ICODrops review: ThunderCore

https://icodrops.com/

https://t.me/IcoDropsReport - ICO reviews channel

https://twitter.com/ICODrops - Twitter

https://t.me/joinchat/FoisO0k4-XXBkPEikfdgow - English chat

ThunderCore is a scalable smart-contract platform with absolute block finalization.

Metrics

Airdrop/Bounty:

There was an insignificant Airdrop of 100,000 TT. No Bounty programs were conducted.

Seed Round:

The percentage of the seed round's tokens from the total circulation of tokens along with the amount of money raised will be revealed before the public launch of the mainnet.

1 TT = 0.01 USD

Private Round:

During the Private Sale stage, there were two rounds that raised 50 million USD according to the information in some media outlets.

In the first round, 1 TT was sold for 0.02 USD;

In the second round, 1 TT was sold for 0.1 USD.

The percentage of the private round's tokens from the total circulation of tokens will be revealed before the public launch of the mainnet. The number of funds raised during that stage will be published later as well.

Crowdsale:

An IEO will be conducted on Huobi Prime Lite (an ultra-fast version of Huobi Prime) on May 9, 2019. The allocation for this round is 500,000 USDT. Additional data is to be announced (link).

Current circulation of tokens is 800,000,000-900,000,000 TT.

Circulation during the first year after the launch is 1,750,000,000-2,000,000,000 TT.

The current valuation is 90 million USD.

Total circulation is 10,000,000,000 TT.

The total valuation is 1 billion USD.

Social metrics:

The official website was created in 2014 and updated in 2018.

There are 12 thousand monthly visits.

According to Alexa, the majority of the traffic comes from France (48.2%), the USA (21.6%), and India (10.9%).

The official Twitter is @ThunderProtocol. It was launched in January 2019 and now has 6340 subscribers. There is news about the project and reposts of other crypto-related accounts.

The official Telegram group is ThunderCore_English. It has 4.5 thousand users, the pace of communication is moderate, no price speculation is allowed, some of the questions about the volume of tokens bought during the seed & private rounds aren't answered.

The official Medium is ThunderCore. It was created in 2019, there are 450 followers and 10 posts.

The official Discord is Thunder Official. There are 940 participants (communication is slow, but it's focused on relevant topics).

Key players

The team:

The project is located in California. Various media outlets state that the team is comprised of more than 60 participants, while the official LinkedIn profile of the company has 46. At the point of this review, ThunderCore was currently seeking new team members (there are 8 job postings in the 'Careers' section on the website).

Chris Wang - CEO & Co-founder.

500+ contacts in LinkedIn.

Education: Chris received a Ph.D. in Computer Science from Carnegie Mellon University at age 22. He got Bachelor of Computer Science from the University of California, Berkeley.

Previous experience: Chris co-founded Playdom Inc. (2 years).

Playdom was a game developer for social networks founded in 2008 and based in California. During 2 years of functioning the company raised funds twice in Reg A of 33 and 43 million USD. The team exceeded 500 employees and the service had 42 million players a month (at the time of it being acquired by Disney). The company was successfully sold to The Walt Disney Company for 532 million USD. In 2011 Playdom was fined for 3 million USD because it collected and uncovered information about children without their parents' permission.

After selling Playdom, Chris acted as VP of Tech in The Walt Disney Company for two years.

Elaine Shi - Chief Scientist & Co-founder.

Elaine has 3.7 thousand followers on Twitter (among the followers we found Vitalik Buterin and Andreas Antonopoulos), but she doesn't have a profile on LinkedIn.

Education: Elaine received a Ph.D. in Computer Science from Carnegie Mellon University.

Previous experience: in 2012 Elaine published her first academic paper about Bitcoin in Financial Crypto. During the Ethereum testnet phase along with other researchers, she published several academic papers about Ethereum smart-contracts. Elaine was one of the first to teach smart-contract development.

Elaine has been acting as Associate Professor of Computer Science at Cornell University since 2015. She created Thunderella protocol with Rafael Pass that was implemented in ThunderCore.

Elaine received multiple academic awards for her research.

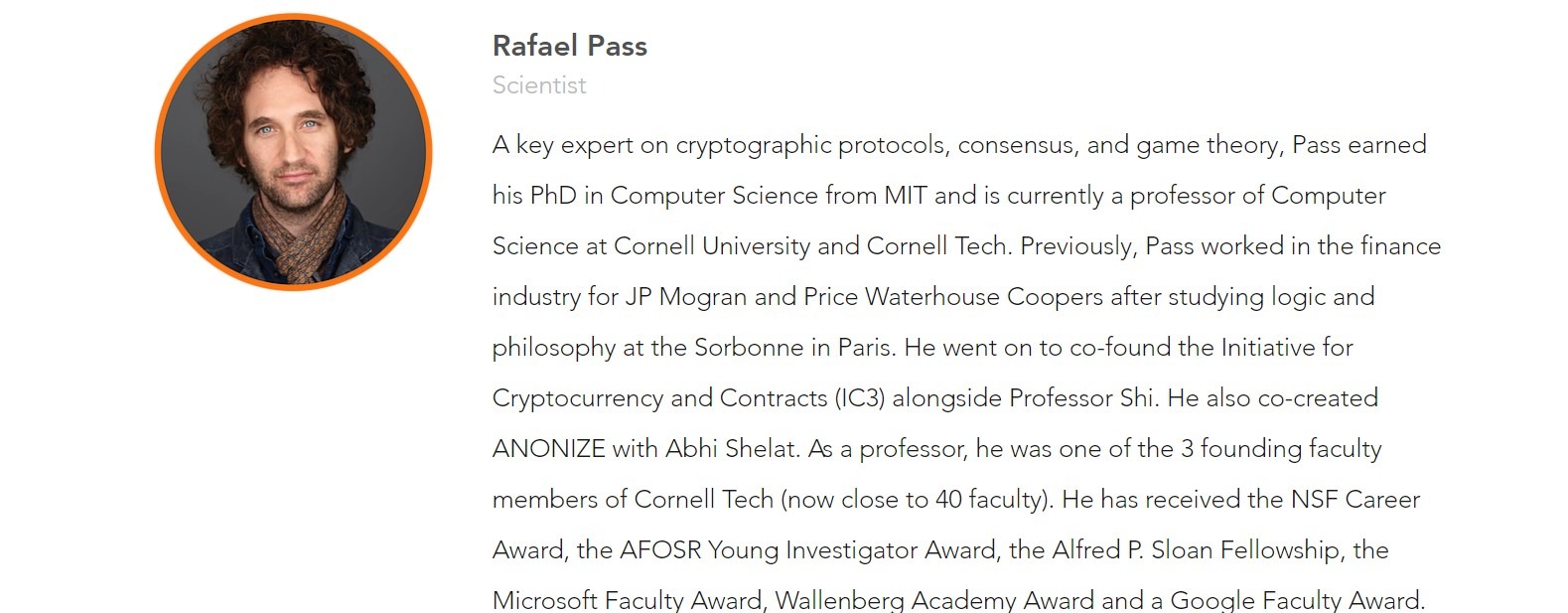

Rafael Pass - Scientist & Co-founder.

345 contacts in LinkedIn.

Education: Rafael got Bachelor degree and Ph.D. in Computer Science from the Royal Institute of Technology (Sweden). He also received a Ph.D. in Computer Science from MIT in 2006.

Previous experience: Pass started as a Business Analyst at J.P. Morgan in 2000 (less than a year) and continued as a Senior Analyst at Price Waterhouse Coopers (1 year). His works are actively published from 2003, the most recent of which was published in 2017.

Rafael has been acting as a professor of Computer Science at Cornell University. His research focuses on cryptography and its relation to computation complexity and game theory.

In collaboration with other researchers, Rafael published a paper about a highly scalable computation protocol ANONIZE that was implemented in Brave browser.

In addition, together with Elaine Shi, he is the author of Thunderella protocol that was included in ThunderCore.

Pass received multiple academic awards for his scientific research.

Investors:

Pantera Capital is a U.S.-based fund that was one of the first to invest in blockchain projects in VC and ICO formats (Bakkt, Bitstamp, Brave, Circle, Ripple, Zcash, Icon, Polkadot, and others).

Huobi Capital is the top Chinese crypto exchange with a branch focused on investments in blockchain projects (Blockstack, Theta, Aelf, Ontology).

ZhenFund is a large Chinese VC firm that is partially managed by Sequoia Capital China (the blockchain-related portfolio of the company includes Basis, Origo, Vault12, Perlin, Lambda, and others).

Arrington XRP Capital is an American VC firm that invests in digital assets американская VC фирма. It's managed by the founder of TechCrunch (Metadium, Mainframe, Certik, Celer, Aergo, Fantom, and others).

FBG Capital is an active Chinese VC fund that invests in blockchain projects (it funded almost every top blockchain project out there).

Electric Capital is a crypto asset management firm (it invested in Dfinity, Oasis Labs, CoinList, and Coda Protocol).

Hashed is a Korean-American VC fund that invests in crypto projects (Quarkchain, Ontology, NuCypher, Oasis Labs, and others).

Kenetic Capital is a South-Korean VC fund that invests in blockchain projects (Iotex, NuCypher, Origin, Certik, Zilliqa, and others).

SV Angel is an American angel-investor that invests in Internet technologies (its crypto-related portfolio includes Helium, Celo, and Dirt Protocol).

MetaStable is a cryptocurrency fund (it invested in Orchid Protocol, Basis, and Oasis Labs).

Partnerships:

TrustWallet is a multi-currency wallet directly integrated with Binance that supports TT token. In addition, the wallet's users have access to all the applications built on top of the ThunderCore (the partnership was announced on March 27, 2019).

Liquidity Network is a non-custodial decentralized and scalable micropayments solution built on the ThunderCore blockchain. The partnership was announced on March 28, 2019.

BlockVigil builds an API-gateway for ThunderCore. The partnership was announced on April 10, 2019.

Anchain.ai is a startup based in Silicon Valley that uses AI and Big Data to ensure blockchains' security, search for vulnerabilities and protect dApps. This partnership is focused on improving overall security while interacting with ThunderCore (the partnership was announced on April 18, 2019).

Technology and idea

Thunder Protocol was designed based on a scientific paper on consensus protocols Thundrella that was written by some of the team members.

The protocol combines two types of blockchains that work depending on a set of conditions.

An asynchronous Fast Path works in terms of optimistic scenarios. This blockchain has PoS and functions using a BFT Thundrella consensus. It requires the following conditions:

- An accelerator within a given committee is honest. There is a concern about the determined results of a random selection of a leader, as a chosen accelerator can influence the process of choosing the next one.

- More than 3/4 of the validators within a committee are honest.

- The slow chain is stable and secure.

To monitor issues on the Fast Path level (no confirmation for a transaction), a sender has to send a dedicated transaction to the Slow Chain and validators must validate it. In case this doesn't happen, the network goes from Fast-Path to the Slow Down mode.

A synchronous Slow Chain works in pessimistic scenarios and is used in terms of a set number of blocks for anchoring the state of the Fast-Path network.

- Works if there is a security breach on the Fast Path level.

- More than 51% of the hashing power shall be controlled by honest nodes.

This concept is used because in the majority of cases with BTF protocols the operations are conducted honestly (meaning that security can be neglected in favor of increased speed and absolute block finalization). There are very few cases in which a network can be attacked. which will lead to the network going into a more secure mode. It's important to mention that a crucial requirement for classic BFT protocol to function is that the number of malicious validators in a network should be less than 1/3. In addition, more rounds are needed when a block is created.

We will highlight the following features of the protocol:

- Mathematical proof of the protocol security (among the current blockchains Cardano has similar approach).

- EVM & smart-contract support. This opens up the possibility to port existing Ethereum apps to Thunder Protocol.

- Off-chain solutions' support (Plasma Network, Lightning Networks, and others)

There still are questions about how miners work in the Slow Chain layer. What are their incentives for inconsistent participation?

Tokenomics:

Thunder token is a native currency. The economic model is standard for a smart-contract platform.

Important notice: the protocol doesn't specify fines for malicious behavior in Fast-Path mode.

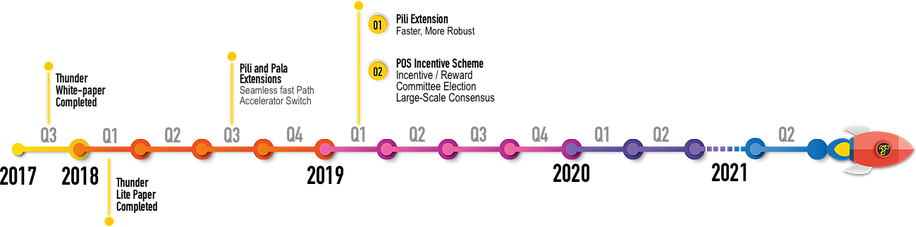

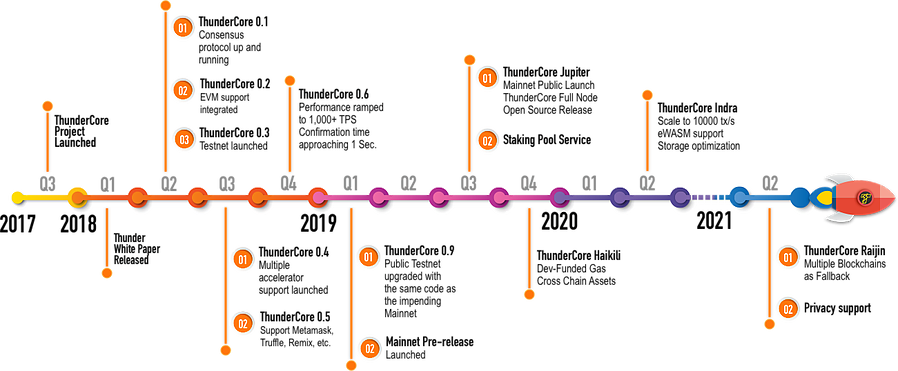

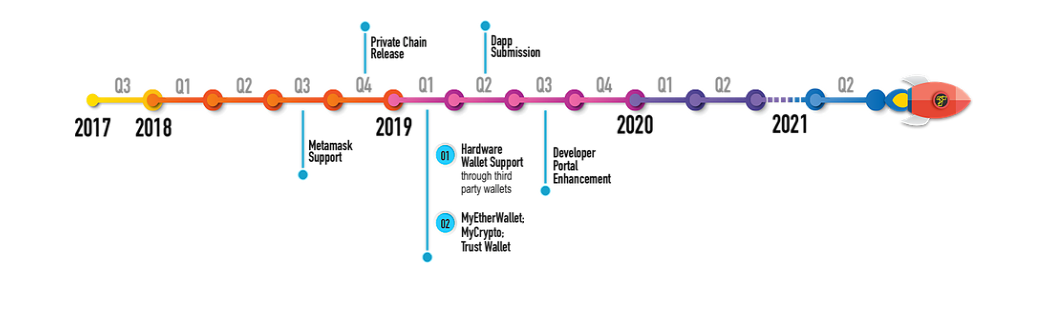

Roadmap:

The roadmap is outlined in great detail. It mentions not only crucial points in development and implementation, but also partially indicates steps of business development.

The roadmap consists of three parts:

- Research and protocol design.

2. Blockchain implementation.

3. Developer and user enhancement.

MVP:

At the time of this review, the project is in the Pre-Mainnet state. The public mainnet is scheduled for Q3, 2019. The SDK for building apps on the testnet and porting apps from Ethereum to Thunder Protocol is available.

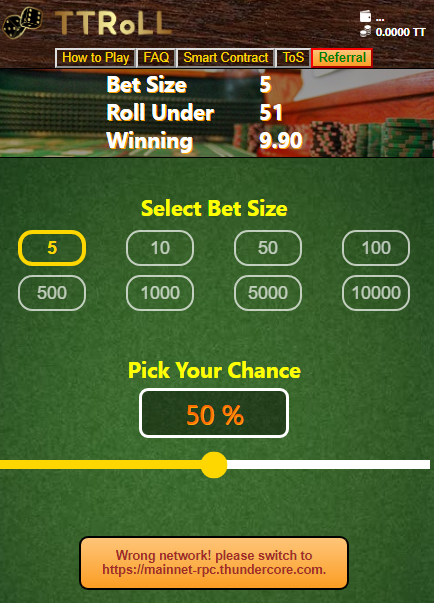

A gambling dApp is offered for testing. Currently, the team mentioned the support of 8 dApps.

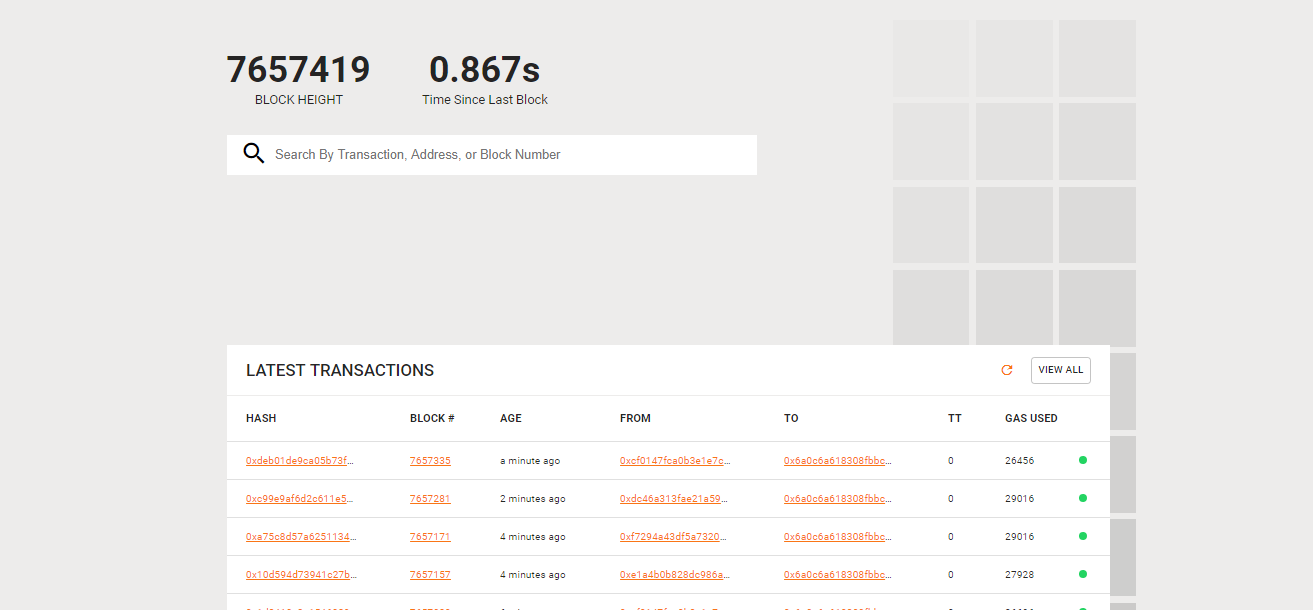

A block-explorer can be accessed from here. As the network is being tested, the transaction blocks are empty.

According to the stats, presented by the team for April 16, 2019, the number of transactions in the network reached 177604. At the time of this review, the number of blocks generated is close to 2x more than it was on April 16. However, we should note that the majority of the blocks do not contain any transactions because of the early stage of the network's development.

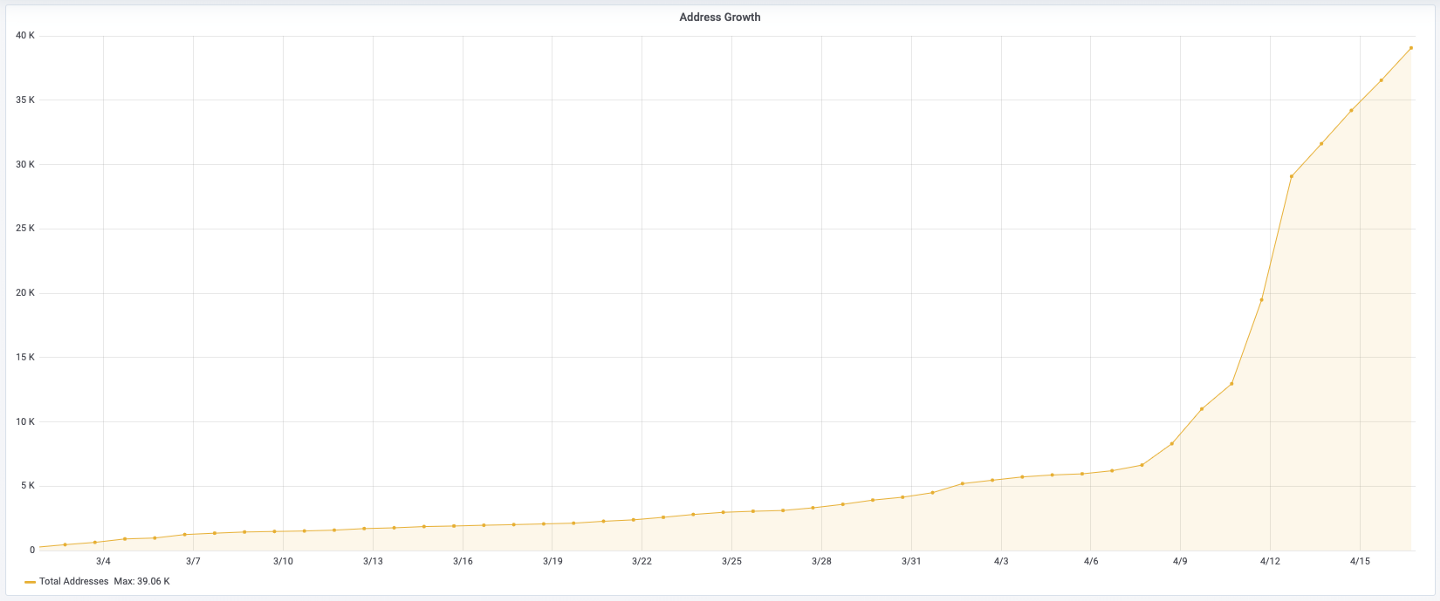

The number of the addresses in the network is roughly 40 thousand. Apparently, this is due to the airdrop of 50 ThunderToken that is given for generating an address.

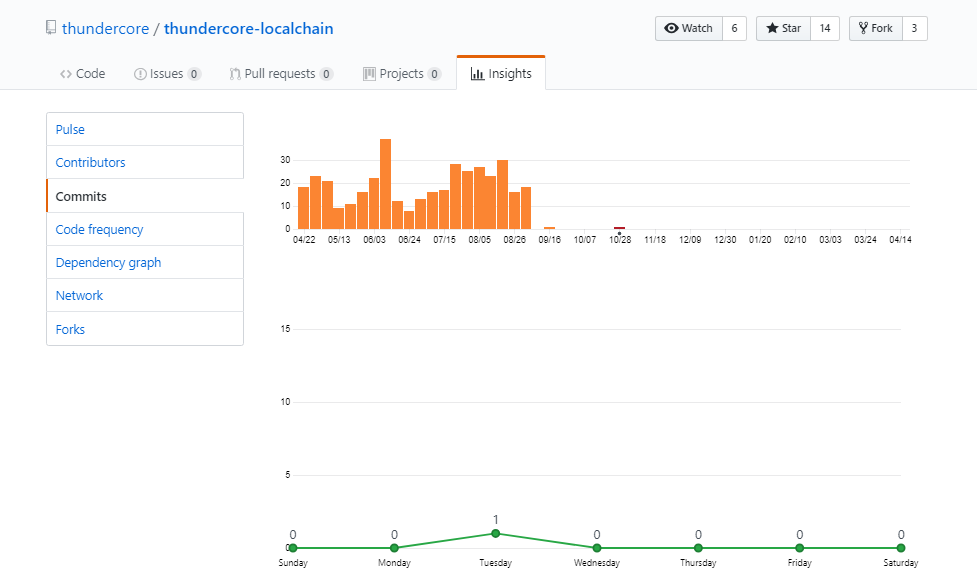

The majority of the development is happening within private repos. There are many forked repos for supporting the infrastructure of Thunder Protocol.

The main repo is Localchain. The public commits stopped from August 2018 before the testnet's launch.

Similar projects:

ThunderCore is similar to all the other blockchains. The most notable of them are:

Summary

Here we have another team striving to build a more efficient blockchain. The project has been out there from the beginning of 2018.

Strengths:

- The consensus protocol can be mathematically proven. Only Cardano was able to achieve the same.

- CEO Chris has experience as a co-founder of a successful startup. Playdom had a high number of users and was sold at a high price. However, there are some concerns due to the 6-year gap in his career record. Co-founder Elaine has been working in the crypto sphere since 2012. She has experience with smart-contracts since their inception. She also co-wrote (with another co-founder) the protocol that is used in the project. The co-founder Rafael has education in blockchain, cryptography, and game theory, which is an ideal combination. To sum up, the team has tremendous knowledge about building distributed systems and consensus protocols.

- Top-tier and the most successful ICO investors of 2018. The only question is whether the 'smart-money' we are used to can influence the success of a project in 2019.

- The product is in its advanced stage. Integration with Binance Trust Wallet is also a huge plus for the mass-adoption.

Risks:

- Currently, EOS and Tron offer gambling dApps. If gambling will be the major focus of the project, it would raise concerns about the demand for it.

- Some information about the metrics is not disclosed. For instance, we don't know how much was raised during the Seed and the Private rounds, there is also no information about evaluated circulation. All of these are necessary for making an investment decision.

- Historically, the U.S.-based projects are very slow because of the legal risks. Hence, the project is a long play and there is a risk of legal actions from the SEC's side.

Weaknesses:

- PoS blockchains with pre-mining distribution models impose a threat of ineffective and unfair token distribution. This can result in centralization or creation of an oligopoly.