Investment Advisers: The Partners in Financial Growth

In a society where financial landscapes are continuously transforming, the position of a monetary adviser has not been more important. Whether you are merely starting your career, preparing for the future, or dealing with the intricacies of property planning, a financial planner can serve as your trusted companion in wealth building. They offer significant expertise and personalized plans that can help you achieve your monetary targets while handling the multitude of challenges that come up along the journey.

Selecting the appropriate financial adviser can substantially impact your monetary path. With various kinds of consultants available, from ethical experts who value your best interests to automated advisers that leverage tech for budget-friendly solutions, grasping the options is crucial. This piece will discuss what monetary planners do, the advantages of collaborating with them, and critical points for selecting one that aligns with your individual demands and aspirations. Whether you're in search of guidance on future preparation or looking to optimize your portfolio approach, collaborating with a skilled monetary consultant can be a life-changing action towards financial stability and success.

Comprehending Financial Consultants

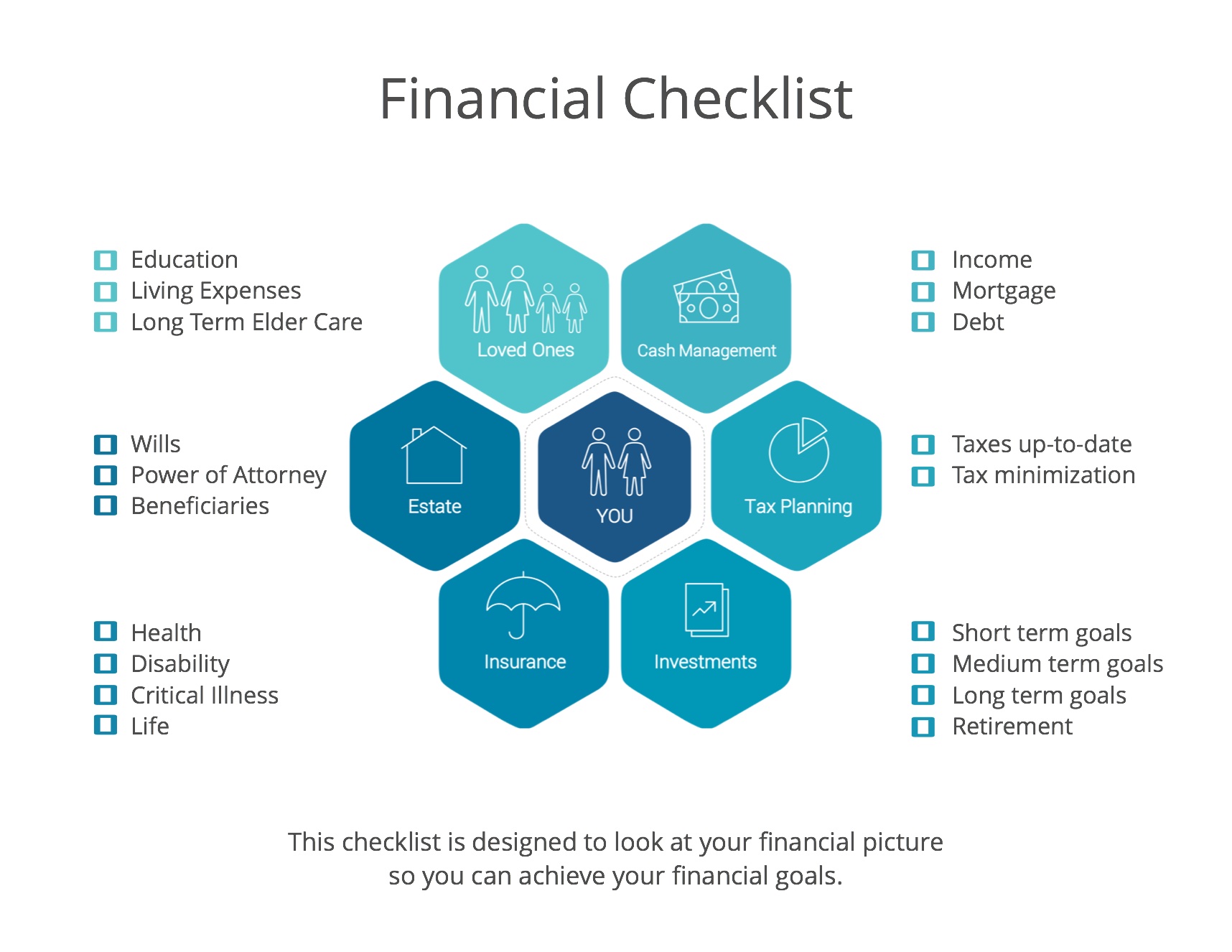

Monetary counselors serve a crucial role in helping people and companies manage their economic landscape. They deliver comprehensive guidance on a variety of financial matters, including investment strategies, retirement planning, tax optimization, and estate planning. By leveraging their knowledge, economic consultants empower clients to make knowledgeable decisions that correspond with their long-term financial goals, ultimately contributing to wealth building and monetary security.

Choosing the best financial counselor can profoundly impact one's monetary success. It is important to understand the different types of consultants available, including fiduciary consultants who are legally to act in their clients' best interests. Additionally, differentiating between monetary planners, fund advisers, and other economic experts is crucial, as each category may specialize in specific aspects of monetary management. This awareness will aid clients identify the exact support they need for their individual circumstances.

The connection between a customer and a financial counselor is established on confidence and openness. Regular communication, establishing clear monetary objectives, and remaining informed about market trends and modifications in monetary regulations are essential components of this partnership. By promoting an honest discussion, clients can more efficiently utilize their consultant's expertise and background, ensuring they receive tailored advice that guides to successful financial decision-making and increased capital accumulation.

Choosing the Proper Financial Advisor

Choosing the suitable financial adviser is a vital phase in your quest toward attaining financial goals. Begin by identifying your specific needs, whether it is pension preparation, investment management, or tax strategies. This will help you shorten down prospects who focus in the areas that are important most to you. Seek out advisors who clearly express their expertise and exhibit a sincere understanding of your financial circumstance.

Afterward, consider the qualifications of possible advisers. Examine their educational history, certifications, and experience in the industry. Many advisors hold designations such as Certified Financial Planner or CFA, which signal a greater level of expertise. https://financialmanagementcornwall.co.uk 's also crucial to verify their regulatory status and check any disciplinary actions that may affect their reputation.

Ultimately, assess the advisor's method to interacting with clients. Set up initial consultations to gauge their interpersonal style and availability. Talk about their fee arrangement, whether it's commission-based or fixed, as this can affect your overall financial strategy. Trust your gut feeling; a great financial adviser should make you feel comfortable and confident, helping you navigate complex financial choices throughout your life.

The Benefits of Partnering with a Financial Consultant

Partnering with a financial consultant grants a gateway to a vast amount of expertise and expertise that can be indispensable in managing intricate financial landscapes . Such advisers are equipped to comprehend financial tactics, market trends , and tax laws . Through harnessing their experience , clients can make wise selections that correspond to their economic aims and avoid financial mistakes . This support is crucial in times of instability, helping individuals to feel confident in their financial choices .

Another significant benefit is the personalized investment planning that a financial consultant offers. All clients has individual needs, and a tailored approach ensures that specific needs are addressed . Whether it's planning for retirement , funding education , or preparing for important life milestones, consultants create roadmaps that reflect the client's dreams. This customization helps in establishing a clear path toward reaching economic goals .

In conclusion, partnering with a financial adviser can contribute to better long-term investment performance . Advisers help clients create balanced portfolios , handle risk, and maintain discipline in their investment strategies , particularly during market volatility . By keeping a stable direction and regularly revisiting investment plans , clients are significantly more likely to achieve their financial aspirations and safeguard their financial futures .