ICODrops Review: Matic Network

https://icodrops.com/

https://t.me/IcoDropsReport - ICO reviews channel

https://twitter.com/ICODrops - Twitter

https://t.me/joinchat/FoisO0k4-XXBkPEikfdgow - English chat

Matic Network solves scalability issues of the Ethereum blockchain (with plans to make the process blockchain-agnostic later) via layer 2.

Metrics

Launchpad:

The hard cap is 5 million USD for 1,900,000,000 MATIC (19% of the total supply).

1 MATIC = 0.00263 USD

Seed Round:

2.09% of the total supply

1 MATIC = 0.00079 USD

The total amount raised was 165,000 USD.

Early Supporters:

1.71% of the total supply

1 MATIC = 0.00263 USD

The total amount raised was 450,000 USD.

The contributors of both rounds will receive 50% of their tokens during the first month of the IEO, but there is no information about whether or not they will get the tokens before or after the listing. The remaining half of tokens will be distributed to them in 7 months.

Initial circulation:

3,232,085,551 MATIC (~32.32% of the total supply):

19% Launchpad Sale

1.05% Seed Round

0.86% Early Supporters

2.74% Foundation

4.67% Ecosystem

4% Staking Rewards

Valuation of the initial circulation is 8,5 million USD.

Total supply:

10,000,000,000 MATIC

Valuation of the total supply is 26,3 million USD.

Social metrics:

The official website was initiated 1 year 9 months ago.

Daily visiting rate is 938 views & 235 unique visitors.

According to Alexa, the official website is ranked 1,224,862. The majority of the traffic comes from India (27.6%), the U.S. (24.4%), and Vietnam (10.7%).

The official Twitter account, @maticnetwork, was created in October 2017 and now has 2254 followers. Among the followers, we could find CZ, Brad Laurie, GoodGuyMat, Balina, Taylor Monahan, Richard Burton, and others. The Twitter page is filled with interesting information, and there is no noise.

The official Telegram group, @maticnetwork, has 8740 users, who actively ask questions that support members actively answer. As per the group admins, the team has no plans for an airdrop or a bounty program.

Key players:

The team:

Jaynti Kanani

Jaynti has 500+ contacts in LinkedIn, 1063 followers on Twitter, and 1347 commits in GitHub for the past year.

Education: Bachelor of Engineering at Dharmsinh Desai University, India, Nadiad.

Previous experience: Senior Software Engineer at Persistent Systems (3 y. and 2 m.). Data Scientist at Housing.com (2 y. 10 m.).

Jaynti is a full-stack developer and a blockchain engineer. He contributes to the development of Web3, Plasma, and WalletConnect.

Sandeep Nailwal

Sandeep has 500+ contacts in LinkedIn, 339 followers on Twitter and 83 commits in GitHub for the past year.

Education: Sandeep has an MBA in Technology, Finance, and Supply Chain Management from NITIE, India, Mumbai.

Previous experience: Intern and then Consultant at Deloitte (1 y.). Head of Technology and Supply chain at the Ecommerce division of Welspun Group (1 y.). Co-founder and CEO of ScopeWeaver.com (1 y. 8 m.).

Sandeep is a blockchain developer and entrepreneur.

Anurag Arjun

Anurag has 500+ contacts in LinkedIn, and 147 followers on Twitter.

Education: Anurag has a Bachelors Degree in Computer Engineering from Nirma Institute of Technology, India, Ahmedabad.

Previous experience: Programmer Analyst at Cognizant Technology Solutions (2 y. 4 m.), Working Partner & Product Manager at Dexter Consultancy Pvt. Ltd. (4 y. 10 m.), Project Manager at SNL Financial (1 y. 3 m.), AVP at Iris Business Services Limited (3 y. 4 m.).

Siddharth Jain

Siddharth has 500+ contacts in LinkedIn, and 136 followers on Twitter.

Education: Siddharth has Bachelors of Engineering Degree from BITS, India.

Previous experience: Intern at Ernst & Young and Shell. Assistant project manager at EXL.

Bhavir Shah

Bhavir has 414 contacts in LinkedIn, 285 followers on Twitter, and 1330 commits in GitHub for the past year.

Education: Bhavir has Bachelors of Engineering Degree from the University of Mumbai, India.

Previous experience: Software Engineer, Senior Software Development Engineer at Housing.com, Lead Software Engineer at PaySense.

Vaibhav Chellani

Vaibhav has 500+ contacts in LinkedIn, 87 followers on Twitter, and 1740 commits in GitHub for the past year.

Education: Vaibhav has a Bachelors Degree in Computer and Information Sciences from Bharati Vidyapeeth College Of Engineering, India, New Delhi.

Previous experience: Blockchain Protocol Developer at Karachain, Head of Development at Mozilla Open Source Group.

Ashish Rajpurohit

Ashish has 500+ contacts in LinkedIn, 87 followers on Twitter, and 383 commits in GitHub for the past year.

Education: Ashish has a Bachelors Degree in Engineering.

Previous experience: Intern in JumpByte, Software Developer at Melvault.

Arpit Agarwal

Arpit has 500+ contacts in LinkedIn, 439 followers on Twitter, and 367 commits in GitHub for the past year.

Education: Arpit has Bachelors of Technology Degree from Indian Institute of Technology, Jodhpur, India.

Previous experience: Intern at Datapad.io, Software Engineer at Google & Semantics3.

Sayli Patil

Sayli has 142 contacts in LinkedIn, and 55 followers on Twitter.

Education: Sayli has MCA from SIES college of management studies.

Previous experience: Intern at 97datalabs.

Delroy Bosco

Delroy has 500+ contacts in LinkedIn, and 26 followers on Twitter.

Education: St. Dominic Savio College.

Previous experience: Scrum master at Iris Business Services Limited, Partnerships Manager at The Bridge.

Vishal Gupta

Vishal has 54 contacts in LinkedIn and no followers on Twitter.

Education: Vishal has a Bachelors Degree in Science from the Uttar Pradesh Technical University.

Previous experience: DevOps Engineer.

Nirbhik Jangid

Nirbhik has 500+ contacts in LinkedIn, and 291 followers on Twitter.

Education: Nirbhik has MBA from UBA, India, Mumbai.

Previous experience: Intern at Pineapple Consulting.

Advisors:

Esteban Ordano, @eornado, is Co-founder & CTO of Decentraland. He worked at various tech companies like Google & BitPay (crypto-based payments) on various positions but spent very limited time there. He acted as Teaching Assistant at ITBA for four years. After that, he was on freelance for four years and then launched $MANA. Esteban speaks freely in four languages. He has 6000 followers on Twitter, among which are Andreas Antonopolus, Dfinity, Breakermag, Chris Burniske, and others.

Pete Kim, @petejkim, is a Head of Engineering, Wallet at Coinbase. He got his Bachelors Degree in Computer Science from the National University of Singapore. Pete is Co-founder & CTO of Nitrous, a web-development platform that raised 7.5 million USD of venture investments during 2013-2014. He also created the Cipher Browser, a mobile wallet, and Ethereum explorer. Coinbase later acquired the project to built its Wallet on its base. Pete has 4200 followers on Twitter, among which are Metamask, CEO MyCrypto, and a co-founder of Coinbase. His other projects can be found here.

Ari Meilich is a Project Lead at Decentraland. He has a Bachelors Degree in Neuroscience. Prior to working in Decentraland, Ari spent about a year working as an Analyst in a San Francisco-based venture fund CRV, which invested in projects like Drift, Airtable, Zendesk, Twitter, Yammer, and others. Ari's Twitter profile is private and has 1600 followers.

Partners:

Decentraland is a VR platform based on the Ethereum blockchain. It's ranked 90 by CoinMarketCap with the market cap of 60 million USD. Matic Network' scaling technology will be able to arrange decentralized exchange of virtual assets in Decentraland with low fees and high bandwidth.

Zebi is an Indian blockchain that is focused on providing blockchain-based solutions for governments to protect their valuable and private data. Matic & Zebi will be closely cooperating on developing of the next generation of the solutions for ID and enterprise-grade blockchains.

MakerDao is a decentralized autonomous organization that provides governance for DAI stablecoin. Matic will support DAI on its sidechains, which will enable dApp developers to create various enterprise-level use cases for DAI.

Coral Protocol provides data & analysis about blockchain addresses to increase legal compliance and act against fraud. Matic ecosystem is designed to support tools for building real apps and partnering with Coral is a step in this direction.

Technology and idea

Whitepaper:

The whitepaper is well-structured. It describes current issues of the blockchains (scalability, finalizing, UX).

The major factor that distinguishes Matic Network from other Plasma-focused solutions is that it uses an account-based approach. In Plasma versions, UTXOs are used.

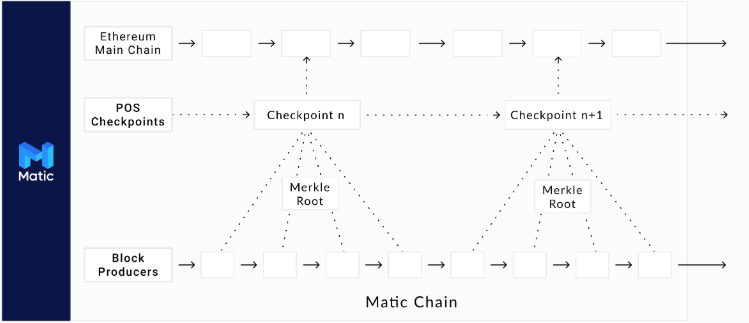

The network's architecture:

- Layer 1: Ethereum mainnet. Used for anchoring transactions from an underlying layer.

- Layer 2: 'checkpoints'. After reaching specific block height on a sidechain, validators translate the latest state of it to the Ethereum mainnet. This layer utilizes the Tendermint consensus algorithm.

- Layer 3: sidechains that support smart-contracts.

All the existing smart-contracts will be compatible with Matic Network. For instance, Matic Network allows transferring ERC-721 tokens using a bridge-swap (an asset is locked on the Ethereum blockchain). In addition, using the bridge-swap will allow cross-sidechain exchange.

Tokenomics:

The token is 'native' in a sense, as it plays an important role in Matic Network's consensus. The functions of the token include value transfer, means of payment for validators' fees, staking/delegation for the functioning of nodes in the network.

Roadmap:

The roadmap is outlined here. It is rather detailed and pictures both business and tech spheres. The team has a lot going on for it in 2019.

Product/MVP:

The protocol is planned to be used by one of the popular Ethereum-based apps Decentraland.

The team also focuses its efforts on the protocol development within Decentralized Finance. For example, the project plans to work alongside MakerDAO (which is by far the most popular DeFi app), and also with Ox & Dharma (a recently launched P2P loan protocol, partnered with USDC (Circle's stablecoin).

At the time of this review, the network works within the Ethereum's testnet, but the first stage of mainnet is planned to begin in April 2019.

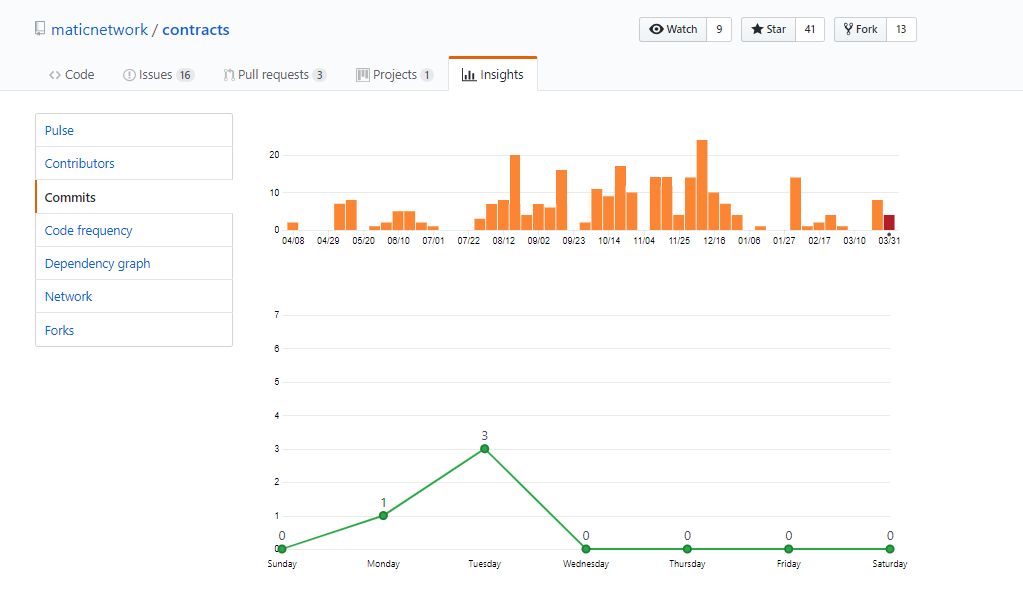

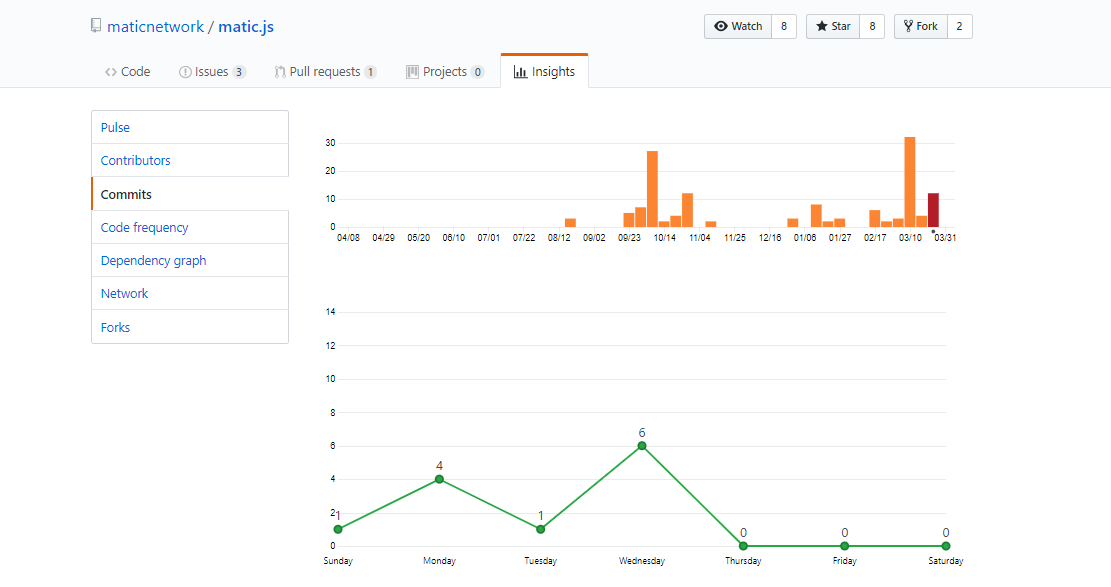

The project has 15 public repos along with some private ones.

Some of the repos are forked, meaning that the team partially based its work on the already available solutions. For instance, the Tendermint consensus, the Bridge-swap contract, and Blockscout were taken from POA Network.

We post here the stats of 2, in our opinion most important, repos:

Smart-contracts on Matic Network

Matic.js

Similar projects:

Raiden Network (valuation of ~37 million USD)

Loom Network (valuation of 77$ million USD)

POA Network (valuation of 10$ million USD)

Liquidity Network (valuation of 5$ million USD)

Cosmos Network (no data)

Plasma (no token)

Perun Network (no token)

Counterfactual (no token)

Connext Network (no token)

Addendum / Summary / Opinions

The project has been around since 2018. It's another attempt to solve the scalability problem of Layer 2, which is the second of this nature launched on the Binance's Launchpad. Technically speaking there is a concern about the security of the account-based approach to Plasma. Such an approach may lead to security issues in case of any disputes.

Strengths:

- The team actively works on integrating its product into various services. The most important use case, in our opinion, is DeFi, the development of which is crucial for the Ethereum's ecosystem.

- Competent advisors.

Risks:

- High competition in the niche. Various teams are working on similar focused products and some of them don't plan to issue tokens.

- The information about the early stages of funding is incomplete. The start of the sales' dates vary. In case the early investors will have a ETH price advantage, they may push the price down on the listing.

Weaknesses:

- The team doesn't have significant work experience and is rather young.