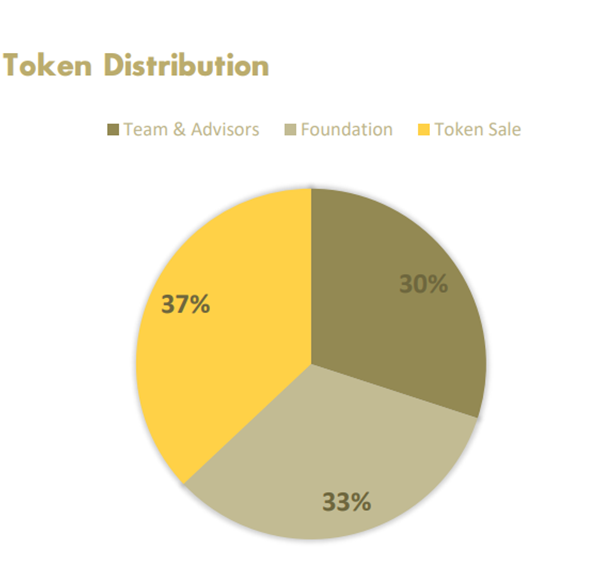

• Total number of KCD Tokens that will be generated during the distribution are 1 billion equivalents to $100,000,000.00

• Number of KCD Tokens that will be allocated for the Crowdsale are 370,000,000 KCD (37%)

• Token Crowdsale (Presale + ICO) Hard Cap: ETH in equivalent of $25,000,000.00

• Soft Cap: ETH in equivalent of $3,000,000.00

• Offered Token exchange ratio: 1 KCD = 0.1 U.S. dollars

• Contributions validation time will be communicated on the website coinmarketcap.com

For more consequential information about this exceptional project, please consult the links below.

Website: https://karatcoin.co

Whitepaper link: https://s3-eu-west-1.amazonaws.com/karatcoin.co/files/docs/KC_WP.pdf

ANN: https://bitcointalk.org / index.php? topic = 4932340

Telegram: https://t.me/KaratcoinGroup

Author's Detail:

BTC Username: Ever-young

BTC Profile Link: https://bitcointalk.org/index.php?action=profile;u=1760289