I Owe You IOU Template I Owe You Legal Document

Download PDF

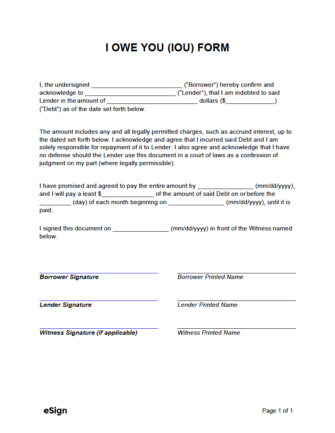

I Owe You (IOU) Template

An I Owe You (IOU) contract is a simple 1-page document that serves as a guarantee (or “promise”) to pay back loaned money. It’s an informal contract used by well-acquainted individuals who trust one another. In many cases, an IOU is used as a placeholder before an official loan agreement is drafted.

Contents

- What is an “I Owe You?”Structure of an “I Owe You” Contract

- Step 1 – Parties & Debt

- Step 2 – Payment Dates

- Step 3 – Signatures

What is an “I Owe You?”

- An “I Owe You” agreement is as simple as it sounds – it’s a document that states a person owes another person a sum of money. From a legal standpoint, IOUs are weak in terms of their ability to effectively bind the parties. A legal contract requires three (3) things in order to be valid: an offer, acceptance of the offer, and consideration. Due to the simple nature of IOUs, they often leave out sections that detail repayment and interest (the consideration). This can make it exceptionally difficult to have the document enforced in a court of law (should it come to that point). However, IOUs come in handy for individuals looking to get something down on paper quickly, and are better than not signing anything at all.

Structure of an I-Owe-You Contract

- Because there is no universal format for IOU contracts, the contents of the document can vary significantly from one to the next. With this in mind, the following terms are recommended when creating an IOU contract:

- The lender’s full name.

- The borrower’s full name.

- The amount of money ($) borrowed.

- The due date for the borrowed money.

- The amount ($) the borrower will pay per month/week.

- The date the borrower and seller signed the document.

Sample

Click to Copy Sample Copy to ClipboardI OWE YOU (IOU) FORM

- I, the undersigned [BORROWER NAME] (the “Borrower”), hereby confirm and acknowledge to [LENDER NAME] (the “Lender”) that I am indebted to said Lender in the amount of $ [AMOUNT] (the “Debt”) as of the date set forth below.

- The amount includes any and all legally permitted charges, such as accrued interest, up to the date set forth below. I acknowledge and agree that I incurred said Debt, and I am solely responsible for the repayment of it to the Lender. I also agree and acknowledge that I have no defense should the Lender use this document in a court of law as a confession of judgment on my part (where legally permissible).

- I have promised and agreed to pay the entire amount by [MM/DD/YYYY] , and I will pay a least $ [MONTHLY PAYMENT] of the amount of said Debt on or before the [#] day of each month beginning on [MM/DD/YYYY] until it is paid.

- I, the Borrower, signed this document on [MM/DD/YYYY] in front of the Witness named below.

- _____________________________

- Borrower Signature

- [BORROWER PRINTED NAME]

- _____________________________

- Lender Signature

- [LENDER PRINTED NAME]

- _____________________________

- Witness Signature

- [WITNESS PRINTED NAME (IF APPLICABLE)]

How to Write

Step 1 – Parties & Debt ($)

- Field 1: The full name of the person or entity that is receiving (borrowing) the money.

- Field 2: The full name of the person or entity that is providing (lending) the money.

- Field 3: The amount ($) of money being loaned in words (e.g., “Five-hundred”).

- Field 4: The amount ($) of money being loaned numerically (“$500.00”).

Step 2 – Payment Dates

- Field 5: Enter the due date for the full borrowed amount. The entire owed balance must be paid off by this date.

- Field 6: The amount ($) the borrower will pay to the lender each month.

- Field 7: Enter the day of the month by which the borrower must make all monthly payments.

- Field 8: Enter the date of the first monthly payment.

Step 3 – Signatures

- Field 9: The date all parties signed the form.

- Field 10: The signature of the borrower. This can be done using eSign or by printing the form and signing by hand.

- Field 11: Enter the borrower’s full printed name.

- Field 12: The lender’s signature.

- Field 13: The lender’s full printed name.

- Field 14 (Optional): If a witness was present to observe the signatures of the borrower and lender, they must sign here.

- Field 15 (Optional): The witness’s printed name (if applicable).