Inflation Baked In As U.S. Money Supply Explodes

www.forbes.com - Clem Chambers

I’m not naturally a pessimist though you might be forgiven in thinking so. I was writing how sunny the future prospects were on Forbes before the coronavirus struck. That is not to say I’m not deeply pessimistic of the road ahead.

If I put my best optimistic foot forwards I can say life will go on and for most people a fair chunk of less stuff in their lives won’t make much of a difference to their net happiness. Net wealth however, is going to take a big hit.

You can never be sure that you are right and the only thing to do, therefore, is examine your thinking and all the new data that comes out with a view to falsifying your theorem or modifying it is to embrace changes of circumstances. There are plenty of unknowns that might dramatically change the model or give it detail or even upend it. I would certainly like my model to be upended. It would be great to be able to do a 180 and say, “It’s all going to blow over fast.”

Yet the more I look, the worse it gets.

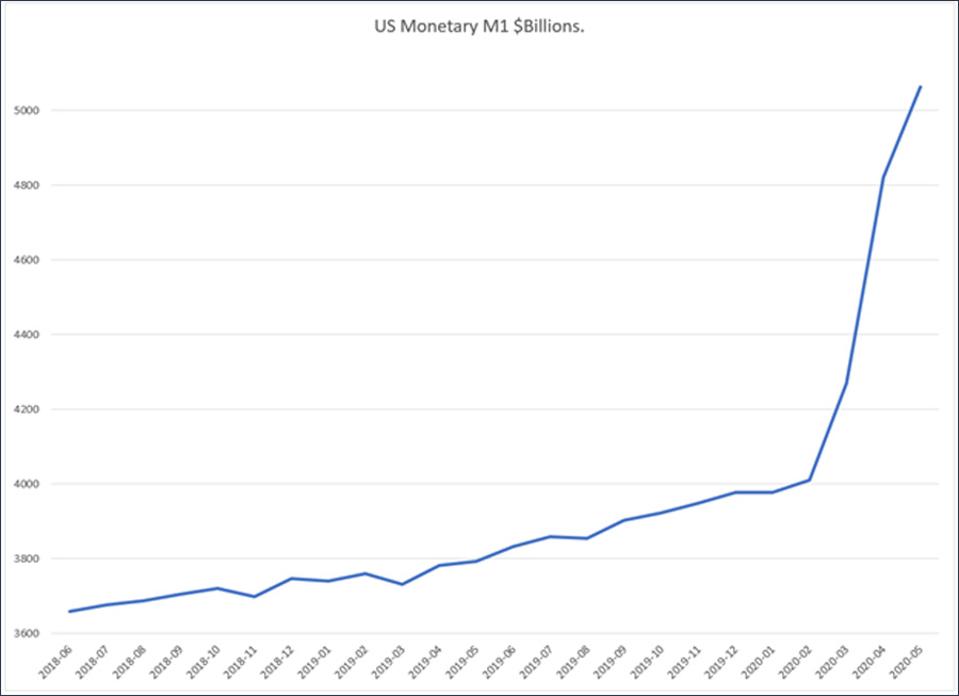

You have to love the Federal Reserve, it really doesn’t cover stuff up. When I saw this I must admit my jaw dropped:

This is the chart of it:

A 33% increase in M1 (the most liquid portions of the money supply) in the last 12 months. A 105% increase (if you annualize it) in the last three months to May. You’d say that’s a 33% inflation rate baked in, right now.

Well don’t take it from me. This is what the ECB has to say. (I love the fact they have a non-technical summary for “normal people.”) Here I cherry pick:

“While the long-run close association between the price level and the money stock is the subject of a widespread consensus in the economics profession…. The analysis also clearly indicates that, at longer horizons, broad monetary aggregates show better leading indicator properties for future inflation than narrow aggregates.”

From 2009, a less tactful take on inflation and money supply. “Over the last two centuries, the fraction of inflation’s long-run variation explained by long-run money growth has been very high, and relatively stable, in the United States, the United Kingdom and several other countries.”

And this little nugget: “The central predictions of the quantity theory are that, in the long run, money growth should be neutral in its effects on the growth rate of production, and should affect the inflation rate on a one-for-one basis. –R.E. Lucas, Jr.1”

Interestingly, this is the Kansas Federal Reserve disagreeing. It begs to differ.

There is a get out of jail free card buried in the text. If there are negative liquidity shocks, this counteracts the effect of the printing, as does a lowering in the velocity of money. So to counteract this huge pump of inflation, the Fed can QT. We saw how quantitative tightening kills the market in 2019, and a fall in the market burns trillions of wealth and takes the punch bowl away.

This we just saw in the Fed’s balance sheet. It QT’d in June 2020 to cut off the Nasdaq’s vertical rise.

The Fed’s balance sheet is the lever that the future economy, its markets and assets are dependent on. So the plan is pump, and QT dump, to keep things aloft but not too high with the dump to cut out inflation when the 30% baked in threatens to appear at the end of the pipe.

It’s a plan; it might work. Economists like to see the economy as plumbing and this model of blow and suck fits right in with that.

But there is a bug. If the Fed thinks it will be allowed to chop the semi-crippled U.S. economy off at the ankles with quantitative easing as inflation strikes, it is going to have a nasty political tussle on its hands. With either side of the aisle in the White House, trying to slam money supply in reverse to stave off a burst of inflation is not going to be politically deliverable with government budgets torn to pieces and with the Federal Reserve likely to be furiously printing to monetize government debt or shove it into proxies.

Why even worry about fixing inflation when it appears in 12 months? Better to be fighting to live another day than dead.

We all still know that the final aftermath is still developing, the economy is still set to worsen for a long time and the only improvement is the slowing down of the rate of fall.

So what is an investor to do?

The call is still, are we going to get deflation or inflation? I think inflation. As such we need only to watch these two Fed pages to get a handle of how this will pan out.

There are three assets to balance: cash, equities and gold/bitcoin. The more inflation an investor divines is coming the more value they should shunt towards the pole of gold.

- Sub-10% inflation: some cash, a bunch of stocks, a nice chunk of gold/bitcoin

- Sub-20% inflation: minimal cash, a chunk of stocks, a chunk of gold stocks, a fat chunk of gold/bitcoin

- 20%-plus inflation: Debt or if you don’t want that or can’t get the lunch money, a bit of stocks, a fat chunk of gold stocks, a lot of gold/bitcoin,

Remember, in a bubble the explanation is, “This time it’s different” and in this monetary bubble where in the past everyone would be screaming, “inflation is coming,” that’s what we are being told by the Fed.

While praying for miracles we must prepare of the alternative.

—-

Clem Chambers is the CEO of leading private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.

Source www.forbes.com