Ig Index Spread Betting

🔞 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Ig Index Spread Betting

How do I spread bet?

Open a trading account

Find an opportunity

Take a position

Monitor your trade

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Options and turbo warrants are complex financial instruments and your capital is at risk. Losses may be extremely rapid.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Unlock the markets’ full potential with spread bets – the tax-free way to trade both rising and falling prices. 1 Offering seamless execution on more than 17,000 markets and round-the-clock phone support, you’ll soon discover why we’re the world’s No.1 provider. 2

Start trading today. Call +35 318 009 95362 or email newaccounts.uk@ig.com . We’re here 24 hours a day, from 8am Saturday to 10pm Friday.

Trade without paying capital gains tax or stamp duty 3

Deal on the UK’s best web platform and app 3

Get full market exposure with just a small initial deposit

Rest assured that you can’t lose more than your account balance 4

Deposit funds safely – your money is held in segregated accounts

Discover opportunities on forex, indices, shares, commodities and more

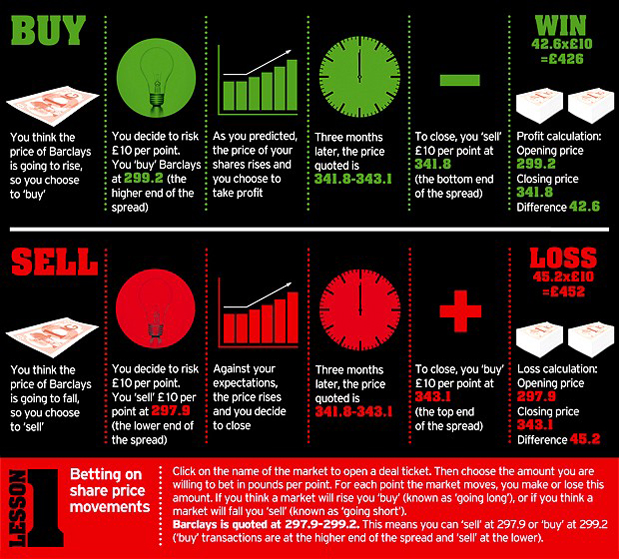

Spread betting is a way to take advantage of opportunities on rising or falling markets – without having to buy the underlying assets. It’s popular in the UK and Ireland because profits are tax-free. 2

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade on the move with our natively designed, award-winning trading app

With 45 years of experience, we’re proud to offer a truly market-leading service

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Trade on the move with our natively designed, award-winning trading app

With 45 years of experience, we’re proud to offer a truly market-leading service

Log in to your account now to access today’s opportunity in a huge range of markets.

Spread betting enables you to open a position with a small deposit known as margin. While this isn’t actually a cost to you, it can make a big difference to the affordability of your trade.

Your key payment for trading is the spread – the difference between the buy and the sell price, our charge for executing your trade. Our spreads are among the lowest in the business.

Depending on your position, you may need to pay overnight funding.

It’s free, quick and simple to create an account with us. Open one today, and you’ll get access to over 17,000 financial markets.

When you’re ready, you choose your deal size. What’s more, you’ll get lower minimum deal sizes for one month while you master the markets.

Open an account to start spread betting today. You’ll gain access to over 17,000 markets, round-the-clock phone support, and lower minimum deal sizes for one month.

Open an account to start spread betting today. You’ll gain access to over 17,000 markets, round-the-clock phone support, and lower minimum deal sizes for one month.

Log in to your account now to access today’s opportunity in a huge range of markets.

Trade a range of FX pairs, with spreads starting at just 0.6 points.

Explore the fast, user-friendly trading platforms that you can use to trade CFDs with us.

Get to grips with the risks of trading, and learn how you can mitigate them.

1 Applies to UK spread betting. Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

2 Based on revenue excluding FX (published financial statements, June 2020).

3 Best trading platform as awarded at the ADVFN International Financial Awards and Professional Trader Awards 2019. Best trading app as awarded at the ADVFN International Financial Awards 2020.

4 Negative balance protection applies to retail traders only. Should your account fall below zero, we’ll bring it back to this level as soon as possible at no cost to you. Please note that this protection does not apply to professional traders who can still lose more than the balance on their account.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading spread bets and CFDs with this provider . You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Options and turbo warrants are complex financial instruments and your capital is at risk. Losses may be extremely rapid.

Professional clients can lose more than they deposit.

The value of shares, ETFs and ETCs bought through a share dealing account, can fall as well as rise, which could mean getting back less than you originally put in. All trading involves risk.

CFD and share dealing accounts provided by IG Markets Ltd; CFD, spread betting, options and derivative and turbo warrants accounts provided by IG Europe GmbH; spread betting accounts provided by IG Index Ltd. IG is a reference to IG Markets Ltd (a company registered in England and Wales under number 04008957), IG Index Ltd (a company registered in England and Wales under number 01190902), both registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA, and IG Europe GmbH (a company incorporated in the Federal Republic of Germany and registered in the Frankfurt Trade Register under number HRB 115624 with registered office at Westhafenplatz 1, 60327 Frankfurt, Germany), as the context requires. IG Markets Ltd (Register number 195355) and IG Index Ltd (Register number 114059) are authorised and regulated by the Financial Conduct Authority. IG Europe GmbH (Register number 148759) is authorised and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht and Deutsche Bundesbank. The Swedish branches of IG Markets Ltd and IG Europe GmbH are regulated by the Finansinspektionen. IG is a trading name of IG Markets Ltd.

The information on this site is not directed at residents of the United States, Belgium or any particular country outside the EEA and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Indices spread bet product details | IG UK

Open a Spread Betting Account and Start Financial Spread ... | IG Ireland

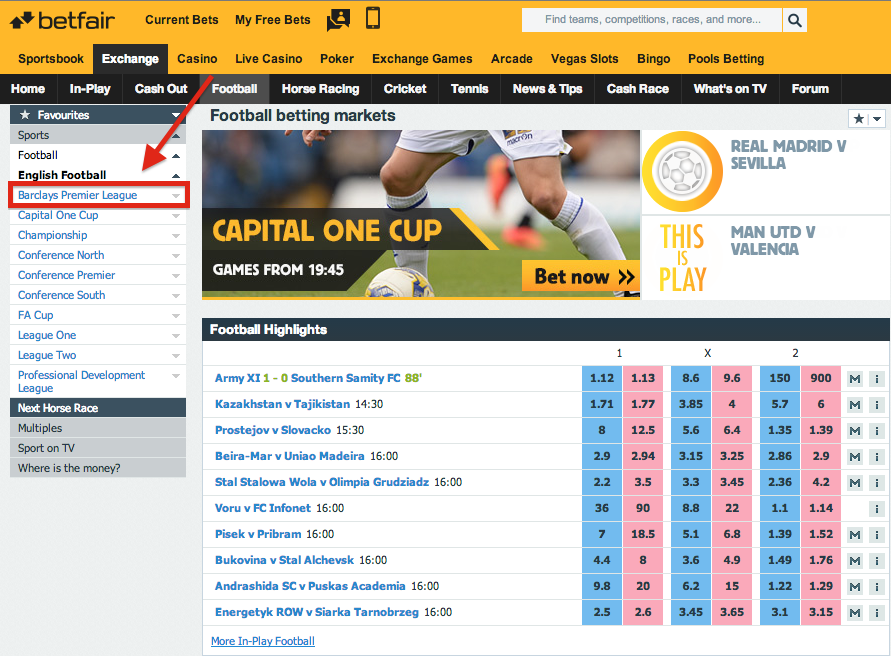

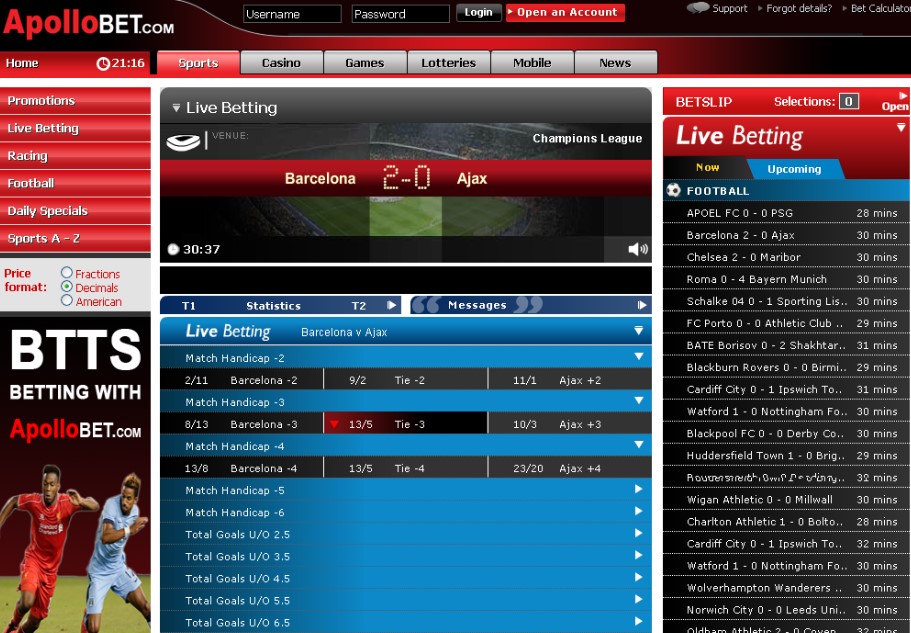

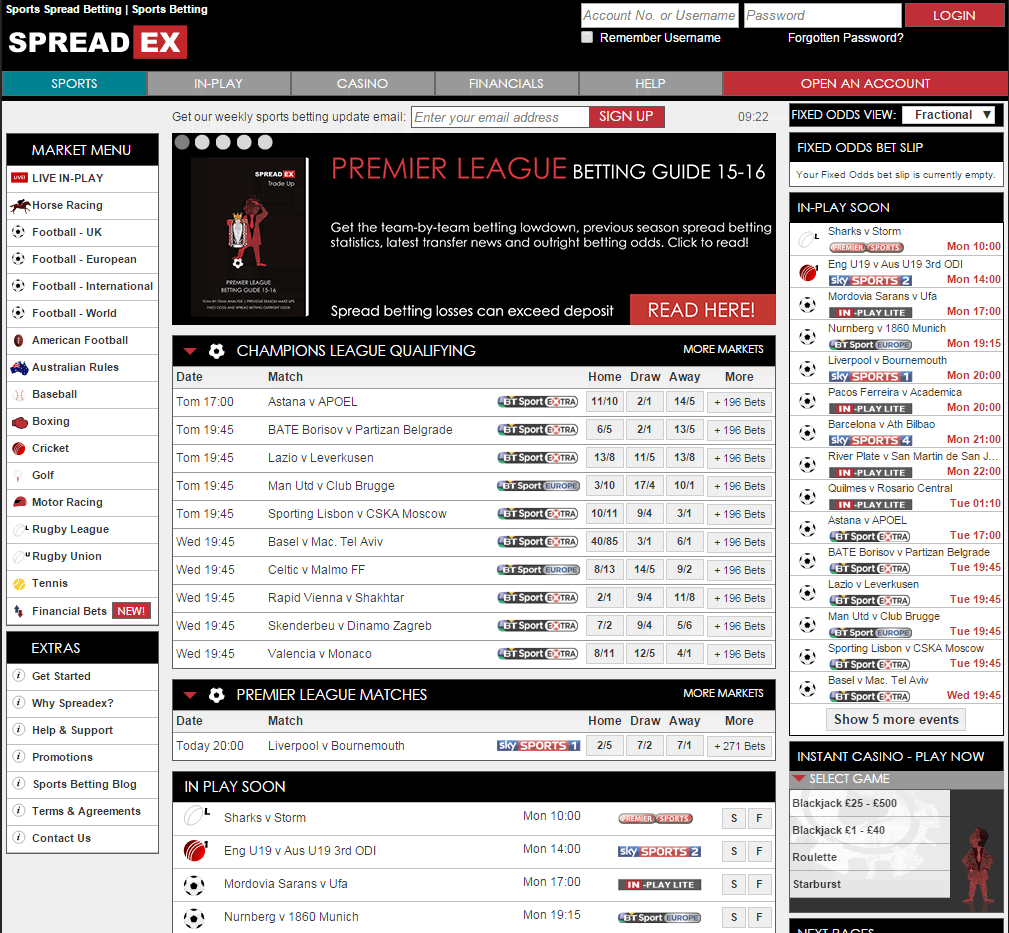

Comparing IG Index UK to other spread betting firms

IG Account Review | IG Index – Number One Spread Betting Company

Spread betting - Wikipedia

Become a fan on Facebook

Follow us on Twitter

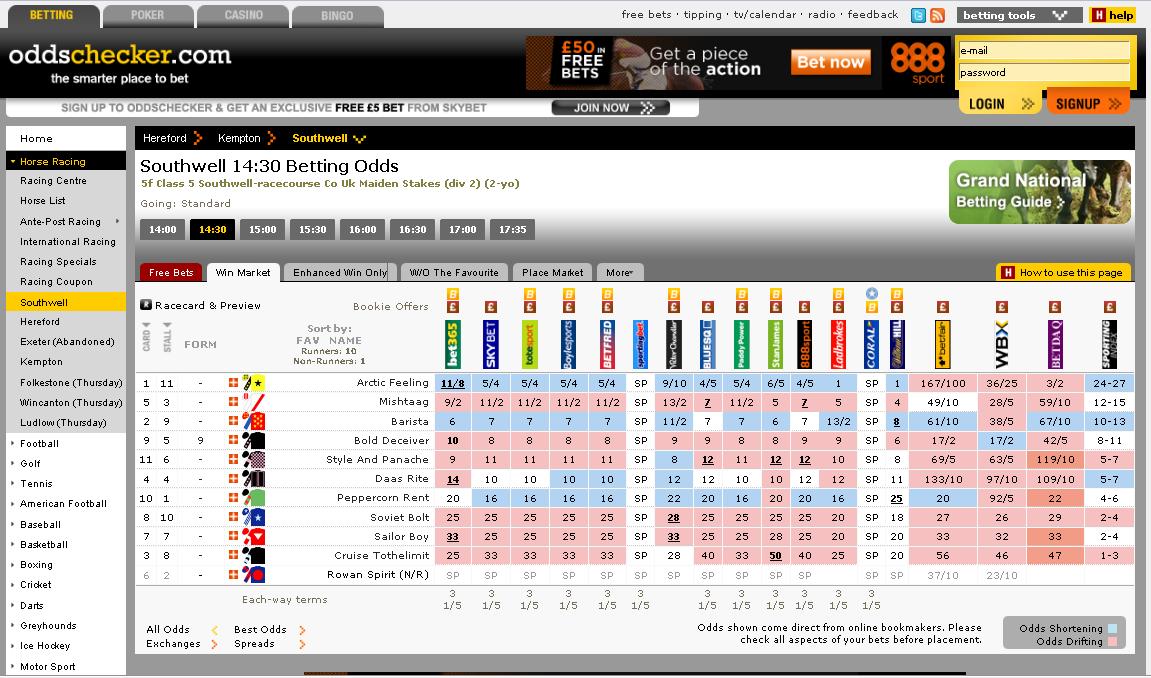

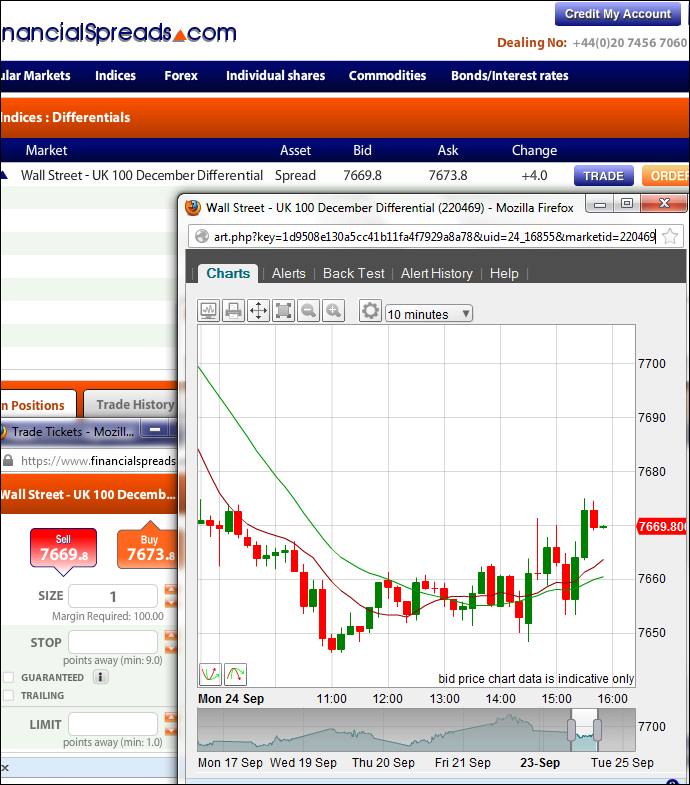

UK Shares: 0.1% either side

FTSE 100: 1 points

Wall Street: 2 points

EUR/USD: 1 points (minimum spread), typical spread is 2 points

GBP/USD: 2 points (minimum spread), typical spread is 3 points

EUR/GBP: 2 points (minimum spread), typical spread is 3 points

USD/JPY: 1 points (minimum spread), typical spread is 3 points

AUD/USD: 2 points (minimum spread), typical spread is 4 points

USD/CHF: 2 points (minimum spread), typical spread is 4 points

Copyright © 2010 - 2020. All Rights Reserved.

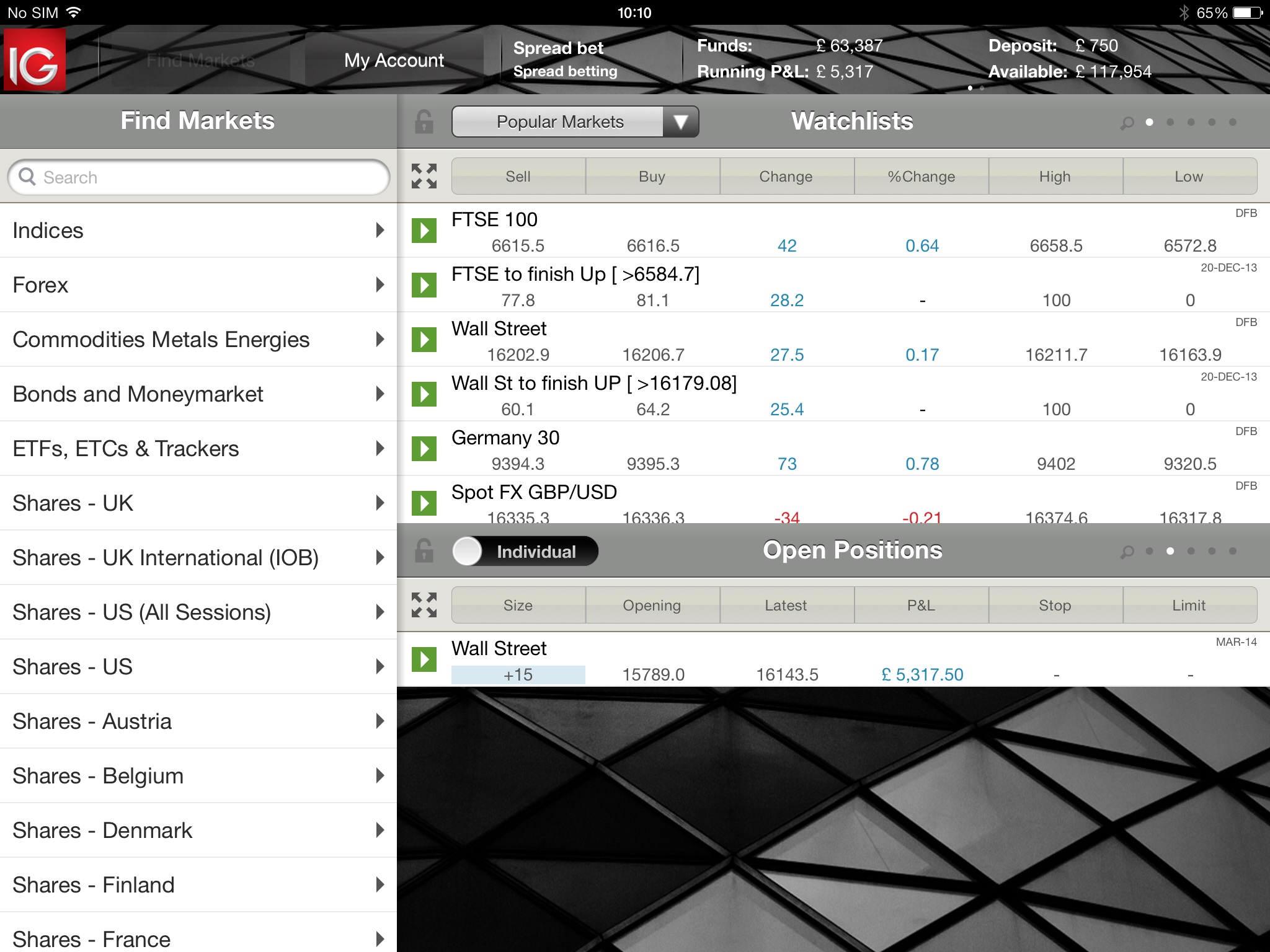

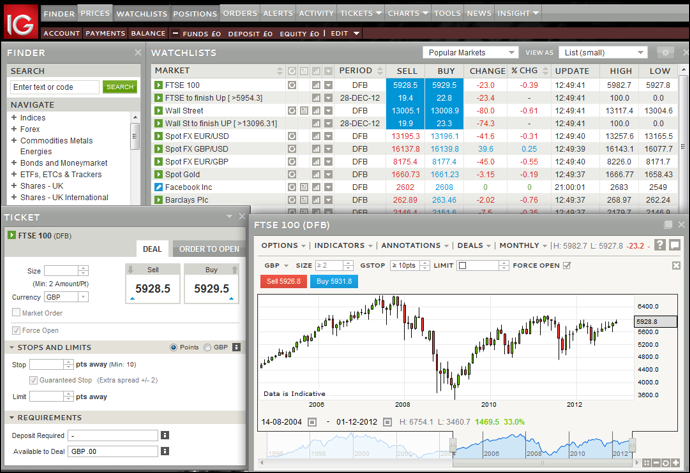

IG Index is Britain's biggest spread betting provider with one of the best platforms around and instant or near-instant execution with very few re-quotes. It is the only company I know that offers spreads on tiny companies with a market capitalisation as low as £10 million (other providers may not quote market caps less than £50 million or £100 million). And IG also offer a cool iPhone Application that not only lets you deal but it also comes with charts, indicators and moving averages :)

⇑ ⇑ ⇑ ⇑ Listen to our review of IG Index

Widest range of markets possible throughout the industry (about 10,000 in all). Thousands of international shares (7000+ shares including AIM shares) plus stock indices, forex currencies, binaries, options and many others.

TradeSense (a 6 week education program with reduced trade sizes). Tradesense will allow you to bet for 50% of the minimum bet sizes for the first 2 weeks after opening the account to give you sometime to familiarise yourself with the platform. After this initial period, the bet sizes are changed to standard minimum bet sizes.

Webinars and seminars are also available for clients to view and attend. Plus online information, manuals, training, support and 24 hour phone support.

IG Index uses variable spreads which mean they will widen their spreads sometimes up to 3 times their typical spread (maximum) depending on the market conditions. In normal market conditions, the typical spread applies.

IG Index will charge 1.75% for credit (not debit) card payments that reach £1,000 or equivalent in one day. Deposit using Switch/Maestro/Solo/ or CHAPS/BACS to avoid incurring fees for amounts larger than this.

2.50% over LIBOR if Long - 2.50% under LIBOR if short. Funding is calculated based on the whole position size including the amount you have laid down as margin.

You can either choose a Plus Account or Limited Risk Account type. Credit facilities are available to eligible clients.

The Plus Account has the tightest spreads on offer and the widest range of order types, including limited risk orders and trailing stops. IG will monitor your account by you still stand to lose more than your initial deposit.

With the Limited Risk Account all your trades carry a guaranteed stop loss order (for an additional charge in the form of a wider spread) which means that you cannot lose beyond your chosen stop level. Please note, Limited Risk Account holders can choose to upgrade to a Plus Account at a later stage.

The new IG Index iPhone application lets you deal and it has charts, indicators and moving averages; with clients . It's quite cool actually - select IG, tilt your phone - that brings up a few main quotes prices - FTSE, Dow, Gold etc...then you can press on the individual instrument and it will bring up a chart, and that's all before you even log into your IG Index's account. IG supports both Anroid and Apple devices and has also developed platforms for Blackbery and the Windows 7 phones. The full range of functionality is provided including stops, limits and working orders while charts are also covered.

Minimum Stake depends on the market. Minimum stake for the FTSE Spread is £2 while the minimum stake for the Dow Spread is £1. City Index also allow fractional bets which is good to control the risk exactly. £10 is the minimum accepted deposit.

In the past profits/Losses on daily rollovers used to be crystalized every day however this changed in April when IG introduced its Daily Cash Bets which are essentially spread bets with a long expiry date extending out till April 2016. The new Daily Cash Bets mean that bets are not closed every night and will remain open until you close the spreadbet. You are still charged for overnight costs, but this amount is reflected on your cash balance, instead of being part of a reopened cash bet which makes it easier to keep track of profits/losses since the trades will now keep rolling until you close the positions without profits/losses being crystallised every night.

For rolling over a UK Shares or Index spread bet to the next quarter the following applies, close at the closing price minus if long/plus if short normal closing spread. Re-open at the next contract with no spread.

IG Index pays out 90% on dividends on rolling daily positions.

Market orders, stops, limits, OCO's, guaranteed stop orders, trailing stops and if dones (contingent orders) are available. Guaranteed Stop Orders available on all markets.

The majority of IG Index's FX, Commodities and Indices are based on the underlying markets price, including IG's spread, hits your stop. For example, if position X is trading at 99 / 101 on the underlying market, and you have a sell stop at 90 and IG's spread is +/- 1, the platform would show the price 98 / 102. The stop loss will only be triggered when a trade in the underlying market is executed at 91, which would put IG's bid price inclusive of spread/premium at 90.

For market maker shares, stop losses are triggered basis corresponding bid/offer prices in the underlying market, meaning that a trade does not necessarily need to be executed in the underlying market in order to trigger the stop. Therefore, using the same example as above this time the stop would be triggered if the underlying market went bid at 91 even if no trade had been executed at that level.

Finally, for markets which IG quotes an out of hours price for and IG Index is therefore acting as a market maker, such as out of hours Indices, a stop level is triggered when their bid/offer price hits the required level. As in this instance there is no underlying market and IG are generating the price based on the business that they see and the movement of other relevant markets, the price IGIndex generates will already have their spread included and will act as the determining factor.

Round-the-clock. 7 - 24 hour trading on popular markets.

Professional charting systems are provided by 'Pro-Realtime' - 3 different levels of charts are offered from dead simple to dead not-simple, charts come with indicator builder/creator too, all free. You can trade/manage trades right off the charts too... Technical detailed useful commentary research covering shares, indices, forex, commodities and fixed income is also freely available to clients (provided by Trading Central and Investors Intelligence).

I've had to use IG Index's customer services and am impressed with their helpfulness and knowledge...and a business is only as good as the customer services department.

Or click here to sign up for a IG Index spread betting account . No vouchers or sign-up offers are offered but IG have graciously agreed to offer new signups a free forex spread betting book written by their Chief Market Strategist (David Jones) to any new clients who sign up from my site. However, your real reason for signing up (!) - if anything should be for the superb charting package and the huge range of markets covered.

Comments? Inaccuracies!!? Send your comments to traderATfinancial-spread-betting.com The spreads of a particular firm have changed? E-mail us and we will post and update.

Milf Tits Masturbate

Private 16

Solo Girl Masturbation Natural Girl Schoolgirl

Anal Gaping Sluts Evil Angel

Girl Having Hard Sex

.png.68a712c5f12b68e696952b87dc3a4e4d.png)