How the Germans are killing their economy

эruдит Alexey Bobrovsky

The murder of German industry is a blow to the entire EU and, of course, China, as a key buyer of German high-tech products. Has such a development of events become a spontaneous process in a series of political events and conflicts?

Morgenthau Plan

Back in September 1944, at the Second Quebec Conference of the allies, the so-called Morgenthau Plan was proposed. It was named after US Secretary of the Treasury Henry Morgenthau. According to this "Post-Surrender Program for Germany", the Americans were going to make Germany an agrarian country.

The plan was rejected, but after the war, the United States implemented some measures in its zone of occupation:

— disintegrated the once unified production system;

— some industrial enterprises were dismantled, the equipment was removed;

— the USA regulated imports to Germany, banned the production of nitrogen, destroyed 13 chemical plants;

After Roosevelt's death, Truman's and the State Department's policies abruptly became anti-Soviet, and the Morgenthau Plan became the Marshall Plan. The recovery of Europe had a side effect for the United States: remaining an ally of the United States, Germany became a real political force, with its own interests. No wonder Stalin wanted the unification of Germany back in the 50s, but England, France and the USA were categorically against the reunification of the GDR and FRG in the late 80s. In 1990, there was an Anschluss - FRG absorbed the GDR without a referendum.

With the advent of the EU, and then the euro in 1999, it became clear that the main beneficiary of the eurozone is Germany. The specific weight of one deutschmark in euros was 40%. When the TARGET2 interbank payment system started working, the payment balances of the zone countries showed that new euros were leaving other countries, but they were coming to Germany. It continues till this very day.

The main beneficiary of the eurozone is Germany. The specific weight of one deutschmark in euros was 40%. When the TARGET2 interbank payment system started working, it became clear that new euros were leaving other countries, but they were coming to Germany. It continues till this very day.

Let's omit 20 years of history. What does Germany have today? Germany was, and still remains, the main economy of the EU - it is 25% of Europe's GDP. These are the European automotive industry, chemical production and electronics. Industry and construction account for about 25% of the country's GDP. Services account for about 64% of German GDP. Developed banking system, trade, tourism, transport system. The country is also strong in agriculture - 90% of food needs are provided by itself.

How did it all happen?

Germany was gradually moving towards a manageable crisis. 2022 was the year of the historical peak of the workers’ shortage. Despite the influx of refugees from Ukraine and other countries, against the background of the migration crisis, the number of vacancies is a record - 1.98 million!

Strangely enough, Gerhard Schröder, who promoted the policy of multiculturalism, laid a mine under the German economy. Launched in the 90s, the mechanism bears fruit today. The concept appeared back in the 40s, which is symptomatic, it implied the adaptation of different cultures to a certain world order, not interpenetration, namely adaptation without mixing. Economist Thilo Sarrazin has long explained the "side effect" of the process - the shortage of highly professional personnel, through a decrease in the quality of education with the influx of migrants.

The shortage of personnel was partially compensated by the expansion of business around the world and, in particular, in the eurozone, which was immediately called the Euroreich. And rightly so, because even during the crises of 2008 and 2010-2013, Germany was the only country that increased sales in foreign markets, including in the EU. Everyone suffered, and Germany demanded discipline and responsibility from them.

The shortage of personnel was partially compensated by the expansion of business around the world and, in particular, in the eurozone, which was immediately called the Euroreich. And rightly so, because even during the crises of 2008 and 2010-2013, Germany was the only country that increased sales in foreign markets, including in the EU. Everyone suffered, and Germany demanded discipline and responsibility from them.

Ordnung muss sein!

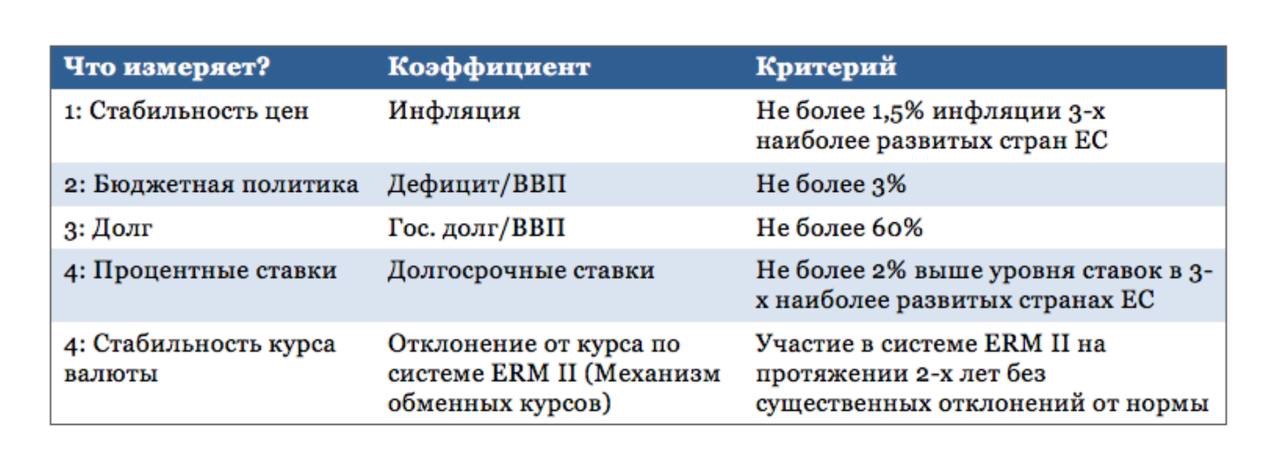

The main principle of Germany is low inflation and limitation of budget expenditures. It revealed the discrepancy between the German monetary policy and the American one. Two periods of frenzied inflation - the Weimar (exactly 100 years ago) and the post-war (40-50s) developed a reflex: the economy begins to overheat - wait for inflation, "jam" growth. The ECB's mandate, like that of the Fed, is price stability and the fight against unemployment, but there is a nuance.

The Fed can regulate the money supply inside the US, the surplus spills out into the world. Excess liquidity is the growth of raw materials and Western markets, and hence economies. In the crisis, the repatriation of capital to the United States begins. If you look at the production schedules of the USA and Germany, you can see how this very repatriation of capital hits Germany, cutting off its growth in the name of saving the American one. But there is no choice.

The reflex of the Germans is so stable that it was ridiculous, at the height of the eurocrisis of 2010-2013, the United States insisted that Berlin increase budget spending. But Finance Minister Schäuble was like a rock. Dependence on other people's economic patterns has become critical. Decision-making does not come from under the fear of the whip of the United States, but under the supervision of their experts.

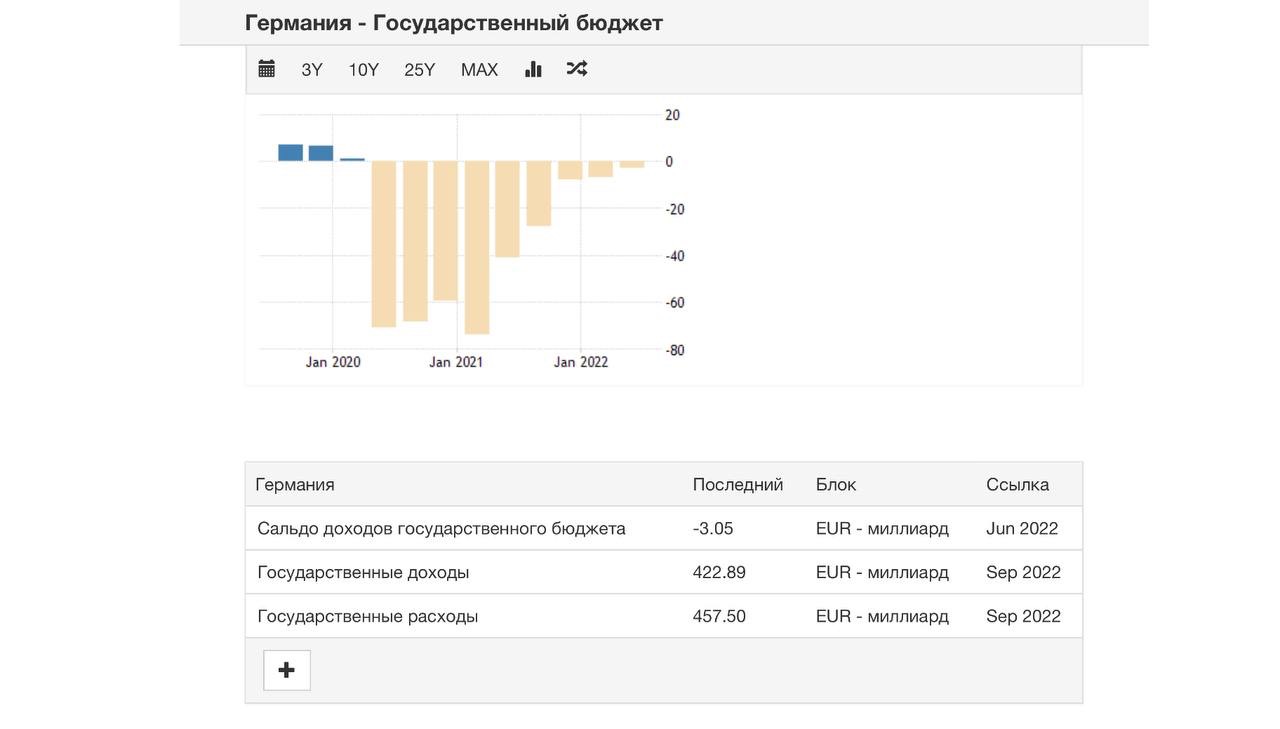

And the Germans cut themselves off from the Russian energy industry. Consciously. The result: production inflation for the year has gone to 20%. Weak data for the IV quarter of 2022. Fixing the trend: the country is sliding into stagflation. The economy shrank by 0.4%, investments in construction and mechanical engineering fell heavily. Industrial orders have been falling in recent years. Monetary policy is no longer able to fix it.

And the Germans cut themselves off from the Russian energy industry. Consciously. The result: production inflation for the year has gone to 20%. Fixing the trend: the country is sliding into stagflation. The economy shrank by 0.4%, investments in construction and mechanical engineering fell heavily. Monetary policy is no longer able to fix it.

Moreover, an ECB rate hike will send the EU economy into a steady depression. The revolt on the ship is already beginning, the Central Banks of Portugal and Italy are already asking the question: "why do we need all this?". Rising rates are problems in the bond market of these countries, and then - a new debt crisis in the EU.

How is Hausgenossen?

Die Welt writes that every second German can afford only the essentials. Citizens began to actively buy food and hygiene items, expecting further price increases.

More than 3/4 of consumers were forced to limit spending - shows the Future Consumer Index - EY research. 56% save on buying clothes. 56% save on electronics. Every second respondent refuels the car less often, and every fourth saves on medicines.

And what about Titov Scholz?

Scholz rushed to fix everything he had done. Last year, he went to Qatar - it seemed that he could replace Russian gas. But Qatar rolled out the same requirements as Russia, and even tougher: it is impossible to resell gas, long-term contracts and the price is higher. The negotiations reached an impasse, Scholz explained something about the EU spot market, after which the Qataris pointed the finger towards China, sold one LNG tanker to Germany and let it go in peace.

Scholz rushed to fix everything he had done. Last year he went to Qatar. The negotiations reached an impasse, Scholz explained something about the EU spot market, after which the Qataris pointed the finger towards China, sold one LNG tanker to Germany and let it go in peace.

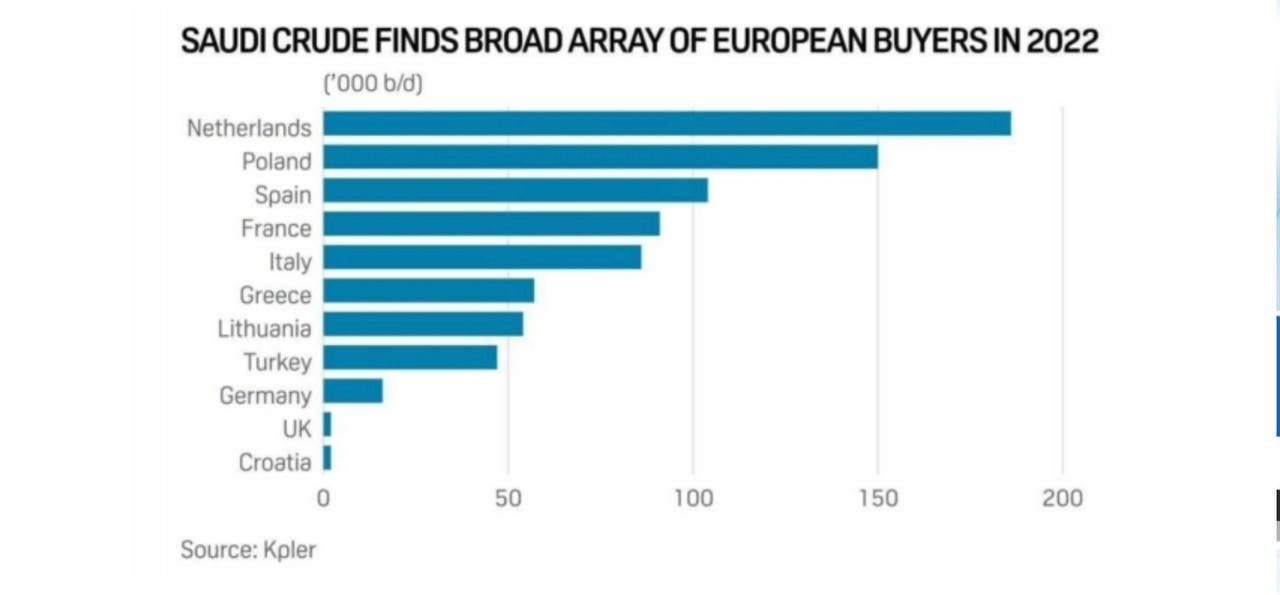

Scholz went to Saudi Arabia, where they promised him with a smile the supply of oil and petroleum products, of course, at market prices. Scholz did not understand what the catch was, the Saudis agreed with the Russians - they exchanged market shares. Russia goes to Asia, the Saudis occupy the EU market. And Europe has no other way out, Russia's niche has been freed up, and the EU will buy Arab oil at lower discounts than China. It is beneficial to the Arabs.

Negotiations with the Chinese were important. Considering that the United States, by the law on reducing inflation, began to repatriate not only its own business, but also to relocate someone else's, including German, the chancellor's visit was strategic. China does not need the economic "murder" of the EU, one of the main trade partners. In this situation, China offered to move German business to itself – labor and cost of energy are cheaper, market is bottomless. Some of the corporations whose leaders flew with Scholz to China have already begun transferring production to the east. Can we call it Scholz's success? Yes, conditions in China are better, not everything will be "sucked out" of Germany by the USA. However, there will be a loss of jobs, an almost guaranteed leakage of technology and pressure on Europe's balance of payments, which in turn will shake the last line of defense of the eurozone - the single European currency.

China does not need the economic "murder" of the EU, one of the main trade partners. In this situation, China offered to move German business to itself - labor and cost of energy are cheaper, market is bottomless. Some of the corporations whose leaders flew with Scholz to China have already begun transferring production to the east. Can we call it Scholz's success? Yes, conditions in China are better, not everyone will be "sucked out" of Germany by the USA. However, there will be a loss of jobs, an almost guaranteed leakage of technology and pressure on Europe's balance of payments.

Well, a trip to the USA brought a basket of surprises to Scholz. They explained to him that it was forbidden to turn on the Nord Stream, even later. The military-industrial complex and the German industry can get cheap US energy carriers, but on the territory of the USA. And if Scholz doesn't like something, then it's his choice, it is possible to go on without Scholz.

The cherry on the cake was the report of the German Ministry of Economy. At the request of the Bundestag deputies, the Ministry of Economy gave a written answer: Germany will need at least 3 years to receive the same volumes of gas that came from Russia in 2021.

"The truth is that in the next 3-4 years, the world's LNG production capacity will not meet the growing demand. So, the strategy that is being hushed up is as follows: Germany continues to pay for gas at crazy prices, and other less wealthy countries will remain without it," said Christian Leye, a deputy from the Left Party. It means that Scholz has no choice.

What to do?

The situation today for Germany could be corrected by a deep economic convergence with Russia. This is what the EU's economic growth has been based on all these years - affordable energy and high labor productivity. But this is the main fear of the Anglo-Saxons, and therefore Berlin will not be given this.

Further "color differentiation of pants" in Europe is subordination to the USA, but building everyone in the EU on the principle of Deutschland über alles will only increase the tension inside. The fault will occur in three directions:

— anti-Russian sanctions that prevent everyone from earning. They will continue to be secretly torpedoed, and soon they will begin to do it openly. Brussels and Berlin will lose control;

— access to energy resources will cause the EU countries to quarrel even more. Hungary will soon be followed by Italy and Austria, and others;

— currency and debt distortions in the EU will affect. Almost all countries violate the Maastricht Treaty - the ceiling on budget deficits and public debt. Lower costs and falling incomes will lead to a riot. Rome, Madrid, Lisbon will soon be unable to contain the discontent of the population. Solution - independent monetary policy, and exit from the euro zone.

The peak of tension will be in 2027-2028. The apotheosis will be the collapse of the eurozone. Time has passed.