I Spread

💣 👉🏻👉🏻👉🏻 ALL INFORMATION CLICK HERE 👈🏻👈🏻👈🏻

Показывать только результаты для I Spread?

https://en.m.wikipedia.org/wiki/I-spread

Ориентировочное время чтения: 1 мин

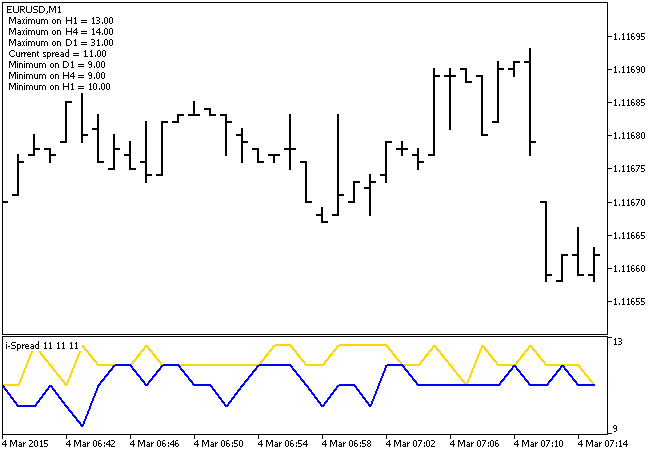

The Interpolated Spread or I-spread or ISPRD of a bond is the difference between its yield to maturity and the linearly interpolated yield for the same maturity on an appropriate reference yield curve. The reference curve may refer to government debt securities or interest rate swaps or other benchmark instruments, and should always be explicitly specified. If the bond is expected to repay some principal before its final maturity, then the interpolation may be based on the weighted-averag…

The Interpolated Spread or I-spread or ISPRD of a bond is the difference between its yield to maturity and the linearly interpolated yield for the same maturity on an appropriate reference yield curve. The reference curve may refer to government debt securities or interest rate swaps or other benchmark instruments, and should always be explicitly specified. If the bond is expected to repay some principal before its final maturity, then the interpolation may be based on the weighted-average life, rather than the maturity.

Wikipedia · Текст по лицензии CC-BY-SA

https://fbs.com/glossary/yield-spread-68

17.05.2021 · I-spread. Interpolated spread (I-spread) is the difference between a bond's yield and the swap rate. We can use LIBOR as an example. It shows the difference between a bond's yield and a benchmark curve. If the I-spread increases, the credit risk also rises. I …

CBS46 Vaccine Team Q&A: Can I spread COVID-19 if I've gotten the vaccine?

How should I spread my investments across sectors?

CBS46 Vaccine Team Q&A: Can I spread the virus if I've gotten both doses of the vaccine? What about

'Can I Spread COVID After Getting The Vaccine?': Dr. Mallika Marshall Answers Your Questions

G-Spread

I-spread

Z-Spread

Option-Adjusted Spread

Example

I-spread stands for interpolated spread. It is the difference between yield on a bond and the swap rate, i.e. the interest rate applicable to the fixed leg in the floating-for-fixed interest rate swap. The difference between yield on a bond and a benchmark curve such as LIBOR is useful in assessing credit risk of different bonds. Higher i-spread means higher credit risk. I-spread is typica…

https://www.linguee.ru/английский-русский/перевод/i+spread.html

Примеры перевода, содержащие „i spread“ – Русско-английский словарь и система поиска по миллионам русских переводов.

https://www.linguee.com/english-russian/translation/i+spread.html

Many translated example sentences containing "i spread" – Russian-English dictionary and search engine for Russian translations.

What's the difference between G spread and I spread?

What's the difference between G spread and I spread?

G-Spread = corporate bond’s yield – government bond’s yield I-spread Interpolated spread (I-spread) is the difference between a bond's yield and the swap rate.

What does I spread stand for in finance?

What does I spread stand for in finance?

I-spread stands for interpolated spread. It is the difference between yield on a bond and the swap rate, i.e. the interest rate applicable to the fixed leg in the floating-for-fixed interest rate swap. The difference between yield on a bond and a benchmark curve such as LIBOR is useful in assessing credit risk of different bonds.

Which is an example of an interpolated spread?

Which is an example of an interpolated spread?

We can calculate the G-spread by using the following formula: Interpolated spread (I-spread) is the difference between a bond's yield and the swap rate. We can use LIBOR as an example. It shows the difference between a bond's yield and a benchmark curve. If the I-spread increases, the credit risk also rises.

What are the different measures of yield spread?

What are the different measures of yield spread?

We can divide the measures of yield spread into the nominal spread (G-spread), interpolated spread (I-spread), zero-volatility spread (Z-spread) and option-adjusted spread (OAS). Nominal spread (G-spread) represents the difference between Treasury bond yields and corporate bond yield with the same maturity.

https://m.youtube.com/watch?v=B1Nvi21HtCM

07.05.2021 · Merch!⬇️⬇️https://farmfocused.com/saskdutch-kid/PO BOXBox 600 S0K-0J0Asquith …

ispread (@ispread) on TikTok | 932 Likes. 154 Fans. Just be in awareness... Watch the latest video from ispread (@ispread).

https://www.eleconomista.es/diccionario-de-economia/spread

Definición de Spread. En términos generales, es la diferencia entre el precio de oferta y demanda para un determinado valor. Puede emplearse como indicador de la liquidez de un valor (menores ...

https://pl.m.wikipedia.org/wiki/Spread

Spread – różnica pomiędzy kursem (ceną) sprzedaży a kursem (ceną) kupna aktywów (np. walut, papierów wartościowych, towarów).. Na terminowych rynkach finansowych i towarowych …

РекламаБазовые опционные стратегии колл спрэд и пут спрэд. Научу Вас брать лучшие сделки · Москва · пн-вс 9:00-21:00

Финансовые услуги оказывает: АО ИК "Церих Кэпитал Менеджмент"

Не удается получить доступ к вашему текущему расположению. Для получения лучших результатов предоставьте Bing доступ к данным о расположении или введите расположение.

Не удается получить доступ к расположению вашего устройства. Для получения лучших результатов введите расположение.

Yield spread is the difference between the yield to maturity on different debt instruments. Common examples of yield spreads are g-spread, i-spread, zero-volatility spread and option-adjusted spread.

Bond yield is the internal rate of return of the bond cash flows. It is the rate of return that a bondholder earns if he holds the bond till maturity and receive all the cash flows at the promised dates. In an efficient market, bond yield is a barometer that can be used to asset the risk inherent in the bond. In general, higher yields means the bond has higher risk and hence lower price.

There are different types of yield spread depending on the benchmark:

G-spread (also called nominal spread) is the difference between yield on Treasury Bonds and yield on corporate bonds of same maturity. Because Treasury Bonds can be assumed to have zero default risk, the difference between yield on corporate bonds and Treasury bonds represent the default risk.

Where Yc is the yield on non-treasury bond and Yg is the yield on government bond of the same maturity.

I-spread stands for interpolated spread. It is the difference between yield on a bond and the swap rate, i.e. the interest rate applicable to the fixed leg in the floating-for-fixed interest rate swap. The difference between yield on a bond and a benchmark curve such as LIBOR is useful in assessing credit risk of different bonds. Higher i-spread means higher credit risk. I-spread is typically lower than the G-spread.

While G-spread and I-spread just measure the difference between the static yield to maturity of the bond and the Treasury yields or benchmark rate, Z-spread determines the difference in yields with reference to whole term structure of interest rates.

Z-spread can be calculated by solving the following equation for Z:

Option-adjusted spread equals zero-volatility spread minus the value of call option as stated in basis points. It is the appropriate yield measure for a callable bond:

Option-Adjusted Spread (OAS) = Z-Spread − Option Value

The bond has a par value of $1,000, trades at 99% of its face value and pays annual coupon payments based a 3.4% coupon rate. Calculate the zero-volatility spread if the 1-year and 2-year treasury yield is 2.14% and 2.42%.

G-spread just equals the difference between the bond yield and the Treasury yield.

I-spread equals the difference between bond yield and swap rate.

I-Spread = Bond Yield − Swap Rate

= 3.5% − 2.69%

= 0.81%

Given the bond price of $990, annual coupon payments of $34 (=$1,000 × 3.4%) and Treasury spot rates for 1 and 2 years of 2.14% and 2.42%, we can work out z-spread by solving the following equation for Z:

by Obaidullah Jan, ACA, CFA and last modified on Apr 28, 2019

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Lesbian Tribbing Seduction

Xvideos Vintage Movies

I Was Tied Up

Young Lovers Porno Gif 3d Shotacon

Solo Tu Matia Bazar

I-spread - Wikipedia

Yield Spread Definition | G-spread, I-spread, Z-spread and OAS

Yield Spread: G-Spread, Z-Spread & OAS | Formula & Example

i spread - Русский перевод – Словарь Linguee

i spread - Russian translation – Linguee

ispread (@ispread) TikTok | Watch ispread's Newest TikTok ...

Spread: qué es - Diccionario de Economía - elEconomista.es

Spread – Wikipedia, wolna encyklopedia

I Spread