Ig Spread Betting Margin

🛑 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Ig Spread Betting Margin

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider . You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Home

Insights

Learn to trade

Learn spread betting

Calculating margins

Join a trading community committed to your success

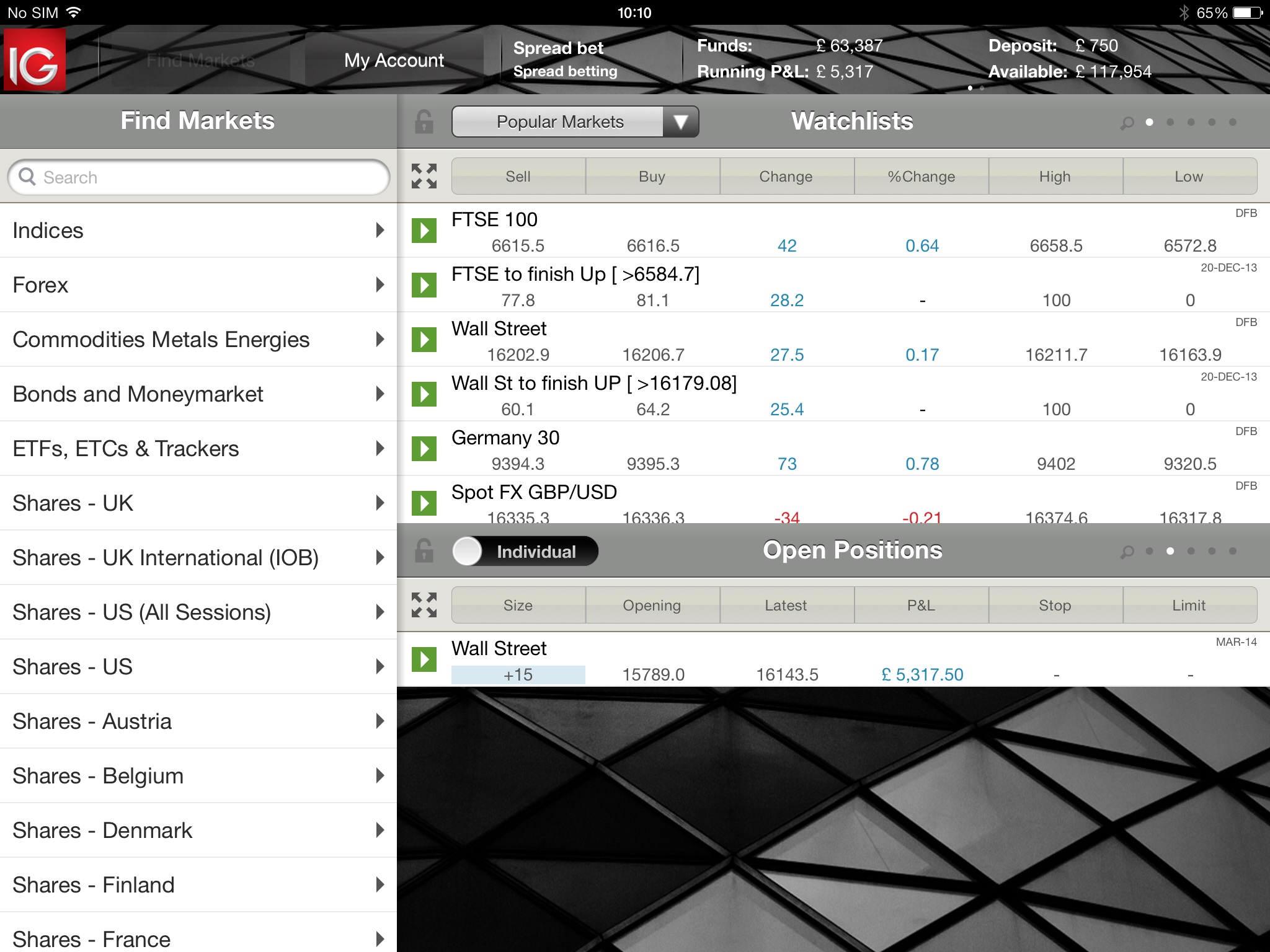

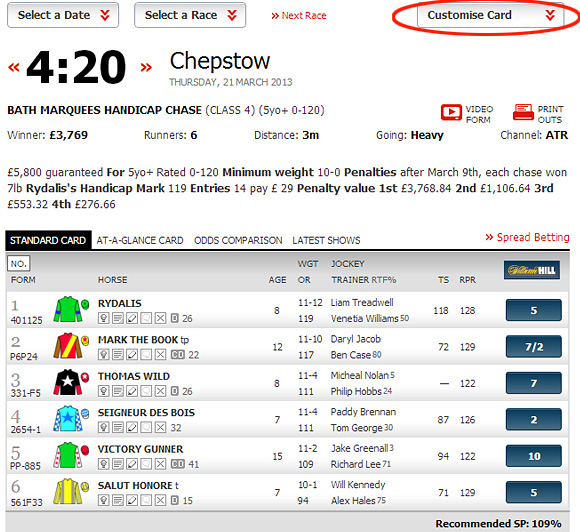

Spread betting is a leveraged product, which means you only have to place a percentage of the full trade value to open a position. For example, if you placed a spread bet on a share you would need to deposit 20% of the full trade value as the margin requirement. View our spread betting margin rates for popular markets.

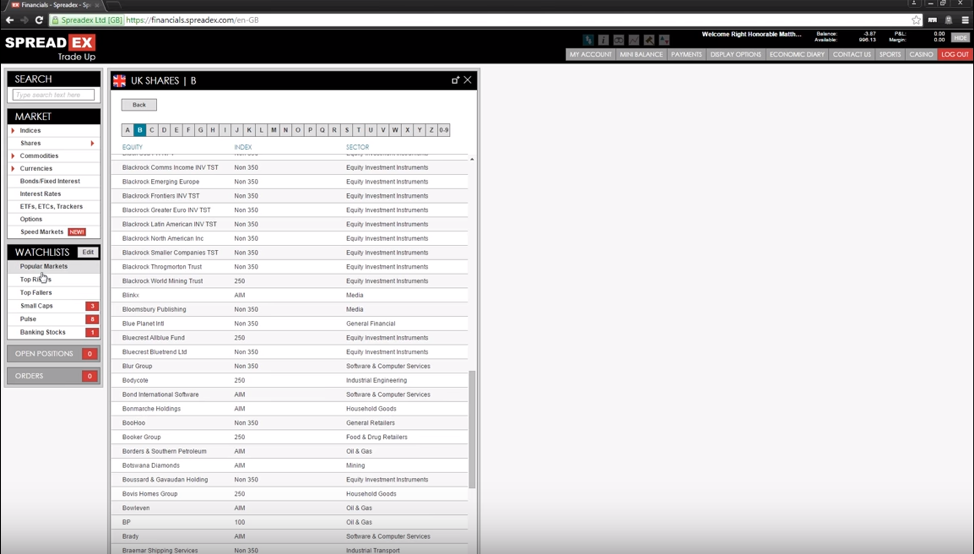

The margin you will be required to deposit reflects a percentage of the full value of the position you wish to open. We refer to this as 'position margin' on our platform. The position margin will be calculated using the applicable margin rates, as shown in the product library area on the platform.

For shares , different margin rates may apply depending on the size of your position or the tier of your position (or a portion of your position) in that instrument. The portion of the position that falls within each tier is subject to the margin rate applicable to that tier.

In order to calculate the position margin, the level 1 mid-price (shown on our trading platform ) is used.

Stake in Tier 1 x Tier 1 Margin rate

Stake in Tier 2 x Tier 2 Margin rate

The sum of: Stake in Tier 3 x Tier 3 Margin rate x level 1 mid-price x point multiplier

Stake in Tier 4 x Tier 4 Margin rate

Stake in Tier 5 x Tier 5 Margin rate

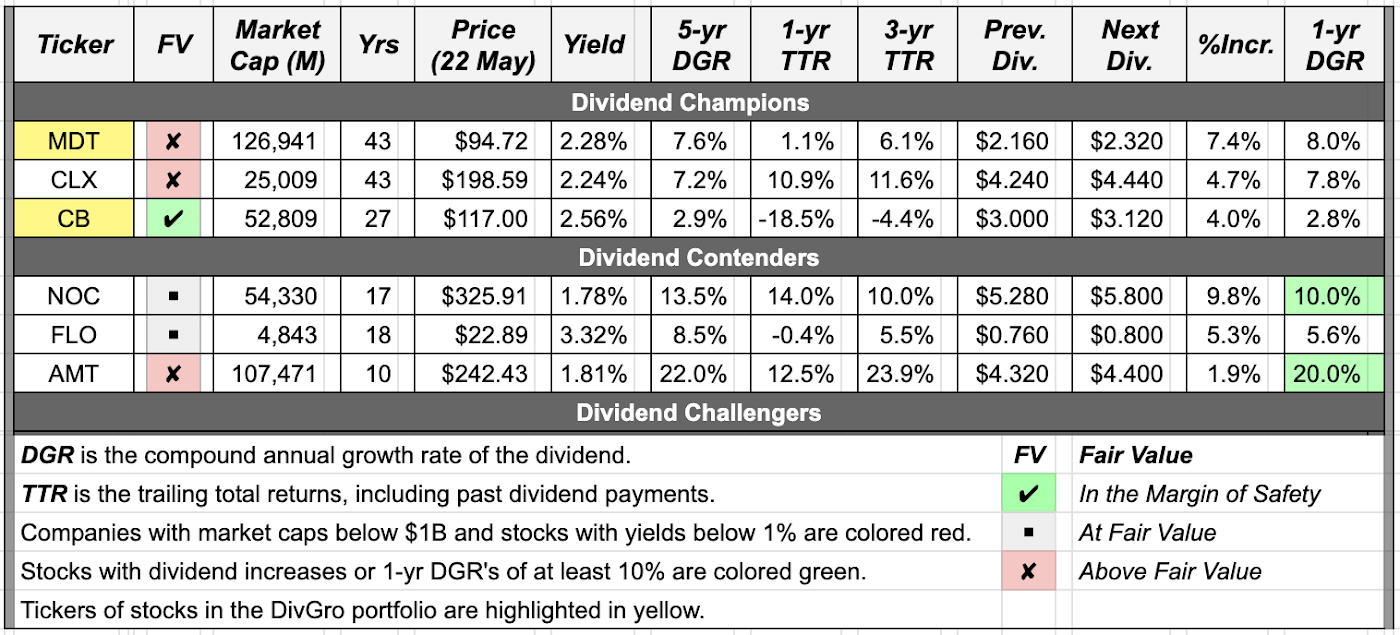

Based on the margin rates in the table below for Company ABC (GBP), a position of £65 per point, using the level 1 mid-price of 275.0 (£2.75), would require a position margin of £5,018.75.

Your position margin requirement is calculated as follows:

The notional value of your total position is: £17,875.00 (65 x 275).

Spread betting using margin allows you to open a position by only depositing a percentage of the full value of the position. This means that your losses will be amplified and you could lose all of your capital. Profits and losses are relative to the full value of your position. Learn more about our trading fees .

Spread betting using margin is not necessarily for everyone and you should ensure you understand the risks involved and if necessary seek independent professional advice before placing any spread bets.

See our spread betting guides to further your learning and consult our trading costs page. Compare our award-winning Next Generation platform features to MetaTrader 4 and choose the best trading platform to tailor for your individual trading needs: Next Generation vs MetaTrader 4 .

A spread refers to the difference between the buy and sell prices of an instrument in trading. The bid-ask spread is affected by a number of factors, including market volatility and liquidity. Discover our spread betting spreads .

Trading with margin when spread betting is an effective way for traders to gain greater exposure to the financial markets, including forex, shares and commodities. This requires traders to place a fraction of the full trade value as a deposit, which is known as the margin requirement. However, profits and losses will be based on the full value of your position. Open a spread betting demo account to practise trading on margin.

How much do I need to start spread betting?

You can deposit as much or as little capital as you want into your spread betting account, once you’ve opened an account with us. Leveraged trading means you only need to pay an initial deposit to open a trade, based on the instrument’s margin requirement. However, you need to have sufficient funds in your account to cover your margined trades and prevent account close-outs. Read more about the risks of spread betting .

How is spread betting margin calculated?

Spread betting position margin is calculated margin rates, which vary depending on the asset class (forex, indices, commodities) and specific instrument you trade on. Spread betting margin also depends on the size of the position that you wish to open. Learn how to calculate spread betting margins .

Are margin rates the same for spread betting and CFDs?

Our margin rates for financial assets are the same for both products, whether you’re spread betting or trading CFDs. These start relatively low at 3.3% for major forex pairs, and are much higher for volatile assets, such as cryptocurrencies, which have a margin rate of 50%. Check our spread betting margin rates .

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Join over 90,000 other committed traders

Complete our straightforward application form and verify your account

Deposit easily via debit card, bank transfer or PayPal

One touch, instant trading available on 9,300+ instruments

Get greater control and flexibility for peak performance trading when you're on the go.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

CMC Markets UK plc (173730) and CMC Spreadbet plc (170627) are authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Telephone calls and online chat conversations may be recorded and monitored. Apple, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. This website uses cookies to obtain information about your general internet usage. Removal of cookies may affect the operation of certain parts of this website. Learn about cookies and how to remove them. Portions of this page are reproduced from work created and shared by Google and used according to terms described in the Creative Commons 3.0 Attribution License.

This website uses cookies to optimise user experience. You can amend your cookie preferences by accessing our cookie policy .

Margin Rates | IG UK | Spread betting

Spread Betting Margin Explained | CMC Markets

Spread Betting Margin & Leverage Explained | City Index UK

What Is Spread Betting ?

Spread betting - Wikipedia

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Start Spread Betting and pay no UK stamp duty or UK Capital Gains Tax*

Create Account

About Us

StoneX

Partnerships

Affiliates

Press Releases

Careers

Sitemap

Terms and policies

Incisive market analysis into the year ahead - Your Outlook 2021 is now online. Get started by reading: End of the Brexit transition period and Market implications of C19 vaccines .

Learn more about how trading on margin and leverage impacts your trading.

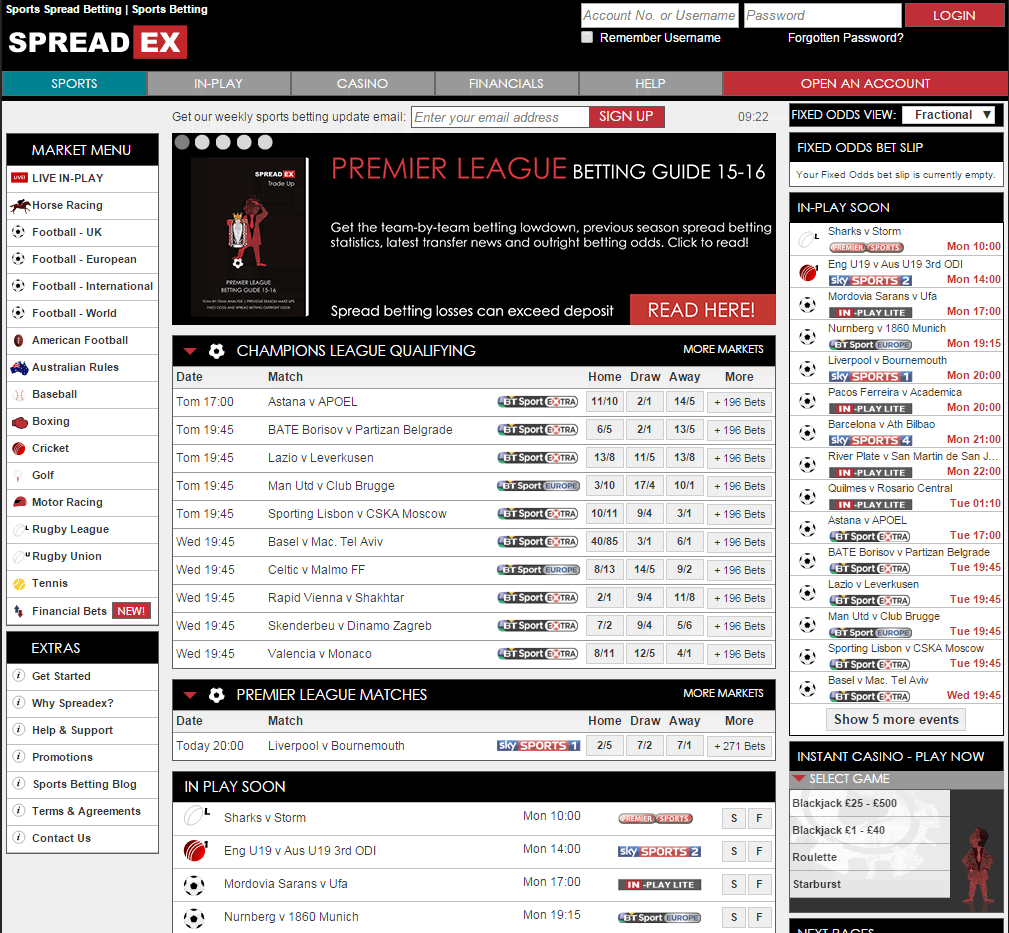

Spread Betting is a leveraged product which means that you can start trading using a relatively small initial deposit.

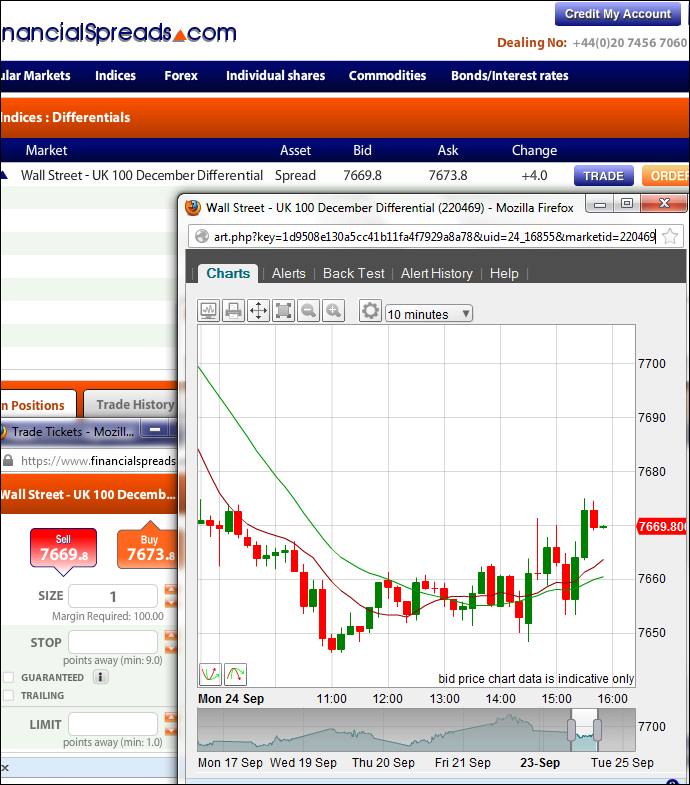

When you trade using a Spread Betting account, you trade on leverage, which allows you to gain a larger market exposure than may otherwise be possible with more traditional forms of investing. Trading on leverage can enhance your profits, but equally can increase your risk so make sure you understand how much you are risking with each position and use a risk management strategy that protects you against rapid market movement.

Margin is the amount of money or deposit you are required to have in your account in order to open a position. Because you are trading on leverage and your positions are magnified, you will need to have sufficient funds in your account in order to protect you against market movements. The amount you will be required to deposit is expressed as a percentage of your total position size. For more volatile markets, the margin level will almost always be higher.

Spread betting is a leveraged product. This means that you only need to deposit a small fraction of the overall value of any trade, known as margin.

For example, if the margin requirement for a trade is 20% then you would need 20% of the full value of the trade in your account to open the position.

If you buy 1,000 shares in ABC plc and its share price is 500p, your total investment is £5,000. The equivalent spread bet would be £10 per point on the same company.

In this example you are required to deposit £1,000 to open the equivalent of a £5,000 investment. This is how trading on margin leverages your position, freeing up additional funds to use on other products.

Trading on leverage means that you benefit from much larger market exposure from your initial capital outlay, increasing your potential profits. But, this also means that you are exposed to more risk if the trade goes against you and your losses will also be magnified.

In the example below you can see how trading on leverage has helped magnify profits compared to a similar investment using more traditional forms on share trading. Your Spread Bet in ABC plc is successful and you decide to close out your trade with a £100 profit. The return on your spread bet deposit is 10%, whereas the return on your share trade is 2%.

Remember, trading on leverages magnifies your losses as well as your profits and it is important that you understand the downsides of greater market exposure. The example below is based on the same trade as the profit example above, though in this example the market has moved against you and your losses are magnified.Your trade in ABC plc is unsuccessful and you decide to close out your trade with a £100 loss. The return on your spread bet deposit is -10%, whereas the return on your share trade is -2%.

Margin requirements refer to the amount of capital you will need in your account to cover your position. Margin requirements are expressed as a percentage of the total value of your position. Please note margin requirements vary across markets. Generally speaking, the higher the margin factor the riskier the market. Please see the relevant Market Information sheet on the trading platform for full details.

A margin call is a warning that the capital in your account has dropped below the required minimum amount needed to keep your position open. You should always ensure you have sufficient funds in your account to cover any losses for the period that you decide to maintain your trade.

If you don't, you could quickly find yourself on a margin call which puts you at risk of having your position automatically closed out.

The Margin Level Indicator on the City Index platform represents the level of cover you have associated with your open positions. It is located in the upper left corner of the trading platform. It displays one of the three scenarios listed below:

View spreads, margins and commissions for City Index products

Take control of your trading with powerful platforms and tools

View upcoming trading opportunities for the weeks ahead

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Full details are in our Cookie Policy .

Sexfight Xhamster

Photo Vintage Lingerie

Trained Ass

Cock Suck Sperm

Betting Nba Point Spread

.png.68a712c5f12b68e696952b87dc3a4e4d.png)